Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

At Arch Public, performance and risk management are inseparable principles. Our algorithms are pre-set with tight stop loss levels. See the two charts below. The losing trade was limited to (-1.6%) while the winning trade ran up 5.2%. Again, the math wins.

Tillman Holoway - Arch Public CEO

Andrew Parish - Arch Public Co-Founder

Consider giving Arch Public a try today. It helps keep this newsletter free!

In This Issue:

A Closer Look At Supply

Bitcoin Thoughts And Analysis

Legacy Markets

Pitching Ethereum To Boomers

Biden May Attend A Bitcoin Roundtable

July 2nd Is The New Launch Date

MicroStrategy Ups The Ante

Trump Vs. Biden. Will Bitcoin Decide Who Wins The Election? | Dennis Porter, Satoshi Action Fund

A Closer Look At Supply

In the world of cryptocurrency, the concept of supply often appears straightforward, or so it might seem at first glance.

In traditional markets, the supply of assets such as stocks or bonds is regulated by centralized entities like governments, central banks, or corporations. These entities can issue new shares or bonds, repurchase existing ones, or adjust interest rates to influence supply.

Our understanding of supply in capital markets has rarely faced disruption—until the advent of cryptocurrency.

One of the primary challenges in learning about crypto is grappling with concepts that simply don't exist in traditional finance. For instance, Bitcoin's scheduled supply issuance reduction, known as 'The Halving,' Ethereum's supply issuance model involving 'staking,' and Solana's rise to popularity with its unique 'fixed inflation rate.'

Today, I aim to break down these concepts and explain them in the simplest terms possible. Once you grasp Bitcoin, Ethereum, and Solana, you'll have a strong foundation to explore other aspects of crypto.

First, I want to address the concept of 'total supply,' which I find more confusing than helpful. The discussion around supply needs more nuanced language, which I promise isn't too difficult as long as you're open to incorporating new ideas.

Many cryptocurrencies, including Bitcoin, have what’s called a 'maximum supply,' referring to the absolute limit on the number of coins or tokens that can ever be created within a protocol. This term should replace 'total supply.' Altering this limit would require significant code changes, often resulting in a 'hard fork,' which creates an entirely new version of the network.

I believe Bitcoin's maximum supply will never change because it doesn't need to. Bitcoin's maximum supply is 21 million coins, and it will only change if a consensus is reached among a significant portion of the community. While this is unlikely due to Bitcoiners' reverence for the fixed supply, it isn't impossible.

It's also crucial to understand that Bitcoin's supply undergoes a halving roughly every four years. This mechanism reduces the rate at which new Bitcoins are created, effectively cutting the supply growth rate in half. A common misconception is assuming that other cryptocurrencies have a similar halving process, which isn't the case.

Next, a more universal supply term applicable to any cryptocurrency is 'circulating supply.' This term describes the current number of coins or tokens available for trading on the network, akin to outstanding shares of stock.

It is commonly understood that Bitcoin’s ‘circulating supply’ is 19.7 million, Ethereum’s is 120 million, and Solana’s 461 million. The nuance of this term is learning that not every one of these coins is circulating in the intuitive sense.

For example, it is widely known that around 6 million Bitcoin are irretrievably lost. Technically, a hard drive could be pieced together from trash or a private key rediscovered, but the odds are so infinitesimally small that these coins are considered non-existent and, in my mind, out of circulation. However, platforms such as CoinMarketCap or CoinGecko still include these lost coins in their count of 'circulating supply,' for the sake of simplicity.

Ethereum also has its share of lost supply, estimated to be around $1 billion. This amount is lower than Bitcoin’s lost supply, as Ethereum came along later when early participants were more experienced. Another intriguing aspect of Ethereum’s supply is the status of staked tokens. Although staked ETH is locked and not immediately accessible, platforms still include these tokens in the 'circulating supply.' About 27% of the supply is currently staked.

Where Ethereum’s supply issuance differs significantly from Bitcoin's is that it does not have a maximum supply—technically, the limit is infinite. This may sound alarming at first, but it's essential to understand the mechanisms in place that manage Ethereum's supply, such as the transition to proof-of-stake and the implementation of EIP-1559, which introduces deflationary aspects by burning a portion of transaction fees. These measures help control inflation and ensure the long-term sustainability of the Ethereum network.

In short, Ethereum's inflation rate can vary based on network activity and the staking participation rate. Overall, Ethereum's supply is designed to be more flexible and adaptable than Bitcoin's fixed supply.

As for Bitcoin, it has a decreasing and ultimately fixed issuance rate, which means its inflation rate decreases over time. This decreasing issuance combined with the potential for lost coins makes Bitcoin deflationary overall.

