Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Expectations For The Ethereum ETF

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Checkout This Ethereum Roadmap

The Stock Market Breaks

GameStop Probably Broke The Market

Bitcoin Has Become Boring

Bitcoin's Next Catalysts | Macro Monday

Expectations For The Ethereum ETF

Few expected the Bitcoin ETF launch to become the most successful in ETF history,

Now all eyes have turned to Ethereum. Will it outshine expectations or be the flop that most anticipate?

Since the Bitcoin ETF launched, nearly $14 billion in net inflows have poured into these products, sparking speculation about where Ethereum will stand in comparison to Bitcoin.

I have seen arguments go both ways, so in light of this discussion, I have dug up some competing opinions on how Ethereum will fare come launch. My opinion is at the end.

Matt Hougan: CIO of Bitwise

“Bitcoin ETFs have seen net flows of about $12 or $13 billion, significantly boosting the assets of the Grayscale Bitcoin Trust (GBTC). When you add these flows to the GBTC assets, the resulting numbers are off the charts for ETFs. This amount is two to three times greater than the next most successful ETF of all time.”

“I don't think Ethereum ETFs will match Bitcoin ETFs, but I do believe they will still be measured in terms of many billions of dollars. The $10 billion converting some of that will involve people selling out, which means new investors will need to step in. However, I think it’s quite possible that we could see an additional $5 billion flow into Ethereum ETFs by the end of the year.”

“Could there be significantly more in future years? I definitely think that's possible. Will it be enough to drive Ethereum to new all-time highs? I believe that's also possible. If Bitcoin ETFs accumulated $12 to $13 billion in their first four months, I think Ethereum ETFs will gather less than half of that, but more than a quarter.”

The Bloomberg Bros: Eric Balchunas and James Seyffart

“I just don't think those numbers are going to be massive right now. However, that could change in the future. Based on my experience and interactions with various people, there's currently less demand.” — James Seyffart

“I had very low expectations for the future ETFs, and they did even worse than I anticipated in terms of flows. No one really cared at all. This indicates that these ETFs are not going to be as significant as the Bitcoin launches.” — James Seyffart

JPMorgan warns of 'negative' initial market reaction to spot ethereum ETFs

“We believe the demand for spot Ethereum ETFs would be a fraction of that seen for spot Bitcoin.”

“JPMorgan cites Ethereum's smaller market cap as a reason they expect ‘a modest’ $1 billion to $3 billion in net inflows during the remainder of 2024, assuming they go live before the end of the year.”

“JPMorgan warns of 'negative' initial market reaction to spot Ethereum ETFs.”

Grayscale: The State Of Ethereum

“Based on international precedent, the Grayscale Research team expects that the U.S. spot Ethereum ETFs will see roughly 25%-30% of the demand of the spot Bitcoin ETFs. Significant portions of Ethereum supply (e.g., staked ETH) will not likely be available for the ETFs.”

“On this basis, Grayscale Research’s working assumption is that net inflows into U.S.-listed spot Ethereum ETFs will be 25%-30% of those observed for the spot Bitcoin ETFs to date, or about $3.5-$4.0bn over the first four months or so (25%-30% of the $13.7bn net inflows into spot Bitcoin ETFs since January).”

“The potential launch of spot Ethereum ETFs will introduce more investors to the concept of smart contracts and decentralized applications—and therefore to the potential for public blockchains to transform digital commerce.”

The first point to establish in discussing expectations for Ethereum’s ETF inflows is to reiterate that Bitcoin's launch far exceeded expectations, surpassing what many thought it could achieve in a year. Assuming that Ethereum's inflows will be one third of Bitcoin's, based on the claim that ‘Ethereum’s FDV is approximately 33.25% of Bitcoin's FDV,’ implies that Ethereum will have a similarly spectacular launch. My current thought process is that Ethereum can have a successful launch without reaching a proportionate size to Bitcoin. The market may not love this in the short-term, but in the long-term, it will adjust accordingly.

This doesn’t make me a bear, it’s a measured approach.

The second point is acknowledging that $1 of inflows into Ethereum will not carry the same weight as $1 of inflows into the Bitcoin ETF. As previously mentioned, Bitcoin's FDV is approximately three times that of Ethereum. Additionally, around 27% of the ETH supply is locked up in staking contracts, with staking rewards typically not being sold immediately. We also know that supply issuance can quickly fluctuate into deflationary territory, and rapid fee burning can occur at any time. These factors will significantly impact the overall effect of $1 entering the Ethereum ecosystem via ETFs, for better or worse.

The third point to acknowledge is that we already have data on the Ethereum ETF performance in other countries! Predicting U.S. performance isn't entirely a shot in the dark. Also, I want to acknowledge that staking will likely be incorporated at some point in the future, which will entice more capital.

From eyeballing these numbers, I would say ETH is around an average of about 25% of total BTC + ETH assets combined.

Another way to look at possible inflows is to examine AUM in ETHE right now, pre-ETH ETF launch, to where GBTC was in AUM before its ETF conversion. ETHE currently has $11.08 billion while GBTC had $29.4 billion. From this perspective, ETHE has 37.7% the AUM GBTC had at launch or 27.3% of assets between GBTC and ETHE combined.

