Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

The Wolf Den Has A New Sponsor: BLENDR

Why $BLENDR? The world of GPU computing is changing fast, and there's a huge need for affordable and powerful computing power, especially in fields like artificial intelligence and content rendering.

Purpose: Blendr is introducing a new decentralized network that utilizes unused GPU resources all over the world, in order to give access to high-performance computing. Blendr uses blockchain technology to create a marketplace for GPU power, making computing more efficient and cheaper. This new approach makes the process scalable and cost-effective.

This newsletter is made possible thanks to BLENDR. Show them some love!

In This Issue:

VanEck Goes Full Bull

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Robinhood Acquires Bitstamp

FTX Creditors Fight Back

Kraken To Pursue An IPO?

Get Ready For The Crypto Explosion: Ethereum to $22K, Bitcoin to $80K

VanEck Goes Full Bull

VanEck's bullish stance is almost contagious—and that's a good thing.

Like many of you, I find bullish price predictions irresistible, but only when they come with solid reasoning. If someone claims Bitcoin will hit $1 million just because it "feels right," I'll probably laugh it off. However, if there's a compelling argument, you've got my full attention. This applies to Bitcoin, Ethereum, Solana, or any other cryptocurrency of your choice.

But before diving into the eagerly awaited report, let's take a brief trip back to one year ago.

VanEck’s Predictions and Statements From 2023

“At the most basic level, one can think of Ethereum as a mall that lives on the internet and provides a secure place for internet commerce to take place. Users interact inside Ethereum’s mall by means of wallets, and Ethereum’s mall businesses are made up of batches of smart contract code. The Ethereum software determines the structure and rules of the mall, while validators ensure that the rules are followed, secure the mall, and maintain a ledger of all economic events that occur within the mall. Ethereum also apportions the limited space within the mall by charging users for conducting business and exchanging value.”

Below is the old chart, notice the price of Ethereum at $1,900.

One year ago, VanEck referred to Ethereum as a “digital mall” and made the following predictions for 2030: (oh how times have changed)

The Base Case: $11,849

The Bear Case: $343

The Bull Case: $51,006

Thankfully, VanEck has broadened its analogies beyond the once-singular "digital mall" concept. They have now released 2030 price predictions that make last year’s numbers look modest. Let’s dive in.

ETH 2030 Price Target and Optimal Portfolio Allocations

The first and arguably most important point is that VanEck adjusted their predictions primarily due to the recent ETF approval. VanEck is ahead of the curve, articulating insights that others are still scrambling to figure out.

“We anticipate that spot ether ETFs are nearing approval to trade on U.S. stock exchanges… In response, we've updated our financial model and reevaluated the fundamental investment case for ETH.”

Some of the new and improved analogies and comparisons include:

High-growth, internet-native commercial system

Digital economy

Programmable Money

Yield Bearing Commodity

Internet Reserve Currency

Let’s now delve into how VanEck arrived at these new predictions. In my opinion, last year’s explanation of their methodology was more insightful than this year's. The excerpt below is from 2023. While VanEck is using the same foundational thought process, this year they have added factors such as the “AI end-market,” “burn of ETH supply,” “greater end market capture,” and a “higher take rate.”

“We value Ethereum by estimating cash flows for the year that ended on 4/30/2030. We project Ethereum revenues, deduct a global tax rate and a validator revenue cut and arrive at a cashflow figure. We then apply multiple estimates by applying a long-term estimated cash flow yield of 7% minus the long-term crypto growth rate of 4%. We then arrive at the fully diluted valuation (“FDV”) in 2030, divide the total by the expected number of tokens in circulation, and then discount the result by 12% to 4/20/2023. You can see our revenue estimates and price targets in the table below with more detailed assumptions in the Ethereum Valuation Scenarios table.”

If that was confusing, let me clarify.

VanEck values Ethereum by estimating its cash flows for the year ending April 30, 2030. They project Ethereum’s revenues, deduct applicable taxes and validator revenue cuts, and arrive at a cash flow figure. This figure is then used to calculate the fully diluted valuation in 2030, which is discounted back to April 20, 2023, at a rate of 12%. I'm not a VanEck expert, but it appears they are following the same process now.

