Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

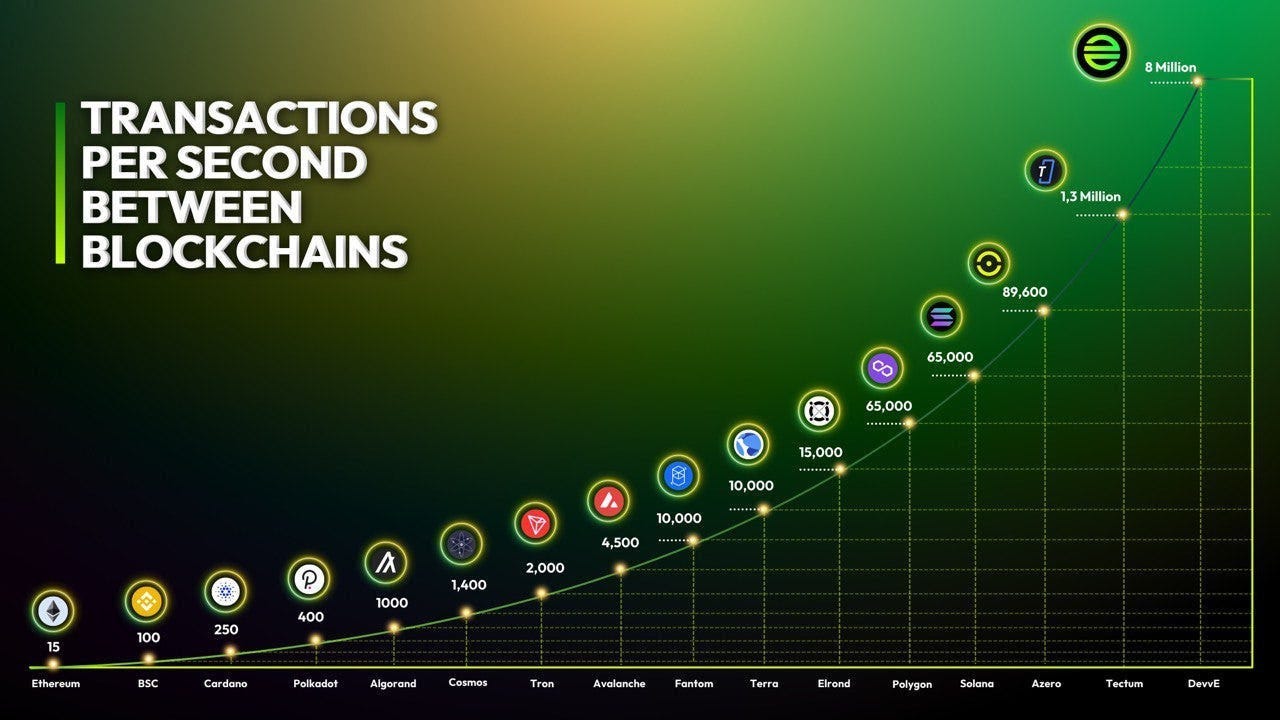

This Newsletter Is Sponsored By DevvE!

DevvE made some cool new changes to their website you should check out.

“DevvE represents the embodiment of all of the promises made by blockchain technology over the past 10 years. Unlike other Layer 1 cryptocurrencies DevvE is truly capable of delivering business enablement and value creation at scale and in ways that make sense for any business.”

“Our infrastructure is market leading, uniquely suited to widespread adoption and directly addresses compliance and cost. To put this in perspective DevvE is not only capable but fully intends to be the world’s token for creating, owning, and transferring value.”

“DevvE will be a payment mechanism for buying and selling assets, an exchange mechanism for exchanging assets, and a verification mechanism for creating assets.”

Click HERE to learn more about DevvE.

