Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

You Need To Check Out Trading Alpha!

I'm deeply committed to delivering the highest-quality content to all of you, which is why I'm thrilled to be partnered with Wick, also known as @ZeroHedge on Twitter, who has both best technical analysis in crypto and Indicators & Tools on the market. These indicators have entirely changed by TA for the better. We are now back to a 25% discount! Use code '25OFF' to get started.

In This Issue:

I Pity The Fool!

Bitcoin Thoughts And Analysis

Legacy Markets

Heed This Advice

Donald Trump Praises Bitcoin Mining

Tether Continues To Innovate

This Makes Zero Sense

Can Donald Trump Make Bitcoin Great Again?

I Pity The Fool!

There's a prevalent belief among critics, non-crypto investors, and those unfamiliar with the industry that since their lives aren't directly influenced by cryptocurrency, nothing of significance is occurring within this space. These skeptics are not hard to find; indeed, they exist within our own circles more often than we'd care to admit.

As Mr. T once poetically remarked, “I pity the fool!”

If the initial phase of mainstream adoption involved introducing the concept of crypto to the masses, the current phase focuses on demonstrating its tangible real-world impact.

Progress takes time, but with concerted effort, we can guide the world toward a deeper understanding of crypto's practical applications. This journey won't be easy, but it is achievable, and the encouraging aspect of our endeavor is that the trend of adoption consistently moves forward.

Today, I aim to highlight some of the most popular use cases, hoping this will enhance your ability to counter arguments from those who believe nothing meaningful is happening here. The battle starts now—equip yourself with the knowledge to convert the skeptics.

Now, let's delve into the substance.

Coinbase has released its Q2 State of Crypto report titled "The Fortune 500 Moving Onchain," emphasizing that America's top public companies are more active on-chain than ever before. If you don’t believe me when I say these companies wouldn’t take these risks if it didn’t boost their bottom line, take it from Coinbase and their research into all the innovative projects being developed.

“The number of cryptocurrency, blockchain or web3 initiatives announced by Fortune 100 companies has increased 39% year-over-year and hit a record high in Q1 2024…”

“A survey of Fortune 500 executives finds that 56% say their companies are working on onchain projects, including consumer-facing payments applications.”

“Many of the most trusted names and products in finance are embracing

blockchain technology and crypto, driving innovation and providing on-ramps

for widespread adoption.”

“Among the Fortune 100 (F100), a record number of onchain initiatives were underway in Q1 2024.”

The graph above illustrates which industries are most active on-chain. Tech (in blue) and financial services (in green) dominate the chart, with Coinbase noting that “The two sectors together accounted for eight out of 10 of the F100's on-chain initiatives in Q1.”

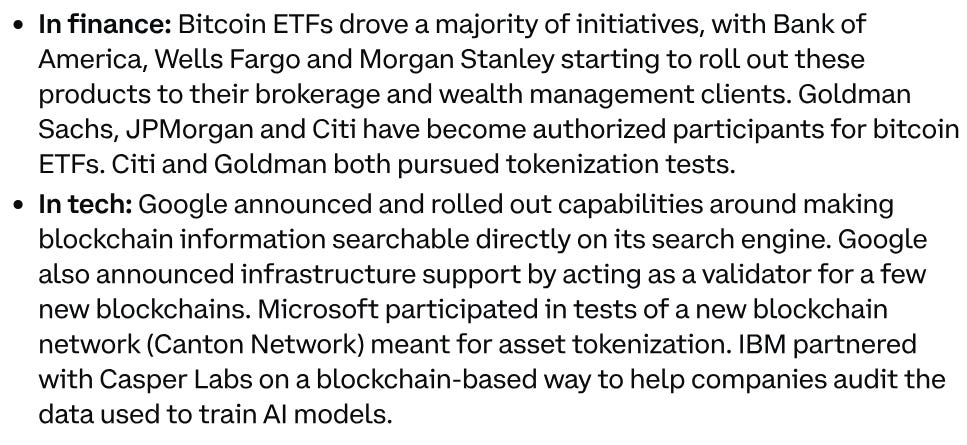

If someone claims that crypto isn’t being adopted, inquire whether they bank with any of the institutions supporting crypto ETFs, such as Bank of America, Wells Fargo, Morgan Stanley, Goldman Sachs, JPMorgan, or Citi.

My next suggestion is to proceed to ask if they use products from Google, Microsoft, and IBM. More than likely, a critic's bank and favorite tech companies are adopting this technology.

