Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public offers you a hedge fund in your pocket, and continues to perform well through early May, adding an additional 4.1% last week. The initial $10K portfolio now sits at $11.78K. Arch Public’s Gateway product has produced 138.8% annual returns for the last decade. This advanced AI trading tool gives retail traders access to the same cutting-edge technology and advantages that Wall Street has kept exclusive for decades. Oh yeah, it’s tax advantaged as well. One of the trades it took is below.

Algorithmic trading has never been this easy.

In This Issue:

Ten Days Remain

Bitcoin Thoughts And Analysis

Legacy Markets

Mark Cuban Speaks Up

Banks Are Buying Bitcoin

Don’t Read This Controversial Article

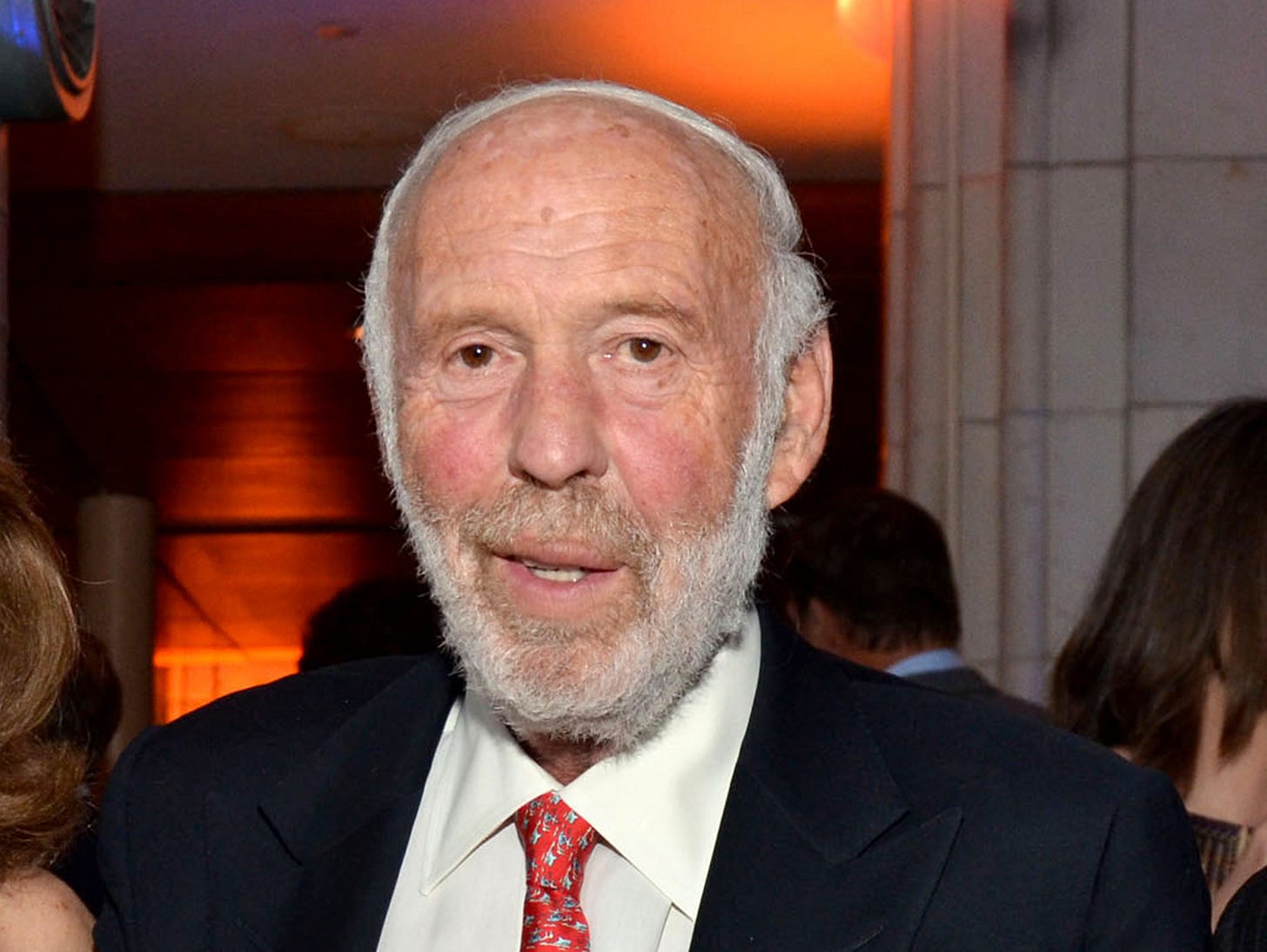

Rest In Peace, Jim Simmons

This Bitcoin Cycle Will Be Massive | Bill Barhydt

Ten Days Remain

The days leading up to the approval of Bitcoin’s ETF were filled with a palpable sense of anticipation, markedly different from the current sentiments as we approach the SEC’s decision deadline for the Ethereum ETF, just ten days away.

