Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

The Wolf Den Is Sponsored By DEGA!

DEGA allows users to build open software tools and solutions removing the complexities of blockchain development.

DEGA provides scalable infrastructure and fast transactions for Web3 gaming and the Metaverse.

DEGA builds Web3 tools to help simplify and speed up the development process of Web3 Games and Metaverse products.

Attracting some of the most talented leadership in business and technology, DEGA is set to change the perception and applicability of blockchain in Web3 Gaming and Metaverse development.

Check Out DEGA HERE.

In This Issue:

Another Epic Speech

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Checkout This RWA Dashboard

Wisconsin Will Probably Buy A Lot More Bitcoin

Nobody Is Paying Attention

IBIT Continues To Set Records

You Can Purchase Part Of A Soccer Team

Why Do Bitcoin Holders Remain So Bullish?

Another Epic Speech

It’s a good day when a new Erik Voorhees speech drops.

Erik Voorhees hardly needs an introduction, but for those less acquainted, he is a self-described 'lover of liberty,' the founder of ShapeShift, a crypto OG, and, as his girlfriend might say, 'the oldest man in crypto.'

Erik's fame predates his legendary keynote speech, 'Why Are We Here?' at Permissionless II, which has been heralded as one of the most profound lectures in crypto history. His latest speech once again showcases his eloquence and fervent advocacy for the crypto movement.

Rather than continue to build up anticipation, let's dive straight into the brilliance of Erik Voorhees's latest address. Please note that this is an abridged version; some parts have been omitted for brevity, but the core message remains intact.

For readability, the speech is presented without italics. Enjoy!

It’s an election year. Isn't that great? Democracy's divine providence now rests squarely once again on our shoulders. Friends, fellow citizens, over the coming months, through our considered debate, through our thoughtful reflection, through our nuanced application of 2,000 years of Western philosophical tradition, we hold the standard bearers of our democracy: Joseph Biden Junior and Donald John Trump.

These two illustrious men have risen to prominence, yet again, from our great nation of 350 million people. And as Americans, the decision in front of us is an important one, for whom we will choose to lead us in spending the next 10 trillion dollars, half of which will come out of the pockets of our own children. To help us decide on which path to ruinous bankruptcy we prefer, over the coming months, we will enjoy a succulent onslaught of political messaging. We will consume hyperbole and sophistry on a grand scale. We will be seduced with promises; we will be compelled toward hatred of one class or another. And then we will be comforted that those institutions who have never solved our problems, with magic, will solve them this time.

It is easy to be cynical, and the cynic builds nothing. So before going too far down that cynical path, toward the city never constructed, let’s take a moment to be grateful for the world that is actually around us. For the world that has actually been built. We should ask ourselves, how did this come to be? How did we get to this state of relative abundance, which every thankful day, we get to enjoy? Well, the past left us messages to show what humans are capable of.

There are clues in our history if we look. Months from now, when the inauguration of the new president is televised, I want you to notice what adorns that ceremony: flags, symbols, sacred inscriptions, sacred oaths, procedures, and traditions hundreds of years old, many of which date back to earlier than our nation's founding. There's a reason the government rituals are imbued with these symbols of America's founding. It invokes those virtuous principles upon which this country was built and associates them with the current administration. To accept this association is to permit a form of kleptocracy to occur, for even our history may be stolen from us…

If you polled every politician, every regulator, every staffer on the hill, and asked, ‘Do you believe that America’s Declaration of Independence was virtuous or sinister?’ I bet nearly all would say it was virtuous. And yet, it was an explicit rebellion against the very type of centralized authority they have chosen as their career path. But let’s not dwell on that contradiction. Indeed, they certainly haven't. Instead, let's appreciate that here, deep down in America’s history, we actually uncover some common ground. For even though politics feels divisive, we do have the shared belief in our genesis, and Bitcoiners of all people should understand how important a genesis can be.

Surely, as the crypto community, we should build upon this common ground to make the moral case for sound money and open decentralized finance. This moral case is an extremely powerful one. It stretches back deep into our societal history on a journey that predates America’s founding and transcends politics altogether. It is a journey which, if we look closely, connects us with the divine. Let’s reflect on how, over a couple of hundred years prior to independence and secession, a culture of liberty emerged in what were then remote British colonies.

Today, crypto expresses a very similar ethos of the individual having a direct relationship, this time not with God, but with money. And before you dismiss matters of money as perhaps trite or inelegant, we can at least agree that its influence is similarly potent. Both God and money are among the greatest influences on individuals, of families, and of entire civilizations. The Protestant struggle was with the Catholic Church as intermediary to God. The early colonial struggle was with the British Crown as intermediary to governance. Our struggle is with the central bank as intermediary to money.

