Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Gold Is The New Black

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Base Turns 1-Year-Old

SEC Official Steps Down

Coinbase Creates A Launchpad For Up-And-Coming Crypto Launches

$1 Million Bitcoin, Is It Possible? | Macro Monday

Gold Is The New Black

The day has arrived, and Tether has delivered.

Tether, the leading stablecoin issuer by a significant margin, has announced the launch of a new class of digital assets focused entirely on gold, and I'm covering it all here. As you read through this report, I encourage you to think about where this is heading. This is only the beginning.

“There are decades where nothing happens; and there are weeks where decades happen.”

Before I start with the news that dropped, I want to call to your attention that Tether’s journey down the gold path it is paving did not start on Monday. In January 2020, Tether launched the Tether Gold platform, releasing a white paper for their gold backed product designed to be an evolution of money.

As per the XAUt white paper, “Tether Gold, digitizes the value of gold using the new token, XAUt. This novel token gives XAUt holders the ability to own digitally allocated gold, in small sums, that are highly transferable and with comparably low fees.”

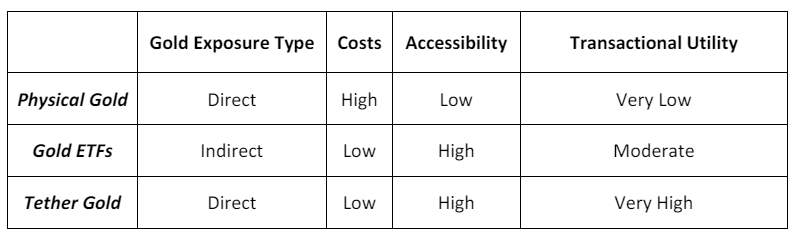

Further reading, “XAUt will combine the best of three distinct worlds: direct exposure to the price of physical gold, the accessibility of traditional financial assets like ETFs, and the transactional utility of a digital token:

At this point, I need to add that for those interested in the history of gold-backed cryptocurrencies, Tether Gold was not the pioneer in this space. Before its introduction in January 2020, several other gold-backed cryptocurrencies had already been established. Notable examples include DigixDAO (DGX), GoldMint (MNTP), and Paxos Gold (PAXG).

Furthermore, today's newsletter won't delve into these alternatives, not because of my lack of interest in their developments, but because there's a wealth of updates from just Tether alone to cover. Given the rapid pace of Tether's expansion, it seems likely that Tether will succeed in any direction it takes in the market, based on its investment power and leadership.

*Do note: In terms of market capitalization, Paxos Gold (PAXG) currently leads the market with a $433 million marketcap, compared to Tether Gold's (XAUt) $389 million.

Between 2020 and the announcement (I am about to cover) that released yesterday, there wasn't much activity from Tether in terms of expanding its gold product line. When I reflect on Tether's recent history, what stands out to me is the company's gargantuan profit generation from its treasuries, which has propelled its USDT market capitalization past $100 billion, and the company branching out into new ventures, including AI, mining, education, and financial services.

Now for the announcement.

Important warning: Some websites are impersonating the announcement. If you're looking for the official page, use my links below or go directly to Tether.io or Paolo Ardoino’s Twitter for safe links.

The Official Site—Alloy by Tether

The Official News Release—Tether Announces Launch of Alloy by Tether: A New Digital Asset Backed by Tether Gold

Tether’s new product, for the record, is not meant to be solely assessed on its own attributes, it’s meant to be assessed based on what it enables. This requires some reading between the lines; hopefully you will see the vision.

To better understand what Tether is introducing, I have to briefly define a set of terms.

Tethered Assets: A general-purpose term for describing assets that are designed to track the price of a specific reference asset, such as the US Dollar. Tethered assets achieve stabilization via over-collateralization and the support of secondary market liquidity pools.