Before the Bitcoin ETF was approved, there was an atmosphere of high activity and optimism among issuers. Several had begun advertising their products even before they were live or officially approved, creating a buzz in the market. Coinbase declared, “We have extensively prepared for ETF approval,” signaling readiness and confidence. Invesco added to the positive sentiment by introducing a fee waiver, while Bitwise revealed a significant $200 million seed investment. BlackRock elevated expectations further by appointing major financial players JPMorgan and Jane Street as authorized participants. Media outlets like Reuters and influential figures such as Mike Novogratz shared optimistic insights, with Novogratz tweeting about big developments on the horizon.

The SEC even mistakenly announced an approval prematurely on Twitter—an ironic twist given their advice to trust only official agency statements.

The atmosphere then was charged with anticipation of approval.

Contrast that with today’s climate as the deadline for the Ethereum ETF looms. The environment now seems less certain, with only basic submissions from major issuers, minimal amendments to these applications, and notable omissions such as the removal of staking clauses from the proposals. The current signals do not inspire the same confidence; banking on approval from these modest indicators might be considered overly optimistic by many.

Moreover, the potential legal and reputational repercussions for the SEC if they were to deny the ETF cannot be overlooked. The agency has shown a propensity for procrastination and caution in its decision-making process. This scenario mirrors the circumstances last September, nearly 100 days before the Bitcoin ETF was finally approved, when the prospects of approval appeared dim. BlackRock had set high standards with its application, yet SEC Chairman Gary Gensler preemptively denied ETFs, citing concerns over a potential government shutdown—a decision that was later criticized by the courts as “arbitrary and capricious” following a lawsuit involving the Grayscale Bitcoin ETF.

The current silence from the SEC could be the most telling sign yet, suggesting a possible repeat of the past. Despite Gensler’s growing unpopularity, which now spans both sides of the political aisle, the option of removing him through impeachment remains a severe and unlikely step. Such a process would start in the House and would require a two-thirds majority in the Senate to pass.

While impeachment seems a distant possibility, the dissatisfaction with Gensler, particularly if former President Trump were to return to office, could lead to significant changes within the SEC through the appointment of new commissioners, potentially altering the landscape of decision-making.

Despite these tensions and uncertainties, the resilience of the crypto industry should not be underestimated. It is likely that the industry will navigate through these challenges, possibly securing the approval for the Ethereum ETF through a combination of political maneuvering, legal strategies, or by directly challenging Gensler’s leadership.

The markets hate uncertainty, but clarity is expected within the next ten days as the SEC makes its decision known. Regardless of the outcome, the history of the crypto sector shows its ability to adapt and overcome regulatory challenges. The community should maintain its faith in this resilience, confident that eventually, persistence will lead to success.

Bitcoin Thoughts And Analysis

Bitcoin es muy aburrido. So boring.

As you can see, we did have multiple candles test the range lows successfully as support, a decent sign. That said, price is still trading below the track line on Trading Alpha and we don’t have grey dots. I also noticed that RSI has bounced relatively hard back to 50 without much price appreciation to show for it.

Chop. I see absolutely no reason to deeply analyze this asset right now. We are in the post halving hangover.

Legacy Markets

Stock markets paused on Monday as investors awaited key economic data from the U.S. that could influence interest rate decisions. European stocks remained stable, while U.S. equity futures saw slight increases. The focus is on upcoming U.S. producer price data and inflation figures, which are expected to provide insights into the economic climate and potential stagflation concerns. Meanwhile, optimism is growing in Europe as economic data suggests Germany is moving out of stagnation, with the broader euro-area economy expected to grow more than previously anticipated this year.

In Asia, market reactions were mixed with gains in Hong Kong and mainland China but losses in South Korea, Japan, and Australia, influenced by China's announcement of its first ultra-long debt sale and ongoing U.S.-China trade tensions. Commodities like oil and copper rose, driven by optimism about Chinese economic measures and OPEC+ discussions on extending supply restrictions.

Some key events this week:

Euro-area finance ministers meet in Brussels, Monday

Australia 2024-25 budget, Tuesday

Japan PPI, Tuesday

Germany CPI, ZEW survey expectations, Tuesday

UK jobless claims, unemployment, Tuesday

US PPI, Tuesday

Fed Chair Jerome Powell and ECB Governing Council member Klaas Knot speak, Tuesday

China rate decision, Wednesday

Eurozone industrial production, GDP, Wednesday

US CPI, retail sales, business inventories, empire manufacturing, Wednesday

Australia unemployment, Thursday

Japan GDP, industrial production, Thursday

China property prices, retail sales, industrial production, Friday

Eurozone CPI, Friday

Stocks

The Stoxx Europe 600 was little changed as of 8:24 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.2%

The MSCI Emerging Markets Index rose 0.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0774

