Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

America Is Going Broke, And Nobody Cares

Bitcoin Thoughts And Analysis

Legacy Markets

H.J Res. 109 Passes In The Senate

CME Looks To Offer Spot Bitcoin Trading

Ethereum ETF Issuers Are Still Hopeful

Chainlink Will Lead Tokenization

Bullish On Bitcoin | Will Bitcoin Hit $120,000 By The End Of 2024?

America Is Going Broke, And Nobody Cares

America's national debt has spiraled out of control, emerging as arguably the single biggest issue facing the nation today. Despite the alarming situation, politicians on both sides of the aisle remain reluctant to tackle this looming crisis head-on.

The U.S. National Debt, defined by the Treasury Department as “the amount of money the Federal Government has borrowed to cover the outstanding balance of expenses incurred over time,” stood at an unprecedented $34.5 trillion in mid-May. Shockingly, the debt is growing by approximately $1 trillion every 100 days, adding new debt at historic levels.

Historically, such debt surges occurred during national emergencies like World War II. Today, however, the U.S. is not engaged in a conflict of that scale, nor is there significant spending on infrastructure. Instead, two primary factors drive the rapid debt increase: entitlement programs and insufficient tax revenue.

Entitlement programs like Social Security, Medicare, and Income Security (e.g., unemployment benefits) accounted for 68% of federal spending in 2023. As baby boomers retire in greater numbers, this percentage is expected to rise. Additionally, in 2023, the federal government spent $6.16 trillion but collected only $4.5 trillion in revenue, a trend that has persisted for years. Successive administrations have addressed this shortfall by expanding the national debt.

The economic consequences are severe and far-reaching. Increasing debt pressures interest rates upwards, hampering economic growth. Higher interest rates divert capital from the private sector to Treasury bonds, further slowing productivity and growth. Moreover, mounting debt can erode confidence in the U.S. government's creditworthiness, posing a severe threat to the economy.

Most concerning is the potential loss of the U.S. dollar's reserve currency status. If the debt spiral continues unchecked, global confidence in the dollar could wane, leading to catastrophic economic consequences both domestically and internationally. This scenario would undermine America's financial stability, trade, and geopolitical influence.

Despite the urgency, neither political party is willing to address the problem effectively. Substantial cuts to entitlement programs are politically unpalatable, as many retirees depend on these benefits. Both Joe Biden and Donald Trump have ruled out major cuts, fearing electoral backlash. On the revenue side, Democrats advocate for tax increases, but Republicans counter that higher taxes would stifle economic growth, and any Republican supporting tax hikes would face a strong primary challenge.

Addressing the national debt requires fresh, bold approaches. One innovative solution could involve implementing targeted spending reforms that modernize and streamline entitlement programs without cutting benefits. For instance, leveraging technology to reduce administrative costs and fraud could save billions annually. Revisiting the tax code to close loopholes and ensure fair taxation could help boost government income. Encouraging public-private partnerships for infrastructure projects could also alleviate some of the fiscal pressure, stimulating economic growth without increasing the debt burden.

Proposing debt ceiling reforms to make it a genuine fiscal check rather than a recurring crisis point is another critical step. Establishing a balanced budget amendment could enforce fiscal discipline, while a sovereign wealth fund could provide additional revenue streams.

To break the political stalemate, fostering a national dialogue on fiscal responsibility is crucial. Educating the public about the long-term consequences of unchecked debt and building consensus on sustainable solutions can drive political will. Additionally, exploring new economic sectors, such as green energy and digital technologies, can create revenue streams and reduce reliance on debt-financed growth.

Moreover, addressing the high cost of healthcare and implementing pension reforms can ensure long-term fiscal sustainability. Emphasizing climate resilience in infrastructure spending can create sustainable economic growth and reduce future costs.

America's political class must confront this fiscal reality. Without decisive action, the specter of the national debt will continue to cast a dark shadow over America's future, threatening to derail the economy and compromise the nation's financial standing. It is imperative that both parties come together to address this issue before it spirals beyond control.

