The Wolf Den #1187 - Decoding The Noise: Wall Street And Crypto Jargon Explained

Do you speak the language?

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public clients have been raving about our $SOL Arb + $BTC Arb set up and yield outcomes.

$SOL Arb 30 Day Cash Yield: $4380

$BTC Arb 30 Day Total Return: +18%

Generating cash yield with your SPOT crypto positions is the only way to protect your position while using it efficiently. Never lend or leverage your positions.

Consider trying Arch Public today!

In This Issue:

Decoding The Noise: Wall Street And Crypto Jargon Explained

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Altcoin Charts

Stocks Fluctuate On Conflicting Tariff Signals As Intel Drags Down Markets

This is IMPORTANT - Horrible Scam Using My Identity

Coinbase Partners With PayPal

Securitize Launches A $400m Crypto Fund

Rapid Fire News

This Bitcoin Deal Will SHOCK You – Price Is About To Explode!

Decoding The Noise: Wall Street And Crypto Jargon Explained

In what seems like a previous lifetime, I studied archaeology at the University of Pennsylvania. One of the earliest artifacts we examined was the Rosetta Stone – the engraved slab that unlocked the mystery of Egyptian hieroglyphs. It conveyed the same decree in three scripts: Greek, Demotic, and hieroglyphic. Because scholars already understood ancient Greek, they could use it to decode the hieroglyphic symbols that had eluded understanding for centuries. It was a profound reminder that, sometimes, the right translation tool can change everything. Unfortunately, this didn’t do much for my career trajectory.

Finance and crypto have their own hieroglyphs – coded language, abstract metaphors, and carefully vague phrases designed to sound sophisticated while often saying very little. I’m guilty of it. Your favorite CNBC guest is guilty of it. Everyone does it – it’s part of the performance. But today, I want to hand you your own Rosetta Stone. Below is a guide to decoding some of the most common expressions you’ll hear in markets and crypto – what they say versus what they usually mean.

Let’s begin:

We’re taking a wait-and-see approach.

We have no idea what’s happening and are hoping something becomes obvious soon.

This time it’s different.

We’re disregarding decades of precedent because we really want to believe this will work.

We see strong secular tailwinds.

Something vague and long-term might eventually justify this position.

The fundamentals are sound.

The price is tanking and we’re scrambling for something reassuring to say.

There’s a lot of dry powder on the sidelines.

Nobody’s buying, but we’re pretending cash is about to flood in.

We’re overweight tech/crypto/etc.

We missed the pivot, so now we’re doubling down and praying.

The market is pricing in perfection.

Any bad news is going to destroy this trade.

We’re cautiously deploying capital.

We’re scared, but trying not to sound scared.

It’s a high-conviction trade.

If this fails, I’m going down with the ship.

We don’t try to time the market.

We timed it poorly before and are now pretending that was intentional.

We’re building in the bear market.

Nobody’s using our product, but we’re still tweeting.

Number go up technology.

We don’t understand it, but the price is rising, so we’re in.

This protocol is revolutionizing finance.

We added staking and a DAO.

Diamond hands only.

I’m down 70%, but trying to sound brave.

Community-driven project.

The team bailed – it’s just memes and vibes now.

Not financial advice.

This is definitely financial advice, I just don’t want the SEC knocking.

We’re so early.

It’s been seven years and still no product-market fit.

Blue-chip NFT.

It was expensive once.

DeFi is the future of finance.

I lost money last week but refuse to admit it.

Layer 1 wars are heating up.

We have no clue who wins, so we’re cheerleading all of them.

Of course, there’s a healthy dose of satire here – but if you’ve been around long enough, you know the drill. To test your decoding skills, try these:

This blue-chip NFT is number go up technology! We don’t try to time the market; we are diamond hands only. We are cautiously deploying capital into a fundamentally sound project because, this time, it just might be different.

Translations:

We have no idea why this overpriced JPEG keeps mooning, but we’re not asking questions. We already mistimed the top, but now we’re pretending that never selling is a strategy. We’re nervous, have little conviction, and are rationalizing our FOMO with a fancy narrative.

Hopefully this gave you a few laughs – but also a helpful reminder: don’t take everything at face value. Markets are full of confident-sounding people who are just trying to sound like they know what’s next.

That wraps up my intro, but before you leave, I’m going to try something new here...

I’ve never run a poll on Substack before, but I’m looking forward to seeing your responses, as we look to improve the newsletter. Feel free to DM me with your input on X - no promises I can reply to everyone, but I’ll do my best to read everything. As always, I appreciate all of your support.

