The Wolf Den #977 - Creditors Finally Receive Good News

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

The Wolf Den Is Now Sponsored By DEGA!

DEGA allows users to build open software tools and solutions removing the complexities of blockchain development.

DEGA provides scalable infrastructure and fast transactions for Web3 gaming and the Metaverse.

DEGA builds Web3 tools to help simplify and speed up the development process of Web3 Games and Metaverse products.

Attracting some of the most talented leadership in business and technology, DEGA is set to change the perception and applicability of blockchain in Web3 Gaming and Metaverse development.

Check Out DEGA HERE.

In This Issue:

Creditors Finally Receive Good News

SEC Ordered To Pay Damages To DEBT Box

PayPal’s PYUSD Is Now Available On Solana

Mastercard Enhances Mainstream Crypto Adoption

The ETH ETF Isn’t Far Away

$450 Billion Will Flood Into Crypto ETFs | Will Bitcoin Skyrocket?

Creditors Finally Receive Good News

Gemini Earn creditors just woke up to the best news ever:

Before discussing good news, let’s rewind to how we got here.

Amid the dominos of collapsing exchanges triggered by FTX and Celsius in late 2022, Gemini’s Earn users found themselves caught in the mess. The exchange was forced to halt its Earn program and hold onto users' assets due to financial issues faced by its partner, Genesis Global Capital. Genesis was responsible for managing the lending and interest payments for the Earn program, but encountered significant financial trouble, thanks to FTX and their own poor due diligence.

TLDR: 2022 was a confusing tangle of trust, lies, leverage, and debt. But amid all the bad actors, Gemini was believed to be the good guy caught up in the mix, and today that has been proven true.

Getting to this point was not straight forward though.

In December 2023, Gemini Earn users faced a threatening plan that, if passed, would have significantly reduced what they could recoup. The original plan, contingent on creditors' approval, which would have returned about 61% of what was owed. On top of the crappy offer, this plan did not include any of the promised interest users were supposed to be 'earning.'

The plan sucked and creditors took a risk and voted ‘no.’

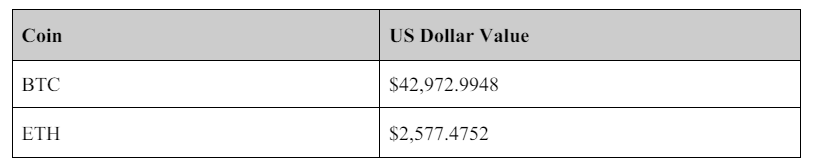

The reason this particular plan, along with many current plans, is unfavorable for creditors is that they choose not to return assets in-kind. If assets are returned in-kind, they are based on lower values (typically during bankruptcies), not their current market prices. The previous proposed plan for Gemini Earn users calculated what was owed based on Bitcoin valued at around $20,940 and Ethereum at $1,545. Creditors were rightfully upset.

At this point, I sense some of you may be developing opinions, so it's important to highlight a key fact that could clarify any confusion: the Winklevoss Twins, Cameron and Tyler, were steadfast in their commitment to do right by their creditors. I’m not sure I can confidently say the same for anyone else involved.

Do you remember the open letters Cameron Winklevoss sent to Barry Silbert on behalf of Earn users demanding the money back? In that letter this was said, “In closing, I've seen a lot of bad behavior from you and your colleagues over the last 9 months, but perhaps the most disturbing thing you said to me this Fall—that you're a victim in all of this. It takes a special kind of person to owe $3.3 billion to hundreds of thousands of people and believe, or at least pretend to believe, that they are some kind of victim. Not even Sam Bankman-Fried was capable of such delusion.”

You can read these letters HERE and HERE.

Today, that persistence paid off, see below.

This news is truly incredible because users are actually receiving the assets they lost, not a fraction of them in a different form. I particularly like the line that clarifies “if you lent one Bitcoin in the Earn program, you will receive one Bitcoin back.” The majority of PR releases that say creditors are receiving about 100% back are beyond frustrating and misleading, which I will get to in a second.

One final comment.

“We are thrilled that we have been able to achieve this recovery for our customers. We recognize the hardship caused by this lengthy process and appreciate our customers’ continued support and patience throughout,” — Cameron Winklevoss.

The Winklevoss twins, Gemini, and creditors, in particular, deserve this victory. It's long-awaited and very refreshing.

Unfortunately, the good news ends right about there. Gemini is turning out to be the exception, not the rule, meaning creditors of other platforms have not been as fortunate. Let’s examine some of the facts with Celsius. Below is a table creditors were instructed to reference regarding the prices of Bitcoin and Ethereum for their claim calculations.

Expected recovery was 79.2%.

Additional important statements:

As stated above, there are a number of factors, but many of creditors compensation plans looked like this.

Let’s say you have a claim of $1,000:

You will receive $579 split between BTC and ETH; $149 Ionic common shares; and maybe $64 in the years to come from illiquid assets. Remember, the claim is calculated based on lower prices of Bitcoin and Ethereum. You are receiving a fraction of what is owed at a fraction of fair prices. Again, this is just an estimation and generalization, this is NOT an exact science.

