Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public offers customers a highly liquid alternative asset, and one that doesn’t require extraordinary amounts of capital to access. Historically alternative assets are illiquid and behind Wall Street walls that are intentionally high. We’ve broken down those walls. 138.8% annual returns, and daily liquidity. Join Arch Public!

Tillman Holoway - Arch Public CEO

Andrew Parish - Arch Public Co-Founder

In This Issue:

Coinbase Throws ETH A Life Preserver

Bitcoin Thoughts And Analysis

Legacy Markets

Ethereum ETF Decision Dates

Transparency Matters

FIT21

Decentralize Everything: The Crypto Takeover of Social Media | James Heckman & Eyal Hertzog

Coinbase Throws ETH A Life Preserver

I’ll skip the hyperbole and stage setting.

Sentiment has never been this bad for Ethereum in a bull market, ever.

Just look at how concerning this chart is. It's the stuff of nightmares.

The last time ETH/BTC was this low was in April 2021, over three years ago—an eternity in the crypto world.

There's no chance the current freshman class of crypto investors knows what the 'flippening' originally meant. Even typing that word feels like I'm writing in a dead language.

In response to this phenomenon, Coinbase saw Ethereum struggling and threw it a lifeline in the form of a bullish report from Coinbase Institutional. This report—“Expectations on Ethereum”—is hands down the best defense of Ethereum I have ever seen. It's rare for commentary to move the market these days, but this one did. The price showed signs of life, and the ETH ETF approval odds on Polymarket doubled.

Without further ado, let’s get to it. My plan here is to share every notable quote and summarize the main points when needed. Spoilers incoming.

The Overview:

Addressing the Counter Narratives:

The Coinbase report starts with discussing three separate counter narratives affecting Ethereum today: the spot ETF, alternative layer 1s, and layer 2 cannibalization. I could easily come up with five more, but I'll stick with what Coinbase provides.

The Ethereum Spot ETF—At first glance, it didn’t make sense that Ethereum vying for a spot ETF could possibly be labeled a ‘counter narrative,’ but from the angle of regulatory scrutiny and uncertainty, I see where Coinbase is going.

“The potential approval of a spot ETH ETF removes this impediment for ETH, opening up ETH to the same capital pools that only BTC currently enjoys. In our view, this is perhaps the largest near term overhang for ETH, especially given the current challenging regulatory environment.”

“While there is uncertainty around a timely approval given the SEC’s apparent silence with issuers, we think that the existence of a US spot ETH ETF remains a question of when, not if.”

“As there is yet to be clear regulatory guidance on the treatment of asset staking, we think that spot ETH ETFs enabling staking are unlikely to be approved in the near term.”

“We think there is room for surprise to the upside on this decision. Polymarket is pricing in odds of a May 31, 2024 approval at 16%, and the Grayscale Ethereum Trust (ETHE) is trading at a 24% discount to net asset value (NAV). We believe the odds of approval are closer to 30-40%.”

“Even if the first deadline on May 23, 2024 encounters a rejection, we think there is a high likelihood that litigation could reverse that decision.”

Challenges by Alternative L1s—Solana is the obvious threat to Ethereum, it’s not a secret. Solana’s growth has been nothing short of explosive, but does that mean Solana is going to displace or replace Ethereum? Coinbase isn’t convinced.

“We think that extrapolating incentivized activity metrics as a confirmation of success is premature.”

“The proportion of trading activities on the leading Ethereum L2s of Arbitrum, Optimism, and Base now constitute 17% of total DEX volume (in addition to Ethereum’s 33%). This may offer a more appropriate comparison for ETH demand drivers to alternative L1 solutions since ETH is used as the native gas token on all three L2s.”

“Large capital holders are often indifferent to Ethereum’s higher transaction costs (as a proportion of size), and have a preference for mitigating risks by reducing liquidity downtime and minimizing bridging trust assumptions.”

L2 Cannibalization—The proliferation of Layer 2s has resulted in lower fee burns and higher annualized inflation rates. While the growth of Layer 2s is intended to be beneficial, it has shifted supply issuance from deflation to inflation since the merge. Is this necessarily bad? Coinbase argues no.

“The entirety of ETH issuance is accrued to stakers, the collective balance of whom has far outpaced the cumulative ETH issuance since the Merge.”