In the image below, you will notice that tokenization is ranked #3 with F100 and #4 with F500, my guess is that it swiftly moves toward the top once the ball gets rolling.

Another graphic, this time specifically on stablecoins and tokenization.

This graph gets me excited. On the left, you'll notice a purple shaded bar representing the size of USDT + USDC holding T-Bills compared to other countries holding U.S. Treasuries.

In addition to stablecoins, several other use cases are emerging, some of which are entirely private. For instance, JPMorgan's JPMCoin continues to operate, reportedly facilitating “$1 billion worth of transactions daily, with expectations for that number to rise to $10 billion in the next year or two.” Unfortunately, this doesn't benefit us any further than bringing legitimacy to the underlying technology.

Here’s are some additional stats Coinbase shared:

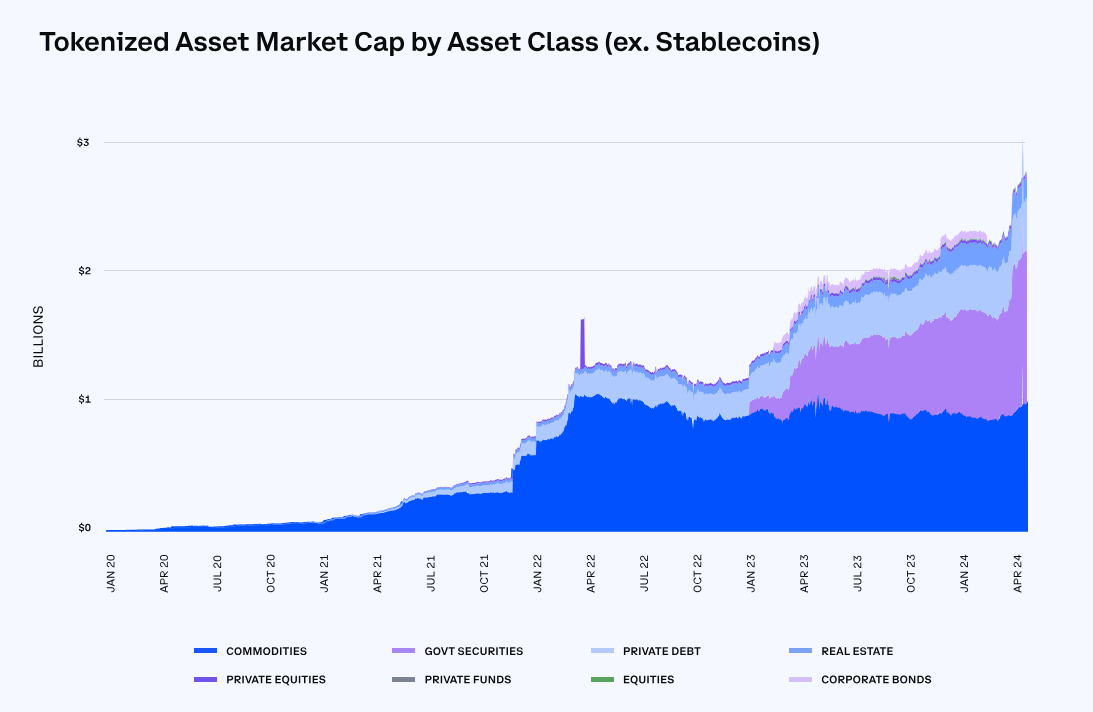

“By 2030, the tokenized asset market is expected to hit $16 trillion – the size of the EU’s GDP today.”

“Total value of tokenized, non-stablecoin assets has reached roughly $3 billion, more than doubling since the start of 2023.”

“Gold is by far the #1 commodity, accounting for nearly the entire $1 billion in tokenized commodities.”

“The overall value of tokenized loans on public blockchains grew from near zero in October 2020 to over $400 million by April 2024.”

This graph above is approaching escape velocity. Read this excerpt regarding Franklin Templeton’s FOBXX, a proprietary U.S. Treasury money market fund.

And perhaps the most transformative statement made this bull market: Larry Fink is poised to disrupt and reshape everything we thought we knew about markets.

Cryptocurrency isn't confined to Wall Street; it's also rapidly infiltrating small businesses from the grassroots level while simultaneously gaining traction from the top down. Blockchain technology is poised to revolutionize how organizations collect, organize, and analyze records, as well as optimize crucial inventory tracking to minimize waste. For instance, merchants using Stripe can now accept payments in USDC via Ethereum, Solana, and Polygon.

