Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

GameStop

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Wisconsin Buys Bitcoin

An Update On Ethereum ETF Approval

Polymarket Is A Staple

Hype Returns | Will These Tokens Skyrocket?

GameStop

All eyes are on GameStop.

Again.

How can you not be captivated by an asset that skyrocketed from a $3.4 billion market cap to $15.28 billion and counting? The velocity of GME is such that anything I say about the stock will likely be outdated by the time you read this.

We are now the cast of ‘Dumb Money 2.0.’

Let’s briefly rewind. The GameStop saga began with a Reddit-fueled trading frenzy in early 2021. Retail investors, organized on forums like WallStreetBets and led by “Roaring Kitty,” drove the stock price of GameStop (GME) to unprecedented highs, causing massive losses for hedge funds that had shorted the stock. This epic David and Goliath story highlighted the power of retail investors and raised questions about market manipulation and the role of social media in investing. Amid regulatory scrutiny and volatility, GameStop's stock price eventually plummeted, but the saga sparked a broader conversation about the democratization of investing and the dynamics of new participants in the stock market.

Other notable details include Robinhood catching heat for halting trading, regulators rushing to meet in D.C. to conduct investigations, Pete Davidson and Seth Rogen starring in a film that flopped in theaters (I personally enjoyed it), and Dave Portnoy's hilarious antics returning to meme stocks.

During the squeeze, there was a lot of speculation about what GameStop might do given its unique position with the stock’s surge and short window to act. GameStop opted for the conservative route, strengthening its financial position by retiring a significant portion of its high-interest debt and appointing new executives with e-commerce and technology expertise. An interesting detail that went largely unnoticed was that GameStop issued new shares over the following two quarters, increasing the float by approximately 15% to 20% of outstanding shares. I managed to dig up this article about one of the offerings.

Despite these efforts, there were no major changes in the company's business trajectory, which could be viewed as a prudent decision—or not. I have no idea.

This brings us to the present. GameStop once again finds itself seated at the table of opportunity, a seat many companies can only dream of. Let's delve into the possibilities that lay before them.

Initiate a Capital Raise: GameStop could issue new shares at the elevated market price, raising capital for various purposes such as debt reduction, expansion plans, or investing in new initiatives.

Make Debt Payments: Since GameStop has outstanding debt ($0.6 billion), they could use the increased market capitalization to pay off or reduce their debt, improving their financial position and potentially lowering interest expenses.

Improve Financial Flexibility: A higher stock price and market capitalization can improve GameStop's ability to negotiate favorable terms with suppliers, lenders, and other stakeholders, providing them with more financial flexibility.

Execute an Acquisition or Partnership: GameStop could use its increased market value to acquire other companies or enter into strategic partnerships, potentially expanding its business and diversifying its revenue streams.

Increase Employee Incentives: GameStop could use the higher stock price to incentivize employees through stock-based compensation, helping attract and retain talent.

Issue Debt to Buy Bitcoin: GameStop could take a page directly out of the MicroStrategy playbook by issuing convertible senior notes, using the proceeds to buy Bitcoin.

Alright, I'll admit, the last option is a bit of a stretch, especially considering GameStop's cautious approach in the past. But you have to admit, it would be an epic move if they went for it. I’ll continue to pray.

This now brings us to AMC, GameStop's younger but more rambunctious sibling. Despite being smaller in size, AMC wasted no time seizing the opportunity and has already raised $250 million in new equity capital, a deal completed on Monday of this week. During the initial craze in 2021, AMC completed several raises and took a somewhat aggressive approach to enhancing the company with its newfound wealth.

I'd love to be a fly on the wall in those executive and director meetings happening right now. The bickering, the testosterone, the raw passion—for many of these old farts, it’s probably the last time they will ever feel alive again.

I can already sense that crypto OGs are getting annoyed that meme stocks are draining some of our precious liquidity, but I'm finding the show rather entertaining. Crypto is destined to prevail anyway, and it's quite enjoyable to see the little guys stick it to these assholes a second time around. How can you not enjoy this show?

As far as where this all goes legally, I don’t know—that’s not my area. But how can the SEC come after someone referencing Marvel movies, sitcoms, and memes of gamers sitting up in their chairs? They have no grounds to come after Roaring Kitty.

Final thought: It would be truly remarkable to see one of these companies caught in the middle turn to Bitcoin, but I'm not holding my breath. I suspect that at some point, this crowd will pivot to crypto. However, for now, it's meme stonk time. That's just the direction the game has taken. We can either enjoy the spectacle or grumble about it—I'll opt for the former.

Just be careful trading these assets—they’re no different than casino games.

Peace out. GME to the moon! Diamond hands!!

(As always, nothing in this letter constitutes financial advice. I have zero ownership of any meme stocks, will not take a position, and have no serious opinion on them. This is all for entertainment and education only.