For crypto natives, this is basic 101 education; for outsiders, this can be quite overwhelming, which I hope you are starting to appreciate.

To take it one step further, Solana doesn’t have a fixed supply, but it does have a fixed year-on-year inflation rate. Each year, Solana abides by a disinflation rate of -15%, aiming for a long-term inflation rate of 1.5%, starting from an initial inflation rate of 8%. Below is an excerpt from the Solana Docs; for a TradFi Boomer, I imagine this resembles Sanskrit.

For now, I'll set this topic aside, but I hope it provides some context for your next discussion or exploration into supply. The challenge for newcomers in crypto is that each asset approaches supply differently, and the more you delve into it, the more layers you uncover. I haven't even touched on 'dormant supply,' 'inelastic supply,' 'semi-elastic supply,' and 'locked supply.'

Now, I want to pivot to an idea that should simplify the complexities around supply.

In a few weeks, BlackRock will start marketing the Ethereum ETF, and they'll need to address Ethereum's supply somewhere in the campaign. They won't declare that Ethereum has an infinite supply and call it a day, as that would deter skeptical investors. Instead, BlackRock will craft clear and digestible language that will shape the global narrative of ETH as a new wave of capital approaches. Financial advisors will use this direction to pitch and sell the ETF to ultra-wealthy clients.

Whatever direction BlackRock chooses with Ethereum will likely become the most important industry-defining perspective of the asset ever, as it will be crafted for the broadest and wealthiest untapped audience. Selling Ethereum is more challenging than selling Bitcoin, partly because its characteristics, such as supply, are not as straightforward as Bitcoin's. However, if BlackRock aims to tokenize the world, it will start with the basics, and this will be reflected in their landing page, interviews, and research reports.

A lot is riding on BlackRock in the next few weeks because a successful launch with Ethereum could pave the way for new assets like Solana, Dogecoin, and tokenized products that we haven't yet dreamed of. We've done the homework and learned about supply; if TradFi wants to join the game, they'll have to study what we already know.

Let’s have a killer week. Can’t wait to see what’s in store.