The argument that crypto lacks use cases is becoming increasingly untenable. Those clinging to this outdated perspective risk significant financial losses if they fail to adapt.

The technology and opportunities are here; it’s up to us to determine how far we can advance with them..

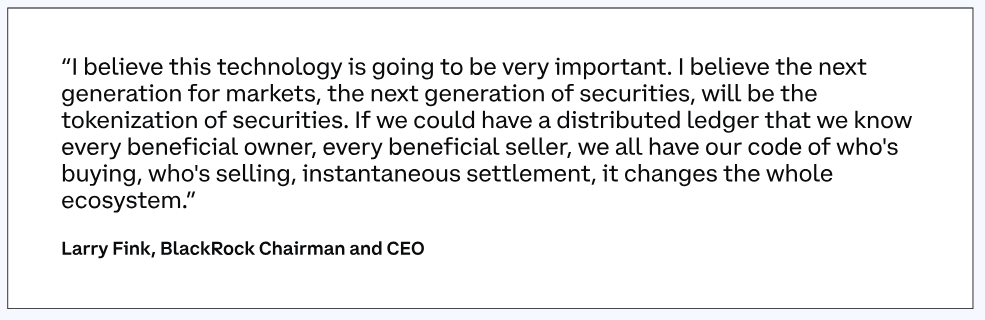

Bitcoin Thoughts And Analysis

Up, down, all around.

True to form, Bitcoin dropped a head of the FOMC, pumped on inflation headlines, then cooled off and ended up right back where it started.

Fun, right?

Still in the top half of the range…

Legacy Markets

European stocks fell on Thursday following a more hawkish tone from the Federal Reserve regarding interest rates. The Stoxx 600 declined by 0.6% after previously experiencing its largest gain in a month. This downturn comes despite US inflation showing signs of easing. The Fed indicated just one rate cut this year, down from the three anticipated in March, which caused some market pullback. Additionally, EU bonds dropped after MSCI Inc. decided not to include the bloc's debt in its government bond indexes.

Despite the Fed's stance, investors remain optimistic about the resilience of the equity market, particularly US stocks, which are expected to reach new highs. Treasury bonds are also predicted to continue their rebound.

Key developments include Tesla shares rising significantly in premarket trading and Wise Plc shares plummeting after a revenue outlook cut. In commodities, oil prices dipped following a three-day rise, and gold declined amidst the Fed's higher-for-longer rate outlook.

Key events this week:

Eurozone industrial production, Thursday

US PPI, initial jobless claims, Thursday

Tesla annual meeting, Thursday

New York Fed President John Williams moderates a discussion with Treasury Secretary Janet Yellen, Thursday

Bank of Japan’s monetary policy decision, Friday

Chicago Fed President Austan Goolsbee speaks, Friday

US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.6% as of 9:53 a.m. London time

S&P 500 futures rose 0.1%

Nasdaq 100 futures rose 0.7%

Futures on the Dow Jones Industrial Average fell 0.3%

The MSCI Asia Pacific Index was little changed

The MSCI Emerging Markets Index rose 0.8%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0807

The Japanese yen fell 0.3% to 157.23 per dollar

The offshore yuan was little changed at 7.2665 per dollar

The British pound was little changed at $1.2794

Cryptocurrencies

Bitcoin fell 0.8% to $67,543.51

Ether fell 1.4% to $3,504.87

Bonds

The yield on 10-year Treasuries was little changed at 4.31%

Germany’s 10-year yield advanced two basis points to 2.55%

Britain’s 10-year yield advanced four basis points to 4.17%

Commodities

Brent crude fell 0.3% to $82.33 a barrel

Spot gold fell 0.4% to $2,315.10 an ounce

Heed This Advice

Roger Federer delivered an outstanding commencement speech at Dartmouth University, drawing remarkable parallels between life and investing. This aligns perfectly with a recent piece I wrote about a hypothetical trader who, fixated on past individual outcomes, overlooked his long-term success.

I already shared and excerpt from his speech on Twitter, but for those who haven’t seen it yet, here it is. I hope you enjoy.

“In tennis, perfection is impossible... In the 1,526 singles matches I played in my career, I won almost 80% of those matches... Now, I have a question for all of you... what percentage of the POINTS do you think I won in those matches? Only 54%.

In other words, even top-ranked tennis players win barely more than half of the points they play. When you lose every second point, on average, you learn not to dwell on every shot.