Considering all these factors, I personally find Grayscale's approach most appealing among the analysts mentioned. According to Grayscale Research, they assume that net inflows into U.S.-listed spot Ethereum ETFs will reach 25%-30% of the levels seen for spot Bitcoin ETFs, totaling about $3.5-$4.0 billion over the initial four months. Grayscale has a vested interest in the ETF's success and still maintains a balanced view without overly bullish predictions. While everyone (including Grayscale) hopes for a positive surprise, Grayscale's forecast, even at 25% to 30%, wouldn't place Ethereum on par with Bitcoin but would still represent a successful and respectable level of inflows.

One unknown at this point is the amount of money that will be allocated for marketing, as we haven't seen much of it yet, along with how much the issuers will put forward seeding these products. Larry Fink won’t show up a bum on day one.

Regarding price, if Grayscale's prediction is accurate, Ethereum will likely stabilize just below its all-time highs after some time has passed following the launch, with the bull and bear cases exerting upward or downward pressure from that point, respectively. My basic premise is that unless Ethereum attracts significantly more inflows relative to its size compared to Bitcoin, it probably won't surpass its all-time highs in the short-term, especially considering Bitcoin's ETF success and its current position still below its ATH.

Anything can happen, so it's best to sit back, temper expectations, and be pleased when the inflows arrive. Ethereum is the only other asset to earn the ETF privilege, and ETHE outflows will finally be addressed absorbed. This overhang will affect any asset that is seeking an ETF that has a Grayscale trust, so it’s better to get it over with sooner rather than later. Expect excitement to build as the final S-1 filings are submitted and marketing establishes a clean narrative for ETH. Let the good times roll!

Bitcoin Thoughts And Analysis

Here is some shocking analysis - Bitcoin is sideways and there is nothing to do for now! Immediate target if you are in a trade is still the area around the all time high - the top of the range.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

I still like Fantom here, bouncing well from the support zone. This is merely an update on a setup that I shared last week - it dipped below the entry, but did not come anywhere near the proposed stop. Now it’s back in profit and still looks solid.

Legacy Markets

US equity futures and European stocks fell, driven by a drop in energy stocks like BP Plc and TotalEnergies SE. Meanwhile, Treasuries held steady after a rally spurred by signs of a slowing US economy. Investors are torn between concerns over economic health and hopes for a Federal Reserve rate cut later this year. The 30-year Treasury yield remained near recent lows, and US manufacturing data reinforced expectations of a rate cut. Analysts predict that upcoming economic data, including job openings and payroll numbers, will be crucial in shaping future rate decisions.

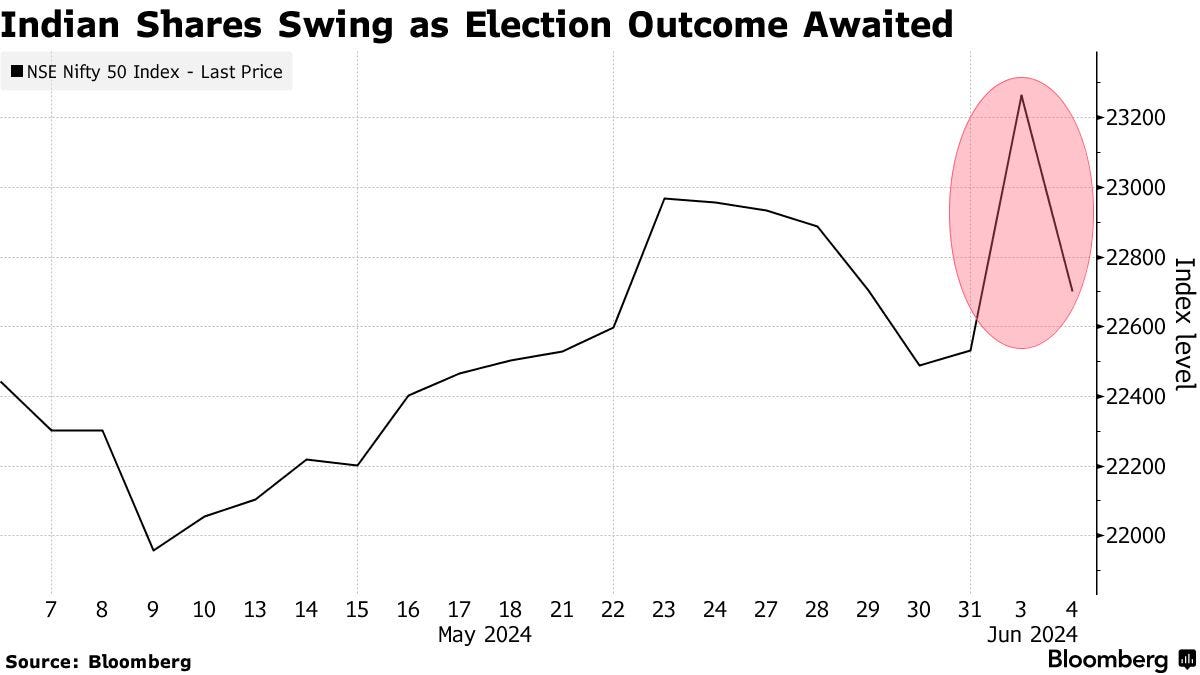

In Europe, strong economic data and comments from European Central Bank hawks have led some analysts to reconsider the likelihood of rate cuts this year. However, Citigroup strategists suggest that rate cuts could still boost the region’s equities. Asian markets had a mixed session, with Indian stocks, currency, and bonds dropping amid early ballot counts indicating a narrow win for Prime Minister Modi.

