Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

This Newsletter Is Sponsored By DevvE!

DevvE represents the embodiment of all of the promises made by blockchain technology over the past 10 years. Unlike other Layer 1 cryptocurrencies DevvE is truly capable of delivering business enablement and value creation at scale and in ways that make sense for any business. Our infrastructure is market leading, uniquely suited to widespread adoption and directly addresses compliance and cost.

To put this in perspective DevvE is not only capable but fully intends to be the world’s token for creating, owning, and transferring value. DevvE will be a payment mechanism for buying and selling assets, an exchange mechanism for exchanging assets, and a verification mechanism for creating assets.

Be sure to check if DevvE is compliant in your jurisdiction and as always, this is not financial advice.

In This Issue:

Rich Vs. Wealthy

Bitcoin Thoughts And Analysis

Legacy Markets

Hashrate Explained

The Morgan Stanley Rumors Are Growing

Grayscale Launches A Staking Fund

The Good In Memecoins

Tron: Cheaper, Faster, and Leading Crypto Adoption | A Quiet Revolution with Justin Sun

Rich Vs. Wealthy

The words “rich” and “wealthy” are used interchangeably, but have vastly different meanings.

The Oxford Dictionary disagrees with my assessment. Rich can be defined as, “having a great deal of money or assets; wealthy.” Wealthy can be defined as, “having a great deal of money, resources, or assets; rich.”

Circular logic.

Investment gurus and self-help experts fail to offer much more clarity. This quote is a good example:

“The real measure of our wealth is how much we’d be worth if we lost all our money” - John Henry Jowett

This quote might be good to print out, frame and give to your favorite Aunt as a birthday gift, but it doesn’t help much in an investing newsletter.

So what’s the difference?

Let’s talk about what it means to be rich.

The starting point is location. Rich in Phuket, Thailand looks very different from rich in Manhattan. On paper, rich means that you have a high income relative to your expenses, have some assets to show for your efforts, and live a lifestyle that allows for exorbitant spending. Rich is unpredictably volatile and can come and go over time. The rich often make a fortune, only to see it disappear. Think MC Hammer, Michael Jackson and Nick Cage. They made it big just to give it all back.

Lottery winners are generally rich, not wealthy.

Wealth is not location-dependent. Being wealthy has less to do with money and more to do with abundance and opportunity. A wealthy person has an abundance of free time with their family, an abundance of knowledge beyond their area of expertise and an abundance of assets that are either 100% owned or financed on intelligently assumed debt. It’s this abundance that allows someone of wealth to pass along what they own and leave a legacy after they are gone. Think Bill and Melinda Gates, Lebron James, the Rockefellers, and Henry Ford.

A wealthy person is no longer under pressure to make perfect financial decisions. They can happily choose to buy their dream home with little concern for a “better investment” that they could have made with the money. The wealthy know how to balance their desires and their needs.

Someone who is rich is often over-leveraged. They buy their dream home, but take on tremendous debt and risk to do so. They own a lot of things, but can lose it all on the drop of a hat.

Rich is about the individual. Wealth is about future generations.

To tie this into crypto, with a few exceptions, choosing altcoins is choosing to be rich, while choosing Bitcoin is choosing wealth.

Yes, these are generalizations, but you get the point.

Acquiring money only to see it lost is a classic example of being rich. Understanding the balance, the importance and power of saving and investing and retaining your wealth to pass on is a hallmark of the wealthy.

Which would you rather be?

Bitcoin Thoughts And Analysis

Bitcoin managed to close above the monthly candle above the previous all time high of $69,000. This was the final meaningful time frame to accomplish this feat. While we are seeing a dip today to test that level as support again, it is still quite encouraging to officially be in price discovery on the monthly chart.

We remain in a bull market, where dips are for buying. There’s not much else to see here.

Legacy Markets

U.S. stock futures rose and gold reached an all-time high, fueled by expectations of a Federal Reserve rate cut following recent data showing a slowdown in inflation. S&P 500 futures increased by 0.4%, with significant pre-market gains in tech stocks like Nvidia, AMD, and Microsoft, while gold prices surged to over $2,265 per ounce. This optimism is based on a deceleration in the core personal consumption expenditures price index and a rebound in household spending, suggesting the bullish market trend might continue. Despite these positive indicators, Fed Chair Jerome Powell emphasized that the central bank is not in a hurry to cut interest rates, prioritizing further evidence of inflation containment. In Asia, Chinese stocks rallied, led by a 1.6% rise in the CSI 300 Index, driven by a rebound in manufacturing activity and renewed optimism about China's economic recovery, while Japanese stocks fell due to a slight dip in manufacturers' confidence.

