Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

This Newsletter is Sponsored by DevvE!

DevvE can easily provide developers with access to the fastest, cheapest and most flexible blockchain on the planet via their restful API which effectively allows the web2 world to utilize blockchain technology with zero knowledge or prerequisite smart contract experience.

DevvE is rolling out the public testnet in March. Developers can now harness our lightning-fast 8 Million TPS, sub-second finality, and enjoy the cheapest gas fees in the market. Get ready to build on-chain like never before with our intuitive RESTful API. Plus, stay tuned for our grant scheme for innovative projects and developers.

Click HERE to learn more about DevvE.

In This Issue:

I Can’t Keep Up

Ignore Everything Lizzy Says

Coinbase Crashed—We Are Back

Bullish Rumors

History is Being Made

I Can’t Keep Up

For today’s newsletter, I had planned to provide some context on our proximity to all-time highs, but quickly realized it’s impossible to do so given the current circumstances with prices. Between the time I write this and the release, we could hit all-time highs, be a sneeze away, go well beyond them, or do all three and then end up God knows where.

Short-term, the market acts like a voting machine; long-term, it behaves like a weighing machine. Today, it’s a Bitcoin machine.

I have a few thoughts on the current situation, along with several other opinions I saw pop up across the timeline that I believe are worth sharing. I'll begin with my own perspective.

Do you remember when I had that sinking feeling ages ago, back during the FTX collapse era and everything leading up to it? When I posted the Tweet below, I felt like my stomach was turning inside out, and things only went downhill from there. For the first time this cycle, my gut is starting to feel the opposite.

For the past year or so, nothing in crypto elicited a stir within me. My belief in Bitcoin reaching $100k remained steadfast, yet the deep-seated feelings I usually rely on hadn't arrived - until now. I've always trusted my gut, and for the first time in a long time, I'm starting to feel a spark of excitement.

This feeling isn't a bad sign, but I know it can't last forever. When Bitcoin was bottoming out in late 2022, that nauseous feeling persisted for a long time, on and off for months. What that says is this opposite feeling of euphoria can endure much longer than our instincts might suggest.

The market can stay irrational longer than you can stay solvent.

Predicting Bitcoin's short-term trajectory is truly impossible. Anyone selling you promises of new all-time highs, imminent pullbacks, or hitting 100k next week is peddling nonsense. The music will stop at some point, but where this goes next is anyone's guess. Stay focused on the long term.

What I can confidently say is that we've reached a turning point, as I'm starting to feel a bit euphoric. I trust my gut more than anything I read online. Whether we're in the 3rd inning, 4th inning, or 5th inning is anyone's guess. I'll share some thoughts from others on this below.

“Stage 1: Rebirth

The exhaustion from the bear market still exists. Sparks of hope pop up, then fade. A few new narrative arise but are quickly killed by apathy. Your friends and the media still focus on the bear market blowups. All the while, prices are quietly recovering. Your investment down 90% in the bear just went up 5x. But you barely notice, you're still down 50% off the high. Only the deepest crypto natives who have seen 2+ cycles realize that the bull market has begun. Most people are still in disbelief that this is the bull market.

Stage 2: Excitement

We are here now. The bear market has officially ended. Your coins are nearing all time highs. Some have even blown past ATHs. Everyone in crypto understands that we are officially in a bull. But it's funny, your normie friends still aren't texting you. You're a weird combo of excited and anxious. Your stack is growing but you feel like you don't own enough coins. Your company starts hiring; you start ordering guac at Chipotle again. Life is good. All your crypto friends are winning. This is the calm before the storm.

Stage 3: Euphoria

Everything you own blows past ATHs. There used to be a new narrative every week, now there's a new one daily. The private market get crazy. VCs announce $500m funds. They skip DD and race to deploy. Every week a new company announces their $100m raise. We're mainstream again. Forbes, Bloomberg, CNBC... they love crypto. Then weird things happen. Fortune 500s buy Bitcoin. Athletes and artists get involved – crypto permeates mainstream culture. Everyone starts to believe it’s going up forever; delusion seeps into decisions.

Stage 4: Disconnection

This stage could also be described as Insanity. Nothing makes sense anymore. You have more money than you ever thought you'd have in your life. Your friend, who knows nothing about crypto, launches a token. He's worth hundreds of millions overnight. A crypto person buys a sports team. Justin Bieber joins a decentralized social platform. Crypto companies spend billions on marketing. Unfortunately, none of it is real. If you're not careful, your arrogance and laziness in this stage will cause for a tough next two years.

So buckle up. The next 18 months will be madness. You'll experience higher highs than you ever have before. Make sure you take time to enjoy it every once in awhile. When you get overwhelmed, step away from the computer, slow down, and go for a walk. Now, let's build.”