Aptos Weekly Review

For those that don’t know, Aptos - one of the most exciting layer 1 blockchain competing with Solana and Ethereum - is an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Each week, I’ll share an Aptos review, covering the network’s latest announcements and milestones. To kick things off this week, I want to inform all of you that applications for the summer wave of the Aptos Collective are closing on May 5th! For those that don’t know what this is, read below:

“The Aptos Collective is an engaged ambassador community uniting enthusiasts from around the world to foster growth and innovation on Aptos. As a member, you’ll gain access to exclusive perks, professional development, and a supportive network of like-minded builders - all while championing a technology you love.”

Here’s a review from someone that is a part of the Aptos Collective:

“Aptos Collective feels like a Web3 family to me—one we've been building from the very beginning. It’s more than just a group; it’s a close-knit community rooted in real friendships and a shared passion for growing the Aptos ecosystem. Being part of this journey fills me with optimism. That’s why I live by the motto: ‘building a better tomorrow on Aptos.’ It’s not just a slogan—it’s a mindset that drives me every day.

I’m deeply committed to supporting new builders and community members. I actively help onboard newcomers, offering guidance and translating complex technical concepts into clear, accessible language so that everyone, regardless of background, can find their place and thrive here. Aptos isn’t just a project to me—it’s my home, and in this home, I truly feel like I belong.” —@DrAlcista

Next, I want to highlight this stat: Aptos has the second-highest staking ratio relative to its market cap, just one percentage point behind SUI.

Also, I know I’ve covered RWAs and DeFi in past segments, but did you know Aptos is making serious moves in stablecoins too? Crossing the $1 billion mark is no small milestone.

That is all for this week, make sure to show Aptos some love - they’re a huge reason this newsletter remains free!

Bitcoin Thoughts And Analysis

Bitcoin remains strong on the daily chart.

After the massive breakout through the descending trendline and the $88,804 resistance level, price has continued to push upward and is now consolidating above key levels. What’s especially notable is the last three candles – each one has a long lower wick, showing that every dip is being aggressively bought.

This kind of consistent demand beneath price often signals that buyers are in control. The move remains comfortably above both the 50-day and 200-day MAs, confirming bullish momentum. As long as these dips continue to get scooped up, the path of least resistance looks higher.

Altcoin Charts

Altcoins continue to generally look bullish. Whether this is the start of the new trend or simply a relief bounce remains to be seen, but many of them are making significant moves.

Stocks Fluctuate On Conflicting Tariff Signals As Intel Drags Down Markets

Stocks struggled for direction Friday as mixed earnings and contradictory trade signals kept markets on edge. S&P 500 futures erased earlier gains, stabilizing after three days of advances. Intel tumbled nearly 8% in premarket trading following a disappointing outlook, while Alphabet rallied on strong earnings. Skechers dropped 7% after pulling its annual forecast due to tariff uncertainty.

The broader mood was cautious. Reports that China may suspend some of its 125% tariffs on US goods offered a glimmer of hope, but were quickly countered by Beijing’s denial that any talks were underway. The dollar climbed for its first weekly gain in a month, while gold and the yen retreated as haven demand eased. Treasuries extended Thursday’s rally.

Fed officials signaled openness to rate cuts if trade tensions worsen. Governor Christopher Waller said he’d support easing if tariffs hit jobs, while Cleveland’s Beth Hammack said a cut could come as soon as June if clearer economic signals emerge. Still, Bank of America warned the rally in US stocks and the dollar may prove unsustainable without a firm trade resolution or resilient consumer spending.

