Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

The Public’s Perception Of Bitcoin

Gary Gensler Tells All

House Republicans Have Had Enough Of The SEC

This Major Investment Firm Has Almost $2 Billion In BTC ETFs

South Korea’s ETF Is Making Progress

Bitcoin's Wild Ride: Plunge Before the Surge? | Arbitrum's Breakthrough - What Comes Next?

The Public’s Perception Of Bitcoin

In our bubble, Bitcoin is popular, trustworthy, and seen as a game-changer in the world of finance. Beyond our bubble, opinions vary widely, ranging from mild skepticism to outright disdain among investors and observers.

Our crypto reality is constructed and bifurcated this way because humans naturally gravitate towards individuals who reinforce their biases and, at the very least, share their fundamental values and principles.

Crypto natives tend to think they have a good grip on this bubble because we are adept at identifying individuals who work against us, i.e. Gary Gensler, Elizabeth Warren, Warren Buffett, Peter Schiff, Jamie Dimon, etc. but where we fail is overlooking everyday people who also harbor similar sentiments.

This reality is further distorted by our selective exposure to information, as our perception is shaped by individuals we choose to follow on social media, watch on TV, and listen to in government. Our consumption reinforces our beliefs, while what we choose to ignore fails to challenge them.

When we do consider the 'other side,' it's through our preferred media outlet, which sets up an expectation of a slam-dunk rebuttal, aligning with what we were already anticipating. Our beliefs are rarely genuinely challenged, and our perception of reality is seldom fully illuminated.

These factors combined make it challenging for today's crypto investors to gauge the opinions of the masses. Five or ten years ago, it was a given that we were in the minority. However, now there is credibility to the idea that crypto investors and fiat critics are somewhere between the loud minority and silent majority.

This is why I value the rare opportunity to converse with someone completely removed from our bubble, who doesn’t spend their entire working week + weekends obsessing over this market. Recently, I met a blue-collar craftsman to whom I mentioned my involvement in crypto. He responded, "It's all dark money," and added that he has no interest until he can pay his property and business taxes with it.

Fair point.

To some extent, this gentleman makes a valid argument. He runs a frame shop, supports his family through his craft, and pays his dues with the money he earns. What he fails to realize is that the government is gradually stealing from him each day without his awareness or consent. I chose not to delve into that conversation though.

Returning to the bigger picture, I want to highlight two recent examples of Bitcoin and crypto being discussed in public, for better or worse.

The first instance was the recent Roast of Tom Brady on Netflix. During the roast, crypto was brought up twice, and here’s how it went: (profanity warning ahead)

Kevin Hart: “You’re probably asking yourself ‘Guys, why didn’t we go to the Crypto.com Arena downtown?”

“Well, the reason why we didn’t go there is because we didn’t want to remind Tom’s fans of how much money he owes them. He fucked those people. Tom fucked those people. Fucked them good, didn’t he?”

Nikki Glaser: “Tom also lost $30 million in crypto — how did you fall for that?”

“I mean, even Gronk was like ‘me know that’s not real money.’”

The crowd loved it, and I must admit, the jokes were good. However, it's pretty clear the elites haven't forgotten our f**k-ups from a while ago. Investors have short-term memory, except when they are burned. It takes a long time for the bad taste to go away. Can we blame someone for having hatred if they lost money?

Moving on, what about the next generation? How do they feel about Bitcoin?

During the Ohio State University 2024 Spring Commencement ceremony, a student speaker praised Bitcoin and drew attention to it but was met with a chorus of boos from the audience.

“So, I know this might feel polarizing, but I encourage you to keep an open mind right now. I see Bitcoin as a very misunderstood asset class.” The crowd begins to boo.

“It’s decentralized and finite, which means no government can print more at will. In the early days, the exchanges for bitcoin were prone to hacks and frauds, but the issues have been resolved with the recent launch of the Bitcoin ETFs backed by two of the world's largest asset managers, BlackRock and Fidelity.”

The problem isn’t so much the public having a distorted view of Bitcoin; it's that the public is being robbed in broad daylight, completely unaware. When the masses internalize this, Bitcoin's value becomes plainly obvious without any jokes or speeches needed.

I encourage all of you to listen intently to the world around you, wherever you go. Listen before you speak and seek to truly understand. Not only will this approach pay dividends in terms of investing, but it will also help us unravel the lies the masses have fooled themselves into believing.

The public's affection for Bitcoin or crypto is lacking; if they truly cared, we wouldn’t be the ones forcing this into a political issue this election cycle. Bitcoin and crypto is not a left or right issue, it’s an issue of basic human rights. On the bright side, this indicates that we are still early, but it also signifies that there is still a lot of work to be done.

I have hope, and you should too. Don’t wait for the public to have a positive perception; be the change you want to see and guide others towards it. Last point, make sure to vote with your financial freedom in mind this election cycle, we have the power to sway the vote in the direction that is most suitable for us.

Gary Gensler Tells All

Crypto Twitter was blessed with 6 minutes of 1-on-1 time with Gary Gensler, and, of course, nothing helpful came of the conversation aside from question dodging and political maneuvering. I didn't copy the whole interview, but according to Gary Gensler, he believes crypto grabs as much attention as it does because it is “a small piece of overall markets, but it is an outsized piece of the scams, frauds, and problems in the market,” along with “an outsized ratio of journalists and questions to market cap.”

The most striking part of the interview is highlighted below. Gary Gensler suggests that cryptocurrencies should have disclosures akin to companies reporting earnings... what the actual f***, ignores questions about Ethereum, and openly acknowledges his agency's reluctance to offer legal guidance. Regulators and law enforcement are fully empowered to declare whether someone is complying with the law and should do so unequivocally.

