Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public focuses on two guiding principles: liquidity and performance. Our customers have access to their funds 24/7. Our hands-free algorithmic portfolios produce alternative asset level returns (138% and 171% respectively). Take a look below and put a hedge fund in your pocket.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Mt. Gox Looms

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Tether Is Strategically Consolidating Its Issuance

Is Solana Under Investigation?

A Pro-Crypto Advisor Returns

Bitcoin Crash: Will It Plummet to $50K? | [Black] Macro Monday

Mt. Gox Looms

Panic has begun to set in within the crypto markets.

Is the crypto sell-off due to NVDA's decline? Are concerns around the ETH ETF signaling a local top? Or are frothy meme coins simply losing their allure? Perhaps Jump Crypto is liquidating its positions?

To some extent, all of these theories hold weight—they conveniently fit various narratives that attempt to explain the invisible force pulling down the market.

That said, I want to dedicate today's newsletter to discussing the potential impact of Mt. Gox distributions on the market.

Let's dive in.

On February 28, 2014, Mt. Gox, the largest crypto exchange at the time by a significant margin, collapsed due to a devastating hack. Based in Tokyo, Mt. Gox was responsible for about 70% of Bitcoin transactions globally. The magnitude of this disaster dwarfs anything in crypto history, even the collapse of FTX.

From the hack, Mt. Gox lost 940,000 Bitcoin. Can you guess what that would be worth today? Approximately 56.4 billion United States dollars.

In late 2022, FTX experienced a $9 billion shortfall. To put this into perspective, if the Mt. Gox incident occurred today, it would be equivalent to six FTX collapses.

I’ll dig into the numbers momentarily, but the history of Mt. Gox has significance today, so let’s briefly go there.

Did you know that Mt. Gox originally served as an online platform for enthusiasts of the card game "Magic: The Gathering" to trade cards? The term ‘Mt. Gox’ was coined as an abbreviation for ‘Magic: The Gathering Online Exchange.’

In 2011, Mark Karpeles acquired the exchange in exchange for six months' worth of revenue, subsequently becoming its largest shareholder and CEO. Why this matters today is because Mt. Gox—in all regards—isn't equivalent to modern crypto exchanges.

Mt. Gox's customer base was unique, to say the least. While not all of these customers were Bitcoin enthusiasts as we understand them today, they were far from the casual retail traders we see now. Among them were early card traders, individuals versed in the workings of the dark web, and forward-thinking tech enthusiasts—smart people.

What this translates to today is that the individuals who are finally receiving repayment are the ideal candidates to have learned about Bitcoin this past decade. And if they learned about Bitcoin, why would they dump it? Sure, some selling is natural, but my guess is that it won't add up to much.

Another crucial point to note is that the individual creditors, who everyone fears will dump on the market, mostly refused to sell their claims to funds that aggressively sought to take these claims off their hands in exchange for USD.

Creditors are signaling they want their Bitcoin back, but will they sell?

Answering this question is hard, but this is where the numbers come into play.