Key events this week:

US construction spending, ISM Manufacturing, Monday

Bank of Canada issues business outlook and survey of consumer expectations, Monday

Eurozone S&P Global Manufacturing PMI, Tuesday

France S&P Global Manufacturing PMI, Tuesday

Germany S&P Global / BME Manufacturing PMI, CPI, Tuesday

India HSBC/S&P Global Manufacturing PMI, Tuesday

Mexico international reserves, Tuesday

South Korea CPI, Tuesday

Spain unemployment, Tuesday

UK S&P Global / CIPS Manufacturing PMI, Tuesday

US factory orders, light vehicle sales, JOLTS job openings, Tuesday

Brazil industrial production, Wednesday

Eurozone CPI, unemployment, Wednesday

Hong Kong retail sales, Wednesday

US ISM Services, Wednesday

Eurozone S&P Global Services PMI, PPI, Thursday

India services PMI, Thursday

US initial jobless claims, trade, Thursday

Eurozone retail sales, Friday

France industrial production, Friday

Germany factory orders, Friday

Hong Kong PMI, Friday

India rate decision, Friday

Japan household spending, Friday

Philippines CPI, Friday

Russia GDP, Friday

Singapore retail sales, Friday

South Korea current account balance, Friday

US unemployment, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.4% as of 5:31 a.m. New York time

Nasdaq 100 futures rose 0.5%

Futures on the Dow Jones Industrial Average rose 0.4%

The MSCI World index fell 0.1%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0787

The British pound was little changed at $1.2620

The Japanese yen was little changed at 151.37 per dollar

Cryptocurrencies

Bitcoin fell 1.9% to $69,492.95

Ether fell 2.4% to $3,545.44

Bonds

The yield on 10-year Treasuries declined one basis point to 4.19%

Germany’s 10-year yield was little changed at 2.30%

Britain’s 10-year yield was little changed at 3.93%

Commodities

West Texas Intermediate crude was little changed

Spot gold rose 1.1% to $2,254.12 an ounce

Hashrate Explained

The Bitcoin halving is about 20 days away and in light of hashrate being at an all-time high, I figured it would be an appropriate time to discuss what hashrate is, why it matters for mining, and what it has to do with the halving.

Hashrate is a measure of the computational power miners are using to secure the Bitcoin network. It represents the number of calculations the network can perform per second. The higher the hashrate, the more secure the network is against attacks.

Just like a faster processor can perform more calculations per second, a higher hashrate means that more calculations can be done to secure the Bitcoin network. It's like having a more powerful engine in a car that can accelerate faster and handle more demanding tasks.

During the halving, which occurs approximately every four years, the reward that miners receive for each block they mine is cut in half. This event is significant because it reduces the rate at which new bitcoins are created, decreasing the supply. As a result, miners need to operate more efficiently to maintain profitability after the halving, which can lead to changes in the hashrate.

Typically, leading up to the halving, miners invest in more powerful hardware to increase their hashrate and compete for the reduced block rewards. After the halving, some less efficient miners may be forced to shut down their operations if they can't mine profitably with the lower block rewards. This can lead to a temporary decrease in hashrate until the network adjusts.

In summary, hashrate is important to Bitcoin mining because it reflects the network's security and miners' competitiveness. The halving affects hashrate by changing the economic incentives for miners, which can lead to fluctuations in the network's computational power.

The Morgan Stanley Rumors Are Growing

The possibility of Morgan Stanley approving Bitcoin ETFs on its platform isn't a brand new idea; the rumor first started circulating at the end of February. It just appears that the rumor is gaining strength, and approval may be getting closer. Supposedly, educational material was sent to all clients explaining Bitcoin, and the image can be seen below (if it is real). However, aside from that evidence, nothing else solid exists, except for mentions from "people familiar with the matter" and "inside sources.” It makes perfect sense for Morgan Stanley to make this move, and I wouldn't be surprised if they did. That being said, I can't find any instances of CEO Ted Pick discussing Bitcoin anywhere on the internet.