And just as the Protestants stepped aside from their intermediaries and obtained a truer relationship with God, so too do we now step aside from our intermediaries and obtain a truer relationship with money. Both acts are virtuous. Both acts are heroic.

And in both cases, the rebels who sought disintermediation were condemned as sinners and criminals. Their crime? Having an individual relationship with God and having an individual relationship with money. The revolution back then was the Bible kept by the bedside; the revolution today is the Bitcoin kept in the seed phrase, private and permissionless in both cases.

But should man have a right to either? Then as now, those in power say no…

We should be grateful that the Treasury Department has not yet resorted to a degree of barbarism as it loses its own…

It is in America that this struggle must occur. There is nowhere else with sufficient philosophical heritage. There is nowhere else that has so loudly, in its past, pronounced unequivocally the virtue of the individual over the collective. Not every battle must be won here, but the war will end here, for better or for worse. And there is reason to be hopeful.

America’s great gift to the world was an unapologetic and radical expression of a certain philosophy. That of the individual and her innate sovereignty. It’s the idea that there is a sacred sphere around the individual which is appropriately beyond interference. Laws may be created, sure, but only up to the doorstep of the sovereign individual. There is a threshold there, in the just world, neither the tyranny of kings nor the tyranny of the voter may violate.

My dear friends, do not let the intermediaries convince you that they are essential. Do not acquiesce to their presumed authority; do not let those who blight the land with paper and propaganda sit for even a moment on the moral throne. They are pretenders, and those who are just will walk around them. If the Protestants can shake off the Catholic Church and the Colonists can shake off the British Crown, perhaps, with great fortitude and conviction, we can shake off Warren and her army. Harder fights have definitely been won. But as our cause grows, so will the battles, and before we move into that fog that awaits us, I want you to take a look at the faces around you at the table.

This room is an expression of the beauty of market forces. This gathering exemplifies the magic of spontaneous order and what can be achieved by committed individuals in civil society, and we are winning. Remember that we are building out of nothing and without permission an entirely new foundation for the economic action of man. We are building the most robust mechanism of virtuous capitalism ever conceived. We are enabling man to have a direct relationship with his own economic value and that of his fellows. We offer it peacefully, we impose on no one, we demand nothing. Ours is a project of virtue, and we must complete it.

So, after tonight, after the wine and wonder of a special evening together, we will enter that fiery forge once more. We will endure the heat of our creation. Many in this room have been on this journey for over a decade; many have been persecuted for daring to disintermediate, and many are understandably weary. But, my friends, we are winning. I want you to take comfort, for we have at our backs the warm winds of American liberty.

Crypto is, after all, an expression of this country's greatest ideals: an open and objective financial system for an open and objective society. It is not a system that will be permitted in China. It is not a system that will be permitted in Russia. But it must be permitted in the United States of America. Our heritage demands it. So it is here in America that we will fight, and it is for American principles that we are fighting.

From John F. Kennedy: ‘The cruelties and the obstacles of this swiftly changing planet will not yield to obsolete dogmas and outworn slogans. They cannot be moved by those who cling to a present which is already dying, who prefer the illusion of security to the excitement and danger which comes with even the most peaceful progress.’ A toast to history, to bravery, to peaceful progress, and the fiery heat of American creation. Cheers.

Erik gave this speech at Coin Center’s 10th Anniversary Dinner. If you want to watch the entire speech, click the image above or HERE.

If Erik were here, I believe the one final message he would share is the following.

