Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Investing On A Tight Budget

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

The Real Bitcoin All-Time High (Adjusted For Inflation)

Solana Investors Receive Good News

Tesla May Be Buying More Bitcoin

Do Kwon Wins A One Way Ticket To South Korea

This Is What I Mean

Bitcoin Rally: Here Is Why It Is Not Too Late To Buy Crypto Now

Investing On A Tight Budget

Many people are scared to invest, or believe that it is only for the wealthy.

The perception that a large sum of money is needed to start investing can be attributed to psychological factors such as a perceived barrier to entry, fear of loss, and a lack of financial education. These factors can create a mental hurdle that makes investing seem more daunting than it actually is.

The truth is, there has never been a more accessible time in history for retail investors to get started, regardless of whether your beginning budget is $10, $10,000, or $10 million.

This is a common thought process I encounter frequently: If I can't afford a full Bitcoin, I'll consider purchasing a few Ethereum. If Ethereum is also out of reach, I might turn to Litecoin or XRP. Alternatively, I might just choose to “invest” in memecoins and call it a day.

This is completely backwards and even affects more seasoned investors who know better.

For today’s intro, I am going to briefly cover a few ways in which beginning investors can make the most of their capital. As always, this is not financial advice, this is merely a guide for entertainment and educational purposes.

Let’s begin.

Lower Your Fees

Stop giving Coinbase, Crypto.com, Binance, or any other exchange free money - they already have enough. What I mean is that Coinbase users have complete access to Coinbase’s professional ‘Advanced’ trading service, which is far cheaper than the more popular retail side of the platform. Use your exact same login information or just select it in the menu and you will save money on virtually every trade… and fill your orders at more precise price levels. Convenience costs money.

Take a look at the mock order I screenshotted for 1 Bitcoin on Coinbase.com. Bitcoin was trading at ~$67,800. However, due to it being a market order and having 'convenient' pricing, Bitcoin was listed at $68,510, with an additional fee of $1,020. Paying $69,531 for a Bitcoin that was trading at $67,800 is highway robbery.

When it comes to DeFi, there are numerous ways to save money. Swaps can be costly, so savvy traders are active during periods of lower network activity. Use DeFi platforms when gas fees are low, or consider using a Layer 2 solution instead of the main Ethereum chain. If this concept is new to you, there are countless tutorials available on YouTube. While some aspects of DeFi can be complex, I assure you that it's not difficult if you're already using an exchange.

Don’t Quit Your Day Job

I say this a lot, so bear with me. If you have been in crypto for a while, then you know that disaster can strike at any time. It is essential that you have multiple sources of income and a steady to job to allow you to invest wisely and with minimal pressure.

A strong safety net is essential. Quitting your job to become a crypto trader is likely to be the end of you financially.

Recognize It’s A Marathon, Not A Sprint

Investors often fall into the unit bias trap, aiming for a home run with just their first or second swing. Consider this scenario: if you started with just $100 and aimed to double your investment by the end of each year for 10 years, you would have $51,200 by the tenth year. Even doubling your portfolio is an incredible feat and is unlikely to happen most years. Instead, focus more on dollar cost averaging and increasing what you can safely allocate to investing.

Another important consideration is that you don't need to invest heavily in meme coins just because your starting capital isn't as high as you'd like it to be. Opting for a more conservative approach in crypto, such as investing in spot Bitcoin or Ethereum, can still yield significant gains while benefiting from the stability these larger assets offer. Treat your portfolio, regardless of its size, with the same care you would give to your ideal portfolio. Allocate a small portion for riskier trades if that appeals to you, but focus the majority of your efforts on long-term, high-quality investments.

Adopt A Learner’s Mindset

Are you taking advice from the wrong people? Are you convinced that there is only one right way to navigate the market? Do your emotions get in your way? Do you change opinion when presented with new information or are you stubborn? These are just a few questions we should be asking ourselves occasionally to avoid major pitfalls.

You should always be humble and learn from the market. There are thousands of ways to skin this cat, so take the time to DYOR and find the strategy that works best for you. Move slowly.