Gary Gensler: “The field of crypto assets, without prejudging any one of them, many of those tokens are securities under the law of the land, as interpreted by the Supreme Court. You, the investors, are not getting the required or needed disclosures about those assets. This is earnings season, and everyone is asking about it. Where are the disclosures from these crypto tokens? Similar to the seasoned earnings releases?”

Andrew Sorokin: “Is Ethereum a commodity or a security? And therefore, will there one day be an ETF? This is the fundamental question on the table.”

Gary Gensler: “You are the one asking questions. To me, the fundamental question is how do we ensure the American investor is protected. Right now, they are not getting the required or needed disclosure, and the intermediaries in this centralized market are conflicted and are doing things we would never allow NYSE to do. The NYSE is not allowed to trade against the investors.”

Andrew Sorokin: “Court filings show there was an intentional attempt to mislead the status of Ethereum.”

Gary Gensler: “We don't speak about whether we have an investigation or whether we don't have an investigation. We don't speak about whether or not somebody, in our opinion, is following the law unless we have a case. We stay quiet on many questions you might ask at this live interview and a congressional hearing.”

House Republicans Have Had Enough Of The SEC

The House of Representatives is voting today on Rep. Mike Flood’s (R-Nebraska) joint resolution to express congressional disapproval of Staff Accounting Bulletin (SAB) 121, which represents a harmful change in crypto policy.

SAB 121 outlines unique technological, legal, and regulatory risks associated with crypto custodians, leading to the reluctance of banks and broker-dealers to safeguard crypto assets like other financial assets, despite the SEC's approval of Bitcoin spot ETFs four months ago.

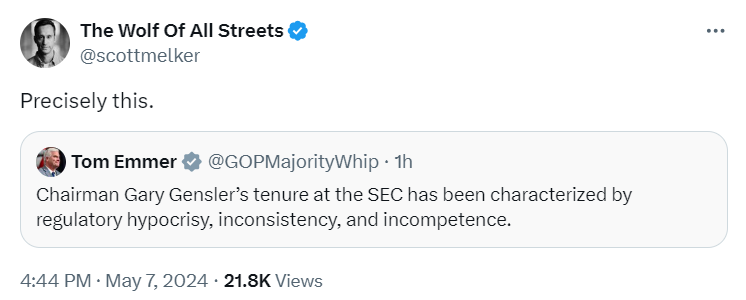

If the resolution passes, it won't be binding but will reflect Congress's collective sentiment and could lead to actual legislation. Tom Emmer argued that “The SAB 121 introduces more unnecessary and avoidable concentration risk into the digital asset ecosystem, making our markets less fair, less orderly, and less efficient.”

As stated above, the law won’t be changed, but a passage will send a strong warning to Gary Gensler and help get everyone onto the same page. Hopefully, Gensler is recognized as a liability to the point that whoever is elected president removes or threatens to remove him to bring him back in line. Distrust towards Gensler has grown significantly over the years, so hopefully, there will be some substantial developments this election cycle.

This Major Investment Firm Has Almost $2 Billion In BTC ETFs

Numerous filings reveal recent purchases of Bitcoin ETFs, with one standout being Susquehanna International Group, LLP (SIG), holding over $1.8 billion in Bitcoin ETFs and Bitcoin and Ether ETFs. Of this amount, over $1 billion is invested in Grayscale's GBTC product, totaling $1,091,029,663. The rest of the funds are spread across various issuers and products, including Bitwise's and Valkyrie's combined Bitcoin and Ether ETFs. This is by far the largest filing I have seen to date.

In other ETF news, Grayscale has withdrawn their 19b-4 filing for an Ethereum futures ETF without providing a reason. It is unknown if this decision followed a private discussion with the SEC or if Grayscale believed approval wasn't forthcoming. However, it is notable that Grayscale did not choose to compel the SEC to comment at the end of the approval period. The withdrawal raises questions about the possibility of a spot ETF following suit. This development is confusing, and it remains to be seen whether more information will be revealed or if this withdrawal is ultimately a positive or negative development.

South Korea’s ETF Is Making Progress

Following the successful election of South Korea’s left-wing Democratic Party, steps are now being taken to ensure regulators move forward in approving a spot Bitcoin ETF, as promised before the election. The country’s regulatory body, equivalent to the SEC, the FSC, currently does not allow the issuance or trade of spot bitcoin ETFs. Meaningful progress is not expected until June, but the party has stated its full intentions to keep its promise regarding the spot Bitcoin ETF. They plan to “request an authoritative interpretation of the Bitcoin spot ETF from the financial authorities again after the 22nd National Assembly opens in June.” So far, only a Bitcoin ETF has been discussed.

Bitcoin's Wild Ride: Plunge Before the Surge? | Arbitrum's Breakthrough - What Comes Next?

I am joined by Steven Goldfeder, Co-Founder and CEO at Offchain Labs, the company behind Arbitrum, the leading Ethereum's Layer 2 solution. My friends from The Arch Public, Andrew Parish, and Tillman Holloway, are joining in the second part of the stream to provide an update on the $10K algorithmic portfolio.

Unleash algorithmic trading with The Arch Public.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - My new go-to indicator site and trading community. Use my link to sign up and get 25% off. Make sure to use code “25OFF”

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Schiff can attack bitcoin all he wants but just about everything he says weighs in favor of bitcoin until he gets to the Gronk punchline. Gold bugs’ preaching is good for bitcoin whether they like it or not. Otherwise there wouldn’t be so many bitcoiners who were gold bugs pre-bitcoin.