Alloy by Tether: A novel class of tokens—Tethered assets—that use Tether Gold as collateral and are intended to track the price of fiat currencies. aUSD₮ is the first Alloy by Tether token.

aUSD₮: This digital currency is designed to track the value of one US dollar. What makes aUSD₮ unique is that it is over-collateralized by Tether Gold (XAU₮), which means it is supported by real physical gold stored in Switzerland.

Tether has effectively created a mini DeFi economy that enables individuals and institutions to engage in transactions, payments, and remittances without relinquishing their XAU₮ holdings and without the risk associated with an unstable dollar. If cryptocurrency was founded on the belief that fiat currencies are failing, then over-collateralizing the dollar with gold represents the first step in establishing insurance against catastrophic failure.

The best part is that all of this is facilitated through Ethereum smart contracts, allowing investors to deposit Tether Gold (XAU₮) as collateral and receive aUSD₮ in return. The potential is vast, and it appears that Tether is leading the way in integrating gold further into the digital economy, expanding beyond the physical asset and the base asset Tether Gold introduced in 2020.

The press release hinted at what’s at stake, stating, “Alloy by Tether is an open platform that enables the creation of various tethered assets with broader backing mechanisms, potentially including yield-bearing products… Moreover, we plan to make this innovative technology available in our upcoming digital asset tokenization platform as well.”

The possibilities are endless, but some of the future avenues I can see include a new line of stablecoins that follow the same principles of aUSD₮ but with the Euro and Yen; aUSD₮ acting as collateral for borrowing and lending, or in liquidity pools for decentralized exchanges; and integrating Alloy by Tether with a new line of tokenized products tethered to stocks or commodities.

Alloy by Tether opens the door to an entirely new asset class, while simultaneously being the first Tethered asset. It’s all exciting, however, it's crucial to understand that interacting with aUSD₮, the first token in the Alloy lineup, requires Ethereum addresses to undergo a whitelisting process. This process includes a KYC procedure, a $150 fee, and submission to Tether's Compliance Department.

This will deter almost all of retail.

That said, Tether's initial product offerings seem tailored for larger players, particularly institutions seeking a reliable entry point into DeFi while holding positions in gold. Institutions don't mind signup fees and KYC requirements. My guess is that as the platform grows, the DeFi expansion will become truly DeFi-friendly across the board.

All in all, I'm fully supportive of the vision. Tether's initiatives continue to go beyond mere profit-making; in this case, they're actively cultivating the long-term stability of the industry by introducing products that tether their value to the security and reliability of gold. Crypto isn't going to make it far without incorporating gold, the most reliable currency to ever exist.

Stablecoins are deeply embedded in the industry and, truth be told, derive their stability from the fiat that backs them. While this may not seem relevant now, it could have massive implications in the future—potentially leading to an epic unwind if we aren't careful. Props to Tether for taking a forward-thinking approach by anchoring our longevity to gold.

Gold is the new black.