Bitcoin Thoughts And Analysis

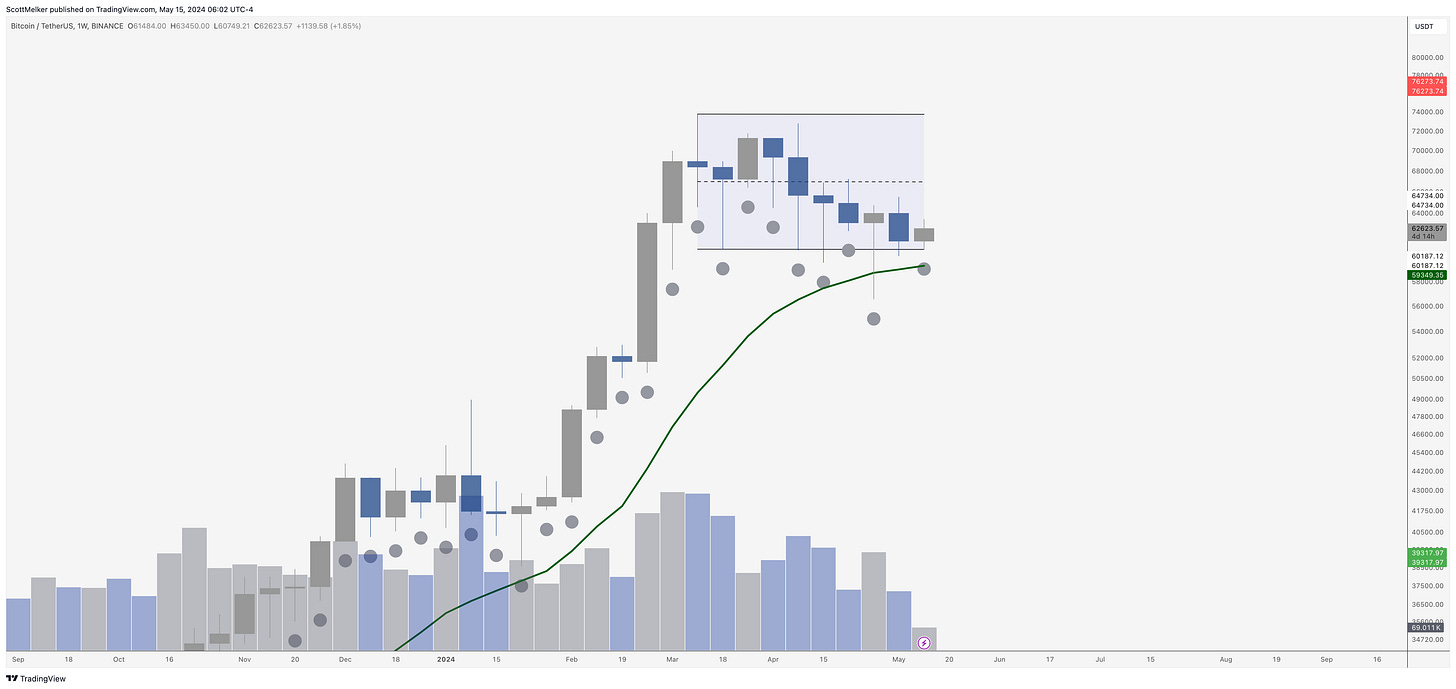

The Bitcoin chart remains perfectly bullish on high time frames, including the weekly. As you can see, Trading Alpha is still showing grey dots and price is trading above a rising green track line.

Bitcoin is choppy and boring, but should just require some patience.

Altcoin Charts

A few coins went up Monday and Bitcoin made it to $63,000, causing people to declare "alt season now" and "correction over," because people are spastic and need engagement and/or hope. Charts looks awful across the board. Most coins are still down 90% from last cycle. We have not had a single whiff of a real altseason. Bitcoin has dominated this cycle, outside of small pumps in select sectors. Memes have gone nuts, but that is generally temporary rotation from coin to coin, so few people benefit.

The real action usually starts 4-6 months AFTER the halving, although history may not repeat. Regardless, now is a good time to step back and chill, not force anything because you think "alt season is today."

Very little is happening.

Bitcoin Dominance is still at near multi year highs, even with thousands of new coins on the market that could impact dominance. This chart is the antithesis of "alt season." Could it be topping? Certainly. But we have very little confirmation that things are changing for now.

Legacy Markets

Global stocks are rallying ahead of key US inflation data, with US futures steady and European shares rising. Treasury yields have dipped, and copper futures in New York hit a record high due to a short squeeze.

The optimism is driven by expectations that the upcoming US inflation report will not undermine the case for Federal Reserve interest-rate cuts. The MSCI All Country World Index continues its longest run of gains since January, and the S&P 500 has advanced despite signals from Jerome Powell that interest rates will remain high for longer.

Treasury yields and the dollar gauge softened before the consumer-inflation data, which is expected to show a slight moderation in price increases. Core CPI is anticipated to slow to 0.3% month-on-month from 0.4%.

Investors are largely expecting a "risk-on" market reaction to the CPI report, with 49% predicting this outcome in a survey by 22V Research.