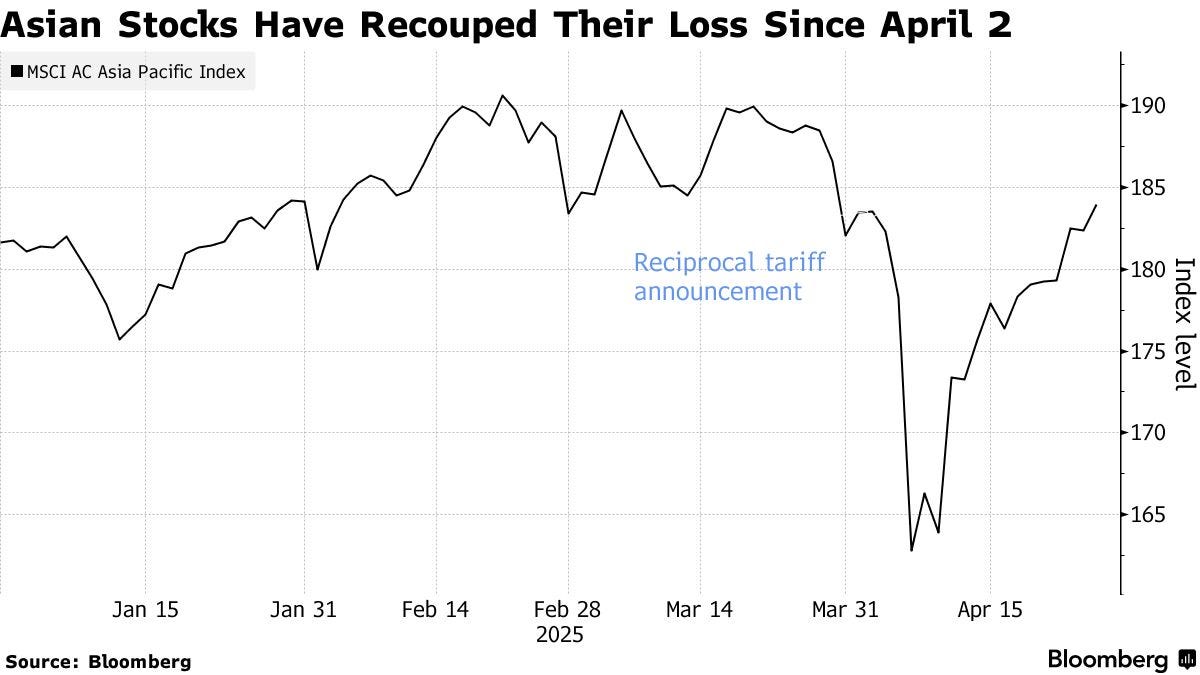

In Asia, markets rallied, with regional indexes recouping all losses since Trump’s April 2 tariff announcement. However, Indian assets buckled on renewed geopolitical tension with Pakistan.

Strategists summed up the market’s whiplash: “We’re in tariff purgatory,” said Panmure Liberum’s Joachim Klement. “Trump has blinked—but we know he can change his mind in a tweet.”

Stocks

S&P 500 futures were little changed as of 7:24 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average fell 0.4%

The Stoxx Europe 600 rose 0.3%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.2% to $1.1365

