Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

The Price Is Wrong

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Smaller Details From The Coinbase Earnings Report

US Banks Have Bitcoin FOMO

The NFT Flippening is Moments Aways

Here Is Why I Am So Bullish On Solana | Austin Federa

The Price Is Wrong

"The Price Is Right" first premiered in 1956 and has since become one of the longest-running game shows in television history. It is known for its engaging gameplay, flashy prizes, iconic hosts, nostalgia, and hilarious moments, all of which have contributed to its loyal fanbase.

The rules are simple: contestants compete in various pricing games to win prizes by guessing the prices of merchandise. The contestant who comes closest to the actual retail price without going over advances to the final showcase for a chance to win a collection of items.

The lasting intrigue of the show lies not in the contestant who expertly knows the prices of items, but in highlighting the disconnect some people experience from reality, at least in my view. I can’t be the only person with this idea, because ‘The Price is Right Failures’ is a very popular trend.

There are many memorable failures to choose from, but one of the most notable examples comes from a mid-2000s contestant (Joy), whose performance has become a viral sensation on YouTube with over 10 million views.

Being on TV and in front of a live audience is nerve-wracking, but Joy's performance was so bad that Bob Barker threatened her, saying, “You’re gonna lose your turn if you don’t write,” and then went on to help her come up with possible answers. Spoiler alert, Joy miraculously manages to win on her tenth and final guess.

In disbelief, Bob Barker sits down in shock and mouths, ‘I can’t believe it’ multiple times over.

First off, rest in peace Bob Barker; you are a legend. Second, Joy’s experience is incredibly similar to sentiment in the crypto market right now.

Have you noticed how, despite stellar technicals and fundamentals in the crypto market, people seem entirely disillusioned? The market is giving us every reason to be excited about the price, literally telling us the price is wrong, and strangely, nobody cares.

The last time Bitcoin was trading above $50,000, Lambos, laser eyes, and outlandish price predictions were all anyone could think of. I feel like we are still at the point where I have to convince people that $100,000 is programmed, let alone possible.

There are substantially more objective reasons to be more bullish now than when Bitcoin was trading at $68,000, yet the optimism has hardly set in. I can think of a few rational explanations for why this is the case, but it largely doesn’t make sense.

Perhaps it has something to do with defeated investors not yet feeling profitable until all-time highs are achieved, or the sheer number of investors who were wiped out during the bear market. Maybe investors have finally learned their lesson about greed. I doubt any of these fully paint the picture.

I think the answer lies in recognizing that the vast majority of people, including non-investors, are simply disillusioned and disconnected from reality. I understand this may come off as critical and sound like I’m putting myself on a pedestal, but if the vast majority of people, including non-investors, WERE NOT disillusioned and disconnected from reality, then Bitcoin would already be well past $100,000.

For us, the rules and the prize are a little different but not too far off. As long as we don't entirely disconnect ourselves from reality, the game is simple and ours to win. Bitcoin doesn’t require guesswork, guidance, or dumb luck. If you think the fair price is higher and own some, then you're winning - it’s that easy.

Joy went home that night with a new toaster, a 4-piece luggage set, and a Ford Fusion. We, on the other hand, went home with a valuable lesson.

Markets struggle to price things right, especially shiny new things, and sometimes the only explanation for when they get it right is dumb luck. We can use this to our advantage.

The week has barely started and the market is already off to a hot start. Wouldn't it be a shame if the ETF boomers had the price run-up before they had a chance to buy because legacy markets are closed on holidays?

The price is never right.

*NOTE! TRADINGVIEW IS NOT ALLOWING ME TO PUBLISH CHARTS, SO THERE ARE NO LINKS, JUST SCREENSHOTS

Bitcoin Thoughts And Analysis

WEEKLY CHART

My twitter timeline keeps mentioning how “boring” Bitcoin is right now, simply because it chopped around $52,000 this weekend. They seem to forget the past two weekly candles. Last week started around $48,000, seeing almost a 10% move and closing near the highs. It also closed right at the $52,100 resistance… and is trying to jump above already today. That is a meaningful level and a bullish candle.

Nothing looks bearish on this time frame. At all.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

TOTAL 3

Total 3 is the market cap of the crypto market excluding BTC and ETH. Looking at it generally gives us a clearer picture of what is happening with altcoins. While I am not a huge fan of charting assets that you can’t trade, because there are no “real” support and resistance levels without orders, we can still use the chart to get a better understanding of the market.

With that in mind, it is important to note that TOTAL 3 just made a new cycle high on the weekly close, around $550B. This indicates that the altcoin market remains healthy and likely to continue to grow.

HBAR/USDT

HBAR is pushing hard into the key resistance zone that I discussed many months ago. To keep it more simple, a pus above 10 cents should do the trick. Bulls want to see daily and weekly closes above the red zone. A retest of that zone as support would be an ideal entry. As you can see on the left of the charts, there is almost NO RESISTANCE until nearly a 2x, around .186. This coin dropped hard, leaving a vacuum. It should do well if it can push through here.