Reprioritize Your Budget

Investing is often the last thought for someone operating on a tight budget. What would the difference be over a decade or three if investing were among the first or second line items you considered? Moving investing higher on the priority list can be intimidating because it almost certainly means cutting back in other areas. Of course, necessities are necessities, but I truly believe that if you try hard enough, you can cut back on spending in all areas if you are willing to make the sacrifices. This concept is less important in your later investing years, but the younger or newer you are, the more seriously you should consider this advice.

Additionally - and again, this is not financial advice - consider opening an IRA ASAP if you don't already have one. There was a time when a blue-collar job and a pension were enough for a comfortable retirement, but that is no longer the case. One of the last guaranteed ways to accumulate wealth is to max out your Roth IRA each year by any means necessary. You are not limited to traditional investments now that platforms like iTrust Capital exist. Yes, they sponsor this newsletter. They did not ask me to say this, but I genuinely believe that their service could be life-changing for those who take advantage of it. Imagine if you had BTC, ETH, or SOL in your IRA this past year - what an epic outcome that would have been for your retirement. iTrust Capital is literally the best crypto IRA platform; I am incredibly fortunate to have their support for this newsletter. If this sounds like something you are interested in, just click on the image to get started.

Investing with a small portfolio can be fun and profitable, as long as you have a plan and are always open to new information.

God speed.

