Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

You Need To Check Out Trading Alpha!

I'm deeply committed to delivering the highest-quality content to all of you, which is why I'm thrilled to be partnered with Wick, also known as @ZeroHedge on Twitter, who has the best technical analysis in crypto! He is offering the absolute best Indicators & Tools on the market. These indicators have entirely changed by TA for the better. Use code 'TENOFFSALE' for a 10% discount.

In This Issue:

Approaching All-Time Highs

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

FIT21 Passes With Flying Colors

Crypto ETFs Are Going Global

MetaMask To Welcome Bitcoin

Do Not Read This!

Ethereum Pump! | ETH ETF Explained: What Are The Chances Of Approval?

Approaching All-Time Highs

There's a widespread phenomenon in crypto that affects both traders and investors, which, as far as I can tell, lacks an official name. It's one of the toughest mental challenges for both new and experienced participants. Given the current market circumstances, it's crucial to address what I call the ‘Problem of Indexing.’

Many of you likely feel frustrated when you look at your portfolio and see that it's still far from its all-time high. This is a natural human response. You might have even crunched the numbers and realized that even if Bitcoin, Ethereum, and Solana reach new all-time highs, you still wouldn't be back to where you once were.

Maybe you made a solid trade in the previous bull market but lost much of it during the downturn. Perhaps you held an altcoin that soared, only to capitulate and swap it in the bear market (probably for good reason). Or you might have sold some crypto at some point to cover bills or personal needs, shrinking your stack size.

The Problem of Indexing occurs when individuals emotionally attach their net worth to specific high or low points in their cryptocurrency holdings. These set points carry emotional baggage that distorts future thinking and leads to pointless self-comparisons.

It’s hard to pinpoint the origin of this problem, but it likely stems from crypto's strong appeal to retail investors, its extreme volatility, and the unique culture and mission of the crypto market, which is unlike anything else in the financial world.

Here’s what someone experiencing this problem might say:

“Bitcoin is past the previous cycle all-time high and my portfolio is still down 15%.”

“My portfolio's all-time high is still 25% away.”

“Ethereum needs to reach $5,500 for my portfolio to be where it once was.”

“I had .75 BTC at the peak, and now I only have .5 BTC. I need to accumulate back to my peak holdings.”

“I made a huge profit during the last bull run, but now I’ve lost most of it. I need to replicate that success.”

“I was doing so well last year when my altcoin investments skyrocketed. Now, it's all gone, and I feel like a failure.”

“I keep holding onto my coins, hoping they'll return to their all-time highs so I can feel successful again.”

“When Solana hit $250, my net worth was the highest it’s ever been. I can't believe it's dropped so much since then.”

Comparing your current status to your all-time high can create unrealistic expectations and emotional distress, potentially leading to impulsive decisions. It's important to understand that past successes may not be repeatable, and you shouldn't feel pressured to replicate them. Instead, view these experiences as valuable learning opportunities. Analyze what went right and wrong and use those insights to make informed choices moving forward.

If that advice didn't resonate with you, try following these steps to hold yourself accountable the next time you are obsessing over what once was:

Focus on the Present: Concentrate on your current portfolio value, positions, and market conditions instead of dwelling on past highs or specific events.

Study Market Cycles: Understand that market cycles are natural, and it's normal for portfolios to fluctuate. Recognize that higher lows can be just as valuable, if not more so, than higher highs.

Set Realistic Goals: Establish achievable, realistic goals based on your current financial situation and market conditions, rather than attempting to replicate past successes.

Limit Price Checks: Unless you are planning to sell soon, avoid checking your portfolio daily or even weekly. Extending the time between reviews can help minimize emotional reactions.

Extend Your Time Horizon: Most emotional decisions stem from focusing on short time frames. Evaluate your success over longer periods, such as year over year, to gain a clearer perspective.

As Bitcoin surges past its previous all-time high and Ethereum and Solana establish new records, don't let desire cloud your judgment. Chasing losses and gains can lead to costly mistakes.

The only cure for this phenomenon is to forget the past, which I understand can be difficult. Once a trader or investor breaks free from this line of thinking, benchmarks become irrelevant, and decision-making vastly improves. It’s a complete paradigm shift in thinking that will set your portfolio free.

A political transformation is underway in the crypto landscape, reshaping the asset class and revitalizing our approach. Embrace this new era, let go of past notions, and seize the opportunities of the ongoing bull market. Forget what once was and detach yourself from the past. Enjoy the ride, take profits if you wish, and don't overthink it.

The market is pointing up; it’s really that simple.

Bitcoin Thoughts And Analysis

Ain’t nothing change, just trading in a range. The good news? We are trading in the top half of the range now.