In This Issue:

The Four-Letter Word

Bitcoin Thoughts And Analysis

Legacy Markets

The Halving Is 30 Days Away

Solana’s Meme Madness

Standard Chartered Ups The Ante

Taxes Done Easy

Solana Skyrockets, Gold Rallies. Why Is Bitcoin Down? | Macro Monday

The Four-Letter Word

Unless you've amassed a large bag of Solana or struck it rich with a meme coin, chances are you're experiencing some level of frustration or FOMO right now. Rest assured, you're not alone in these feelings.

On paper, this is what I mean:

“My superior investment is under performing.”

“Why is nobody paying attention to fundamentals.”

“Meme coins are taking away from what matters.”

“I thought I had a winning strategy, but the market keeps surprising me.”

“I wish I had invested more in Solana when I had the chance.”

“It's hard to stay patient when others seem to be making easy gains.”

“I feel like I'm missing out on opportunities, but I don't want to make impulsive decisions.”

Here’s the cold hard truth on frustration and FOMO: making good decisions is the name of the game in crypto, which is very difficult when you are experiencing these two emotions. To make sound decisions you must understand that you can’t capitalize on all of the opportunities. You won’t always know the right time to buy or sell. Even the best investors or traders in the world don’t expect that to happen. Hindsight is easy, but foresight is incredibly hard.

How many investors, speculators, or traders have experienced intense FOMO or frustration, given in to these emotions, and ultimately succeeded in the long run? If I am being generous, maybe 5%, while the remaining 95% suffered losses. In Homer's “The Odyssey,” Odysseus instructed his men to tie him down and plug their ears with beeswax just to safely sail past the Sirens, avoiding the temptation of their captivating songs. I can’t think of a better allegory for what’s happening right now.

Odysseus would have been a great investor.

This isn't to say that those who are successful in this environment should stop playing the game. Rather, this is a warning to everyone else who hasn’t partaken to exercise extreme caution. Answer this honestly: if trading this market hasn’t been your strategy up until this point, do you think now is the ideal time to start? Probably not.

What many of you don’t realize, however, is how often emotions are actually driving your decisions. Getting clearer on what FOMO is really about is a simple way of identifying the hidden emotions affecting you. In this way, FOMO provides an interesting opportunity.

What is FOMO really about? Some of you are genuinely worried that you will miss out on the next hot altcoin or a big move in the market. But the real issue is what missing out means to you.

Think about it for yourself. Missing out could feel like losing - and you hate losing. Or maybe missing out would be proof that you’re not perfect when you struggle with perfectionism. Perhaps you’re not happy in your life/job and you saw that one big trade as your ticket to freedom. Or maybe the only reason you are in this game is to make a shit ton of money and FOMO is really just greed compelling you to gamble.

Whatever your reason may be, make a concerted effort to pinpoint it. Doing so can help reveal any faulty patterns in your decision-making process, enabling you to be more aware when you're about to make a poor decision and giving you the opportunity to change course. Now that we've addressed our feelings - I guess I am a group therapist now - let's discuss the current state of the market.