“In fact, staking has acted as a sink for ETH liquidity – the growth in staked ETH is greater than the rate of ETH issuance (even excluding burns) by a factor of 20.”

“We firmly believe that the growth of L2s are positive not only for the Ethereum ecosystem, but also for ETH the asset.”

Ethereum’s Edge:

Beyond the metrics, Ethereum has several positive narratives that are difficult to quantify but hold significant long-term value, even if they don't immediately impact the price. I'll cover these in the next few sections at a quicker pace.

Pristine Collateral and Unit of Account

Bitcoin is often praised as ‘hard money,’ a ‘store of value,’ and ‘digital gold.’ However, Ethereum shares many of these properties but isn't given the same credit. Coinbase argues that Ethereum is “the money of DeFi,” directly benefiting from all forms of growth across its ecosystem, including Layer 2 expansion.

Continued Innovation Amidst Decentralization

“Although many alternative L1s have seemingly been able to develop far more rapidly, their single clients make them more brittle and centralized. The path to decentralization inevitably leads to certain levels of ossification, and it is unclear whether other ecosystems will have the capacity to create a similarly effective development process if and when they begin that process.”

Rapid L2 Innovation

“We believe that innovation around execution environments and developer tooling actually outpaces that of its competitors.”

EVM Proliferation

“The innovation around new execution environments does not mean that Solidity and the EVM will be obsolete in the near future. On the contrary, the EVM has widely proliferated to other chains.”

Tokenization and Lindy Effects

“The push for tokenization projects and increasing regulatory global clarity in the space are also likely to benefit Ethereum foremost (among public blockchains) in our view.”

“We believe that modestly higher transaction fees (dollars instead of cents) and longer confirmation times (seconds instead of milliseconds) are secondary concerns for many large tokenization projects.”

Tokenization is happening on Ethereum.

An Evolving Trading Regime:

“We believe this trading behavior is reflective of the market’s relative valuation of ETH as both a store-of-value token and as a technological utility token.”

Coinbase argues that Bitcoin is less volatile in a pure crypto portfolio but is seen as a diversification asset in traditional portfolios. This shift in BTC's utility affects its trading patterns compared to ETH. If spot US ETH ETFs are introduced, ETH could experience a similar shift and realignment in trading patterns.

Conclusion:

I’ll let the conclusion speak for itself.

“We think that ETH may yet have the potential to surprise to the upside in the coming months. ETH does not appear to have major sources of supply side overhangs such as token unlocks or miner sell pressure. To the contrary, both staking and Layer 2 growth have proven to be meaningful and growing sinks of ETH liquidity. ETH’s position as the center of DeFi is also unlikely to be displaced in our view due to the widespread adoption of the EVM and its Layer 2 innovations.”

“That said, the importance of potential spot US ETH ETFs cannot be understated. We think the market may be underestimating the timing and odds of a potential approval, which leaves room for surprises to the upside. In the interim, we believe the structural demand drivers for ETH, as well as the technological innovations within its ecosystem, will enable it to continue straddling multiple narratives.”

In late 2022 and most of 2023, Solana was the most hated crypto in the space, but look at what happened. While I can't predict the future or where prices will go, history shows that widespread hatred can lead to epic non-consensus price rallies.

Quality tokens, like Ethereum, don’t fade into oblivion. Unlike many assets that have ended up in the crypto graveyard from previous cycles, Ethereum remains robust for all the reasons Coinbase listed and more.

I won't claim Ethereum will be the fastest horse this cycle, but it will be a strong contender, regardless of what Twitter says. Bitcoin rallied before the spot ETF was approved, and as we get closer to that reality, Ethereum will likely follow suit. If the ETF is approved this week, expect a MASSIVE move. Don’t get your hopes up, but it will come at some point or another.

Let's have a great week. Wolf out.

Bitcoin Thoughts And Analysis

Trading Alpha is showing a strong renewed daily bullish trend, with 6 candles in a row showing grey dots after the trigger arrow near the lows and the yellow squeeze shading.

As expected, price continues to struggle at the trading range EQ (equilibrium, center dashed line). This is the key resistance at the moment. Bulls want to see this broken and to see price trading in the top half of the range, which would potentially send price back to the highs.