All eyes are on ETH and altcoins today.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Interesting spot for Ethereum Vs. Bitcoin on such a big day. Right at long term descending resistance. By the way, there was bullish divergence coming from oversold RSI at the bottom, as often happens.

Here is yesterday’s stream, covering a number of altcoins using Trading Alpha.

Legacy Markets

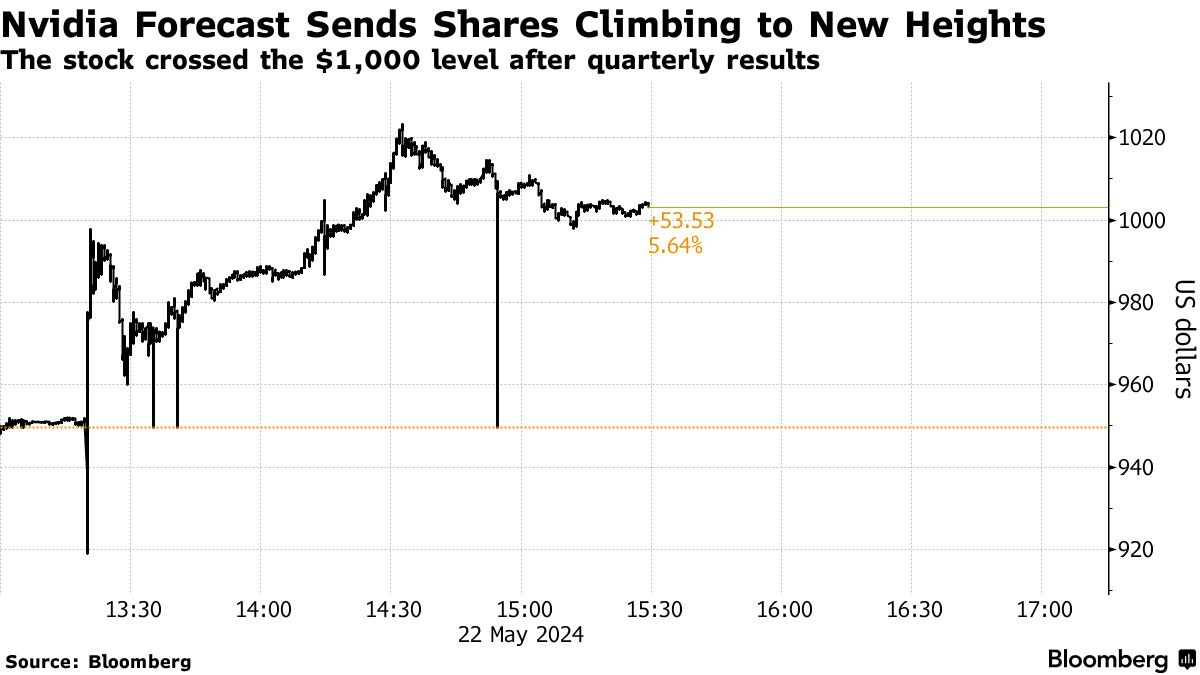

Wall Street is heading for a new record high after Nvidia Corp. reported blowout earnings, reinforcing confidence in the global artificial-intelligence boom driving equity markets. Nvidia shares rose more than 7% in premarket trading, poised to add to its over 90% year-to-date rally. This optimism lifted other chip stocks like Super Micro Computer Inc. and Advanced Micro Devices Inc., with Nasdaq 100 and S&P 500 futures rising 1% and 0.6%, respectively.

Nvidia’s strong performance highlights the growing importance of AI. Guy Miller, chief market strategist at Zurich Insurance Company Ltd., noted, “Top-performing companies have to deliver, and Nvidia has delivered.”

In Europe, the Stoxx 600 index climbed 0.4%, led by tech companies ASML Holding NV and ASM International NV. Meanwhile, the Federal Reserve minutes indicated no rush to cut interest rates, with US Treasuries inching higher and the dollar retreating after a one-week high.

European bond yields rose following positive private-sector business activity data, though investors expect the European Central Bank to cut rates in June. M&A news saw Hargreaves Lansdown Plc rebuff a $6 billion offer, Anglo American Plc shares gain amid a potential $49 billion BHP Group takeover, and Millicom International Cellular SA shares jump on a potential all-cash tender offer.

In commodities, oil edged higher but remained near a three-month low, while gold and copper prices continued to slide from recent highs.

