Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

A Seismic Shift

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Coinbase To Offer Gold And Oil Trading

The ETF Flippening Happened… Briefly

Donald Trump Is Now Accepting Crypto

DOP’s Mainnet Is Almost Live

Crypto Skyrockets: Will The Ethereum ETF Be Approved?

A Seismic Shift

The phone rings. Gary Gensler glances at the caller ID. Unknown number. He swallows hard and picks up, his hands trembling.

Gary Gensler: Uh, hello?

A sinister, gravelly voice: You're blowing it for us, Gary. Approve the spot Ethereum ETF immediately. We need to buy some time and win some good grace… or else.

Gary Gensler: Y-yes, of course. I’ll do exactly as you say.

Sinister voice: One more screw-up, and you're finished, Gensler. Understand?

Gary Gensler: Crystal clear.

Sinister voice: Good. Now get to it, pathetic son of a b….

The phone slams down.

I can't think of a better way to begin than by expressing my profound happiness for Ethereum investors. You all deserve this moment and more. Reaching this point has been a marathon through hell, and I truly believe the best is yet to come.

Just a day before the big Ethereum news broke, I remarked on how I had never seen sentiment this bad during a bull market. Bad sentiment in a bull market is arguably harder to stomach than horrible sentiment in a bear market. Bottoms form at epic times.

There's a lot to discuss, but let's start with the bigger picture. The Ethereum ETF news is fantastic, but its timing, alongside other developments, suggests that something significant is shifting in D.C., particularly among Democrats, the SEC, and the Biden administration.

Let's recount some of the major political moments from the last couple of weeks: The Biden Administration vowed to veto H.J. Res 109 if it reaches his desk (and now it sits there). Donald Trump has declared himself pro-crypto, RFK Jr. has doubled down on his pro-crypto stance, and Congress has passed its first standalone crypto bill. Additionally, 21 House Democrats and 12 Senate Democrats, including Senate Majority Leader Chuck Schumer, broke ranks. We also saw the introduction of the FIT21 and Anti-CBDC Surveillance Act, the firing of the FDIC Chair, and the departure of Klaus Schwab (an anti-crypto figure). Lastly, and most recently, Trump announced his acceptance of crypto donations (more on that below).

While sentiment for Ethereum was in the gutter, so was the perception of the political elites orchestrating Chokepoint 2.0 and those trying to cripple the crypto industry. I've been saying for a while now that I don't think the heat on Gary Gensler has ever been this intense. Gary picked a fight with everyone and managed to infuriate his own party in the process. When your actions threaten the re-election prospects of your overlords, who grant you power in the first place, you know you're in deep trouble.

Given all of this context, the ETH ETF approval is a means for Gary to briefly stick his head out of a burning building for a breath and a feeble attempt to win back lost Democrat votes. Make no mistake, Gary Gensler has not suddenly become pro-crypto, nor has the Biden administration or the anti-crypto Warren camp. These individuals are still adversaries until A) they're out of office and behind bars OR B) they publicly change their stance and back it up with their actions.

What’s ironic about the Ethereum ETF approval is that had select Democrats not pushed so hard against crypto, they wouldn't be the ones today forced to make the right decisions (push through an ETH ETF) and approve the bills that are in front of them. Maybe sending Wells Notices, picking fights with major exchanges, preemptively announcing a veto, not being clear about the status of Ethereum, and appeasing the banks wouldn't have led to this outcome in the first place. Out-of-line Democrats handed Republicans crypto served on a golden platter.

Just one month ago, these numbers were separated by a couple of percentage points; now, the gap has never been wider. This is entirely due to crypto.

Seismic shifts are taking place in D.C., making it hard not to be bullish.

With politics out of the way, let’s dive into some of the finer details.

First, I want to discuss the prospect of staking and its implications for the ETF.

Based on current rumors and insider commentary, it seems the SEC is directing issuers to remove staking clauses from their applications. If this is the necessary compromise for approval, so be it, but it won't be like this forever. Reversing this detail may take as long as Coinbase winning in court, so don't expect it to change anytime soon.

There are both advantages and disadvantages to excluding staking from ETF approvals. On the downside, ETF purchasers and issuers will miss out on yield until the decision is reversed, making the product less attractive. However, issuers are likely thinking that eventually, the acquired ETH can be converted into staking contracts once the regulatory landscape changes. Both issuers and investors will eagerly await the day they can cash in on staking.