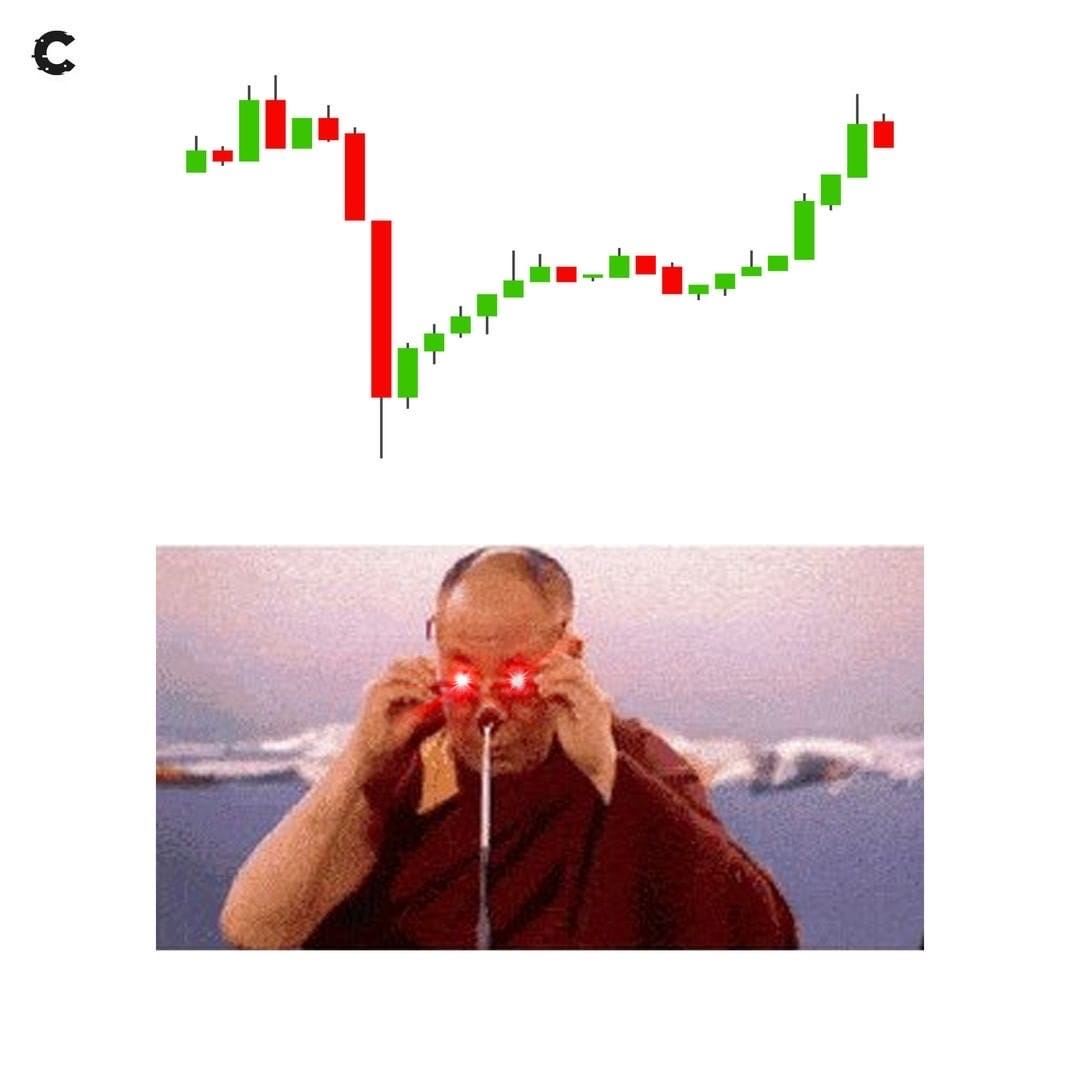

Bitcoin Thoughts And Analysis

The Dalai Lama pattern. You may think it’s a meme because it sounds like one but it has been a recurring pattern in the crypto-market. Price drops, shakes out many, instills fear and then proceeds to recover fully. Take a quick look at the 4-hour chart. We have a v shaped bottom with a Dalai Lama. Bullish.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

I know, I am like a broken record.

But looking at the ETH weekly chart, there is effectively no resistance between here and the all time high. Take it as you will.

Solana is also pushing through the last key area of resistance (not through yet) before the all time high.

Legacy Markets

The global stock market continued to rally, reaching new heights ahead of the anticipated U.S. jobs report, with expectations that the data will further solidify the case for imminent interest rate cuts. European stocks hit a new record, with the Stoxx 600 index marking a 0.2% rise, indicating a seventh consecutive week of gains. In the U.S., futures on the S&P 500 and Nasdaq 100 also moved upwards, with significant gains noted in chip stocks, particularly Nvidia Corp., which has seen an impressive increase in value this year.

The European Central Bank's recent inflation forecast suggested the onset of monetary easing as early as June, a sentiment echoed by Federal Reserve Chair Jerome Powell, hinting that the Fed is nearing the confidence level required to initiate rate cuts. This anticipation led to a decline in 10-year Treasury yields and a drop in the dollar, alongside falling bond yields across Europe as more policymakers lean towards a rate reduction in June.

The market's direction now hinges on the upcoming U.S. employment data, with expectations of a slowdown in new job creation and hourly wage growth. A robust jobs report could potentially challenge the current market optimism built on the premise of decreasing interest rates and bond yields.

In the commodities market, gold continued its upward trajectory, setting a new record and expected to climb further in the coming months, partly due to significant buying from China at both the central bank and wholesale levels.

European stock movements were mixed, with notable changes including a sharp decline in HelloFresh SE shares after adjusting its 2025 targets and DS Smith Plc's rally following its acquisition by Mondi Plc to become one of the largest packaging manufacturers.

Key Events This Week:

Eurozone GDP, Friday

US nonfarm payrolls, unemployment, Friday

New York Fed President John Williams speaks, Friday

ECB Governing Council member Robert Holzmann speaks, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.2% as of 9:48 a.m. London time

S&P 500 futures rose 0.1%

Nasdaq 100 futures rose 0.1%

Futures on the Dow Jones Industrial Average fell 0.1%

The MSCI Asia Pacific Index rose 1.2%

The MSCI Emerging Markets Index rose 0.9%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro fell 0.1% to $1.0936

The Japanese yen rose 0.8% to 146.88 per dollar

The offshore yuan was little changed at 7.1980 per dollar

The British pound rose 0.1% to $1.2826

Cryptocurrencies

Bitcoin was little changed at $67,283.45

Ether rose 1.8% to $3,944.31

Bonds

The yield on 10-year Treasuries declined one basis point to 4.07%

Germany’s 10-year yield declined four basis points to 2.27%

Britain’s 10-year yield declined four basis points to 3.96%

Commodities

Brent crude rose 0.6% to $83.43 a barrel

Spot gold rose 0.4% to $2,168.13 an ounce

The Real Bitcoin All-Time High (Adjusted For Inflation)

The Bitcoin all-time high isn't a fixed number; it doesn't consider inflation adjustments. The value of a dollar in 2021 isn't the same as in 2024. These observations are based on U.S. data; for other countries, adjustments and extrapolations are necessary.