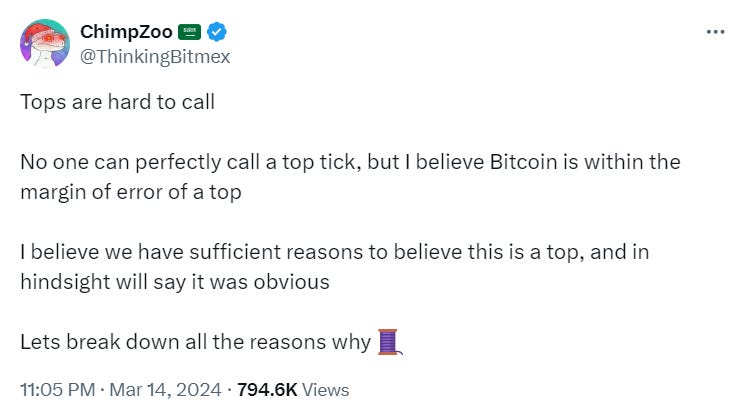

I don’t want to be the person who sounds the alarm and declares that the market top is here. I think we are likely in a “normal” bull market correction, which can easily last months and see price dropping 30% or more from the top. However, I do want to highlight the glaring signs of greed and euphoria that aren’t being taken seriously, which I really started to think about yesterday morning when I was preparing for my YouTube show. The first thing to note about market tops are that they occur when the majority is convinced the top isn’t in. This is also typically when available funds for buying have dried up, and the only option left is to HODL. For reference, I am not talking about a cycle top, rather a temporary one. Not THE top, but potentially A top.

I made the following post on X yesterday. The replies were fairly mixed between agreement and disagreement. What are your thoughts?

Remember, the “normal” 4 year cycle includes a 30% sell off around the halving (which is next month), a boring summer and then “up only” in the fall. We are ahead of schedule.

If you're concerned about spotting some of the top signals I'm seeing, you might find this thread below quite helpful. It's a well-documented list of some of the most remarkably absurd and greedy recent examples, which is incredibly useful for a market that never sleeps and has a memory of a mentally handicapped goldfish. FOMO has a way of erasing lessons of the past. Simply being able to remember can be a superpower. Much of this newsletter boils down to documenting events so we don’t forget. Anyways, take a look below.

I’ll spoil a few because there isn’t enough room to screenshot all of the images.

#1 dogwifhat on the sphere

#2.A Solana ecosystem coins going batshit crazy, exhibit A $BODEN $150m market cap

#3 Bitcoin up 90% in 30 days, with a max pullback of 15%

#4.A Memecoins up 1000%, Exhibit A WIF

#5 Annualized funding rates of 100% persisting for weeks

#9 Solana Twitter tweeting about AI Video Games on the Blockchain (WTF?)

#10.B Michael Saylor - People who use Fiat as a store of value are called poor

Bitcoin has yet to experience a significant pullback this bull market, which is becoming increasingly concerning. Corrections of 8% to 10% are not sufficient to allow the market to cool off and are not on par with previous cycles. Perhaps I am just not understanding that boomer flows will sustain an upward trend for a long time. However, I prefer to err on the side of caution and be pleasantly surprised if large corrections are over forever. Regardless, I am not selling my Bitcoin. Therefore, it doesn’t matter if the market continues to move upward exclusively and we are truly in a new paradigm, or if the market corrects for a few months before a second half of year rally.

If the market shifts back to Bitcoin being the main focus, I'll take a small breather, but even that won't be much of a break. Just keep your cool and resist the urge to FOMO into meme coin trends, as these frenzies are typically short-lived. You don't want to be left holding the bag when the music stops. 99% if you will.

If you feel compelled to invest in meme coins, do so with only a tiny portion of your net worth. Then, metaphorically tie yourself to the helm of the ship and fill your ears with beeswax to resist the temptation to make impulsive decisions based on hype. I promise that where we are going, many miles away, is a safer and more fruitful place.

Bitcoin Thoughts And Analysis

We currently have a spinning top last week with a close below the previous all time high resistance, which I discussed yesterday. Now we have a potential large down candle to follow up, although it is ONLY TUESDAY and we need to see confirmation on a weekly close on Sunday.

Nothing to see for now, but worth watching and waiting for this weekly candle.

Remember, significant corrections are completely normal in a bull market. I am NOT bearish long term, but also would not be surprised to see us range or slowly grind down for a bit.

The next major support is the blue zone.

My charting strategy on corrections (and pumps) is very simple and clear. Wait for RSI to be oversold or overbought, then look for divergences. We had bear divs all over the charts at this local top - now we look for bull divs at the bottom. 4-hour is almost oversold.

Daily is not particularly close yet, and we have not been oversold on that time frame since August. It is due.

