Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Two Weeks Post Op

Bitcoin Thoughts And Analysis

Altcoin Charts - Weekly Levels

Legacy Markets

BlackRock Toots Its Own Horn

Arkham Intelligence Reveals 4 ETF Addresses

Crypto Crashes - When Will It Stop? (When To Buy The Dip)

Two Weeks Post Op

History was made exactly two weeks ago, when 11 spot Bitcoin ETFs were approved in a decisive three-to-two SEC vote. The approval, largely influenced by industry pressure, secured the vote of Chairman Gensler and opened the gates for Wall Street to finally join us.

We achieved our goal, but true to the unpredictable nature of the crypto space, the market has chosen to present us with a new set of challenges. As I curated the news for this newsletter, I observed three distinct stories, all related to ETFs. Recognizing their significance, I've chosen to highlight them up here, as I believe there are valuable takeaways. Let's delve into them.

Story One: The ETH ETF May Be Closer Than We Think

I'm unsure if this is widely known, but the votes in favor of approving the Bitcoin ETF were cast by Chairman Gensler, Commissioner Peirce, and Commissioner Uyeda, while Commissioner Crenshaw and Lizárraga voted against the approval. I highlight this because a recent interview with Commissioner Peirce suggests her inclination towards working on approving an Ethereum ETF.

Interviewer: If it was only the case that Bitcoin ETFs were approved from a court case ruling specifically from Bitcoin ETF applicants, does that mean in your reading does that need to happen for an ETH ETF approved?

Comissioner Pierce: That's not how we are going to do our approvals. As I have said, we need to apply regular way consideration to these products, the same kind of consideration we apply to similar products. We shouldn’t need a court to tell us that our approach is arbitrary and capricious for us to get it right. I certainly hope that won't be the case.

Additionally, given Commissioner Mark Uyeda's statement that "the applications satisfy the standards for approval" despite his concerns, the SEC might be one vote away from fully aligning with its mission and assisting applicants in refining their approval submissions.

I wouldn't recommend expecting an ETH ETF before the upcoming major deadline in May, but it does seem plausible during that timeframe. Moreover, with Bitcoin leading the way and managing the sell-off and associated expectations, the path for ETH's price may be smoother, now that investors have gained a better understanding of what to anticipate.

Story Two: Mt Gox Enters The Chat

Is it just me, or does the Mt. Gox conversation always make a comeback at the most inconvenient and random times? Recent reports indicate that former customers are now receiving emails requesting confirmation of their identity and account details. The email prompts customers to specify their preference for receiving repayments in either Bitcoin or Bitcoin Cash.

The exact amount of funds to be distributed remains uncertain, but expectations hover around 142,000 Bitcoin and 143,000 Bitcoin Cash. Additionally, there is an anticipated distribution of 69 billion Japanese yen ($510 million) by October 2024. If you are wondering what 142,000 BTC is worth, it’s approximately $4.5B.

Similar to Grayscale selling, predicting Mt. Gox selling cannot be anticipated in advance. While I wouldn't overly emphasize the negative implications, when coupled with relevant bearish narratives such as Grayscale, the impact could potentially be more significant. Leave it to Mt. Gox to rain on our parade from a collapse a decade ago.

Story Three: Don’t Trust TradFi Analysts

Normally, I avoid articles with titles like "Coinbase Stock Faces Downgrade from JP Morgan: What’s Next for Investors?" but against better judgment, I took the bait. The JP Morgan analyst downgrade of COIN seems to be grounded in inaccurate information related to the ETF. Here's a breakdown of what was stated.

“While it has only been ~1 week since launch, the initial net inflows into Bitcoin ETFs seems to be far less than the cryptocurrency community was touting in the financial media, and less than what we witnessed in the first week of flows into the Gold ETF when it launched in 2004.

We think much of the crypto-industry set a high bar for the ETF launches, and, while meaningful, we think expectations are simply too high and unrealistic.”

Here’s the refutation (GLD’s inflows):

2004: $1.5B

2005: $3.3B

2006: $4.8B

2007: $5.6B

2008: $11.2B

2009: $19.3B

2010: $14.8B

The analyst is wrong about GLD outperforming BTC, but right to say that the market is cooling off from expectations that were, “too high and unrealistic.” Frankly, nobody knew how the ETF would perform, but prices rising into approval did get their hopes up. One of the bottom signals I will be looking for is if more analysts label the ETF as a failure. Analysts are overestimating the short-term and underestimating the long-term.

In summary, the ETFs and the proxy discussions surrounding them have provided valuable insights. I don't foresee this decline extending beyond 30% for BTC, but that being said, crazier things have happened in crypto. The sooner the timeline turns mega bearish, the sooner it’s over.

The narrative of GBTC selling shouldn't be alarming for seasoned crypto investors – it's a scenario that shouldn’t warrant much more than a flinch. We all know that the selling will eventually taper off, and gradual purchases will likely restore us to our previous position. In my assessment, the next significant milestone is reaching the all-time high, and I anticipate we'll achieve that this year, even if we experience months of market fluctuations.