VanEck arrives at a $22,000 price for Ethereum, noting it would require a total return of 487% from today's ETH price and a compound annual growth rate (CAGR) of 37.8%.

If you're curious about the $154,000 figure, Ethereum would need a total return of 3,070% from today's price. The CAGR required for this return over a 7-year period would be approximately 98.6%.

On my YouTube channel, I hosted Alex Tapscott from NinePoint Partners to discuss these numbers, just to ensure I wasn't overestimating VanEck's projections. He confirmed my thoughts without any prompting.

“The base case by 2030 is that Ethereum will be about as big as Nvidia is today. And I think if you frame it in those terms, it actually makes a lot of sense. I mean, Ethereum has the potential, in my opinion, to become the most valuable asset of all time. This is a platform that today still supports the vast majority of new applications, new protocols, and networks in Web3.”

“I think of Nvidia and Ethereum as being quite similar. Nvidia provides the picks and shovels—the key infrastructure unlocking the value of the AI age. Similarly, Ethereum is the platform on top of which all these new applications and protocols are being developed. In many respects, they both underpin the growth of what I believe are the two most important technology trends of this era.”

I may sound like a broken record, but I firmly stand by these two points: the price of Ethereum is not an indictment but an opportunity, and Ethereum remains one of the most undervalued assets. I want my money where innovation is happening while everyone else is looking the other way. Surprisingly, Wall Street is becoming more bullish on crypto than the crypto space itself.

As promised in yesterday's news section, I have something special for Solana enthusiasts: your big moment has arrived.

VanEck’s Base, Bear, Bull Case: Solana Valuation by 2030

VanEck released its Solana valuations on October 27, 2023. If I were to speculate, these numbers might be revised upward if VanEck publishes an updated report. At that time, Solana was trading at about $31—a fraction of its current price, which is now approaching $200.

Solana has its own set of challenges but has improved immensely since this report was released: major outages aren't occurring (knock on wood), it’s leading in stablecoin trading volume, retail is flocking to Solana NFTs and memecoins, TVL is soaring, and Solana's optics are arguably easier to understand than Ethereum’s. While Solana and Ethereum are competitors, both will benefit from the expanding market. Solana is poised to claim a larger share than it had in 2023, and the overall market will grow significantly during this cycle. Both are winners.

Crypto is not a winner-takes-all market; it’s a winners-take-more market.

There will be only a handful of major winners, and right now, Ethereum and Solana appear to be right up there with Bitcoin.

I hope you have a great weekend. Don’t spend too much time thinking about these predictions. Go outside, hug your family, and call a friend. As always, thank you for your support; it means the world.