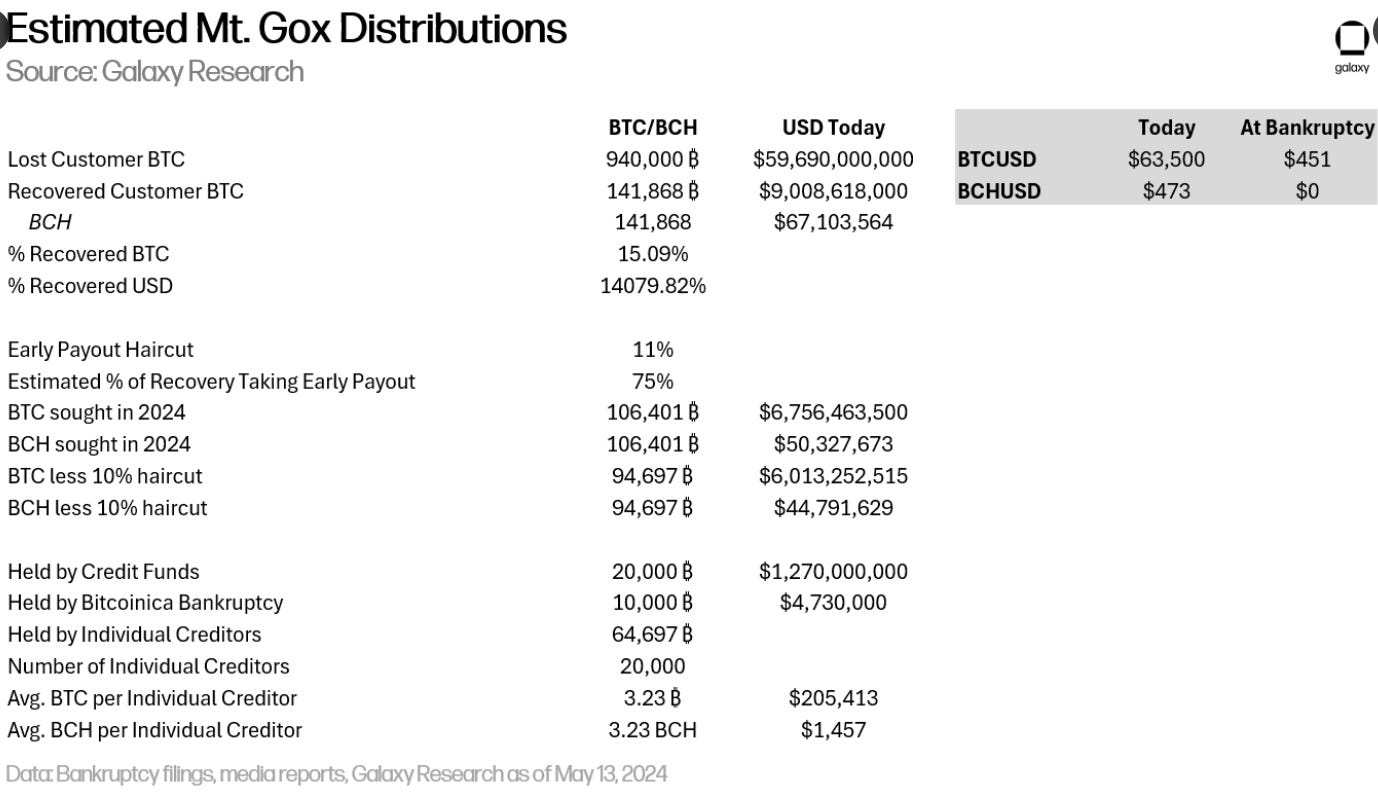

Here’s the breakdown:

940,000 BTC lost

15% were recovered, totaling 141,868 BTC

BTC price at the time of bankruptcy: $451

Bitcoin price today: $60,000

If a creditor had 10 Bitcoin on the exchange at the time of bankruptcy, valued at $4,510, receiving 15% back today would mean they are receiving 1.5 BTC, which is now worth $90,000. The percentage gain from $4,510 to $90,000 is approximately 1,896%.

But here’s the kicker: the average creditor isn’t receiving 1.5 BTC, they are receiving 3.23 BTC, which at $60,000 is worth $193,800 at today’s prices. At all-time highs, this is about $239,020. Both $90,000 and $239,020 are NOT insignificant amounts of money.

For reference, the average American household debt is $104,215.

I know for a fact that every creditor is closely examining the amount they are receiving and calculating the potential value of their Bitcoin at prices of $100,000 and beyond. Additionally, it's intriguing to note that 75% of creditors chose to accept an 11% haircut in order to receive their Bitcoin earlier. You could argue this may be indicative of selling interest since the October 31st deadline is just around the corner.

But as the saying goes, a bird in the hand is worth two in the bush.

If I were a creditor, there’s a good chance I too would opt to be in the ‘early delivery haircut bucket,’ and I still wouldn’t be selling.

Depending on the price of Bitcoin at the time of repayments, approximately $5.7 billion in Bitcoin is expected to be distributed in early July to credit funds, Bitcoinica Bankruptcy, and individual creditors. This largely explains the current panic selling.