For now, we are still chopping, but there are signs that things could improve. Eyes on the dashed line for now.

Legacy Markets

Asian stocks rose, continuing a seven-day winning streak, following gains in the U.S. markets and supportive measures from China. The MSCI Asia Pacific Index advanced, while European equities remained near their all-time high, supported by record-high prices for copper and gold. Key mining stocks such as Glencore, Rio Tinto, and KGHM saw gains.

Copper prices hit an all-time high, and gold surpassed its previous record amid concerns over fresh tensions in the Middle East following the death of Iranian President Ebrahim Raisi in a helicopter crash. The commodity rally is raising inflation concerns, potentially impacting recent gains in equity and bond markets. However, strong economic growth, resilient earnings, and hopes for policy easing continue to drive investor sentiment.

The Federal Reserve's anticipated pivot to rate cuts has influenced market trading, with the Dow Jones closing above 40,000 for the first time and U.S. inflation data showing signs of easing. Despite this, some policymakers, including the ECB’s Martins Kazaks, have urged caution regarding rate cuts. Investors will closely monitor upcoming speeches from Fed officials.

Meanwhile, crude oil prices remained steady despite the geopolitical tensions following the Iranian president's death and the ongoing conflict in Gaza.

Some key events this week:

BOE Deputy Governor Ben Broadbent speaks on monetary policy transmission, Monday

Chile GDP, Monday

Reserve Bank of Australia issues minutes of May policy meeting, Tuesday

Canada CPI, Tuesday

Fed Governor Christopher Waller speaks on the US economy and monetary policy, Tuesday

BOE Governor Andrew Bailey delivers a lecture, Tuesday

New Zealand rate decision, Wednesday

Indonesia rate decision, Wednesday

South Africa CPI, Wednesday

UK CPI, Wednesday

FOMC minutes from April 30-May 1 policy meeting, Wednesday

Singapore CPI, GDP, Thursday

South Korea rate decision, Thursday

India S&P Global Manufacturing & Services PMI, Thursday

Eurozone S&P Global Services PMI, S&P Global Manufacturing PMI, consumer confidence, Thursday

US new home sales, initial jobless claims, Thursday

Chile rate decision, Thursday

Japan CPI, Friday

Germany GDP, Friday

Malaysia CPI, Friday

US durable goods, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.1% as of 9:53 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures rose 0.1%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.4%

The MSCI Emerging Markets Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0873

The Japanese yen was little changed at 155.69 per dollar

The offshore yuan was little changed at 7.2398 per dollar

The British pound was unchanged at $1.2701

Cryptocurrencies

Bitcoin rose 0.9% to $66,769.54

Ether rose 0.9% to $3,101.46

Bonds

The yield on 10-year Treasuries was little changed at 4.42%

Germany’s 10-year yield advanced one basis point to 2.53%

Britain’s 10-year yield advanced two basis points to 4.14%

Commodities

Brent crude rose 0.1% to $84.08 a barrel

Spot gold rose 1% to $2,439.20 an ounce

Ethereum ETF Decision Dates

Mark your calendars, maybe even buy a pack of beer (in case you need to drink away your sorrows).

1. VanEck - May 23 (this Thursday)

2. Ark Invest/21Shares - May 24 (this Friday)

3. Hashdex - May 30

4. Franklin Templeton - June 11

5. Grayscale - June 18

6. Invesco/Galaxy Digital - July 7

7. Fidelity - August 3

8. BlackRock - August 7 (the date to watch)

9. Bitwise - December (unknown date)

Transparency Matters

An interesting sequence of events unfolded over the weekend. It began with an innocuous tweet from Vitalik praising Ethereum's ethos of openness. Cobie then responded with a tweet raising concerns about financial alignment and incentives, hinting he might have known something the public didn’t.

Twenty-four hours later, Justin Drake, one of Ethereum’s most important researchers, announced his new advisory role at Eigen Layer, one of Ethereum’s significant recent innovations.

On one hand, this announcement could be celebrated if the intentions are good. However, such deals always come with significant incentives, and Justin Drake’s influence over the Ethereum protocol makes disclosures crucial. It's similar to a former regulator or politician joining the board of a rising company—the public deserves transparency. The same rules should apply to crypto.