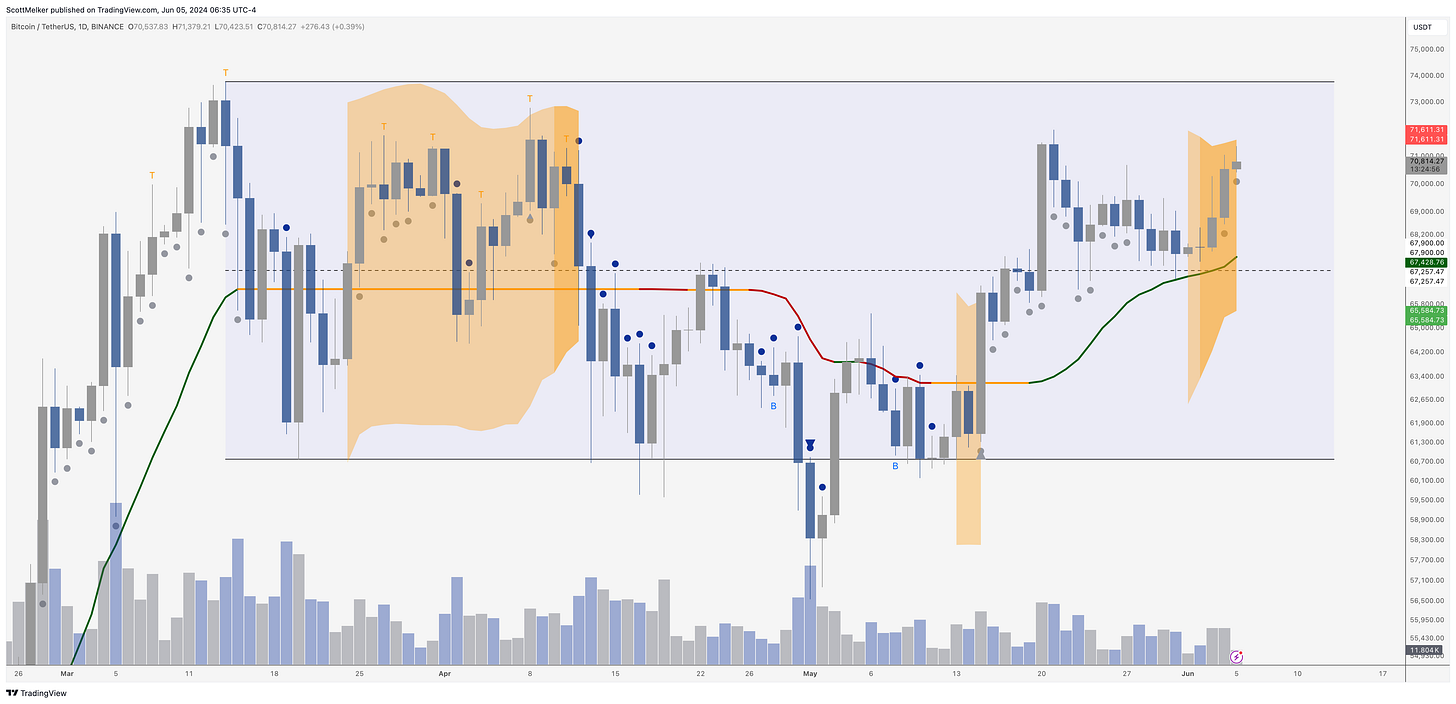

Bitcoin Thoughts And Analysis

Bitcoin continues to push towards the range high, around $74,000. As you know by now, once price broke into the upper half of the range, the expectation is a visit to the top. At that point, we will be at resistance and people will be losing their minds with bullishness. The reason charts work is because of humans - they get bullish at resistance and bearish at support.

We need to see a clean break of the all time high on real volume to indicate that all of this is anything but chop… but chop near the highs is much more fun than chop near the lows.

Everything still look great.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Trading Alpha is looking bullish on Solana. As you can see, we have squeeze shading (orange) with price rising, which indicates a likely volatile move coming, with evidence pointing to it happening to the upside. Price perfectly held the track line as support and the dots are once again turning grey, having never turned blue.

Solana continues to be arguably the most bullish asset in crypto and the easiest to trade.

Legacy Markets

Stocks rose on expectations that a slowing economy will allow the Federal Reserve to cut rates this year, while Treasury yields climbed after a significant drop. Europe’s Stoxx 600 Index increased by 0.5%, and futures for the S&P 500 and Nasdaq 100 also edged higher. The 10-year Treasury yield rose to 4.35%.

The labor market remains a key focus, with US job openings hitting their lowest since 2021, suggesting potential Fed flexibility on rate cuts. Retailers in Europe, led by Zara owner Inditex SA, saw gains after positive trading updates. Indian stocks surged over 2% following coalition support for Prime Minister Modi’s party.

Traders are also anticipating a rate cut from the European Central Bank, which could boost the Stoxx 600 further. A Bloomberg dollar gauge remained steady, while the yen weakened. In commodities, oil prices were stable, and Bitcoin surpassed $70,000.

Key events this week:

Eurozone S&P Global Services PMI, PPI, Wednesday

Canada rate decision, Wednesday

US ADP Employment, S&P services PMI, ISM services, Wednesday

Eurozone retail sales, ECB rate decision, Thursday

US initial jobless claims, trade, Thursday

China trade, forex reserves, Friday

Eurozone GDP, Friday

US unemployment rate, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.5% as of 9:46 a.m. London time

S&P 500 futures rose 0.1%

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.2%

The MSCI Asia Pacific Index was little changed

The MSCI Emerging Markets Index rose 0.9%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0875

The Japanese yen fell 0.9% to 156.21 per dollar

The offshore yuan fell 0.1% to 7.2561 per dollar

The British pound was little changed at $1.2773

Cryptocurrencies

Bitcoin rose 0.9% to $71,038.76

Ether was little changed at $3,805.6

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.35%

Germany’s 10-year yield was little changed at 2.54%

Britain’s 10-year yield advanced three basis points to 4.21%

Commodities

Brent crude rose 0.3% to $77.77 a barrel

Spot gold rose 0.3% to $2,333.64 an ounce

Checkout This RWA Dashboard

If you want to track the real-world asset space, there is no better publicly available dashboard than RWA.xyz. Here are some quick stats to see where the RWA space stands today:

The total size of the RWA market is $1,451,926,198.