In corporate news, GameStop Corp. surged due to a significant Reddit post, while Airbus SE is negotiating a major sale of aircraft to China. JetBlue Airways Corp. expects better-than-expected sales performance, and Skydance Media plans a $23 per share offer to merge with Paramount Global. Bill Ackman’s Pershing Square aims to raise $25 billion for a new fund, A.P. Moller-Maersk A/S raised its profit forecast due to supply line congestion, and Deutsche Telekom AG fell as Germany sold a stake in the company.

Key events this week:

US factory orders, JOLTS, Tuesday

China Caixin services PMI, Wednesday

Eurozone S&P Global Services PMI, PPI, Wednesday

Canada rate decision, Wednesday

US ISM services, Wednesday

Eurozone retail sales, ECB rate decision, Thursday

US initial jobless claims, trade, Thursday

China trade, forex reserves, Friday

Eurozone GDP, Friday

US unemployment rate, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.5% as of 6:25 a.m. New York time

Nasdaq 100 futures fell 0.4%

Futures on the Dow Jones Industrial Average fell 0.5%

The Stoxx Europe 600 fell 0.7%

The MSCI World Index fell 0.1%

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.3% to $1.0867

The British pound fell 0.4% to $1.2758

The Japanese yen rose 0.7% to 154.93 per dollar

Cryptocurrencies

Bitcoin fell 0.4% to $68,815.76

Ether fell 0.3% to $3,758.01

Bonds

The yield on 10-year Treasuries declined one basis point to 4.38%

Germany’s 10-year yield declined three basis points to 2.55%

Britain’s 10-year yield declined two basis points to 4.20%

Commodities

West Texas Intermediate crude fell 2.3% to $72.55 a barrel

Spot gold fell 0.7% to $2,333.73 an ounce

Checkout This Ethereum Roadmap

The Ethereum roadmap just became a lot easier to follow. This easy-to-read visual shows the progress of various components of Ethereum development along with a historical timeline of hard forks further down the page.

The Stock Market Broke

Yesterday morning, a ‘technical issue’ caused major stocks to appear as though they plummeted by 99%, leading the NYSE to halt trading in the affected shares. Among those impacted were Warren Buffett’s Berkshire Hathaway A-class shares, Barrick Gold, and Nuscale Power. An investigation immediately began to determine the cause of the error, which was quickly attributed to a 'technical glitch' related to price bands. I'm not very convinced though. Is it merely a coincidence that the market experiences 'technical errors' whenever GameStop sees volatility? There was a significant outage in June 2023, and coincidentally, the day before, Robinhood had suspended GME trading due to volatility. Which leads me to my next story.

GameStop Probably Broke The Market

In typical Twitter fashion, Twitter erupted with claims that GameStop was the catalyst for the market breaking. While it's impossible to confirm this, here's what we do know: at one point pre-market, GameStop surged 100%. Roaring Kitty has been heavily investing in $20 calls expiring on June 21 and holds $115 million in shares; short sellers are down over $1 billion, and the market hates when GameStop rises. If GME reaches $70, his position would be worth about $1 billion. Roaring Kitty might go down as the greatest trader of the decade.

As for the identity of the counterparty in this trade is unknown, but if GME continues to climb, we can expect fireworks. How this order will be filled remains a mystery, but if it goes through, Roaring Kitty will own a significant portion of GameStop stock. Currently, Yahoo Finance reports he already owns 1.8% of its publicly available stock. Meanwhile, Robinhood and Reddit stocks both rose while the market was down on the news. If Robinhood maintains 100% uptime throughout this turmoil, it would certainly be good for the platform's reputation amongst skeptical traders.

In other Roaring Kitty news, it's been reported that E-Trade is internally discussing whether to ban Keith Gill over potential market manipulation. There hasn't been a public announcement yet, but unfortunately, this development isn't surprising. Before even thinking about Roaring Kitty, at the very least, all members of Congress should be on a do-not-trade list, as it makes no sense for lawmakers to trade assets they legislate. What a backwards world we live in.

Bitcoin Has Become Boring

Bitcoin has become boring, staying rangebound since the end of February. Active addresses have hit lows, and both spot exchange and derivative exchange volumes have plummeted to yearly lows. It's annoying, but necessary for the next leg up. Breaking $100,000 won't be easy and will require every last bit of momentum Bitcoin can muster. When it happens, everyone will be talking but an army of traders will be enticed to sell. It’s going to be a war.

Bitcoin's Next Catalysts | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code 'TENOFFSALE' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.