The British pound fell 0.2% to $1.3315

The Japanese yen fell 0.4% to 143.27 per dollar

Cryptocurrencies

Bitcoin rose 0.7% to $94,119.5

Ether rose 1.3% to $1,785.18

Bonds

The yield on 10-year Treasuries declined three basis points to 4.28%

Germany’s 10-year yield advanced two basis points to 2.47%

Britain’s 10-year yield declined one basis point to 4.49%

Commodities

West Texas Intermediate crude fell 1.3% to $62 a barrel

Spot gold fell 1.6% to $3,296.06 an ounce

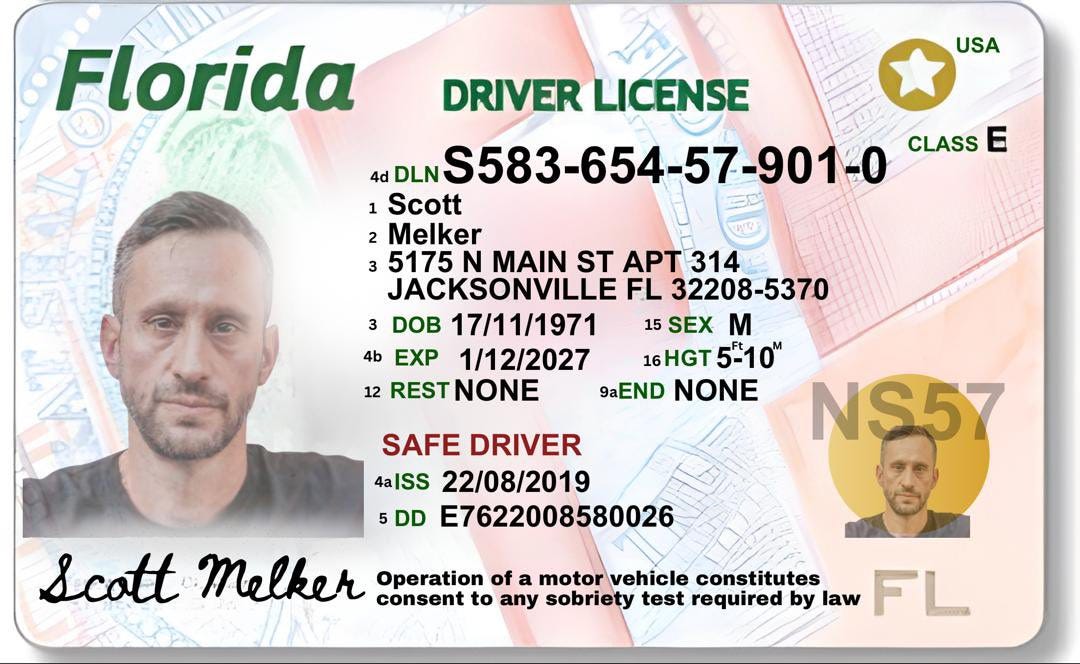

This is IMPORTANT - Horrible Scam Using My Identity

I’ve been talking about this story on X for a couple of days now. Cointelegraph picked it up as well, which is great for getting the word out — but here’s the gist:

I’m doing everything I can to stop scammers, but it’s one of those situations where my hands are tied and my ability to change the outcome is extremely limited. I am currently working with my lawyers to get the scammers removed from Instagram, and a private investigator to track down the perpetrators. The FBI is next.

Here is the fake instagram account:

This is the (obviously) fake driver’s license they are using.

They are using AI versions of me on zoom and phone calls to convince people that they are speaking with me. Some of the victims have been talking to them for 18 months. The story is truly insane.

I will never DM you on X asking for money, asking you to sign up for anything, or offering investment opportunities. If you get a message like that - it’s not me.

Coinbase Partners With PayPal

I still can’t get over how odd “PYUSD” sounds for a stablecoin – it’s hard to believe that name made it past branding. But awkward name aside, it’s gaining real traction: now the sixth-largest stablecoin with an $860 million market cap – and it just got a major boost from Coinbase. The exchange is teaming up with PayPal to accelerate PYUSD adoption, offering zero-fee conversions between USD and PYUSD and expanding access for both retail users and major merchants.

“The adoption of stablecoins for faster, low cost payments is core to Coinbase’s mission of accelerating access to financial freedom. Stablecoins are already transforming the global payments system, with transaction volumes surging 250% from $6.2T to $22T between 2023 and 2024. Our relationship with PayPal will take the payments revolution forward.”

I’ve got to give credit where it’s due – PayPal has earned it here. I was skeptical about PYUSD’s staying power, but the stablecoin has proven itself. Sure, it’s still a drop in the bucket compared to USDT and USDC – but it’s carving out its own lane and continues to grow.

Securitize Launches A $400m Crypto Fund

Securitize, the real-world asset tokenization firm known for its partnership with BlackRock and its role in launching the BUIDL fund, is expanding further into crypto. The company just unveiled a new institutional crypto index fund - The Mantle Index Four (MI4) - in collaboration with Mantle, which has committed $400 million as the fund's anchor investment.

The MI4 fund offers exposure to leading crypto assets: BTC, ETH, SOL, and stablecoins, aiming to become the ‘S&P 500 of crypto.’ It uses a market cap and risk-based allocation strategy, with added returns driven by quarterly rebalancing and staking through platforms like Mantle’s mETH and Bybit’s bbSOL.

“[The fund] aims to capture all capital onchain looking for smart beta with income and is a set-it-and-forget-it solution for institutions without the complexities of direct custody.”

Rapid Fire News

I have a few brief stories to cover.

If you lost money in Celsius, there’s at least some closure on the horizon – former CEO Alex Mashinsky, who pleaded guilty to fraud and market manipulation involving the CEL token, is set to be sentenced on May 8, 2025. If Sam Bankman-Fried’s 25-year sentence is any indication of what’s to come, Mashinsky could face serious time – though his case involved a smaller scale of fraud. Celsius had a $1.2 billion deficit and owed around $4.7 billion to its users when it collapsed.

Next up, we’ve got some fresh stats from Fidelity Digital Assets:

Last on the docket – CME Group is set to launch XRP futures on May 19, pending regulatory approval, expanding its crypto derivatives lineup alongside Bitcoin, Ethereum, and Solana. The cash-settled contracts will use a daily XRP-Dollar reference rate and come in two sizes – 2,500 and 50,000 XRP – designed to cater to both institutional and retail traders. Robinhood and Teucrium (an investment platform) are already preparing to trade these products.

This Bitcoin Deal Will SHOCK You – Price Is About To Explode!

Is Bitcoin set to explode? David Duong, Head of Coinbase Research, and Edan Yago, Core Contributor to Bitcoin OS, join me today to break down what's happening in the crypto market and explore what the near future holds for Bitcoin.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.