I highly doubt they will.

Bitcoin Thoughts And Analysis

Bitcoin remains in a local bullish trend, trading just below the center of the trading range. A break above the $67,000 area should send price eventually towards the range highs, around $73,000. This is far from guaranteed - we first want to see price trading in the top half of the range.

Still chop… and I am cautious…

My concern at the moment is that we had confirmed bearish divergence with overbought RSI on the 4-hour chart. Like bull divs with oversold RSI are usually local bottoms, this usually signals a local top. We got a drop yesterday - that could be it, but I would proceed with caution. This was a classic short signal. This could indicate that we will stay in the bottom half of the range.

Legacy Markets

European stocks declined as diminished expectations for Federal Reserve policy easing led to reduced risk appetite. The Stoxx 600 dropped 0.2%, affected by sectors sensitive to interest rates like tech and real estate. US futures remained mostly unchanged after a slight decline from previous highs. The dollar index rose, and Treasury yields were steady.

Luxury group Richemont saw gains after appointing Nicolas Bos as CEO. Meme stocks GameStop and AMC Entertainment rebounded after significant losses, and Reddit shares surged due to a partnership with OpenAI.

Caution prevailed on Friday as markets adjusted their expectations for only one Fed rate cut in 2024, following statements from several Fed policymakers advocating for higher borrowing costs to combat inflation. Comments from Fed officials Christopher Waller, Neel Kashkari, and Mary Daly were anticipated for further rate guidance.

In Europe, ECB Executive Board member Isabel Schnabel cautioned against consecutive interest rate cuts in June and July. Swap traders continued to anticipate three ECB rate cuts this year, starting next month.

Asian markets fell amid signs of economic weakness in China. The yen weakened against the dollar after the Bank of Japan maintained its bond-buying levels.

Oil prices were set for a modest weekly gain, while a record squeeze in the New York copper market eased.

Key events this week:

Eurozone CPI, Friday

US Conf. Board leading index, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.3% as of 10:23 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index fell 0.1%

The MSCI Emerging Markets Index was little changed

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.2% to $1.0843

The Japanese yen fell 0.3% to 155.90 per dollar

The offshore yuan fell 0.1% to 7.2329 per dollar

The British pound fell 0.1% to $1.2651

Cryptocurrencies

Bitcoin rose 1.3% to $66,156.66

Ether rose 3% to $3,025.1

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.39%

Germany’s 10-year yield advanced three basis points to 2.49%

Britain’s 10-year yield advanced three basis points to 4.11%

Commodities

Brent crude rose 0.1% to $83.36 a barrel

Spot gold rose 0.3% to $2,383.98 an ounce

H.J Res. 109 Passes In The Senate

The ball is now in President Biden’s court. H.J. Res 109, a resolution of disapproval of the SAB 121 rule submitted by the SEC, has passed in the Democrat-controlled Senate, meaning a presidential decision is the last step. Unfortunately, the Biden Administration has already announced it would veto the resolution, but the decision would be damning for winning the crypto vote come November. I am loosely holding onto hope the administration reconsiders its stance. I included the demographics of the vote and the current senate below in case you’re interested.

118th Congress (2023–2025)

Majority Party: Democrats (48 seats) ((12 Democrats broke rank))

Minority Party: Republicans (49 seats)