MATIC/USDT

MATIC managed the close that we were looking for when I posted this idea last week - above descending resistance and above horizontal resistance. Anything above 97 cents looks good, as this was the highest weekly close in this cycle. This should head towards $1.56.

Legacy Markets

European stocks took a breather after nearing record highs, with investors on the lookout for new drivers of momentum. Despite the previous week's 1.4% increase that brought the Stoxx Europe 600 close to its January 2021 peak, the index saw a slight decline, influenced by a drop in iron ore prices and underperformance in the technology sector. However, defensive sectors like utilities and health care managed gains. Meanwhile, in the U.S., markets were closed for Presidents’ Day, leaving S&P 500 futures flat and Nasdaq 100 futures slightly up.

Key movers in Europe included AstraZeneca, gaining over 3% due to positive trial results for its lung cancer drug, and Rheinmetall AG, which rose after announcing a new plant in Ukraine. Banco Santander also saw an uptick after initiating a share buyback. The backdrop to these market movements includes mixed earnings reports, geopolitical tensions, and economic indicators leading to adjustments in Federal Reserve rate cut expectations.

In Asia, the mood was cautiously optimistic with China's stock market bouncing back post-Lunar New Year, despite early losses and ongoing economic challenges. Calls for more robust policy support to bolster the economy were highlighted by China's Premier Li Qiang.

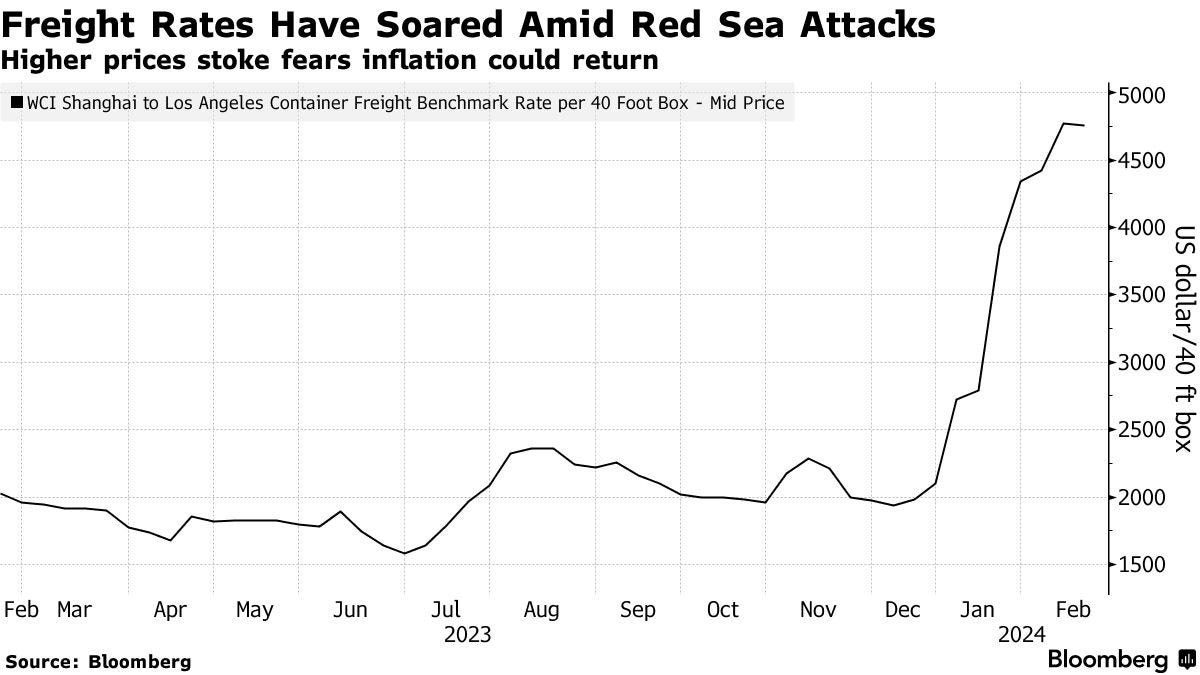

Bond markets were quiet due to the U.S. holiday, following a drop after the producer price index indicated a rise in service costs. The commodity sector saw oil prices retracting from a three-week high, while gold maintained its gains. Iron ore prices fell after a week of increases, reflecting concerns over China's economic outlook.

Looking ahead, market watchers are eyeing European inflation data and key earnings reports to assess global economic health. The ongoing conflict in the Middle East also remains a concern, with stalled negotiations over an Israel-Hamas cease-fire adding to the uncertainty.