BlackRock’s BUIDL accounts for 31% of the market, at $462.5 million.

71% of RWAs exist on Ethereum, the remainder is split between Stellar and Solana.

This market ONLY has 1,986 holders, of which BUIDL has just 14.

You can also view a dashboard for stablecoins on the site.

Wisconsin Will Probably Buy A Lot More Bitcoin

David Krause, a professor of finance at Marquette University, was recently interviewed by PBS regarding the State of Wisconsin Investment Board's decision to invest in Bitcoin. In the interview, he stated that this move marks just the beginning. While the decision for the pension fund to buy Bitcoin is significant, it represents only a fraction of the fund's assets under management. Specifically, the board purchased $162 million worth of IBIT and GBTC, out of a total AUM of $136.3 billion as of March 31, 2024. Consequently, Bitcoin accounts for just 0.1191% of the portfolio.

Here’s some commentary from David Krause on the decision. Please note that either his math is off, or he is using current figures that I couldn't verify. Either way, it doesn’t really matter.

David Krause: “Compared to the fund itself, it’s just a toe in the water. It’s 1/10 of 1%. Now $180 million is not pocket change. But this is a $180 billion fund. I think it’s just an entry point. I think they’re testing to see the reaction of the public to whether or not there’s resistance to owning this. And they’re using it as a trial run, because it really is not going to impact the portfolio substantial, until you get to maybe a 1% or 2% positioning.”

Interviewer: “Do you expect other states to follow suit? Watch this closely and follow?”

David Krause: “Oh I do, I do. Now I don’t expect those that are underfunded can afford to do that because this is a long play. I mean, the state of Wisconsin can afford to go through maybe several cycles. I think the long term trend of this type of assets is going to be upward slope, but there’s going to be dips. There’s going to be peaks, but if you’re a pension fund with low liquidity, you really can’t afford long plays.”

Nobody Is Paying Attention

One recurring theme I emphasize in this newsletter is the disparity between our perceptions within the crypto bubble and the reality faced by outsiders. Matt Hougan, the CIO of Bitwise, eloquently highlighted this in his Monday newsletter, capturing the sentiment perfectly. Enjoy.

“The reason this smells like alpha to me is that, outside of the crypto bubble, no one cares.

I’ve been on the road speaking at conferences for the past few weeks and, try though I might, I cannot get this story to resonate with people. I talk about the votes, and Warren’s anti-crypto army, and the surprise progress on Ethereum ETFs, and people’s eyes glaze over.

The story is too complex, and the impact too far removed. After all, no policies have actually changed in Washington yet. SAB 121’s repeal was vetoed; FIT21 is unlikely to make it through the Senate before the elections; and the Ethereum ETFs haven’t actually launched.

The tide has changed, but the water hasn’t come in yet. Wake me up when the action happens.

But here’s the thing: If people understood the ramifications of the shift in D.C., the crypto market would be at new all-time highs.

The market will wake up to the fact that we are in a new era for crypto, and when it does, I suspect it will move the industry towards all-time highs. But until it does, there may just be some alpha laying around.”

IBIT Continues To Set Records

No other ETF has crossed the $20 billion mark as quickly as BlackRock’s IBIT, with the second-place runner-up not even remotely close. It took IBIT just 144 days to reach this milestone. In comparison, the JPMorgan Equity Premium Income ETF (JEPI) took 985 days to achieve the same level. If Bitcoin undergoes explosive growth this cycle, I wouldn't be surprised to see IBIT take in $100 billion. Currently, IBIT is somewhere in the bottom half of the 100 largest ETFs in the world, but this won't last forever.

You Can Purchase Part Of A Soccer Team

This is exciting news! The English football team Watford FC has partnered with the digital asset investment firm Republic to sell 10% of the club to fans and investors. While this stake doesn’t offer voting rights, it does provide dividends, and investors are already showing significant financial interest. This innovative move is somewhat similar to Juventus’s JUV token and FC Barcelona’s BAR token. Financially democratizing sports teams is the future.

Why Do Bitcoin Holders Remain So Bullish?

I am joined by Sidney Powell, the CEO and Co-Founder of Maple, a digital asset lending platform. Together we will break down what's going on in crypto and Sidney will make an important announcement!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code 'TENOFFSALE' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.