In other news regarding staking, spot Ethereum holders who stake ETH natively may enjoy rising yields as Ethereum is purchased but not staked via the ETFs—a well-deserved win for native stakers. Furthermore, with about 27% of the supply staked and completely off the market, this limits available liquidity on the open market. When DeFi activity picks up and nearly one-third of the supply is unavailable, the price may have to jump significantly to balance demand.

This leads me to the perfect segue to discuss price. As you can see below, the ETH/BTC pair is only just starting to wake up.

On the news, Ethereum printed its largest daily candle in history. However, I would argue that the approval is not fully priced in until we receive 100% confirmation from the SEC that the Ethereum ETF will eventually trade. As of now, we are not at full certainty. Notably, this move was so significant that Ethereum added the entire market cap of Solana and surpassed Mastercard, becoming the 24th largest asset in the world.

It could take a few weeks or even months before these products actually go live, assuming Ethereum receives the green light.

Other assets benefiting from this include $COIN, which will custody the assets and profit from the increased volatility, as well as platforms like Robinhood that will capture heightened trading volumes. Ethereum's surge will also rejuvenate beleaguered Layer 2 solutions and altcoins in dire need of capital rotation. PEPE, for instance, is currently in price discovery as we speak.

The CoinTelegraph intern sparked the first rally this cycle, and Gary Gensler’s approval of the Ethereum ETF will ignite the second rally. It’s a sight to behold.

On another note, approving a spot Ethereum ETF suggests that the anticipated repercussions for companies facing Wells notices may either not materialize or arrive with less impact. Approving the spot ETH ETF is tantamount to declaring that Ethereum is not a security, though it doesn’t address staking, which remains one of the last significant overhangs for Ethereum.

The temporarily bearish case for Ethereum is that it will likely face the same Grayscale outflows Bitcoin experienced when ETFs first went live—a rite of passage, if you will. Having gone through this once, the market knows what to expect, and there will likely be less panic when the outflows begin, which should temper negative sentiment. However, the outflows will come and potentially depress or overshadow inflows, which will also happen for Solana if that day ever comes.

Speaking of Grayscale, the ETHE discount has been halved to -11% and will likely be tighter by the time you read this.

As I conclude, it’s worth mentioning the Bloomberg Bros, Erich Balchunas and James Seyffart, for there are a couple of key takeaways. These men deserve credit for consistently presenting the facts and promptly adjusting their percentages when new concrete evidence emerged. However, they failed to account for the 'what if' scenarios and didn't leave the door open. On the flip side, Ethereum maximalists who claimed the spot ETF was 100% certain to happen this week were speaking prematurely.

I will continue to look to these two for their insights because they are knowledgeable, and I will also continue to draw from others who offer varying perspectives. The moral of the story is that everyone is fallible, anything can happen in crypto, and it’s always wise to consider multiple sources.

A seismic shift is occurring, one that overshadows even the news of the Ethereum ETF approval. While it’s still early to fully understand the developments behind the scenes, I suspect the Ethereum ETF approval is just a glimpse. If both political parties turn pro-crypto, it would be the most bullish development the industry has ever seen. The second half of this cycle could be monumental if regulations truly turn in our favor. In that case, we might need to adjust the goalposts to account for just how bullish this is.

There’s never been a better time in history to own crypto, but the fight is still far from over. Our voices aren’t just being heard; they are moving the needle in our favor. I can’t wait to see what unfolds in the coming months; it’s truly going to be extraordinary.

Bitcoin Thoughts And Analysis

Bitcoin looks solid, trading in the top half of the range. Do not be surprised if we retest the range EQ as support, the dashed middle line around $67,000. That would be relatively normal now that we are in the top half.

Once again, this last move is exciting, but we are still in a range until we make new highs. For now, the safest approach is playing in the top half of the range.

All eyes are really on ETH at the moment.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