According to The U.S. Inflation Calculator, if an item cost $69,000 in 2021, it would cost $78,535.53 in 2024 due to a 13.8% depreciation of the dollar. CoinDesk highlights this by stating, “Put differently, bitcoin’s market peak set this week would have the same purchase value as $60,907 in 2021, $55,097.30 in 2017 and $52,363.34 in 2013 — years which saw significant price appreciation for the first cryptocurrency.” This thought experiment underscores the narrative of Bitcoin as a 'store of value' in light of modern-day inflation.

Solana Investors Receive Good News

Crypto hedge fund Pantera Capital is raising funds to acquire a substantial stake, $250M, of FTX’s Solana from the bankrupt estate. The details of the deal are that Pantera will acquire the tokens at a discount, potentially 39%, while investors of the fund must be willing to commit to a four-year vesting period. If I am being honest, this deal is a head-scratcher in a few ways. Solana is up and spot holders are happy (as expected), but this seems to screw over FTX creditors big time. I get that FTX needs cash, but considering we are in a bull market, I don't understand why FTX won't opt to slowly sell their position rather than execute this private deal.Also, how could private investors in Pantera Capital like this deal when they have to wait 4 years in the fund and Pantera charges a 0.75% annual management fee and a 10% performance cut? At that point does it not make more sense to just buy spot Solana without the risk of being held down to the position potentially into a bear market?

Tesla May Be Buying More Bitcoin

Tesla's wallet, reportedly identified by the Crypto intelligence firm Arkham Intelligence, has increased its Bitcoin holdings by 1,789 BTC, adding to its previous position of 9,720 BTC as reported in the last earnings report. CoinTelegraph has provided a concise timeline of Tesla's Bitcoin transactions to bring us up to speed with the current situation.

February 2021: Bought $1.5 billion worth of Bitcoin

March 2021: Sold 4,320 BTC

2022: Sold 29,160 BTC

2023: There was no change in the balance of 9,720 BTC

Just as an FYI, it's conceivable that Tesla's buying is false, potentially stemming from an accounting error on Tesla's part or a misidentification by Arkham. Until the next earnings report or Tesla provides clarification, we cannot be certain. Musk has remained largely silent on cryptocurrency, so anything major from him, Tesla, or SpaceX would come as a surprise.

Do Kwon Wins A One Way Ticket To South Korea

For the love of God, can we just see Do Kwon behind bars and this story be over with? The Montenegrin high court has decided to send Do Kwon to South Korea, and supposedly, the decision is final. Do Kwon is from South Korea, which is probably where he wanted to end up because he had previously consented to be deported there and was fighting U.S. extradition. Regardless, both countries plan to hold him accountable for over $40 billion in losses, and from what I have seen on TV, South Korea isn’t exactly a fun place to be locked away.

This Is What I Mean

I wrote an entire intro on this just two days ago, and it's already accelerating. This narrative is incredibly underappreciated right now; all I can say is, Holy crap! If BlackRock continues down this path of adding Bitcoin to its investment funds, other funds will follow suit, and Bitcoin will...moon. Prepare accordingly—I wish I could shout this much louder.

Bitcoin Rally: Here Is Why It Is Not Too Late To Buy Crypto Now

I am joined by David Duong, Head Of Institutional Research at Coinbase, and Dan from The Chart Guys, who are coming to my show to discuss the recent Bitcoin rally and why it is still not too late to buy crypto!

My Recommended Platforms And Tools

Trading Alpha - My new go-to indicator site and trading community. Use my link to sign up and get 25% off. Make sure to use code “25OFF”

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Thanks Scott!

Excellent. Thanks so much for reminding us about coinbase advanced feature!! Totally forgot about this!!