European stocks saw notable movements with Burberry Group Plc declining due to a slump in sales, ABN Amro Bank NV dropping over 5% on unchanged guidance, and Finnish refiner Neste Oyj falling on a downward revision of sales margins for its renewable products.

In the US, the meme-stock rally continues, with GameStop Corp. and AMC Entertainment Holdings surging for a third consecutive session.

The euro-zone economy grew 0.3% in the first quarter, recovering from a shallow recession, and inflation is expected to slow down quicker than anticipated. The European Central Bank is likely to start easing policy in June.

In commodities, oil prices held gains despite a softer demand growth outlook, and copper futures hit a record high due to a short squeeze. Gold extended its gains, rising almost 1% on Tuesday.

Key events this week:

US CPI, retail sales, business inventories, empire manufacturing, Wednesday

Minneapolis Fed President Neel Kashkari speaks, Wednesday

Japan GDP, industrial production, Thursday

US housing starts, initial jobless claims, industrial production, Thursday

Philadelphia Fed President Patrick Harker speaks, Thursday

Cleveland Fed President Loretta Mester speaks, Thursday

Atlanta Fed President Raphael Bostic speaks, Thursday

China property prices, retail sales, industrial production, Friday

Eurozone CPI, Friday

US Conf. Board leading index, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.3% as of 10:16 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.6%

The MSCI Emerging Markets Index rose 0.5%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.1% to $1.0830

The Japanese yen rose 0.5% to 155.70 per dollar

The offshore yuan rose 0.3% to 7.2180 per dollar

The British pound rose 0.2% to $1.2616

Cryptocurrencies

Bitcoin rose 0.7% to $62,001.01

Ether rose 0.3% to $2,898.38

Bonds

The yield on 10-year Treasuries declined two basis points to 4.42%

Germany’s 10-year yield declined six basis points to 2.48%

Britain’s 10-year yield declined six basis points to 4.12%

Commodities

Brent crude rose 0.5% to $82.82 a barrel

Spot gold rose 0.7% to $2,373.59 an ounce

Wisconsin Buys Bitcoin

If I had to guess which state would be the first to purchase Bitcoin ETFs, Wisconsin wouldn't have been my first choice—but it’s certainly a pleasant surprise. According to a recent 13F filing, the State of Wisconsin Investment Board owns 2,450,400 shares of IBIT and 1,013,000 shares of GBTC, totaling approximately $99.17 million and $63.69 million, respectively, as of the end of March.

Wisconsin boasts the 9th largest state pension fund in the USA, and here's the kicker: these ETF purchases represent just 0.1% of their AUM. Considering the state and local pension funds market size is $6 trillion, this is no small game. Bitcoin will have to climb much higher to absorb even a fraction of this market. The game theory of Bitcoin is undeniably real and unfolding before our eyes.

An Update On Ethereum ETF Approval

More bad news for hopeful Ethereum investors. Scott Johnson noticed in a filing this from the SEC, “Pursuant to section 19(b)(2)(B) of the Act, the Commission is providing notice of grounds for disapproval under consideration.” Also, this, “Given the nature of the underlying assets held by the trust, has the exchange properly filed its proposal to list and trade the shares under Nasdaq Rule 5711(d), Commodity Based Trust Shares?”

According to Eric Balchunas, that was legal jargon for, “TLDR: the SEC asked commenters re the Eth spot ETFs whether these filers have properly filed their ETF listing proposals as commodities. This shows the SEC is perhaps considering to Eth is a security in their denial. Our odds of approval remain the same: slim to none.”

And this comment from James Seyffart, “Looks like odds just went up for SEC to deny Ethereum ETFs by claiming #Ethereum is a security. Not a guarantee that they will do this but i think this almost guarantees that the SEC is at least considering it. (not groundbreaking but first i've seen in public SEC documents).”

Polymarket Is A Staple

While I'm not a huge fan of gambling, I am a fan of Polymarket. The world's largest prediction market has completed its Series B funding, raising $45 million in the round. Led by Peter Thiel’s Founders Fund, the round also included other notable funds such as 1confirmation, Dragonfly, and ParaFi, as well as Vitalik Buterin. There's a strong possibility that Polymarket will explode in volume this election cycle, which would be beneficial for both crypto and the advancement of transparent prediction markets. There are already a plethora of outcomes to bet on in this 2024 election. Built on Polygon, an Ethereum Layer 2 solution, Polymarket represents a win-win for the crypto space.

The following is a statement from Bankless, “Prediction markets have long been heralded as potential sources of truth by people like Vitalik Buterin, aiming to use financial incentives to make people take the most informed stance on an issue, in turn surfacing the most accurate, probable results. Whether or not that vision proves true, Polymarket’s new funding signals strong investor confidence in the market’s growth potential despite regulatory hurdles. It also shows how much of a spectacle the U.S. election will be, given the global demand Polymarket serves and how, in 2020, most betting occurred outside the States due, in part, to regulatory restrictions.”

Hype Returns | Will These Tokens Skyrocket?

Chartapalooza is back! Join me for live charts and price analysis of Bitcoin and Altcoins!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use MY LINK to sign up.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.