The Japanese yen was little changed at 155.81 per dollar

The offshore yuan fell 0.1% to 7.2419 per dollar

The British pound was little changed at $1.2522

Cryptocurrencies

Bitcoin rose 0.7% to $61,703.21

Ether rose 0.2% to $2,928.98

Bonds

The yield on 10-year Treasuries declined one basis point to 4.48%

Germany’s 10-year yield declined two basis points to 2.50%

Britain’s 10-year yield declined three basis points to 4.14%

Commodities

Brent crude was little changed

Spot gold fell 0.4% to $2,350.31 an ounce

Mark Cuban Speaks Up

Despite catching some recent heat from the crypto industry, billionaire investor Mark Cuban has now aligned with the industry in its rally against Gary Gensler, Joe Biden, the SEC, and Congress, unleashing a series of damning Tweets you simply cannot miss. I think many of those watching Cuban’s assault right now may not realize that he has held this view for a long time as he humorously remarked on Twitter, “I've been torturing the SEC for 15 years :)”

“All he has done is make it nearly impossible for legitimate crypto companies to operate, killing who knows how many businesses and ruining who knows how many entrepreneurs.

This is also a warning to Congress. Crypto voters will be heard this election. You could solve this problem for Biden by passing legislation that defines registration that is specific to the crypto industry just as other industries have registration that is defined for them

Or you could do the better option and assign all crypto to be regulated by the @CFTC.”

Mark Cuban wields significant political and financial influence, making his vocalization of our frustrations all the more impactful. Moreover, I don't believe Mark aligns with the Republican Party, so it's refreshing to witness someone outside the mainstream crypto political alignment taking a firm stand for what is right. If there were a chart tracking Gary Gensler's popularity, I'd short it to oblivion given the chance.

Banks Are Buying Bitcoin

JP Morgan’s Jamie Dimon has long been one of crypto’s and Bitcoin’s staunchest critics, famously stating that he would, “shut it down if he were the government,” just this past December. Despite this sentiment, BlackRock named JP Morgan an authorized participant of its ETF, and it is now known that the banking giant has exposure to several spot Bitcoin ETFs worth roughly $760,000. While this amount may be insignificant to the bank, especially considering that Susquehanna International Group holds $1.8 billion in ETFs, it marks a notable beginning rather than an end. James Seyffart made some interesting points regarding the news.

“Just FYI everyone. JPM, Susquehanna (which also owns these ETFs and was all over this site last week) and others are just market makers and/or AP's. Their ownership isn't necessarily indicative of anything other than this is how many shares they had on 3/31/24.

If you're making markets in these things, the number of shares held could swing heavily day to day. The 13F data is simply a snapshot of *LONG* positions held on 3/31

13F's don't show shorts OR derivatives. So we don't even have a full look at their true exposure on 3/31.”

James then suggests that the number of holders for these spot ETF positions is a “far more relevant and interesting statistic.” In the same week that the Bitcoin ETFs launched, several other ETFs that debuted that week currently have between 0 to 3 holders. For comparison, IBIT has 250 holders, Fidelity has 136, Bitwise has 60, and ARK has 42. Of course, inflows are the king of metrics, but it’s the number of holders that opens the doors for inflows. In other bank news, Wells Fargo owns GBTC and BITO, equivalent to two Bitcoin worth of shares—minute, but a start, nonetheless.

Don’t Read This Controversial Article

I chose the headline, ‘Don’t Read This Controversial Article’ in the hopes that it would pique your curiosity enough to bring you here. This opinion piece from Blockworks has certainly stirred up a mix of attention and frustration within the crypto community, which is precisely why I felt it was crucial to share. It's important to challenge ourselves with content that spans the spectrum of our emotions and understanding. While I have my views, the focus here is really on what you think.

The crypto community is united in its desire for success come November, yet there's a wide array of opinions on the best path forward. With election season upon us, we're on the brink of many challenging discussions—consider this article a mere introduction to the debates ahead. And remember, as passionate as we might be about crypto, it's essential to maintain the bridges that connect us to friends and family. Dedicating yourself to crypto doesn't require sacrificing other relationships; finding common ground outside our niche can actually be a powerful strategy.

Rest In Peace, Jim Simmons

Jim Simmons, also known as James Harris Simmons or the ‘Quant King,’ was an American mathematician, hedge fund manager, and philanthropist, famously known for disrupting the world of finance with his quantitative ingenuity. Jim founded Renaissance Technologies, a highly successful quantitative hedge fund known for its use of mathematical and statistical models that achieved unheard-of success year-over-year for decades, making Simmons one of the most successful hedge fund managers in history, with a net worth estimated to be in the billions. Beyond his professional success, Simmons was also known for his commitment to philanthropy, supporting causes in education, health, and scientific research—effectively giving it all away. Rest in peace, Jim Simmons.

This Bitcoin Cycle Will Be Massive | Bill Barhydt

In this episode of The Wolf Of All Streets podcast, Bill Barhydt, the founder and CEO of Abra, discusses the evolution of yield over the years, borrowing against crypto, how Bitcoin is becoming the ultimate collateral, and his expectations for a flood of institutional money into the market.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - My new go-to indicator site and trading community. Use my link to sign up and get 25% off. Make sure to use code “25OFF.”

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.