Some of the key events this week:

Reserve Bank of Australia Feb. meeting minutes, Tuesday

China loan prime rates, Tuesday

BHP Group Ltd earnings, Tuesday

European Central Bank publishes euro-area indicator of negotiated wage rates, Tuesday

Rio Tinto Plc earnings, Wednesday

Eurozone consumer confidence, Wednesday

Nvidia Corp earnings, Wednesday

Federal Reserve Jan. meeting minutes, Wednesday

Atlanta Fed President Raphael Bostic speaks, Wednesday

Eurozone CPI, PMI, Thursday

European Central Bank issues account of Jan. 25 meeting, Thursday

Fed Governor Lisa Cook, Minneapolis Fed President Neel Kashkar speak, Thursday

China property prices, Friday

European Central Bank executive board member Isabel Schnabel speaks, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.2% as of 9:39 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.2%

The MSCI Emerging Markets Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0776

The Japanese yen rose 0.2% to 149.92 per dollar

The offshore yuan was little changed at 7.2104 per dollar

The British pound rose 0.1% to $1.2615

Cryptocurrencies

Bitcoin rose 0.9% to $52,315.31

Ether rose 2.4% to $2,915.97

Bonds

Germany’s 10-year yield declined one basis point to 2.39%

Britain’s 10-year yield was little changed at 4.10%

Commodities

Brent crude fell 1% to $82.61 a barrel

Spot gold rose 0.3% to $2,020 an ounce

Smaller Details From The Coinbase Earnings Report

I handpicked a few key insights from the Coinbase earnings report that stood out to me and followed them up with brief commentary. Everyone is going to have a different takeaway, but the consensus is that Coinbase crushed it. Here’s what you might have missed.

“Our balance sheet strengthened as we reduced debt by $413 million and grew our total $USD resources1 by $217 million Y/Y, ending 2023 at $5.7 billion.”

Considering Coinbase is in the midst of defending the entire space in a costly legal battle, this is truly impressive. Armstrong meant it when he said the company was prepared to go to battle against the SEC. The lawsuit will eventually become a strong tailwind for Coinbase.

“We expanded operations internationally by obtaining licenses or registrations or launching in key growth countries including Bermuda, Brazil, Canada, France, Singapore, and Spain.”

Coinbase isn’t just a U.S. company anymore. While other exchanges are retreating, Coinbase is slowly expanding into new territories to capture new business around the globe. I anticipate Coinbase will expand well beyond these six countries in 2024.

Capitalizing on consumers (aka retail) volume is where Coinbase will earn the bulk of its revenue in this bull cycle. You can see that 2023 was a far cry from 2022, but the numbers are starting to pick back up rapidly in Q4. Crypto’s ascent will pay massive dividends to Coinbase, which Wall Street doesn’t yet grasp for the simple reason they don’t yet believe $100,000 is happening or possible.

US Banks Have Bitcoin FOMO

The irony of watching a banking coalition lobby the SEC to participate in crypto is a sight that will never get old. On February 14, the Bank Policy Institute, the American Bankers Association, the Securities Industry and Financial Markets Association, and the Financial Services Forum sent a letter asking for the SEC to reconsider its rule, which classifies cryptocurrencies held on a bank’s balance sheet as liabilities, forcing banks to add assets to their sheet to counter the weight of the liabilities. Of course, the rule is outdated and needs to be removed for the space to progress, but there's something vindicating about watching banks get a taste of their own medicine. Gary Gensler will likely have to cave to this request, which will be another win for crypto.

The NFT Flippening is Moments Away

It's essentially a foregone conclusion that Pudgy Penguins will flip Bored Ape Yacht Club, considering the current trajectory of analytics for both collections. From an outsider's perspective, looking at just the numbers, the projects are diverging sharply. While a more engaged Discord member might offer a more nuanced explanation, it seems that Yuga Labs, the creator of Bored Ape Yacht Club, has fumbled the lead, while Pudgy Penguins has been attentive to its community and has made significant strides. The key takeaway here is that, despite our hopes, there are no guarantees in this industry. The advantage of being the first mover is substantial, but it doesn't guarantee success in a never-ending race. Congrats to Pudgy Penguin holders and to the Bored Ape Yacht Club holders, I wish you the best. There’s always a chance of an epic comeback story.

Here Is Why I Am So Bullish On Solana | Austin Federa

Join Austin Fedra as he delves into the resilient world of Solana in this podcast journey. From its survival to exploring its ecosystem, including projects like Helium and DePIN, the discussion touches on the evolving landscape of DeFi 2.0, token extensions, and the intersection of Solana with governments and regulations. Tune in for insights on scalability, infrastructure readiness, airdrops, and the potential of Layer 2 solutions, all while contemplating the self-sovereignty and interoperability challenges Solana faces in the crypto realm.

My Recommended Platforms And Tools

iTrust Capital - Buy and Sell Crypto, Gold & Silver with Your IRA. Transfer Your Existing IRA or Start a New One. Unlock new possibilities HERE.

DevvE - Faster, cheaper, more scalable and architecturally flexible than any other Layer 1. DevvE is ESG friendly and seamlessly connects Web2 to Web3.

Trading Alpha - My new go-to indicator site and trading community. Use my link to sign up and get 10% off. Make sure to use code “TenOFF”

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

I think the quandry in your newsletter highlights the fact that it is still very early on in the Bull Run. A feeling of : 'yeah of course it's 50k again, it was always gonna be because it's going past 100k at least this cycle' That type of sentiment is what I think is happening.

واقعا دستت درد نکنه