Bitcoin Thoughts And Analysis

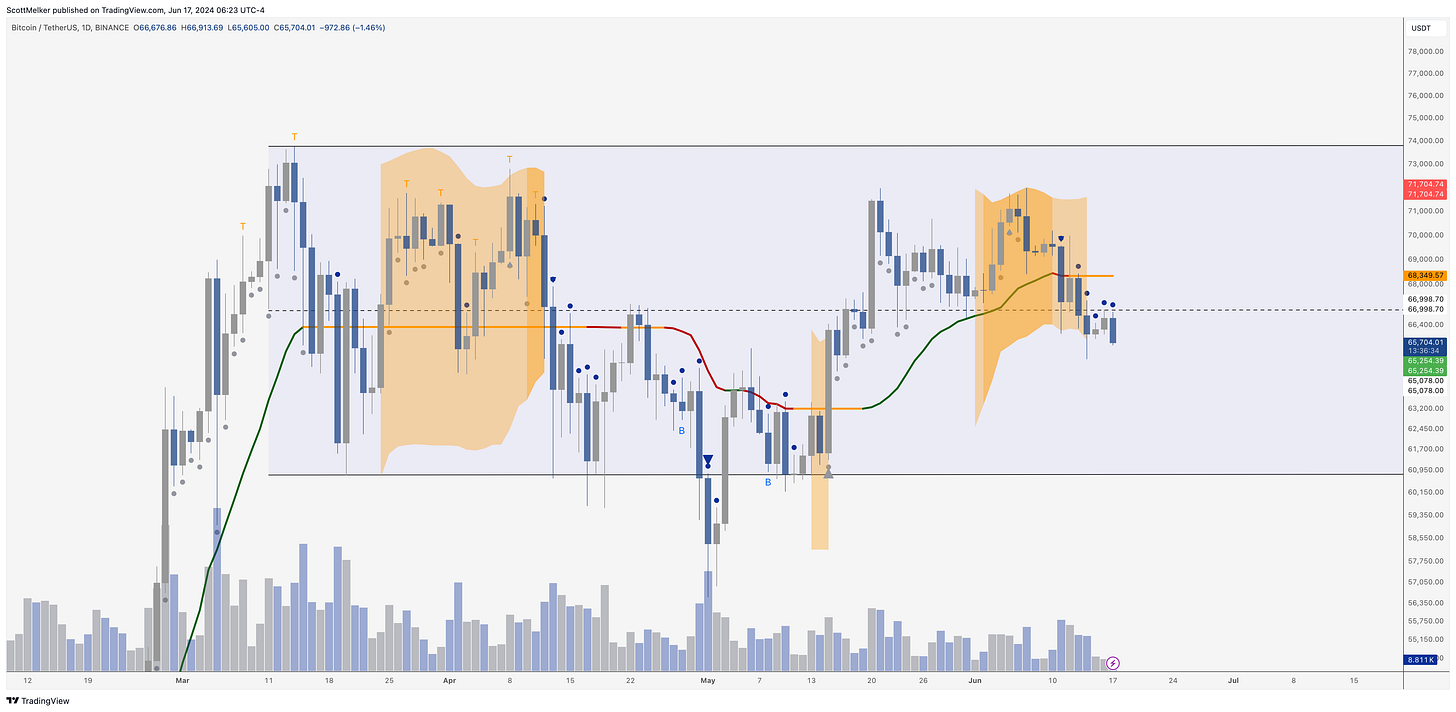

The EQ (equilibrium, center dashed line) of the range is now resistance once again, meaning the price is statistically more likely to trade between $60,000 and $67,000 than above. Important reminder - things are far from certain in these scenarios. We had price in the top half of the range and it never even managed to visit the highs, as one would “expect.”

For now, things are looking decidedly weaker, but still simply annoying and sideways.

Nothing to do here but wait.

Legacy Markets

A selloff in European stocks and bonds paused on Monday after Marine Le Pen, France’s far-right leader, assured that she would respect political institutions if she wins the upcoming snap parliamentary election. This assurance caused the Paris market to rebound by as much as 1%, recovering from a 6.2% drop last week that wiped out over $200 billion in value. French bond yields remained stable, and the euro steadied just off six-week lows against the dollar.

The Stoxx 600 remained mostly unchanged, while US equity futures were mixed. Le Pen's comments seemed to appeal to moderates and investors, suggesting she would not push out President Emmanuel Macron if she wins. Her party, the National Rally, is on track to become the largest in the lower house.

Despite this, sentiment remains fragile. Citigroup analysts highlighted the potential risk of a far-right majority in France. Additionally, France’s left-wing parties have presented a manifesto to dismantle many of Macron’s economic reforms.

Markets are also focused on upcoming central bank meetings. The Bank of England, along with banks in Australia and Norway, are expected to maintain their current rates. Several Federal Reserve officials are scheduled to speak, potentially impacting market sentiment.

In China, the PBOC kept its one-year MLF interest rate unchanged, as economic growth remains under pressure. In commodities, oil prices slipped after a significant weekly gain.

Key events this week:

Italy CPI, Monday

US Empire manufacturing, Monday

ECB Chief Economist Phillip Lane speaks, Monday

Philadelphia Fed President Patrick Harker speaks, Monday

Australia rate decision, Tuesday

Chile rate decision, Tuesday

Eurozone CPI, Tuesday

Singapore trade, Tuesday

US retail sales, business inventories, industrial production, cross-border investment, Tuesday

Richmond Fed President Thomas Barkin, Dallas Fed President Lorie Logan, Fed Governor Adriana Kugler, St. Louis Fed President Alberto Musalem, Chicago Fed President Austan Goolsbee, Tuesday

Japan trade, Wednesday

Bank of Japan issues minutes of April policy meeting, Wednesday

UK CPI, Wednesday

Bank of Canada issues Summary of Deliberations, Wednesday

Brazil rate decision, Wednesday

New Zealand GDP, Thursday

China loan prime rates, Thursday

Indonesia rate decision, Thursday

Eurozone consumer confidence, Thursday

Norway rate decision, Thursday

Switzerland rate decision, Thursday

Eurozone finance ministers meet, Thursday

UK BOE rate decision, Thursday

US housing starts, initial jobless claims, Thursday

Japan CPI, Friday

Hong Kong CPI, Friday

India S&P Global Manufacturing PMI, Friday

Eurozone S&P Global Manufacturing PMI, S&P Global Services PMI, Friday

UK S&P Global / CIPS Manufacturing PMI, Friday

US existing home sales, Conf. Board leading index, Friday

Canada retail sales, Friday

Richmond Fed President Thomas Barkin speaks, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 was little changed as of 9:50 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures rose 0.1%

Futures on the Dow Jones Industrial Average fell 0.2%

The MSCI Asia Pacific Index fell 0.8%

The MSCI Emerging Markets Index fell 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0709

The Japanese yen fell 0.1% to 157.59 per dollar

The offshore yuan was little changed at 7.2691 per dollar

The British pound fell 0.1% to $1.2674

Cryptocurrencies

Bitcoin fell 0.4% to $66,195.1

Ether fell 1.6% to $3,541.35

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.24%

Germany’s 10-year yield advanced three basis points to 2.39%

Britain’s 10-year yield advanced three basis points to 4.08%

Commodities

Brent crude rose 0.4% to $82.94 a barrel

Spot gold fell 0.5% to $2,320.70 an ounce

Pitching Ethereum To Boomers

The Bankless podcast recently produced a video showcasing their Ethereum pitch, and I wanted to share Ryan Sean Adams' message to boomers who might be considering investing in the ETH ETF. Over the years, there have been numerous attempts to simplify Ethereum as its technology has evolved and become better understood. I believe that tokenization is the ultimate end game.

