Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter is Sponsored by iTrust Capital!

You can unlock new possibilities for your investments through iTrust Capital! If you currently hold a Traditional, Roth, Inherited, Simple, or SEP IRA at a traditional firm like Fidelity, Schwab, or Etrade, you can seamlessly transition to iTrust Capital. Enjoy tax-efficient investing in cryptocurrencies or precious metals without any hassle.

iTrust Capital is a trusted and secure company in operation since July 2019 and boasts over 200,000 accounts created. Take advantage of this chance to roll over your old 401k, 403b, or 457 from a previous employer into a Traditional IRA or SEP IRA with no taxable events. Your financial future awaits – make the switch with confidence.

Sign up for iTrust Capital now.

In This Issue:

$50,000

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

15 Timeless Investing Principles

ERC-404 is Exploding

Franklin Templeton Joins The Race

Time To Buy Bitcoin | Fundamentals Suggest Massive Growth To $112K

$50,000

Witnessing Bitcoin surpass the $50,000 threshold is an occasion that has become a rarity for enthusiasts and investors alike. Apart from the recent surge, the cryptocurrency has not ventured above this landmark figure for a staggering 776 days, a period stretching back to December 2021. This milestone was first achieved in February 2021, nearly three years ago to the day, marking a significant moment in Bitcoin's history.

Observing the $50,000 marker from a broader perspective, it signifies the apex of Bitcoin's performance since the last glimpse of this level in December 2021. The digital currency's journey since then reminds us of the transient nature of financial markets, where 2021 feels like a bygone era in the fast-paced world of cryptocurrency.

Bitcoin's relationship with the $50,000 mark is complex and multifaceted. By segmenting its time spent above this value into two primary phases, we gain insight into its market behavior:

- The initial phase spanned from mid-February to mid-May 2021, lasting approximately 100 days.

- The subsequent phase occurred from early October to late December 2021, covering around 90 days.

These periods, totaling roughly 190 days excluding the current resurgence, encapsulate the fleeting instances Bitcoin has enjoyed above $50,000. The anticipation of extending this phase is palpable, yet it comes with a cautious optimism that history may not repeat itself in the form of a downturn.

The journey back to $50,000 this time around presents a unique landscape, largely devoid of significant technical resistance, except for a psychological barrier nearing its all-time high. The potential selling pressure from long-term investors, while noteworthy, is unlikely to exert a substantial downward force on the market.

An intriguing aspect of Bitcoin's recent trajectory is the impact of external factors, such as the China mining ban. This event, although initially viewed as a setback, might have inadvertently laid the groundwork for a more robust bull market by preventing an extended duration above $50,000 previously. This suggests that Bitcoin is poised for a period of catch-up growth, compensating for the previous cycle's curtailed expansion.

Here’s a solid take I found from @MitchellHODL on the concept of $50,000 now vs. in the past.

The narrative surrounding Bitcoin is further enriched by the increasing interest in spot ETFs, as evidenced by the substantial inflows recorded last Friday, marking one of the largest single-day increases. This trend is expected to continue, potentially setting new records in the coming months. The rise in Bitcoin's value not only benefits early ETF adopters but also solidifies the investment thesis for a burgeoning group of traditional investors, thereby expanding Bitcoin's appeal.

Moreover, the forthcoming halving event introduces a new dynamic, especially for a fresh cohort of investors unfamiliar with its potential impact. Unlike previous halvings, which were primarily celebrated within the crypto community, the next event will capture the attention of a broader audience, potentially fueling further interest and investment in Bitcoin.

As Bitcoin approaches and possibly surpasses its previous all-time high, the community's focus shifts towards the next grand milestone: $100,000. This level holds a symbolic significance that transcends incremental gains, representing a benchmark of widespread adoption and validation for the cryptocurrency. The anticipation of reaching this milestone is expected to galvanize not only veteran investors but also attract new participants, eager to be part of Bitcoin's continued ascendancy.