“It's like a supermassive black hole of RIA allocations...and they have $8trn under mgt so we can play this game for a while. Then we add ETH ETF into the equation, and there are two fun games for the RIAs to play! Then retail investors will begin to come back above all time highs (Coinbase has 100+ million users and only around 10 million currently active, for example). These more crypto-familiar people will go full-on ‘Alt-tastic’. Then, as the size of the overall market increases, it brings in the institutions, who are still mainly missing from the equation. Welcome to the Banana Zone. As ever, be patient, avoid FOMO, avoid leverage, expect horrid sell-offs, and Dont Fuck This Up. #DFTU”

“…market with elevated funding rates. This tension (between general bullish currents and overextended market structure) tends to create more realized volatility, sharper retracements, etc. This is the inning that entices retail, where the crypto bull run starts feeling 'real' to mainstream. Historically, we've typically gotten pretty deep retracements (30%+ in BTC, 50%+ in alts) at some point in this inning. Has never been easy (for me at least) to identify the point we get those sell-offs *from* though (e.g. maybe we get a 25% sell-off from $80k in a month) I.e. BTC is a good buy here, but not as good as it was 3 months ago. You could argue that some alts are better buys than they were 3 months ago specifically because of the 'confirmation' of bullishness and wealth creation from bitcoin and ethereum over last 3 months. This is the stage where many start feeling "FOMO" and start reaching for new and riskier forms of leverage. Stay guarded against that. You shouldn't become more bullish with rising prices and market sentiment...the opposite. I think it's reasonable to be bullish here *in spite of* the general sentiment and market technicals. But not mindlessly bullish.”

As evidenced by these various posts, while everyone may have a slightly different perspective, there seems to be a consensus that we are entering a new period. Personally, I have only observed very mild signs in my everyday life of retail participation, but signs are beginning to emerge. Nonetheless, we are still in the early to mid-stages. In Bitcoin's history, we have never seen an old all-time high go unbroken.

It’s pretty much only OGs who will likely celebrate this ATH milestone, so enjoy the limited crowds while you can. If Bitcoin manages to stabilize and the market maintains its euphoria, I anticipate significant moves for resilient assets like Ethereum, Solana, and other prominent altcoins. And if these moves don't happen in this phase, they will eventually.

Whatever you take away from this, remember not to show your new portfolio highs to family or friends. Just kidding…sort of. Enjoy the gains! Let's finish this week with a bang.

Ignore Everything Lizzy Says

I’ll refrain from choice words, but seriously, ignore every word that comes out of Senator Warren’s mouth. It is nothing more than lie after lie after lie. Lizzy (her new name) is clearly just trying to buy votes by saying she wants to collaborate with us, but she isn't being sincere. It’s easy to see through, and there is an infinitely better option to vote for: John E. Deaton.

Interviewer: Clearly this crypto relationship is antagonistic, why not collaborate with this industry?

Lizzy: I want to collaborate with the industry, what I don’t understand is why the industry seems to be saying that they only way that they can survive is if there’s plenty of space for the drug traffickers and the human traffickers.

Oh and the terrorist, and the ransomware scammer, and the consumer scammers and the rogue nations, North Korea that is financing about half of its nuclear missile program with crypto, that all of that has to be left open.

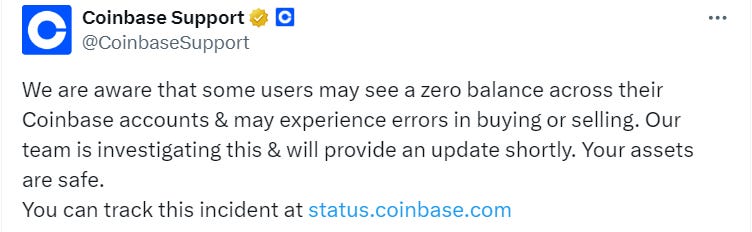

Coinbase Crashed—We Are Back

The good old days have returned. It appears that Coinbase hasn't quite resolved their crashing issue this bear market, but I'll give them the benefit of the doubt this time and consider it perhaps a fluke. In fairness, both Binance and Kucoin also faced outages and technical glitches, so it wasn't solely a Coinbase crashing problem.

The aftermath of the crash was significant, with approximately $100 billion disappearing from the market in just about 15 minutes. This event may have served as the reset needed to give this surge more breathing room. Watching the price drop from $64,000 to $58,800 was truly remarkable. However, more corrections are likely to come, so get accustomed to them.

Bullish Rumors

I try not to pay too much attention to rumors, but since I am in a good mood, I’ll share a couple that I am seeing talked about.

I hope Snowden is right because the 'nation state adoption' narrative was as exciting, if not more exciting, than the ETF news. Following El Salvador, other LATAM countries were supposed to follow suit but never did. This narrative is what Bitcoin needs to surpass $100k.

The other rumor is this CoinDesk headline.

CoinDesk's source is 'people familiar with the matter,' so it's not worth much attention until we have concrete news. The current numbers are already impressive, but just imagine the impact when other major names like Merrill Lynch, Morgan Stanley, Wells Fargo join in, and Goldman Sachs and J.P. Morgan become more actively involved beyond just acting as authorized participants.

History is Being Made

I promise that soon I won't have a dedicated ETF segment in the newsletter every day, but today was a must. Yesterday smashed the record for daily trading volume by 1.65 times. Since the opening day record was set at $4.66 billion, it only took a little more than a month for Bitcoin to set a new record at $7.69 billion. BlackRock alone did $3.3 billion—unbelievable.

In other volume news, I came across this Tweet regarding Coinbase’s volume. After a quick glance at the math, it seems to check out.

My Recommended Platforms And Tools

Trading Alpha - My new go-to indicator site and trading community. Use my link to sign up and get 25% off. Make sure to use code “25OFF”

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Thanks for all your help Scott! Been following you for many years but never thanked you for contributing to my insights of crypto and macro! Big hug!

5 + years in this gig and I can’t value any acronym higher. . . #DFTU . . . Cheers Raoul!