I'll share my final thoughts below on this, but the more concerning story is what happens to Bitcoin Cash in the coming weeks. On average, creditors are also receiving 3.23 BCH alongside their Bitcoin, which is currently trading at $350 for one BCH. Just for historical context, BCH is a hard fork of Bitcoin that occurred after the exchange collapsed, entitling all of the creditors to their fair portion based on the recovered BTC.

Venturing out on a limb here, I firmly believe that the sentiment toward holding BCH will not even come close to the enthusiasm for holding BTC. None of these individuals ever chose to buy BCH, and the asset's adoption, liquidity, and trading volume are severely underperforming. Not to mention, if we are giving credit to the creditors for their tech acumen, then they probably figured out by now Bitcoin Cash isn’t relevant. Just take a look at this chart.

The Mt. Gox saga has been an industry overhang for nearly a decade, and we are finally pushing through the final wave of FUD. We have a choice: to be frustrated that locked Bitcoins—which we knew wouldn’t be locked forever—are entering the market, or to be thankful that these coins were removed from circulation for a decade, allowing prices to rise higher during more critical times than today.

The optimistic approach is appreciating that the distribution of these coins is taking place now rather than the possibility of them stifling growth near the peak of the bull market or dragging us lower during a full-blown bear market.

It’s time to put Mt. Gox fears to rest.

Last point: I believe that the fear of forced selling has a more significant impact on the market than the selling itself. Mt. Gox is providing us with one last opportunity to venture into the valley of discounted prices. In this valley, the days of sellers are numbered, and buyers will begin to find solace.

For those descending, they may be sharing our path, but nothing awaits them.

Strength lives in those who arrive in the depths, ready to climb.

From here, beautiful peaks are within our sight.

Bitcoin Thoughts And Analysis

Bitcoin looks… fine. I know there is panic everywhere with price breaking support, but it has had a nice bounce so far. As we know, with a key support like the 200 MA (red line), we usually see it broken or front run - rarely do people get the exact entry they want.

For now, we have a sweep of the lows and price back in the range. We need to watch closely for where today’s candle closes… subsequent days as well. Back in the range means we likely head back up to $67,000 to the middle.

Bulls do not want to see many candle closing below the range.

Just a quick reminder that we historically have multiple 30% and 40%+ corrections in a Bitcoin bull market. In this cycle, our LARGEST correction has been 23.48%. The current correction is 18.84% These are NOTHING in a bull market. Remain calm.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

The performance of Ethereum Vs. BTC has historically been a decent gauge for what is likely to happen with the altcoin market as a whole. That has changed some, with Solana stealing the spotlight, but this should still give us an idea of what will happen with a number of older coins, especially ERC20s.

Ethereum has been consistently rejected at this descending resistance on the weekly chart. Literally for years at this point. Price is once again consolidating below it, so it is time to pay attention. As you can see, we have had massive bullish divergence coming from oversold RSI, which is not a combo we have seen often on this pair. That said, it has played out to some degree and price is not much higher.

Still, I expect ETH to eventually break out and outperform, especially with an impending ETF. Keep your eye on it. And there is this…

Trading Alpha is showing buy signals on numerous time frame for ETH on the BTC pair. As you can see, we have a bounce from the trackline yesterday with a grey arrow signaling to go long, all coinciding with a squeeze shading that indicates volatility is likely increasing.

This has been showing grey dots now for a few weeks.

ETH looks ready to rock if the market can stabilize.

Legacy Markets

European stocks declined, influenced by tech-led drops on Wall Street and a significant fall in Airbus SE shares. The Stoxx 600 Index decreased by 0.3%, with technology firms and industrials dragging it down. Airbus fell over 10% after cutting its guidance due to ongoing supply-chain issues. Additionally, Germany’s Merck KGaA saw a decline following another unexpected failure of a promising medicine. US equity futures rose slightly as non-tech sectors advanced, even though Nvidia Corp. continued its three-day decline.