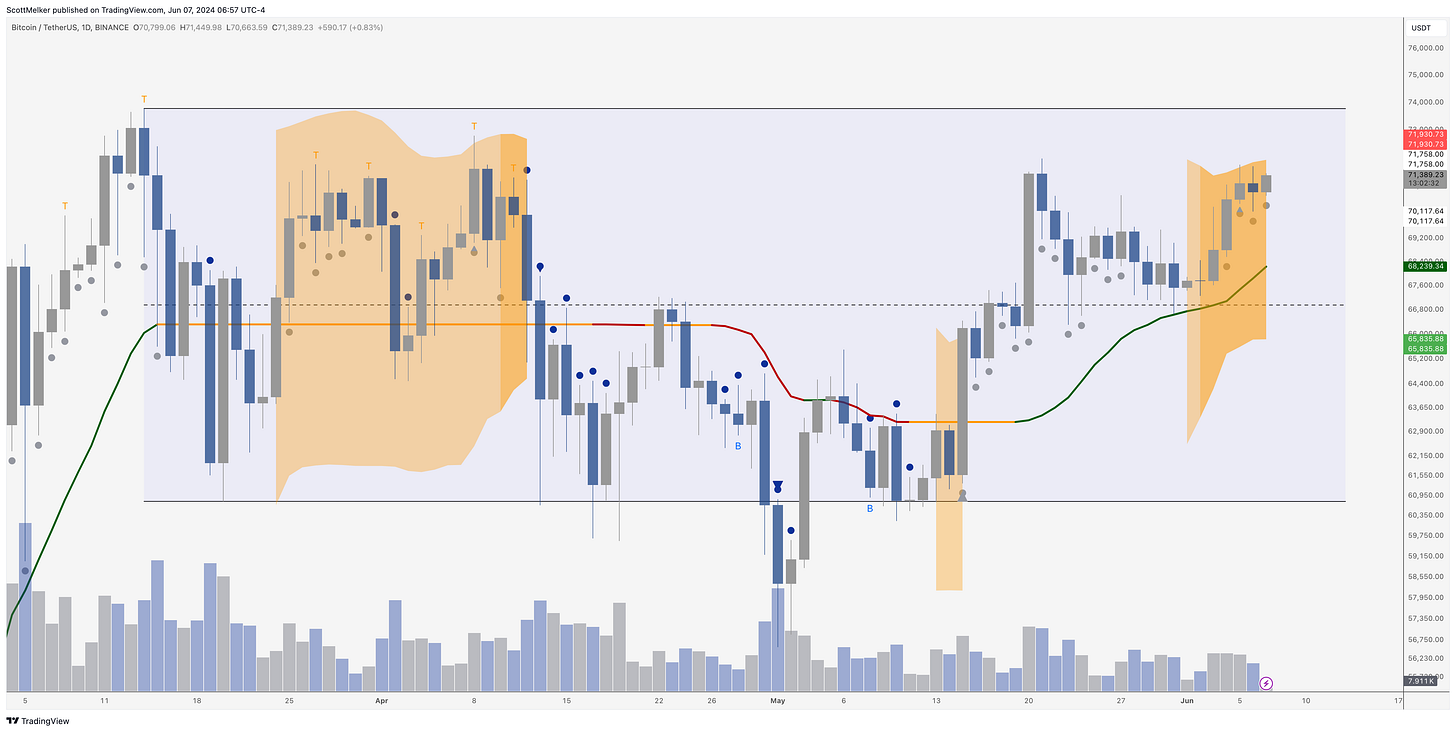

Bitcoin Thoughts And Analysis

I would love to share some fresh thoughts, but there are none. Bitcoin looks totally fine, trading in the top half of the range, targeting the recent all time high. We have squeeze shading, so if we get strong volume on a break, we could go beyond $74,000 and into blue skies. That is when we would get excited.

For now, the target is the highs,

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

If you have been here a while, you know that we rode this coin from the lows to new all time highs this cycle. Well, it appears to be revving up again. Trading Alpha shows squeeze shading (orange), grey dots and a fresh buy signal arrow, all above the track line. You should absolutely be using Trading Alpha, it’s an incredible indicator (25off for discount, if you are looking to grab the suite). You can also see that this token has been consolidating sideways, with resistance at $29.85. I want to see price closing above that line (we are below now) to confirm this breakout. If that happens, I see no reason this cannot reach the all time high again around $53.

Legacy Markets

A global equity rally faltered ahead of crucial US jobs data, which could cement bets on when the Federal Reserve might start easing monetary policy. Europe's Stoxx 600 index retreated by 0.4%, pulling back from record peaks hit earlier in the week as the European Central Bank began its policy easing cycle. While technology stocks gained, property and insurance stocks lagged due to the ECB's indication that it wouldn't rush additional rate cuts. In the US, futures flatlined with modest premarket gains for Nvidia Corp. and Micron Technology Inc., while meme stocks like GameStop Corp. and AMC Entertainment Holdings Inc. continued to surge.

The upcoming US jobs report is expected to show an addition of 180,000 jobs in May, slightly more than in April, with the unemployment rate holding steady. This data could confirm current market pricing for Fed rate cuts, potentially fueling further market gains. Rate-cut expectations have risen over the past week, driven by weaker-than-forecast US data and easing measures by the Bank of Canada and ECB. A Bloomberg gauge of global government bonds marked its longest rising streak since November.

Investors are increasingly optimistic, pouring money into stocks, with US equity funds receiving $4.6 billion in inflows for the seventh consecutive week. However, Bank of America strategist Michael Hartnett warned that a Fed rate cut might not be entirely positive, suggesting it could indicate underlying economic troubles and increase the chances of a hard landing.