Legacy Markets

The Bank of Japan (BOJ) recently ended its negative interest-rate policy and abandoned its yield curve control, marking its first rate hike in 17 years. Despite these changes, the BOJ maintained a dovish stance, committing to continue purchasing long-term government bonds and expressing concerns about achieving its inflation targets. This announcement led to a 1% drop in the yen against the dollar and set the stage for a closely watched week in global financial markets, with the Federal Reserve's meeting on Wednesday drawing significant attention.

Analysts have termed the BOJ's move as a cautious step towards tightening, highlighting a global trend towards rate normalization amid economic recovery. Meanwhile, the Australian dollar hit a two-week low after the Reserve Bank of Australia signaled a halt in its monetary tightening, and Bitcoin experienced a significant outflow from the Grayscale Bitcoin Trust, indicating investor wariness in the cryptocurrency market.

In corporate news, significant developments included Unilever's decision to separate its ice cream business, AstraZeneca's $2.4 billion acquisition of Fusion Pharmaceuticals, and Nvidia's unveiling of a new, faster processor for AI models. These moves reflect broader shifts in global markets and technology, underscoring a dynamic period in both financial and corporate sectors as they adapt to changing economic conditions and investor expectations.

Key events this week:

Germany ZEW survey expectations, Tuesday

European Central Bank Vice President Luis de Guindos speaks, Tuesday

US housing starts, Tuesday

Eurozone consumer confidence, Wednesday

Fed rate decision; Chair Jerome Powell holds news conference, Wednesday

Reddit’s IPO, Wednesday

ECB’s Christine Lagarde speaks, Wednesday

Eurozone S&P Global Services PMI, S&P Global Manufacturing PMI, Thursday

Bank of England rate decision, Thursday

US Conference Board leading index, existing home sales, initial jobless claims, Thursday

Nike, FedEx earnings, Thursday

Japan CPI, Friday

Germany IFO business climate, Friday

Atlanta Fed President Raphael Bostic speaks, Friday

ECB’s Robert Holzmann and Philip Lane speak, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 was little changed as of 9:54 a.m. London time

S&P 500 futures fell 0.2%

Nasdaq 100 futures fell 0.3%

Futures on the Dow Jones Industrial Average fell 0.1%

The MSCI Asia Pacific Index fell 0.6%

The MSCI Emerging Markets Index fell 1%

Currencies

The Bloomberg Dollar Spot Index rose 0.4%

The euro fell 0.3% to $1.0838

The Japanese yen fell 1% to 150.67 per dollar

The offshore yuan was little changed at 7.2120 per dollar

The British pound fell 0.5% to $1.2671

Cryptocurrencies

Bitcoin fell 4.8% to $64,101.39

Ether fell 6.2% to $3,291.73

Bonds

The yield on 10-year Treasuries was little changed at 4.32%

Germany’s 10-year yield declined one basis point to 2.45%

Britain’s 10-year yield declined two basis points to 4.07%

Commodities

Brent crude fell 0.3% to $86.59 a barrel

Spot gold fell 0.3% to $2,153.59 an ounce

The Halving Is 30 Days Away

In 30 days, Bitcoin will undergo its 4th halving, reducing the reward from 6.25 Bitcoins per block to approximately 3.125. As the halving nears, I plan to continue adding educational content on why it is important and address some of the common misunderstandings surrounding the event. One of the common concerns regarding the halving is this question: how does the halving help secure the network if miners receive less compensation for their efforts? Doesn't this work against their incentive to mine?

While it's true that the halving reduces the immediate reward for miners per block, its purpose is to align with Bitcoin's long-term objectives of security and sustainability. Regarding security, although the block reward reduction directly impacts miners' rewards, it also decreases the new supply entering the market, contributing to Bitcoin's appreciation over time, thus compensating miners who held. This gradual reduction is instrumental in preparing miners to very slowly transition from reliance on block rewards to transaction fees, ensuring a sustainable model for the network.