Bitcoin Thoughts And Analysis

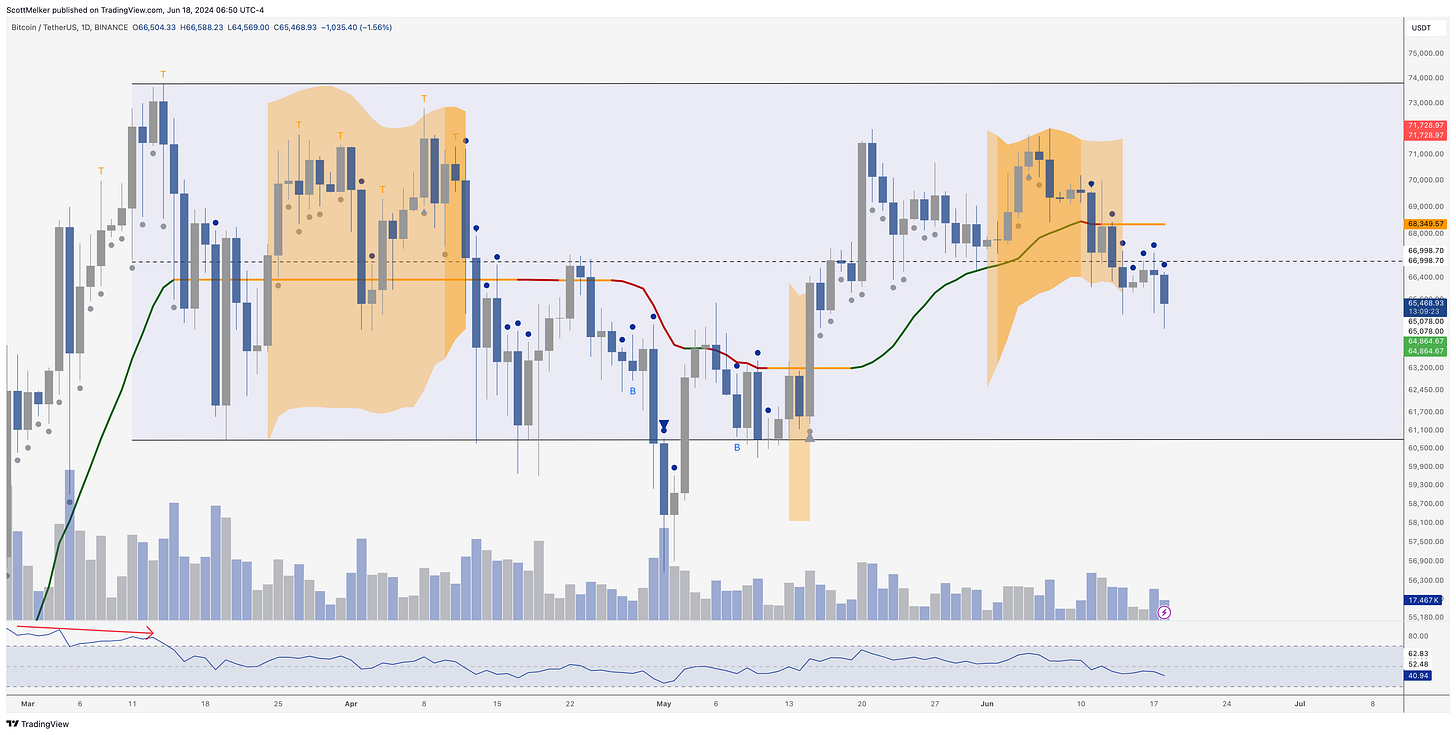

The painful chop continues, this time to the downside.

Bitcoin RSI has been neither overbought or oversold on the daily chart since the top in March, when there was clear bearish divergence and top signals abounded. This is an indication that neither buyers or sellers have much conviction to push hard in either direction - hence the predictable range.

In May, RSI almost reached oversold, which would have been nice to finally see.

We remain in purgatory, but now between $60,000 and $67,000. I would love to be able to offer more, I could dig into other indicators etc., but what is the point? We are just in this part of the cycle.

Altcoin Charts

Altcoins are currently getting slaughtered, as Bitcoin shows weakness and traders get bored and start to capitulate. Many of them are actually starting to look oversold, but I am not in the business of recommended that you catch falling knives. We will take a look further, but hard to pick winners at this moment.

Legacy Markets

US stock futures remain steady, with Nasdaq 100 futures rising following a tech-led rally on Wall Street. Treasury yields are flat, crude oil edges lower, and copper rallies. European shares are rebounding, with France's political situation viewed as a potential buy-the-dip opportunity.

US equity futures indicate further gains, driven by strong performances from tech companies like Broadcom, Micron Technology, and Qualcomm. The S&P 500 hit another record peak, with optimism over a resilient economy and improving corporate earnings pushing US equities up about 15% this year. Treasury yields and the dollar remained steady, while retail sales data and Federal Reserve speakers are anticipated for more rate cut insights.

European stocks rebounded despite concerns over French political turmoil, with positive outlooks on risky assets favoring the US. Travel, leisure, and biotech stocks led advances in Europe. Meanwhile, China's anti-dumping probe on EU pork imports and the EU's tariffs on Chinese electric cars add to trade tensions.