To compound matters, many creditors will not receive their original assets back, which would potentially trigger a capital gains tax event depending on an individual's cost basis. These calculations can be intricate, but the premise is clear in Celsius' bankruptcy proceedings, creditors got f**ked. Which is the common theme among creditors for other bankrupt companies that are working through repayment or already made repayments.

Just recently, FTX made a statement about their bankruptcy proceedings that many chose to celebrate, and I called out the BS, here’s what I said: “The primary issue is that investors receive the cash value of their portfolios back during bankruptcy. Consequently, all gains in Bitcoin and Ethereum from the bottom have been erased. It's akin to being compelled to sell during FTX's bankruptcy and being barred from repurchasing for a long period, possibly ranging from one to three months from now, if the plan progresses smoothly.

It's puzzling to witness the celebrations over a 'liquidity injection' and 100% repayments to creditors, all while disregarding the fact that Bitcoin has surged approximately 4x since its low, with even greater gains for most other assets. Creditors are effectively receiving only a fraction of the value of their initial Bitcoin holdings. FTX's actions are akin to robbery both before and after the bankruptcy.”

As mentioned earlier, these plans are complex and impact creditors differently. If I were to meticulously delve into each plan, I'd be writing continuously for the next week.

The part that really pisses me off the most is the framing and optics around the bankruptcy announcements and repayment plans:

If you weren't a creditor facing a meager repayment or someone closely following this situation, this news might sound positive as it's currently framed. Personally, if I were the CEO, I wouldn't feel "pleased" to make this announcement; I would be embarrassed.

Many of the facts surrounding the collapses of multiple popular exchanges will likely fade in the coming years, and the shortcomings creditors faced will likely never be made whole. I sincerely hope that anyone who lost any amount of money from these collapses has good fortune in the upcoming bull market. You deserve to be rewarded more than anyone else. Additionally, I hope this newsletter cements in your mind that Gemini, led by the Winklevoss Twins, was one of the good guys because of their commitment to doing what’s right by their creditors.

It was a costly lesson, and one we should vow to never repeat.

*The newsletter is shorter and delayed because I am at Consensus in Austin! I will be back to normal on Monday.

SEC Ordered To Pay Damages To DEBT Box

The SEC's case against DEBT Box has been dismissed without prejudice by the US District Court for the District of Utah, and the agency has been fined over $1.8 million for its misconduct. While this outcome is a win, it falls short in my opinion. The dismissal without prejudice means the SEC could potentially take further action against the firm in the future. Additionally, American taxpayers are ultimately footing the bill for the SEC's misconduct, and DEBT Box has suffered irreparable damage. As per CryptoSlate, “the SEC had provided misleading information to the court when it justified its orders, including incorrectly describing the recency of account closures and mistaking domestic transactions for international transactions.” A $1.8 million slap on the wrist is not enough.

PayPal’s PYUSD Is Now Available On Solana

PayPal users can now send and receive PYUSD on either Solana or Ethereum from their PayPal accounts and Venmo wallets. In the press release, PayPal emphasized that Solana is the "ideal" chain for PYUSD.

“The Solana network's speed and scalability make it the ideal blockchain for new payment solutions that are accessible, cost-effective, and instantaneous.”

“As the most used blockchain for stablecoin transfers, according to data from blockchain analytics platform Artemis, Solana has emerged as the leading blockchain to run tokenized transactions and is ideal for PYUSD as it continues to be used for payment use cases.”

“I think there’s a lot of use cases that have probably been throttled because of the nature of transacting on Ethereum layer 1 that will be lit up once PYUSD is on Solana because it’s faster and cheaper.”

All in all, this is fantastic news for Solana, investors, PayPal, and end users. PYUSD is the 7th largest stablecoin with a market cap of about $400 million, which is significant, but it pales in comparison to USDC at $32 billion and USDT at $111 billion. All progress is good progress.

Mastercard Enhances Mainstream Crypto Adoption

Wallet addresses are arguably one of the biggest obstacles to mainstream crypto adoption. They may be easy to us, but to those not tech literate, they are daunting. While Mastercard isn't introducing groundbreaking technology, they are tackling this problem for their audience by launching a pilot program that replaces traditional addresses with human-readable 'aliases,' simplifying transactions. Additionally, the program aims to prevent financial loss by screening transactions to ensure compatibility with the recipient's address. The easier crypto becomes, the more mainstream it will go.

The ETH ETF Isn’t Far Away

In about a month, the Ethereum ETF will be live. The final step is fine-tuning the S-1 forms, and after some back and forth, it’s set to be a done deal. So far, I’ve only seen the advertisement from VanEck. I imagine many issuers are spending considerable time strategizing how to present Ethereum to Wall Street and boomers who will be buying the product. This is going to be epic.

$450 Billion Will Flood Into Crypto ETFs | Will Bitcoin Skyrocket?

Crypto ETFs are forecasted to experience massive inflows of up to $450 billion. What will happen to the price of Bitcoin and Ethereum, and other cryptos? This and more I will discuss with James Butterfill, Head of Research at Coinshares. Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code 'TENOFFSALE' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.