Key events this week:

G-7 finance meeting, May 23-25

US new home sales, initial jobless claims, Thursday

Fed’s Raphael Bostic speaks, Thursday

US durable goods, consumer sentiment, Friday

Fed’s Christopher Waller speaks, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.4% as of 12:27 p.m. London time

S&P 500 futures rose 0.6%

Nasdaq 100 futures rose 1%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index was little changed

The MSCI Emerging Markets Index fell 0.2%

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro rose 0.2% to $1.0843

The Japanese yen was little changed at 156.70 per dollar

The offshore yuan was little changed at 7.2511 per dollar

The British pound was little changed at $1.2727

Cryptocurrencies

Bitcoin rose 0.7% to $69,875.71

Ether rose 3.4% to $3,875.63

Bonds

The yield on 10-year Treasuries was little changed at 4.42%

Germany’s 10-year yield advanced one basis point to 2.55%

Britain’s 10-year yield declined two basis points to 4.21%

Commodities

Brent crude rose 0.7% to $82.49 a barrel

Spot gold fell 0.5% to $2,367.57 an ounce

FIT21 Passes With Flying Colors

Last week, the Biden Administration preemptively announced a veto of a crypto bill that had yet to pass. This week, the White House stated that they are "eager to ensure a balanced framework for digital assets." This shift in stance highlights the Democrats' concern regarding the November outcome.

What’s peculiar about the reporting on the statement is that the headlines indicated something along the lines of, “The White House says it will not veto HR 4763.” Nowhere in the statement was the word ‘veto’ used. There wasn't a clear declaration that the administration would or would not veto FIT21 in its current form. Biden could certainly veto the bill and request a rework with compromises. The key point here is the tone shift, showing a willingness to work with the industry and not entirely against it.

"The Administration is eager to work with Congress to ensure a comprehensive and balanced regulatory framework for digital assets, building on existing authorities, which will promote the responsible development of digital assets and payment innovation and help reinforce United States leadership in the global financial system."

Despite this, FIT21 passed in the House with nearly unanimous support from Republicans and significant backing from Democrats. The Biden administration's tone shift helped secure Democratic support, leading to its swift passage. While it's not guaranteed to pass in the Senate, given the current circumstances, it has a very strong chance. Both Democrats and Republicans are now voting pro-crypto, and they can hold the administration accountable for its willingness to collaborate.

71 'Yes' votes out of 213 Democrats is truly unbelievable. This isn't just progress - it's a significant victory by a HUGE margin.

Crypto ETFs Are Going Global

While the U.S. celebrates its victory over the SEC with the potential approval of the Ethereum ETF, the UK's Financial Conduct Authority (FCA) has given the green light for Bitcoin and Ethereum ETPs to begin trading on May 28th. The WisdomTree Physical Bitcoin ETP and the WisdomTree Physical Ethereum ETP were approved, making them the first crypto ETPs to be listed in the UK.

Unfortunately, these products are only available to professional and institutional investors due to a ban on retail customers that went into effect in 2020. Nonetheless, this is a significant step in the right direction, which could eventually lead to lifting the retail ban. Bitcoin and Ethereum have definitively become the preferred institutional crypto assets, and that door has only just opened.

MetaMask To Welcome Bitcoin

MetaMask, Ethereum’s largest wallet, is helping bridge the tribal divide by planning to add support for Bitcoin, according to sources familiar with the matter. This development is particularly significant because MetaMask serves as the gateway to Web3 and DeFi for more than 30 million monthly active users. Allowing Bitcoin will likely bring in a flood of new capital. A MetaMask spokesperson said the following in an email to CoinDesk:

“We're excited about MetaMask's commitment to embracing the multi-chain world of web3 and continually exploring new integrated features to enhance the usability and security of the leading self-custodial wallet. While we can't confirm any timeline for specific developments at this time, we're always working on innovations to serve our users better. Stay tuned for further updates when we're ready to share more.”

Do Not Read This!

Do you recall the controversial Blockworks article I shared about ten days ago titled, “Only a Fool Would Vote on Crypto Alone?” That article argued— as you can probably tell from the title— that Americans should not prioritize their own financial interests over broader societal and ethical concerns, which struck a nerve with the crypto community.

If you’re interested in reading the opposite take, namely, a critique of the current Biden administration, then this article is for you. A lot can change between now and November; we just witnessed the Polymarket polls boost Trump in the span of a couple of weeks. Getting crypto investors to the polls is priority number one.

Crypto is currently winning the fight, but the largest battle will come in November.

Ethereum Pump! | ETH ETF Explained: What Are The Chances Of Approval?

Latest updates on the Ethereum ETFs approval process from 2 main ETF people: Bloomberg's Eric Balchunas and James Seyffart.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code 'TENOFFSALE' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.