I stand by the fact that the ETFs have been a MAJOR success, and that anyone claiming otherwise is spewing misinformation.

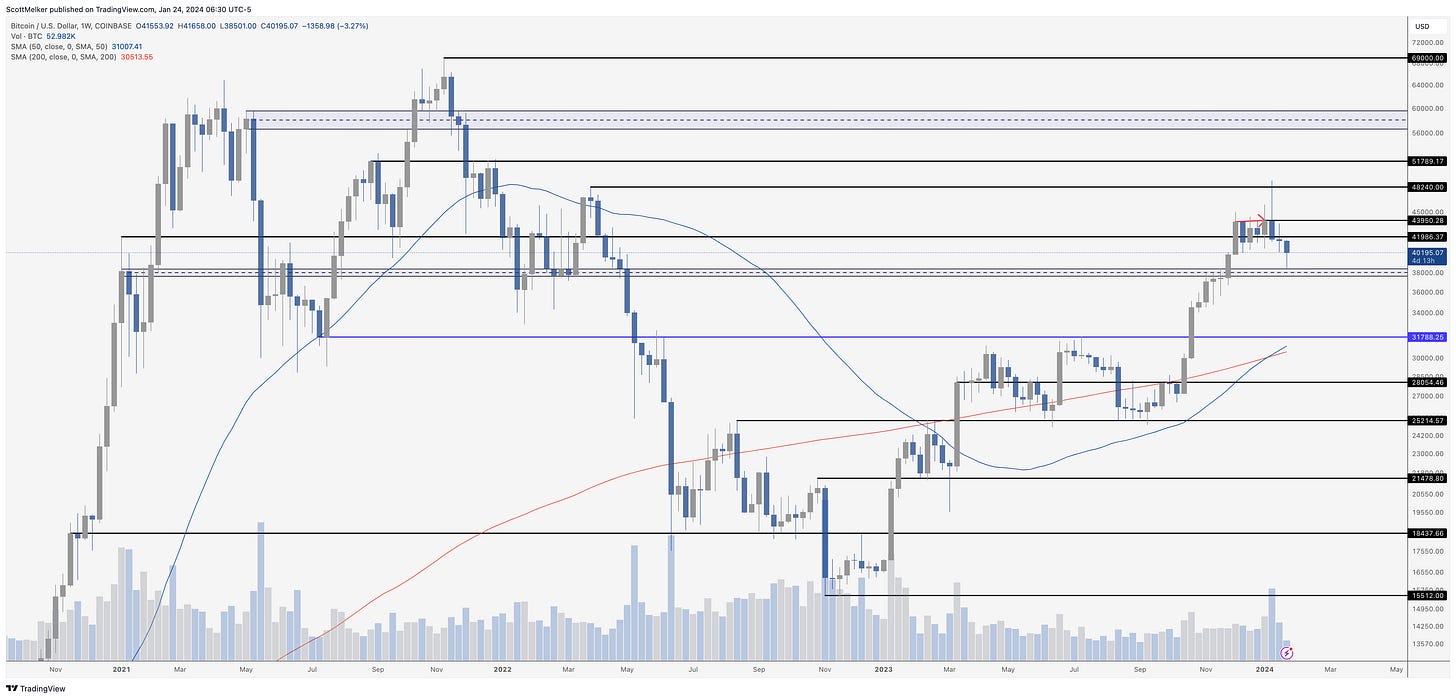

Bitcoin Thoughts And Analysis

Bitcoin bounced EXACTLY at the key support zone that I have been sharing for months. Remember, this was the key resistance on the way up, the area where the Luna crash happened.

Say it again with me - the most reliable indicator for finding tops and bottoms (even if temporary) is bullish divergence with oversold RSI.

We had this again on the 4-hour, it confirmed, and price quickly made its way back above $40,000.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Ethereum bounced perfectly off of key weekly support at $2159. Just like Bitcoin did above. This is the reason that I shared high time frame support and resistance a few weeks ago, to gives us really key areas where we could look for entries and exits.

Keep in mind, Larry Fink is about to push Ethereum and the spot ETF for the next few months, just like he did with Bitcoin in advance of the BTC ETF fight.

I still believe ETH is the "next big trade."

As you know from reading this newsletter, Injective was a leader in the altcoin rally, making a fresh new all time high before any other major coin. This is one of my largest holdings, still, even after selling some over the past few weeks. It has never come back down to test the previous all time high as support, at $25.31. I have NO IDEA if it is going to make it back down, or if support will hold if it does… but that is an area that I have bids to add a bit more to my position. A retest of a previous all time high as support is a great technical entry.

Legacy Markets

The stock market is experiencing a rally, mainly driven by strong earnings from tech companies. Netflix saw a significant premarket jump due to better-than-expected subscriber numbers, while other major tech firms like Tesla and IBM are set to report their earnings, contributing to positive sentiments.