All credit to Ryan Sean Adams on this.

“Bitcoin is one asset. It’s just Bitcoin. Ethereum is all possible assets. Which is bigger: gold or all the assets in the world? Bitcoin was designed to secure one asset, just Bitcoin. Ethereum is a general-purpose platform designed to secure everything else: stable coins, loans, equities, bonds, derivatives, everything in finance. The word for this is tokenization. People like Larry Fink are saying every stock, bond, and asset will be tokenized on a global ledger. Even he's thinking too small. Tokenization isn't just about the assets of the past; it's about the assets of the future: AI compute, personal data, social status, and celebrity. Everything will be tokenized. Ethereum is a global computing network to tokenize and program any asset. Ethereum adds property rights to the internet.

Now, tokenization can and will happen on other platforms, but Ethereum is positioned as the strongest contender to ride the tokenization wave. There are 100 million people that own ETH, and 100,000 developers actively contribute to the code. Already, Ethereum settles more transactions than the Visa network, and it's just getting started.

So now, let's talk about ETH. The cryptocurrency of Ethereum is called ETH. It has investable economics, including an algorithmic buyback and dividend program that drives billions per year in earnings for ETH holders. This number grows as the network expands. You can build a DCF model on ETH as you would with any stock, like Nvidia. And because ETH is extremely secure and decentralized like Bitcoin, more and more people are seeing ETH as a complement to Bitcoin as a store of value. While Bitcoin has greater certainty of supply, Ethereum pays a dividend and is deflationary with the upside of an entire token economy. Bitcoin provides exposure to digital gold; Ethereum provides exposure to everything else. I own both, but if I could only pick one, I'd pick the super set. I'd pick ETH.”

Biden May Attend A Bitcoin Roundtable

Bitcoin Magazine claims to have seen private emails revealing that U.S. Congressman Ro Khanna, representing California's 17th congressional district, is hosting a Bitcoin and blockchain roundtable in Washington D.C., which President Biden plans to attend. The alleged email described the meeting as “the most significant meeting between policymakers and innovation leaders in blockchain to date.” Other attendees reportedly include House and Senate members, Mark Cuban, and representatives from the Biden Administration.

While this is certainly a step in the right direction, it feels like it may be too little, too late. I question the extent to which Biden truly understands the situation versus how much of this is merely an attempt to prevent Trump from securing the crypto vote. Trump recently pledged to "end Joe Biden's war on crypto," and it wouldn't surprise me if he attends the Bitcoin Conference in Nashville next month. At this point, I don't see how Biden could win back a meaningful amount of crypto voters.

July 2nd Is The New Launch Date

Last Friday, I reported that the ETH ETF was likely to arrive by the end of summer, based on Gary Gensler’s latest comments. However, the consensus has since shifted, and now the prediction is for an earlier launch, possibly as soon as July 2nd. This situation feels like a guessing game of conflicting statements, but what truly matters is that we'll know we're closer when advertisements start ramping up. Bloomberg analysts moved their expected date forward because the comments received on the initial round of S-1 filings were minimal, indicating there may be no further revisions. Lessons learned from the Bitcoin ETF filings have streamlined this process, making it more efficient this time around. I expect ETH to outperform leading up to the launch. As for post-launch, inflows on days 1, 2, and 3 will be very telling for future price movements.

MicroStrategy Ups The Ante

Last Friday, I detailed MicroStrategy's $500 million raise, only to discover that the offering has increased by $200 million—go figure. While I won't recalculate the numbers, as the difference is minor, I will say that I don't believe Saylor has any intentions of selling anytime soon, despite what some may think. At a recent conference in Prague, Saylor emphasized that people may consider it overbought at $950,000 and then hesitate to buy the dip at $700,000. He also mentioned an $8 million price tag, which seems absurdly high but could potentially be feasible in the distant future, depending on the state of fiat currency.

I don’t want to live in a Mad Max world—$1 million per Bitcoin is fine with me.

Trump Vs. Biden. Will Bitcoin Decide Who Wins The Election? | Dennis Porter, Satoshi Action Fund

Dennis Porter, CEO & Co-Founder of Satoshi Action Fund, is dedicated to advancing Bitcoin adoption in the USA. As the fall elections approach, the debate over Bitcoin is heating up, with both Biden and Trump seeking to leverage their positions on cryptocurrency. Will Bitcoin play a decisive role in this political battle?

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.