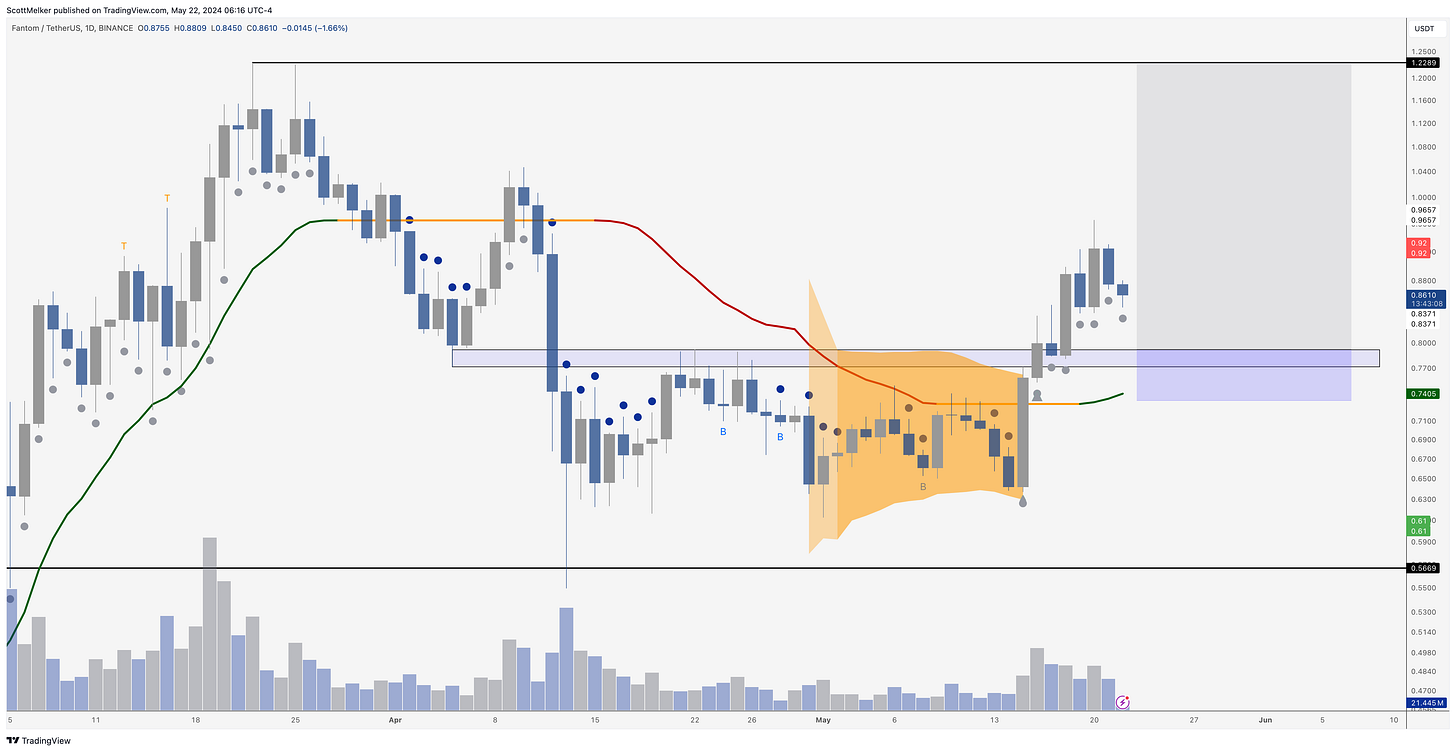

Trading Alpha is giving bullish signals across the board on many altcoins and FTM is one of my favorites. We have grey dots after a grey tear drop and grey arrow and a squeeze shade. Very, very clear. Now we are trading above support with the trackline turning green and curling up.

My target is $1.22, the highs.

If it comes, a dip to test support around .80 could be a solid entry with great risk reward.

Long position shows on chart.

Legacy Markets

European stocks fell and bond yields rose after UK inflation data showed slower-than-expected easing, raising doubts about when the Bank of England can cut interest rates. The Stoxx 600 and FTSE 100 both declined, while the pound strengthened and UK gilt yields surged.

US equity futures remained steady ahead of Nvidia's earnings report. Nvidia is expected to report a 243% revenue gain, but high expectations could impact stock performance. Other notable market movements included Lululemon and Tesla shares dropping in premarket trading.

Inflation concerns persist globally, with the Reserve Bank of New Zealand maintaining tight policy and Federal Reserve officials emphasizing the need for more data before cutting rates. Commodity prices, including gold, silver, and copper, eased after hitting record highs, but the overall spot commodity index remains near a 16-month peak.

Traders have reduced expectations for Fed rate cuts in 2024, now anticipating around 40 basis points of cuts, down from 50 basis points last week. The minutes from the last Fed policy meeting, due later Wednesday, may provide further insights.