Among individual stock movers, GameStop soared as much as 37% after a YouTube post announced the return of Keith Gill, a key figure in the stock's previous rallies. This followed a 47% jump on Thursday. As markets await the jobs report, all eyes are on the potential impact of the data on future Fed policy and market movements.

Key events this week:

Eurozone GDP, Friday

US unemployment rate, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.4% as of 10:36 a.m. London time

S&P 500 futures were unchanged

Nasdaq 100 futures rose 0.1%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.3%

The MSCI Emerging Markets Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0895

The Japanese yen rose 0.1% to 155.42 per dollar

The offshore yuan rose 0.1% to 7.2519 per dollar

The British pound was little changed at $1.2796

Cryptocurrencies

Bitcoin rose 0.6% to $71,122.65

Ether rose 0.2% to $3,807.91

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.30%

Germany’s 10-year yield advanced three basis points to 2.58%

Britain’s 10-year yield was little changed at 4.18%

Commodities

Brent crude fell 0.2% to $79.69 a barrel

Spot gold fell 1.5% to $2,341.58 an ounce

Robinhood Acquires Bitstamp

Robinhood made headlines yesterday morning by announcing its acquisition of Bitstamp, one of the oldest and most reputable centralized crypto exchanges. Founded in 2011, Bitstamp predates both Coinbase (2012) and Binance (2017). Notably, Bitstamp survived the wave of bankruptcies in 2022 without any threat of collapse. It operates legally in both the US and EU, serving over 4 million customers.

Valuing the acquisition purely on a per-customer basis, Robinhood paid approximately $50 per customer, which is a reasonable amount. When considering Bitstamp's lending and staking capabilities, licenses, experienced employees, robust infrastructure, tradeable assets, and established industry relationships, the deal appears even more advantageous.

Do note, the deal isn't final until it closes, acquisitions can fall through, it’s happened before. “Robinhood expects the final deal consideration to be approximately $200 million in cash, subject to customary purchase price adjustments. The acquisition is subject to customary closing conditions, including regulatory approvals, and is expected to close in the first half of 2025.”

Statement from Bitstamp CEO: “As the world’s longest running cryptocurrency exchange, Bitstamp is known as one of the most-trusted and transparent crypto platforms worldwide. Bringing Bitstamp’s platform and expertise into Robinhood’s ecosystem will give users an enhanced trading experience with a continuing commitment to compliance, security, and customer-centricity.”

Statement from Robinhood: “The acquisition of Bitstamp is a major step in growing our crypto business. Bitstamp’s highly trusted and long standing global exchange has shown resilience through market cycles. By seamlessly coupling customer experience with safety across geographies, the Bitstamp team has established one of the strongest reputations across retail and institutional crypto investors. Through this strategic combination, we are better positioned to expand our footprint outside of the US and welcome institutional customers to Robinhood.”

FTX Creditors Fight Back

Remember when there were celebrations on social media about FTX's redistribution plan, touted as a 'liquidity injection'? It's now clear that those claims were far removed from reality. This is evidenced by a group of FTX creditors objecting to the bankruptcy plan, and I hope the judges and lawyers take heed.

The list of objections includes concerns about creditors being forced to pay capital gains taxes due to the lack of in-kind payment. Other issues involve the estate's connections to the law firm prior to the collapse and key IRS disclosures. I feel bad for FTX creditors and hope their efforts result in positive outcomes.

Kraken To Pursue An IPO?

Kraken's ambitious pursuit of going public remains intact, with reports indicating the exchange is exploring raising over $100 million before the IPO and searching for a suitable board member. Like many other major exchanges, Kraken has faced challenges with the SEC but seems to be in a more favorable position now, especially as Coinbase faces similar scrutiny and regulatory power appears to be diminishing. Crypto Briefing estimates Kraken's revenue to be between $1 and $2 billion this year.

Get Ready For The Crypto Explosion: Ethereum to $22K, Bitcoin to $80K

What are the chances Ethereum makes it to $22K? According to Van Eck - pretty high! As for Bitcoin - the price ranges from $80K in a few weeks to $100K closer to the US elections, doubling to $200K in 2025. Are these numbers realistic? Alex Tapscott, Managing Director of the Digital Assets Group at Ninepoint Partners, and author of the best-seller, Blockchain Revolution, is coming to my show to discuss it. In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.