You can review Justin Drake’s comprehensive disclosure post HERE. I believe he is genuinely trying to do the right thing and has good intentions. However, the mistake was not addressing this with the public beforehand.fore it was discovered by others. The point below from Justin Drake is at the core of the concerns.

“Some people may ask if EigenLayer is trying to systematically "bribe" or "corrupt" the EF. Nowadays the EF is a large organisation with 300+ people. To my knowledge 3 EFers have a formal relationship with EigenLayer entities: one as an early EigenLabs investor, and two as recent EigenFoundation advisors. EFers are some of the highest integrity people I know and I don't see the 1% of EFers formally involved with EigenLayer compromising their morals.”

FIT21

A broad coalition of cryptocurrency industry leaders signed a letter urging U.S. House lawmakers to support the Financial Innovation and Technology for the 21st Century Act (FIT21). The bill, set for a floor vote this week, aims to help the U.S. compete globally by regulating digital assets and blockchain technology. The Crypto Council for Innovation, including major firms like Coinbase and Kraken, emphasized the legislation's potential to accelerate blockchain growth, enhance financial inclusion, and safeguard national security.

FIT21 designates the CFTC as the primary regulator for digital assets, delineating its responsibilities from those of the SEC. The bill aims to establish consumer protections, such as rules on asset custody and treatment in bankruptcy, to mitigate risks. While the industry has recently seen success in overturning SEC policy through congressional resolution, passing FIT21 would mark a significant step forward in formalizing cryptocurrency regulation in the U.S.

You can view the FIT21 Coalition Support Letter HERE.

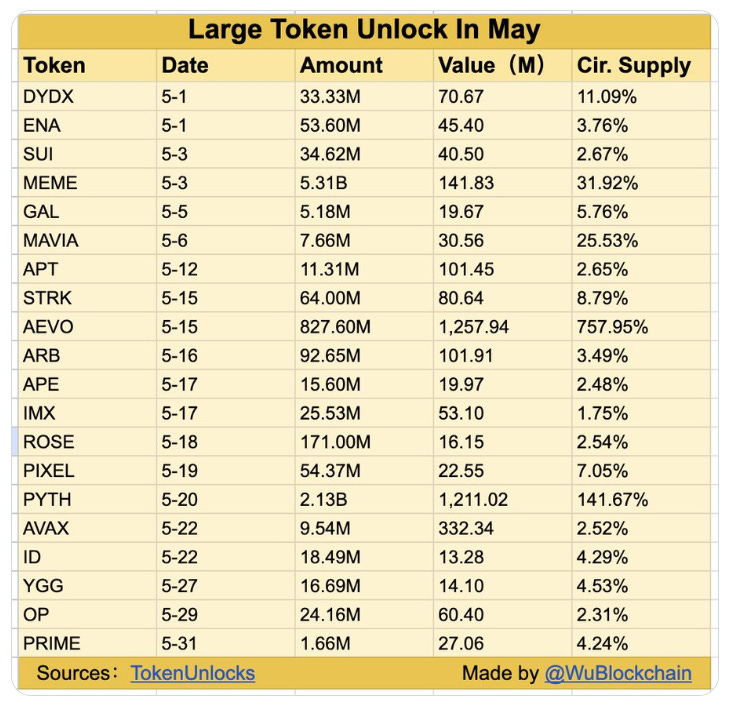

Major Unlocks Are Happening This Month

Your favorite token may have a significant unlock this month, possibly starting today. According to Finbold, over $4 billion in token unlocks are expected from various projects this month, with the largest ones coming from Aevo (AEVO) and Pyth Network (PYTH). Out of the 21 projects expecting unlocks this month, these two account for $2.5 billion. Wu Blockchain, a popular media outlet, provided the image below.

Keeping up with unlocks is exhausting but necessary if you hold positions in altcoins.

Decentralize Everything: The Crypto Takeover of Social Media | James Heckman & Eyal Hertzog

James Heckman, an entrepreneur and media executive with decades of experience, and Eyal Hertzog, co-founder of Bancor and CEO of deWeb, are on a mission to dethrone social media giants with blockchain and give power back to the audience. Learn about the inner workings of social media and how these two plan to disrupt it.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code 'TENOFFSALE' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Just right, man. Thanks.