Other Parties: 3 Independents

Total Seats: 100

CME Looks To Offer Spot Bitcoin Trading

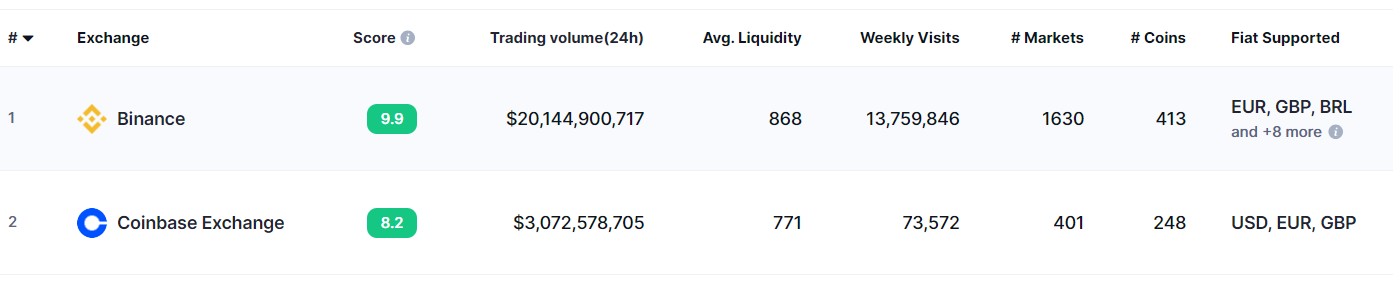

The global leader in Bitcoin futures trading now plans to offer spot Bitcoin trading. How can you not be bullish on Bitcoin? The Financial Times reported the news, but as of now, there is no comment from the CME regarding the details of the decision. This would be an excellent opportunity for futures traders to trade spot in the same place and would likely drive new entrants into the spot market. As for existing exchanges, this will definitely steal market share from Binance and Coinbase (mostly Binance since it’s much larger), but I don't see this being a huge detriment. New entrants mean prices go up, which means more trading volume across the board. If anything, existing exchanges may benefit in some ways. Exchange stats below.

Ethereum ETF Issuers Are Still Hopeful

The odds of an ETH ETF approval seem unlikely next week, but it's not impossible. According to a new SEC filing, Grayscale’s ETHE has entered an agreement with The Bank of New York Mellon (BNY) to serve as a transfer agent for the trust. Of course, for this partnership to go into effect, the ETF has to be approved, but all of the necessary requirements, as far as the issuers know, are set in place.

In other news regarding ETH, the asset, this has to be one of the worst sentiments I have ever seen in recent history. The ETH/BTC chart looks like hot garbage, Solana folks are celebrating 24/7, Bitcoin has captured institutional interest, and Ethereum investors are defending themselves at a pace never seen before. This trend can’t last.

Ethereum’s layer 2 success has slowed down fee accrual for the base chain, but growth is still happening despite the weight of frustration. Also, Bitcoin’s entire value proposition is based on it being a store of value and hard money, traits that Ethereum shares, which is not being recognized at the moment. Wall Street will enjoy yields, and when an ETF comes, I anticipate a strong reversal in price and interest. In the short term, the market is a voting machine; in the long term, it's a weighing machine.

Side note: Solana clearly has the upper hand in terms of optics right now. Do you think Solana has definitively surpassed Ethereum as the better #2? This could be the most important question of this cycle.

Chainlink Will Lead Tokenization

Real world tokenization is around the corner. Chainlink and the DTCC (Depository Trust and Clearing Corporation) conducted tests with major US banks like JPMorgan, Templeton, and BNY Mellon to speed up fund tokenization. The pilot project, Smart NAV, tested bringing and sharing fund data on multiple blockchains, a crucial step for tokenization's future. Participants included American Century Investments, BNY Mellon, Edward Jones, and others. Results showed structured data on-chain can support various on-chain use cases, like tokenized funds and 'bulk consumer' smart contracts. Chainlink's capabilities could aid in exploring tokenization further, including brokerage portfolio applications, offering real-time benefits like automated data dissemination and access to older information. The DTTC reported it sees potential to expand the pilot's scope for broader use cases and more blockchains.

No exaggeration, this is HUGE for Chainlink and crypto. This news is bigtime!

Bullish On Bitcoin | Will Bitcoin Hit $120,000 By The End Of 2024?

Edan Yago, the Founder of Sovryn, a decentralized Bitcoin trading and lending platform, joins me today to discuss the future of Bitcoin and to introduce his new show: the Bitcoin Alpha. In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code 'TENOFFSALE' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.