Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

The math works. Everyday it works. On May 31st it worked to the tune of 12.9% in less than 47 minutes. When we say our algorithms are equivalent to putting a hedge fund in your pocket - the proof is in the proverbial pudding. See the chart below and try Arch Public today.

Tillman Holoway - Arch Public CEO

Andrew Parish - Arch Public Co-Founder

In This Issue:

Returns Vs. Variance

Bitcoin Thoughts And Analysis

Legacy Markets

Something To Consider

Iggy Azalea Meets Crypto

Hedge Funds Are Shorting Bitcoin

Never Trust A Crypto Email

Bitcoin In Europe: How Verena Ross, The Chief Regulator, Is Shaping The Future Of Crypto

Returns Vs. Variance

There is no exciting news in the market. Bitcoin remains rangebound, unable to break through highs and unwilling to fall to lower lows. This monotonous price action yields little news, leaving the mind to wander.

Let’s engage in a thought experiment.

Bob, an imaginary investor, finds himself with ample time in retirement and decides to embark on a data-gathering project to evaluate the success of his investing career.

First, it is crucial to comprehend two fundamental concepts in investing: returns and variance. Returns signify the profit or loss from an investment over a specified period. Higher returns translate to greater profit. Variance, conversely, measures the volatility or risk associated with those returns. A higher variance indicates greater unpredictability in the investment's performance.

Over 35 years of investing, Bob meticulously collects and analyzes his trade receipts. He knows he is proficient, but to his astonishment, he discovers that his average return is an exceptional 18.5%.

Bob learns that his returns follow a normal distribution, with a mean of 18.5% and a standard deviation of 10%, forming a realistic bell curve. This implies that approximately 68% of his annual returns lie within one standard deviation of the mean (between 8.5% and 28.5%), about 95% fall within two standard deviations (between -1.5% and 38.5%), and around 99.7% fall within three standard deviations (between -12.5% and 49.5%).

Gleaning the data, Bob surmises that when he wins, he wins significantly, and when he loses, he loses modestly.

Bob continues to explore the numbers and now seeks to determine the odds of being successful over any given decade. To achieve this, he needs to define what ‘successful’ means in the context of his investing career. Given Bob's average return of 18.5%, he decides to consider a decade successful if his average annual return for that period exceeds a specific threshold, such as the average return of the stock market or a benchmark index like the S&P 500.

Bob decides that for a decade to be deemed successful, his average annual return for that period must surpass 10%, a common long-term average return for the stock market. Utilizing the normal distribution, we can calculate the probability of Bob achieving an average return greater than 10% in any given decade, based on his average return of 18.5% and a standard deviation of 10%.

Using the properties of the normal distribution, Bob calculates that the probability of him achieving an average annual return greater than 10% in any given decade is approximately 99.6%. Bob's historical performance indicates that he is virtually guaranteed success.

Feeling invincible, Bob decides to narrow his time horizon to any given year. He calculates that, by his definition, he has an 80.23% chance of being successful each year.

However, as he zooms in, he learns that his chances of success diminish dramatically. In any given month, the odds of his success stand at a mere 19.77%, rendering him a 5 to 1 underdog in beating the market.

Frustrated, Bob closes the worksheet, opens his broker platform, and sets out to defy the numbers. His trading strategy that day looked something like this...

Trade after trade, it was all a disaster. But after the dust settled, Bob came back to his senses and reflected on what had just transpired. His obsession with observing performance over short time frames revealed nothing more than variance, not returns. The more he focused on short-term data, the worse his mindset became, despite not altering his fundamental strategy. That night, he vowed to continue adhering to his proven strategy and to disregard the noise.

Bob was astute enough to steer away from the path of ruin he had set himself on, but his redirection is more the exception than the rule. We, like Bob, should refrain from fixating on our day-to-day outcomes and minute-to-minute trades. Instead, we ought to concentrate on what we can control and avoid falling into the trap of randomness.

Bob’s example may exhibit some exaggerated extremes, but his story is not unique. As investors, we are constantly resisting the urge to spiral down this path. Moreover, as long as there are investors who persist in scrutinizing their short-term results, there remains an opportunity for those who don’t to thrive.

Do not be too hard on yourself; crypto is challenging enough as it is. Remember, we are currently in the midst of a bull market, and there is no better time than now to step back, detach from the stress of constant decision-making, and let time work its magic.

Bitcoin Thoughts And Analysis

Bitcoin has been in a sustained uptrend since $27,000. Why overthink it?