The Australian dollar rose after discussions of a potential rate hike by the Reserve Bank. In Asia, chip stocks and Tesla suppliers drove gains, with SK Hynix hitting a 24-year high. Oil prices slightly declined, while copper and gold remained stable.

Key events this week:

US retail sales, business inventories, industrial production, Tuesday

Fed’s Thomas Barkin, Lorie Logan, Adriana Kugler, Alberto Musalem, Austan Goolsbee speak, Tuesday

UK CPI, Wednesday

US Juneteenth holiday, Wednesday

China loan prime rates, Thursday

Eurozone consumer confidence, Thursday

UK BOE rate decision, Thursday

US housing starts, initial jobless claims, Thursday

Eurozone S&P Global Manufacturing PMI, S&P Global Services PMI, Friday

US existing home sales, Conf. Board leading index, Friday

Fed’s Thomas Barkin speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 6:07 a.m. New York time

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 rose 0.5%

The MSCI World Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.1% to $1.0720

The British pound fell 0.2% to $1.2684

The Japanese yen fell 0.2% to 158.08 per dollar

Cryptocurrencies

Bitcoin fell 1.5% to $65,404.12

Ether fell 2.5% to $3,426.86

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.29%

Germany’s 10-year yield advanced two basis points to 2.43%

Britain’s 10-year yield declined one basis point to 4.10%

Commodities

West Texas Intermediate crude was little changed

Spot gold fell 0.3% to $2,312.12 an ounce

Base Turns 1-Year-Old

One year and three days ago, Base launched its genesis block, marking the beginning of an impressive journey. The public launch took place in August. In less than a year, Base has established itself as Ethereum’s second-strongest Layer 2 solution, just behind Arbitrum, thanks to a recent surge in activity. Notable developments on Base include the SocialFi app Friend.tech, the decentralized exchange Aerodrome, the lending protocol Moonwell, and a degen network for memecoins.

In December, Coinbase announced that transfers through Coinbase Wallet would be free on Base. This led to an increase in the volume of USDC on the network. Although Base temporarily held the top spot among Ethereum’s Layer 2 solutions, Arbitrum has since reclaimed it, fueled by excitement around a $215 million allocation to a gaming fund aimed at boosting partnerships with gaming companies. Overall, things are looking promising for Base, and the competition remains vibrant and healthy.

SEC Official Steps Down

David Hirsch, the SEC's (now former) head of the crypto asset enforcement division, has resigned after nearly 10 years in his position. While I don't know much about Hirsch's record, online sources suggest he was adamant about taking legal action, indicating he was probably behind the SEC’s regulation by enforcement agenda.

SEC ya later, pal!

Also, there is a rumor going around that David joined Solana’s Pump.fun as the new head of trading. Pump.fun posted it and Binance news as well—very odd. There’s plenty of fake news out there and I highly doubt this is true. Something tells me David isn't looking to end his career as a Solana shitcoiner.

Coinbase Creates A Launchpad For Up-And-Coming Crypto Launches

Following in the footsteps of other popular centralized exchanges, Coinbase International is creating a launchpad for up-and-coming crypto projects. These types of investments are popular, but they are not designed for inexperienced traders. Coinbase is aware of the risks, which is why pre-launch market assets are capped at an initial margin of 50%, or two-times leverage, and a notional position limit of $50,000 per token. Don’t expect this to launch anytime soon in the U.S. under the current regulatory regime. Further details below.

“Pre-launch markets allow users to trade perpetual futures contracts on tokens that have not launched yet. When the underlying token is launched on applicable spot exchanges, the instrument converts to a standard perpetual contract.”

“There is a risk—outside of Coinbase’s control—that the underlying token may never launch. If such a determination was made, the pre-launch market would not be able to convert into a standard perpetual futures market, and the market may need to be suspended and/or delisted.”

$1 Million Bitcoin, Is It Possible? | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.