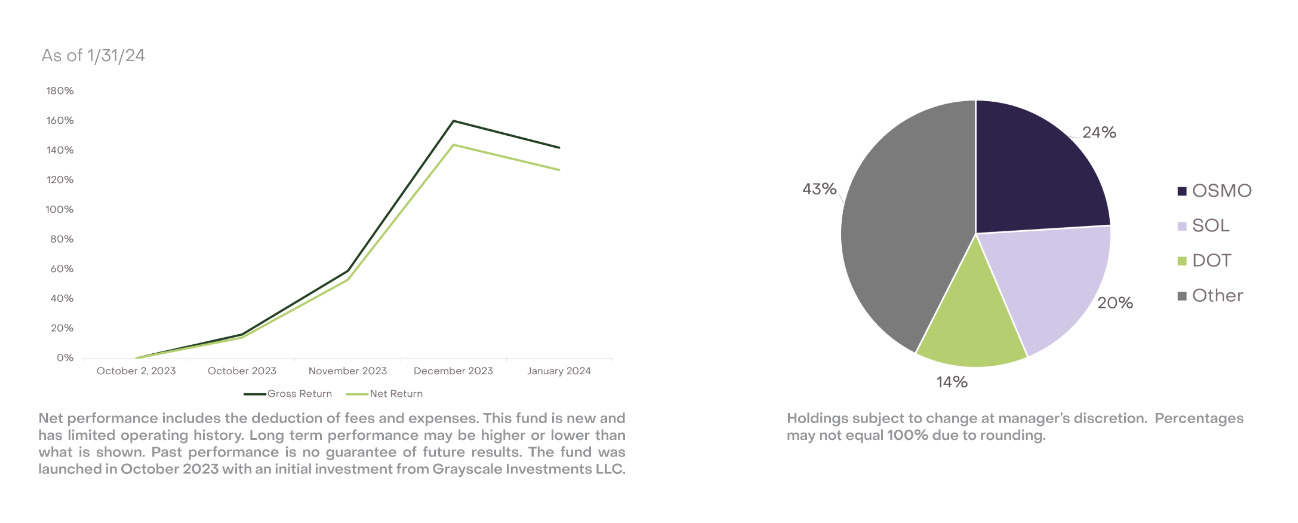

Grayscale Launches A Staking Fund

Grayscale has released a new private fund called the "Grayscale Dynamic Income Fund" (GDIF). This fund is unique as it aims to optimize income through staking rewards associated with proof-of-stake digital assets. GDIF marks Grayscale's first actively managed crypto fund, and it intends to distribute rewards in USD on a quarterly basis. Below is an outline of how the fund operates.

Investors commit capital

Using qualitative and quantitative factors, we invest capital across a portfolio of proof-of-take tokens

We stake tokens to earn rewards (in the form of tokens)

We aim to monetize token rewards into cash weekly

We aim to distribute cash to investors quarterly and rebalance token as needed to optimize income

If you are considering investing in GDIF, it is only available to accredited investors with a net worth of $2.2m or Grayscale customers that have $1.1m under management. My one piece of commentary on this news is that crossing over staking into tradfi is going to take time and it should be expected to start in very inaccessible forms—this is still a solid start.

The Good In Memecoins

I share the frustration many of you feel with memecoins right now. They are a distraction from more significant issues and paint our space in a bad light. However, setting aside the negatives, there is a case to be made for altcoins, as Vitalik points out. If you have a few minutes, I highly recommend this article, but I can also share the highlights (spoilers) below.

“Issuing new coins seems like a third class of large-scale funding technology, and it seems different enough from both markets and institutions that it would succeed and fail in different places - and so it could fill in some important gaps.

People who care about cancer research could hold, accept and trade AntiCancerCoin; people who care about saving the environment would hold and use ClimateCoin, and so forth. The coins that people choose to use would determine what causes get funded.

This time, they are heating up again, but in a way that is making many people feel uneasy, because there isn't anything particularly new and interesting about the memecoins. In fact, often quite the opposite: apparently a bunch of Solana memecoins have recently been openly super-racist. And even the non-racist memecoins often seem to just go up and down in price and contribute nothing of value in their wake.

It feels like there is an unclaimed opportunity here to try to create something more positive-sum and long-lasting. But ultimately, I think even that would create something fundamentally limited, and we can do better.

Charity coins and games could even be combined: one of the features of the game could be a mechanism where players who succeed at some task can participate in voting on which charities the issued funds are distributed to.

I value people's desire to have fun, and I would rather the crypto space somehow swim with this current rather than against it. And so I want to see higher quality fun projects that contribute positively to the ecosystem and the world around them (and not just by "bringing in users") get more mindshare.”

Tron: Cheaper, Faster, and Leading Crypto Adoption | A Quiet Revolution with Justin Sun

Half of the USDT assets under management, roughly $50 billion USDT, are on the Tron network. How did it happen, why Grab, the 'Asian Uber,' is using Tron, and when will Tron expand to the USA? Find out the answers to these questions and more in this episode of the Wolf Of All Streets podcast with Justin Sun, the Founder of Tron.

My Recommended Platforms And Tools

Phemex - Exclusive for new user, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Trading Alpha - My new go-to indicator site and trading community. Use my link to sign up and get 25% off. Make sure to use code “25OFF”

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

ماشالا