You teach yourself to think: OK, I double-faulted. It’s only a point. OK, I came to the net and I got passed again. It’s only a point.

Even a great shot, an overhead backhand smash that ends up on ESPN’s Top Ten Plays: that, too, is just a point. Here’s why I am telling you this.

When you’re playing a point, it is the most important thing in the world.

But when it’s behind you, it’s behind you... This mindset is really crucial, because it frees you to fully commit to the next point… and the next one after that… with intensity, clarity and focus.

The truth is, whatever game you play in life... sometimes you’re going to lose. A point, a match, a season, a job... it’s a roller coaster, with many ups and downs.

And it’s natural, when you’re down, to doubt yourself. To feel sorry for yourself. And by the way, your opponents have self-doubt, too. Don’t ever forget that But negative energy is wasted energy.

You want to become a master at overcoming hard moments. That to me is the sign of a champion.

The best in the world are not the best because they win every point... It’s because they know they’ll lose... again and again… and have learned how to deal with it.

You accept it. Cry it out if you need to... then force a smile. You move on. Be relentless. Adapt and grow. Work harder. Work smarter. Remember: work smarter.”

Here is the entire, amazing speech…

Donald Trump Praises Bitcoin Mining

Donald Trump met with Bitcoin Magazine's CEO David Bailey and several prominent U.S. Bitcoin miners in Washington DC and made numerous positive statements about the sector. Some of the notable names at the gathering included, CleanSpark, Riot Platforms, Marathon Digital, and a director from Fidelity in charge of Bitcoin mining. After the event, many key figures in attendance posted positive comments about Trump's presence, expressing their support for his backing of our industry.

Trump continues to push for the crypto voter base.

Tether Continues To Innovate

Every time I take a closer look at Tether's market cap, I'm astonished by the company's exponential growth and their continuous efforts to push the industry forward beyond merely being the leading stablecoin provider.

In a recent Bloomberg interview, Paolo Ardoino, Tether’s CEO, revealed that the company plans to invest at least $1 billion into various deals over the next 12 months through its venture capital arm, which has already deployed $2 billion across a range of sectors.

“It’s all about investing in technology that helps with disintermediation with traditional finance. Less reliance on the Big Tech companies like Google, Amazon, and Microsoft. Our investment policy is investing only in projects we find extremely interesting. We are not a classic VC. We do invest in things that we care about, and we have our own strategy.”

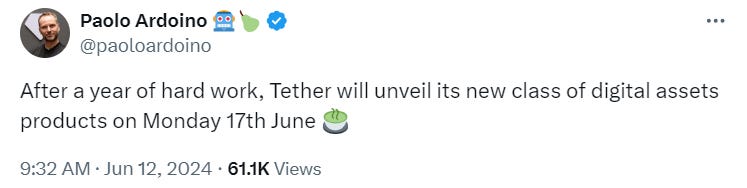

Ardoino also hinted at an upcoming announcement next Monday, though its nature remains a mystery. Perhaps it could involve a new class of digital assets, potentially Real World Assets (RWAs).

Rates Remain Unchanged

Jerome Powell took the stage, drum roll please… announcing that rates would remain unchanged at the current target range of 525-550 bps. What surprised listeners was the revised median forecast, now indicating just one rate cut in 2024, compared to the three previously expected. Essentially, the Fed's stance is that inflation remains too high, necessitating further tightening to reach the target range.

Notable commentary from the meeting includes Powell's admission that he does not have “a definitive answer as to why people are not happy with the economy,” along with his statement that there has been “modest progress to 2% inflation target” from “lack of progress.” It appears Powell was more hawkish than the data warranted, highlighting the absurdity of the situation.

One last thing to consider: Twenty times more people tuned into Roaring Kitty’s GME livestream than the Fed’s decision yesterday.

This Makes Zero Sense

Explain to me how Do Kwon and Terraform Labs agreeing to pay a multi-billion dollar fine to the SEC is a better outcome than finding a way to return assets to the victims of the fraud committed. Once again, under the SEC’s guidance, victims are left with the short end of the stick. Surprise, surprise.

Can Donald Trump Make Bitcoin Great Again?

Donald Trump is making headlines with his bold statements about Bitcoin. Is he truly convinced it's the future, or is he simply trying to garner more votes? Join Mike Alfred as he delves into this intriguing topic and more. Additionally, today is a crucial day for Bitcoin, with the FOMC meeting and CPI report set to impact the price of Bitcoin and other cryptocurrencies. Don't miss this insightful analysis! Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.