As you know, my base case in March, based on the timing of the halving and four year cycle and the massive proliferation of memecoin degeneracy, among other factors, was that we were likely to experience many months of sideways.

Here we are. And that is totally fine.

Legacy Markets

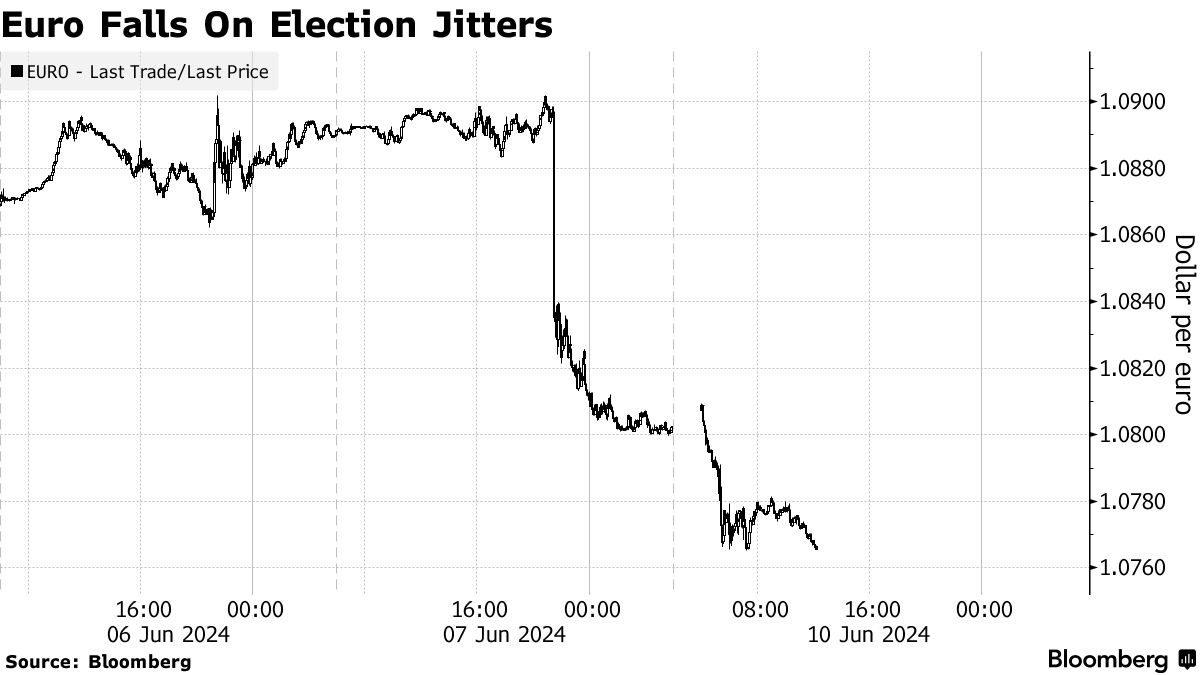

The euro dropped to its lowest point in a month following French President Emmanuel Macron's call for a legislative election after a significant defeat in the European Parliament elections. The common currency fell by 0.4%, accompanied by declines in European equities and French bonds, with major banks like BNP Paribas SA and Societe Generale SA experiencing over 6% losses. The snap election is seen as Macron's attempt to counter the rise of far-right leader Marine Le Pen, whose party gained ground in the vote. This development, coupled with a stronger dollar driven by robust US jobs data, has put additional pressure on the euro. Market focus is now shifting to the upcoming Federal Reserve meeting, where policymakers are expected to update their rates forecast, which could further impact the euro. Meanwhile, US equity futures edged lower, and the dollar strengthened, while Southwest Airlines Co. saw a significant premarket rise due to Elliott Investment Management's substantial stake in the company. The yield on 10-year Treasuries increased for the third consecutive day. In Asia, the MSCI’s Asia-Pacific stock index remained relatively unchanged, with traders also paying attention to Indian Prime Minister Narendra Modi's forthcoming cabinet announcements.