The path to $100,000 is not merely an extension of Bitcoin's market trajectory but a journey that encapsulates the evolving narratives, challenges, and milestones of the cryptocurrency ecosystem. As we stand on the cusp of potentially historic market movements, the excitement and anticipation within the Bitcoin community are palpable. Together, we look forward to navigating this journey, celebrating each achievement, and embracing the opportunities that lie ahead in the ever-unfolding saga of Bitcoin. Let this week mark the beginning of another thrilling chapter as we rally around the resurgence of Bitcoin, ready to witness the phoenix soar once again.

Bitcoin Thoughts And Analysis

Bitcoin has finally broken through 50K, making a new high for this cycle and breaking through a key resistance. This is clearly on the back of ETF spot buying, which is very encouraging.

That said, there will ALWAYS be retracements and breathers. I am not sure how high this will go, I would never short or fade this move... but I will be watching for dips to buy and altcoin opportunities.

Target of the bull pennant hit. Incredible move, zero suspense. Still looking strong.

Hard to fade this move, but there’s significant bearish divergence with overbought RSI on multiple time frames.

4-hour shown.

Reasonable time for a breather?

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

There are a number of altcoin charts that are breaking out through descending resistance, a classical charting signal that I have used since day 1. This is extremely easy to spot. Here are a few quick examples, but that does not mean you should buy them now. I am showing you what to look for on tokens that have not broken out yet. If Bitcoin consolidates soon, altcoins should rage.

*I own ALL of these tokens.

Illuvium is breaking through descending resistance.

METIS breaking descending resistance and tracking the 50 MA

SHIB is breaking through descending resistance. Should be headed back to the range EQ.

UNKJD (I have owned this since it was MBS last cycle and added more recently) is breaking resistance on major volume.

Legacy Markets

US equity futures dropped in anticipation of an important inflation report, with expectations set for a CPI reading below 3% for the first time since March 2021. However, strong US economic indicators suggest that this might not hasten Federal Reserve rate cuts. Financial experts warn that the market may be overly optimistic about the timing of rate reductions, with some cautioning against premature Fed action and the possibility of rate hikes after the easing cycle. The bond market has adjusted its expectations, now forecasting fewer rate cuts in 2024 than previously anticipated. In premarket trading, Arm Holdings Plc surged, continuing its rally on AI spending optimism, while activist investor Carl Icahn took a significant stake in JetBlue Airways, deeming its shares undervalued. Michelin also saw a boost from positive earnings and a share buyback plan. Meanwhile, the pound strengthened as UK wage growth data supported a cautious approach to Bank of England rate cuts, and Asian markets, led by Japan, rebounded after recent declines.

Key Events This Week

Germany ZEW survey expectations, Tuesday

US CPI, Tuesday

Eurozone industrial production, GDP, Wednesday

BOE Governor Andrew Bailey testifies to House of Lords economic affairs panel, Wednesday

Chicago Fed President Austan Goolsbee speaks, Wednesday

Fed Vice Chair for Supervision Michael Barr speaks, Wednesday

Japan GDP, industrial production, Thursday

US Empire manufacturing, initial jobless claims, industrial production, retail sales, business inventories, Thursday

ECB President Christine Lagarde speaks, Thursday

Atlanta Fed President Raphael Bostic speaks, Thursday

Fed Governor Christopher Waller speaks, Thursday

ECB chief economist Philip Lane speaks, Thursday

US housing starts, PPI, University of Michigan consumer sentiment, Friday

San Francisco Fed President Mary Daly speaks, Friday

Fed Vice Chair for Supervision Michael Barr speaks, Friday

ECB executive board member Isabel Schnabel speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.3% as of 4:56 a.m. New York time