Solana’s Meme Madness

Let's address the elephant in the room: Solana is rising because of meme coins. As much as the Solana maximalists want you to believe that Solana's price movement is due to X, Y, and Z fundamentals, I'm not taking the bait. Solana is a great coin, and the fundamentals are there for it to be a monster player with staying power. However, based on any metric, this current rise is all meme-driven. Speculators need Solana to buy meme coins; as meme coins go up in value, funds flow back to Solana, and value is sloshed around until the music stops.

I could have typed "Solana" into my Google search bar over the past few weeks and stumbled upon something wildly frothy on any given day. Lo and behold, I do it now, and the top story is about Slerf, a sloth-themed meme coin on the Solana network. The developer 'accidentally' burned the entire $10 million liquidity pool from the pre-sale, yet the token managed to hit $1.7 billion in trading volume, quickly overshadowing the massive blunder. Dogwifhat, Bonk, BOOK OF MEME, Myro, Slerf, the list of shitcoins goes on and on.

My last point is that it appears to be the case that Solana's meme season is occurring at Ethereum's expense. The explanation is straightforward: speculators are selling their other DeFi holdings, such as Ethereum, to finance their new ventures on Solana. However, meme coin frenzies are typically short-lived, and a good portion of the new money and old money will flow back to where it came from. When this happens, fundamentals will return as the main topic of interest. Additionally, Ethereum is expecting some significant airdrops this year, and the meme coin frenzy will likely coincide with these events.

Standard Chartered Ups The Ante

The previous prediction of $100,000 per BTC by the end of 2024 apparently was not high enough for the bank, which has now upped its forecast to $150,000. Here’s what the bank’s analyst wrote: “For 2024, given the sharper-than-expected price gains year-to-date, we now see potential for the price to reach the $150,000 level by year-end, up from our previous estimate of $100,000.”

As for 2025, the bank foresees Bitcoin hitting $250,000, up from the previous prediction of $200,000. What's interesting about this prediction is that the bank forecasted that 2024 would bring in $50-100 billion in inflows into ETFs, which seems to be on track, considering there have been $12 billion in inflows so far. My thesis is that inflows will be backloaded when the rally takes us to $100,000 and beyond, far exceeding our current levels of flows.

Truth be told, Standard Chartered has opinions on more than just Bitcoin. “We estimate that spot ETFs will drive inflows of 2.39-9.15 million ETH in the first twelve months after approval. In USD terms, that equates to roughly $15 billion to $45 billion…This would imply a USD level of 8000 for ETH,” the bank wrote as its end-of-2024, price prediction. For 2025, based on its BTC expectation of 200,000, it expects an ETH price of $14,000.”

It seems like Standard Chartered may need to reassess their Ethereum prediction if they believe Bitcoin will reach $250,000. Their ETH forecast of $14,000 is based on Bitcoin hitting $200,000. While this might seem like nitpicking, the underlying point is that nobody truly knows, and Bitcoin can serve as a reliable benchmark for estimating the potential movements of other assets.

Taxes Done Easy

Figuring out your taxes doesn’t have to be a puzzle every year. Platforms are improving at calculating what you owe, and integrations are making it possible to calculate everything you need to know with just one click. While the systems in place aren't perfect, especially for traders using multiple platforms that don’t communicate with each other, the overall process is improving. MetaMask just teamed up with CoinLedger, a cryptocurrency tax reporting software, to allow users to connect their accounts and load their transaction history into CoinLedger’s tax reporting software in a single click. The April 15 deadline is fast approaching, and the IRS is more concerned with crypto than ever before. There are no shortcuts.

Solana Skyrockets, Gold Rallies. Why Is Bitcoin Down? | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Phemex - Exclusive for new user, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Trading Alpha - My new go-to indicator site and trading community. Use my link to sign up and get 25% off. Make sure to use code “25OFF”

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Thx Scott ! Always such good info