Key events this week:

US existing home sales, Wednesday

Fed minutes, Wednesday

Nvidia earnings, Wednesday

Eurozone S&P Global services and manufacturing PMIs, consumer confidence, Thursday

G-7 finance meeting, May 23-25

US new home sales, initial jobless claims, Thursday

Fed’s Raphael Bostic speaks, Thursday

US durable goods, consumer sentiment, Friday

Fed’s Christopher Waller speaks, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.4% as of 10:18 a.m. London time

S&P 500 futures fell 0.1%

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index fell 0.2%

The MSCI Emerging Markets Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0844

The Japanese yen fell 0.2% to 156.48 per dollar

The offshore yuan was little changed at 7.2486 per dollar

The British pound rose 0.1% to $1.2722

Cryptocurrencies

Bitcoin rose 0.4% to $69,968.91

Ether was little changed at $3,748.2

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.44%

Germany’s 10-year yield advanced three basis points to 2.53%

Britain’s 10-year yield advanced nine basis points to 4.22%

Commodities

Brent crude fell 1.3% to $81.77 a barrel

Spot gold fell 0.2% to $2,416.91 an ounce

Coinbase To Offer Gold And Oil Trading

It seems that everyone missed this, including me. “After launching Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Dogecoin futures, we have noticed increasing demand for retail-focused products on an accessible and regulated exchange. Therefore, we are thrilled to extend these benefits to gold and oil futures and provide investors with cross-hedging opportunities across asset classes.”

The story continues: “The new contracts, sized at 10 barrels of oil and 1 troy ounce of gold, aim to offer enhanced trading opportunities in traditional markets. Like our crypto futures, these contracts empower traders to capitalize on price movements and hedge their existing holdings, catering to seasoned investors and retail enthusiasts.”

This could be the initial phase of Coinbase paving the way for the tokenization of real-world assets on its platform, once the right parameters are in place. We already know that BlackRock is working on this and has a close relationship with Coinbase. Just imagine the possibilities of trading tokenized oil and gold on-chain.

The ETF Flippening Happened… Briefly

This would have been one of the bigger stories this week, but frankly, there isn’t much focus on Bitcoin ETF flows at the moment, which is a welcome change. BlackRock briefly outpaced Grayscale in spot BTC AUM, taking the lead with just under $18 billion. However, Grayscale quickly regained the top spot as it recorded more inflows than BlackRock. With Grayscale's outflows appearing to have stopped, it's unclear who will ultimately come out ahead in this race. Competition is healthy, though, and it will be interesting to see how this plays out.

Donald Trump Is Now Accepting Crypto

Donald Trump just became the first major party presidential nominee to accept donations in crypto. The following was included in the official compaign statment, “Biden surrogate Elizabeth Warren said in an attack on cryptocurrency that she was building an "anti-crypto army" to restrict Americans’ right to make their own financial choices. MAGA supporters, now with a new cryptocurrency option, will build a crypto army moving the campaign to victory on November 5th!”

“Demonstrating President Trump’s success as a champion of American freedom and innovation, we proudly offer you a chance to contribute to the campaign with cryptocurrency. Saving our nation from Biden’s failures requires your support. As Biden piles regulations and red tape on all of us, President Trump stands ready to embrace new technologies that will Make America Great Again.”

On the same day as Trump went live asking for crypto donations, Biden sent this text:

“Folks, this couldn’t be any more serious. Cryptocurrency executives and oil barons are coming out of the woodwork for Trump. They’re rushing $800,000 checks at glitzy events. Now, Trump is outraising us. He raked in $76 million total in April — over $50 million of it coming from a single gala in Palm Beach.”

Tldr: One candidate is actively seeking donations from crypto supporters, while the other is complaining and criticizing the industry.

DOP’s Mainnet Is Almost Live

“DOP’s mainnet is almost live — and with it we will launch an exciting campaign designed to encourage our community to use the protocol to its full potential.

A staggering 545,000 users were eligible for rewards after completing tasks during our testnet phase, and we’re expecting even more enthusiasm for the mainnet reward campaign.”

Periodically, I've been sharing exciting updates about DOP, or Data Ownership Protocol, which, true to its name, is revolutionizing data ownership standards in blockchain technology. They are a partner of Crypto Town Hall, my X Spaces show.

There's a lot happening with DOP, too much to cover here, but the key points are: the completion of the DOP protocol security audit, the decision by Bitcoin.com to utilize DOP, and several unfolding partnerships including Chain Analysis and Zk.me. DOP is one of the reasons this newsletter remains free. If you have a moment, check them out.

Keep an eye out for the mainnet going live very soon!

Crypto Skyrockets: Will The Ethereum ETF Be Approved?

Ethereum, Bitcoin, and the broader crypto market are surging on rumors that an Ethereum ETF might be approved tomorrow. What are the chances of this happening, and what could it lead to? I'm joined by Matt Hougan, CIO at BitwiseInvest, to discuss this and more.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code 'TENOFFSALE' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.