Nasdaq 100 futures fell 0.5%

Futures on the Dow Jones Industrial Average fell 0.2%

The Stoxx Europe 600 fell 0.2%

The MSCI World index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0766

The British pound rose 0.2% to $1.2653

The Japanese yen fell 0.2% to 149.59 per dollar

Cryptocurrencies

Bitcoin rose 0.7% to $50,202.35

Ether rose 1.7% to $2,677.62

Bonds

The yield on 10-year Treasuries was little changed at 4.18%

Germany’s 10-year yield was little changed at 2.36%

Britain’s 10-year yield advanced three basis points to 4.08%

Commodities

West Texas Intermediate crude rose 0.9% to $77.63 a barrel

Spot gold rose 0.3% to $2,026.47 an ounce

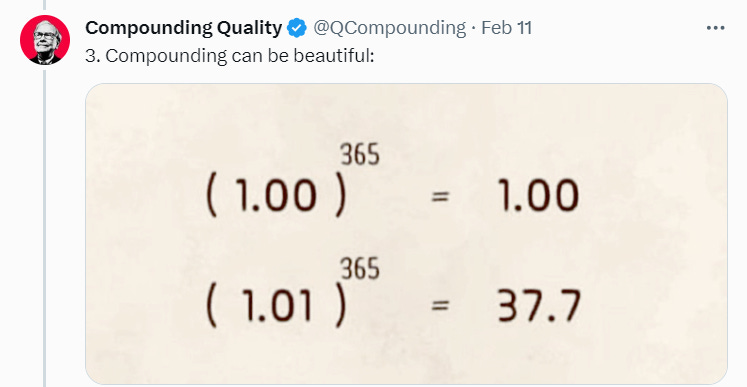

15 Timeless Investing Principles

If you have a few spare minutes, scroll through the thread I linked above. If you don’t, enjoy the highlights I picked out.

ERC-404 is Exploding

If you've ever interacted with the Ethereum network, you are probably familiar with ‘ERC20’ or at least recognize it. Essentially, ERC-20 is a set of rules that allows developers to create digital tokens on the Ethereum blockchain. Other variations include ERC-721, ERC-777, ERC-1155 etc.

I shared this information because, “a new, unofficial, and experimental Ethereum standard, ERC-404,” has emerged, offering promising utility. From my research, ERC-404 combines aspects of the popular ERC-20 and ERC-721 standards, enabling fractionalized ownership of NFTs.

While similar concepts already exist, ERC-404 distinguishes itself by allowing fractionalization across multiple wallets without a central governing entity. This innovation addresses previous limitations where fractional NFT holders had to align with centralized entities, marking a significant shift in decentralized ownership dynamics.

If ERC-404 proves to be effective and not just a passing trend, it holds the potential to offer smaller NFT investors improved access to high-value NFTs. This is particularly significant as it addresses the issue of companies acting as gatekeepers by issuing tokens to represent fractional ownership, which may not accurately reflect the fair value of the underlying assets.

If you're considering jumping into ERC-404, it's essential to understand that it's currently in a highly speculative phase. Pandora, the first token launched on ERC-404, went on a colossal run to $32,000 but has since retraced to $20,000, as of my last check. Additionally, for ERC-404 to become established, it needs to be introduced formally via an EIP, a process that will likely require some time.

ERC-404 presents a unique and innovative promise that Ethereum has been seeking, yet it also carries significant risks. It will be intriguing to monitor the evolution of this standard in the coming months.

Franklin Templeton Joins The Race

Franklin Templeton is now the eighth asset manager to file an S-1 registration statement and seek approval from the SEC for a spot Ethereum ETF. The complete list of filers now includes Franklin Templeton, BlackRock, Fidelity, VanEck, Ark and 21Shares, Grayscale, Invesco, Galaxy, and Hashdex. Notably, the filing includes Coinbase Custody Trust Company and the Bank of New York Mellon as custodians (a strong sign for COIN) and mentions the possibility of staking a portion of the fund's assets. If the Ethereum ETF is approved, not only will buying likely increase, but staking will also rise (pending approval), providing Ethereum's price with a serious catalyst. While Bitcoin may currently hold the torch, it would not be wise to underestimate the potential for substantial Ethereum gains.

Time To Buy Bitcoin | Fundamentals Suggest Massive Growth To $112K

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Trading Alpha - My new go-to indicator site and trading community. Use my link to sign up and get 10% off. Make sure to use code “TenOFF”

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.