Some key events this week:

UK jobless claims, unemployment, Tuesday

China CPI, PPI Wednesday

Thailand rate decision, Wednesday

India CPI, industrial production, Wednesday

UK monthly GDP, Wednesday

US mortgage applications, CPI, Wednesday

FOMC decision, quarterly summary of economic projections, Fed Chair Jerome Powell’s press conference, Wednesday

Australia unemployment, Thursday

Eurozone industrial production, Thursday

US jobless claims, PPI, Thursday

New York Fed’s John Williams moderates discussion with US Treasury Secretary Janet Yellen, Thursday

Tesla annual meeting, Thursday

Japan rate decision, Friday

U. of Michigan consumer sentiment, Friday

Chicago Fed’s Austan Goolsbee, Fed Governor Lisa Cook, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.7% as of 10:17 a.m. London time

S&P 500 futures fell 0.2%

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average fell 0.3%

The MSCI Asia Pacific Index was little changed

The MSCI Emerging Markets Index fell 0.4%

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.4% to $1.0758

The Japanese yen was little changed at 156.80 per dollar

The offshore yuan was little changed at 7.2654 per dollar

The British pound was little changed at $1.2709

Cryptocurrencies

Bitcoin fell 0.4% to $69,384.41

Ether fell 0.8% to $3,671.26

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.45%

Germany’s 10-year yield advanced three basis points to 2.65%

Britain’s 10-year yield advanced four basis points to 4.30%

Commodities

Brent crude fell 0.1% to $79.52 a barrel

Spot gold was little changed

Something To Consider

Here's a quick thought experiment: Imagine we are currently midway through the bull market. With this in mind, set aside everything you know fundamentally and technically about every crypto asset and consider the following question:

Would you feel comfortable holding an asset that hasn't even reached halfway to its all-time high, or even halfway to that midpoint?

Before you jump to an answer, take a moment to truly contemplate this. I’m not here to criticize anyone; I’m as guilty as anyone else of holding onto an altcoin that is teetering on the brink. But seriously, is this a comfortable position to be in?

Only a handful of coins in the top 20 by market cap are further along than this position. In other words, if your investment is not in Bitcoin, Solana, or Ethereum (with a few exceptions), its price is significantly lagging. Of course, not everyone bought at the exact peak, nor should we view investments solely through this lens. But at what point in the bull market does this become alarming? It’s never too late to move from a weak position to a stronger one—a necessary step for improving your portfolio.

Iggy Azalea Meets Crypto

I usually don't give much thought when a celebrity jumps into crypto, lists a questionable coin, and then starts sharing their opinions as if they're experts. However, there’s something to glean from this story. Let's first look at what Iggy Azalea said that sparked the feud:

“I'm not mad at this man's opinion. Whatever. I question what you are doing with gas money. It's so rich of you to have an opinion on charities and hospitals, whatever…but let’s talk about the gas fees…the gas tax.”

Clearly, she is confused, but her comment highlights potential mainstream opinions outside our echo chamber. Are the optics so poor that people generally believe the coin's creator, in this case, Vitalik, is simply profiting off the users? It’s probably impossible to launch an educational campaign to teach everyone everything about crypto. But if superior technology is cheaper, it will naturally stick without question. Nobody questions the backend processing systems behind credit cards, SMTP behind email, or HTML behind the web. Iggy’s questions won’t exist when Layer 2 solutions go mainstream.

Hedge Funds Are Shorting Bitcoin

Something has to give because Bitcoin is currently experiencing a 19-day positive inflow streak, bringing in over $2 billion. At the same time, there is a record high of 18,175 contracts shorting Bitcoin, each sized at 5 Bitcoin. While it's possible these short sellers are attempting to capitalize on a carry trade, the exact extent is unclear, especially since this type of trade has become increasingly less profitable. As the market grows, the number of shorts will naturally increase, so I wouldn't overanalyze this metric. What truly matters is that we are firmly in a bull market; the general direction is upward.

Never Trust A Crypto Email

Every link and message you interact with or receive that isn’t delivered from a trusted platform should be assumed fake until proven otherwise. On June 5th, CoinGecko publicly announced that "An attacker had compromised a GetResponse employee’s account, leading to a breach. While no phishing emails were sent from CoinGecko’s domain, the attacker exported 1,916,596 contacts from CoinGecko's GetResponse account and sent phishing emails to 23,723 emails from another GetResponse client’s account."

It can be very tempting to believe a phishing email when it confirms personal information about you. However, if you assume the message is fake before authentic, you’ll be ten times harder to scam.

Bitcoin In Europe: How Verena Ross, The Chief Regulator, Is Shaping The Future Of Crypto

Verena Ross is the Chair of the European Securities and Markets Authority (ESMA). In this conversation during Paris Blockchain Week, we explore how European crypto regulation differs from that of the US and discuss the future of crypto in Europe.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.