In Europe, the technology sector is also booming, with ASML Holding NV leading the charge after reporting a tripling of orders. The focus on artificial intelligence is boosting companies like SAP SE, which announced a restructuring plan to enhance profitability.

Market optimism is further fueled by China's decision to stimulate its economy, leading to positive movements in commodity shares and the Hang Seng Index. Additionally, currency markets are active, with the yen strengthening against the dollar amidst expectations of Japan moving away from negative interest rates.

Central banks, including the Bank of Canada and the European Central Bank, are in focus as they hold policy meetings, with decisions likely to influence market directions.

The bond and currency markets are reacting to various economic data and policy expectations. The Euro-area is seeing a contraction in business activity, while UK data indicates inflation concerns. The dollar has weakened slightly, and US Treasury yields have dipped.

On the corporate front, the market is seeing mixed results. Companies like Siemens Energy and Infineon are making headlines for different reasons, ranging from strong quarterly performances to concerns over demand in sectors like industrial and automotive electronics.

In politics, former President Donald Trump's primary win in New Hampshire is causing speculation about future trade policies and their potential impact on various industries, particularly in Germany.

In summary, the market is currently buoyed by strong tech earnings and economic stimuli, but remains sensitive to monetary policies, currency shifts, and political developments.

Key events this week:

Canada rate decision, Wednesday

Eurozone S&P Global Services & Manufacturing PMI, Wednesday

US S&P Global Services & Manufacturing PMI, Wednesday

Eurozone ECB rate decision, Thursday

Germany IFO business climate, Thursday

US GDP, initial jobless claims, durable goods, wholesale inventories, new home sales, Thursday

Japan Tokyo CPI, Friday

US personal income & spending, Friday

Bank of Japan issues minutes of policy meeting, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.8% as of 9:26 a.m. London time

S&P 500 futures rose 0.4%

Nasdaq 100 futures rose 0.8%

Futures on the Dow Jones Industrial Average rose 0.1%

The MSCI Asia Pacific Index rose 0.8%

The MSCI Emerging Markets Index rose 1.1%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.3% to $1.0889

The Japanese yen rose 0.6% to 147.49 per dollar

The offshore yuan was little changed at 7.1643 per dollar

The British pound rose 0.3% to $1.2728

Cryptocurrencies

Bitcoin rose 2% to $39,995.62

Ether rose 1.7% to $2,240.07

Bonds

The yield on 10-year Treasuries declined three basis points to 4.10%

Germany’s 10-year yield declined four basis points to 2.31%

Britain’s 10-year yield declined three basis points to 3.96%

Commodities

Brent crude rose 0.7% to $80.08 a barrel

Spot gold rose 0.2% to $2,032.97 an ounce

BlackRock Toots Its Own Horn

Feeling skeptical about the success of the ETFs? Just look to BlackRock for reassurance – things are progressing positively. “By every measure, this launch has gone incredibly well. We have seen a groundswell of interest coming from many directions. When you look at volumes, flows, and how the product is trading, IBIT has traded over $3.5B since its launch and has done $1.6B in flows.”

When asked about an ETH ETF, this was the head of iShares answer, “We are constantly thinking about what our clients need and staying ahead of those needs. We will continue to be at the leading edge of innovation. It does not involve a straight path but that's what we are here for and love.”

Arkham Intelligence Reveals 4 ETF Addresses

Regardless of where you stand on the ethics of Arkham Intelligence, the good news behind leaks is that we can verify for ourselves that public companies have the Bitcoin they say they have. Thanks to an Arkham Intelligence sleuth, we now have on-chain locations of Bitcoin ETFs managed by BlackRock, Bitwise, Fidelity, and Franklin Templeton.

Here’s what was found: “The IBIT iShares Bitcoin Trust has about 28,620 BTC, which is estimated to be worth $1.16 billion. The Fidelity Wise Origin Fund has about 29,910 BTC holdings, valued at approximately $1.21 billion. The BITB Bitwise Bitcoin ETF with a holding of 10,150 BTC, valued at approximately $422.68 million. And the EZBC Franklin Bitcoin ETF holds 1,160 BTC, which is worth about $47.09 million.”

Crypto Crashes - When Will It Stop? (When To Buy The Dip)

Bitcoin and altcoins are crashing. Join my guest, David Duong, Head of Institutional Research at Coinbase, who will explain why we are experiencing this meltdown and what you can do to profit from it.

My Recommended Platforms And Tools

Trading Alpha - My new go-to indicator site and trading community. Use my link and get 2 months for FREE. Make sure to use code “25OFFBUNDLE”

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

How do I participate in DevE as a US citizen??

Scott, this newsletter is amazing, you put in so much work. I cannot believe it is free. You are an excellent writer. Your technical analysis sections are so valuable. This newsletter has become my secret weapon for crypto.