As the quarter nears its end, investors are shifting from tech to value stocks. In Europe, there is a focus on France’s political debate ahead of the legislative elections. According to Nomura Asset Management’s chief strategist Hideyuki Ishiguro, global investors are rebalancing their portfolios by selling recently well-performing assets and buying lagging ones.

The dollar remained steady, and US Treasuries showed minimal movement. Danske Bank analysts noted that the tech share retreat is due to investor sentiment rather than macroeconomic factors, with fundamentals unchanged from the previous week.

Corporate Highlights:

Airbus expects to deliver 770 aircraft in 2024, down from 800, and adjusted earnings before interest and tax will be €5.5 billion, down from a previous goal of up to €7 billion.

Merck dropped 11% after announcing the discontinuation of the drug xevinapant for head and neck cancer treatment.

Eurofins Scientific SE rose over 5% after a significant decline, rejecting allegations from Muddy Waters Research and asserting confidence in its accounts.

In currency news, the yen risks sliding to levels last seen in 1986 amid continued selling in favor of the higher-yielding dollar. Separately, the US is investigating Chinese telecom firms over concerns about potential data access for Beijing.

Oil maintained gains amid geopolitical tensions, gold edged lower, and Bitcoin rebounded after a Monday decline.

Key events this week:

US Conference Board consumer confidence, Tuesday

Fed’s Lisa Cook, Michelle Bowman speak, Tuesday

US new home sales, Wednesday

China industrial profits, Thursday

Eurozone economic confidence, consumer confidence, Thursday

US durable goods, initial jobless claims, GDP, Thursday

Nike releases earnings, Thursday

Japan Tokyo CPI, unemployment, industrial production, Friday

US PCE inflation, spending and income, University of Michigan consumer sentiment, Friday

Fed’s Thomas Barkin speaks, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.3% as of 9:37 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.9%

The MSCI Emerging Markets Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0734

The Japanese yen was little changed at 159.47 per dollar

The offshore yuan was little changed at 7.2841 per dollar

The British pound rose 0.1% to $1.2701

Cryptocurrencies

Bitcoin rose 2% to $60,660.22

Ether rose 1.2% to $3,348.65

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.24%

Germany’s 10-year yield was little changed at 2.41%

Britain’s 10-year yield declined one basis point to 4.07%

Commodities

Brent crude was little changed

Spot gold fell 0.4% to $2,325.99 an ounce

Tether Is Strategically Consolidating Its Issuance

Yesterday morning, Tether issued a press release affirming its commitment to "prioritizing community-driven blockchain support," effectively signaling it no longer sees value in supporting low-usage chains. EOS and Algorand were named as the two chains losing support, with issuance ending yesterday and redemption ending in about 12 months. Not much was directly said other than the paragraph below.

“Community interest plays a pivotal role when we bring USD₮ to specific blockchains. We carefully evaluate the network’s security architecture to ensure the safety, usability, and sustainability of the chosen blockchain. Our goal is to allocate resources where they can best enhance security and efficiency while continuing to support innovation across the crypto landscape.”

Is Solana Under Investigation?

I'm not a fan of rumors, so I’ll stick to the facts. Numerous high-profile sources have indicated that Solana is under investigation, a situation that has been developing for weeks. So far, there is no evidence other than ‘he said’ and ‘she said.’ What we do know is that the SEC appears to have shifted its focus away from Ethereum. Assuming that's true, Solana was one of the tokens named as a security in the lawsuits against Coinbase and Binance. Solana being under attack isn't good for the industry, just as it wasn’t good when Ethereum was under attack. Nobody should be cheering for this.

A Pro-Crypto Advisor Returns

The Biden Administration has rehired Carole House, a pro-crypto cybersecurity advisor, as Special Advisor for Cybersecurity and Critical Infrastructure Policy. House previously criticized the administration's lack of regulatory clarity for crypto companies. Her return indicates a possible shift towards a more engaged and less adversarial stance on crypto policy. This move comes amid growing scrutiny of Biden's crypto policies and ahead of the 2024 presidential election, where Republicans, including Trump, have shown strong support for the crypto industry.

Bitcoin Crash: Will It Plummet to $50K? | [Black] Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.