Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Buying The Dip

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

FTX Is To Blame

We Are Growing

Ordinals Are Here To Stay

Online Pastor Scams Congregants

Stocks Make All Time Highs - Can Bitcoin Follow? | Macro Monday

Buying The Dip

It’s impossible to know when the outflows from Grayscale will end.

It’s impossible to know if these outflows will find a new home as inflows.

It’s impossible to know the material impact of the spot ETFs on the market.

Regarding ETF capital flow dynamics, the list of ‘unknowns’ is infinitely long.

Technically speaking, we could find the average outflows from GBTC day-to-day, add up the inflows among the other funds, and make some predictions about when the selling stops, but does that really help us make definitive conclusions about the direction of the market?

Nobody knows how much of an impact GBTC selling is materially making on the market vs. the impact we perceive it is making. The same goes for ETF inflows, futures ETFs, options trading, hash rate growth, the halving countdown, legacy markets, the presidential election, and the current moon phase.

What I do know is how to act on a bull market dip and I can impart this knowledge to all of you.

The mantra in bull markets is straightforward, so let's say it together:

'Dips are for buying.’

‘Dips are for buying.’

and

‘Dips are for buying.'

Dip buying is indeed the most favorable opportunity a bull market can provide for investors. While deploying all your capital at the market bottom last January would have been an ideal outcome, expecting perfect timing isn’t feasible, and that time has already passed. What we can control, however, is taking advantage of the discount the market has provided us while the market structure is in a bullish phase. Opportunity is literally being handed to us on a silver platter.

From Bitcoin’s current high in this market cycle of $48,923, it is currently down about 18.7% and dropping.

From Ethereum’s current high in this market cycle, $2,712, it is currently down 14.38%.

From Solana’s current cycle high of $125.5 the asset is currently down 33.45%.

The challenge with these discounts is that some traders are reverting back to old habits. Bitcoin enthusiasts are eyeing $35,000 and $30,000, Ethereum holders are hoping for $2,000, and Solana investors are aiming for $75 and below. Personally, I've set bids at $75 for Solana, but my portfolio doesn’t hinge on it - I'm satisfied with my current holdings and don’t care if I fail to catch the knife. If you find yourself in a similar position, set your stink bids and walk away. However, if you're not content with your current portfolio, now is the time to start shopping in the market - not because it is definitely the bottom, but because it will inevitably trade higher at some point down the road.

The market is destined to encounter dips on the path to the halving; it's unavoidable. A brief glance at the charts reveals a consistent pattern in all previous pre- and post-halving cycles. Bitcoin tends to undergo multiple casual 10%, 20%, and 30% dips during the bull phases of the cycle, followed by swift recoveries. What distinguishes these dips is that each subsequent one typically becomes progressively more expensive to buy.

In other news, the Fear & Greed Index has nearly returned to a balanced center position. I wouldn’t hold my breath for 'fear,’ but I could definitely see it temporarily coming. Historically, high-teen percentage dips, at the minimum, have proven to be opportune times to commence shopping.

Some investors will be selective about the dips they choose to buy, satisfied with their current risk exposure, while others, like Michael Saylor, won’t think twice. Regardless, dips are objectively the optimal time to buy in a bull market, and attempting to time them is a risky way to revert to old habits.

I hope this introduction aids in choosing the option that aligns best with your needs. Occasionally, a gentle nudge or a bit of restraint is all it takes to pursue what we know is the best course of action that will still hesitate to act upon. Personally, I find that your continued readership keeps my discipline on track during moments of my own uncertainty about the optimal path forward.

Grayscale's outflows can't persist indefinitely, and in due course, it will become evident that the selling was, in fact, an optimal buying opportunity. By the time this realization unfolds, the markets will likely have already rebounded. That's why I'm proactively positioning myself ahead of this shift, anticipating its inevitable arrival.

Bitcoin Thoughts And Analysis

The dip keeps on dipping.

The good news? We were obviously prepared. I turned short term bearish early last weekend and my bias has not changed. Although it pains me to share negative analysis on Bitcoin, it is my duty to objectively share what I see. When price had the ugly weekly candle and wick up to $49,000, then continued to lose support and MAs on multiple time frames, downside became more likely than upside.

Everyone wants to know when the dip will end. Well, so do I! But we can take a look at key level and metrics that I always look for.

First, I would like to see daily RSI hit oversold after being overbought at the top with bearish divergence. Oversold is inevitable at some point, let’s get it over with. It is currently around 34 - oversold is 30. Second, I like seeing bullish divergence with oversold RSI on the 4-hour chart as a signal - we could get that soon. Third, I want to hear people saying that we are dead.

For now, we have a daily demand zone in the high $37,000s that I am watching. There are a number of supports levels between current price and here on multiple time frames as well.

You may remember that $38,600 was a key resistance on the way up, that the current area marks the zone where price crashed after LUNA.

Bottom line, there is a lot of support here. This area is very interesting. Below it, we start talking about $35,000 and $32,000 as ballparks.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

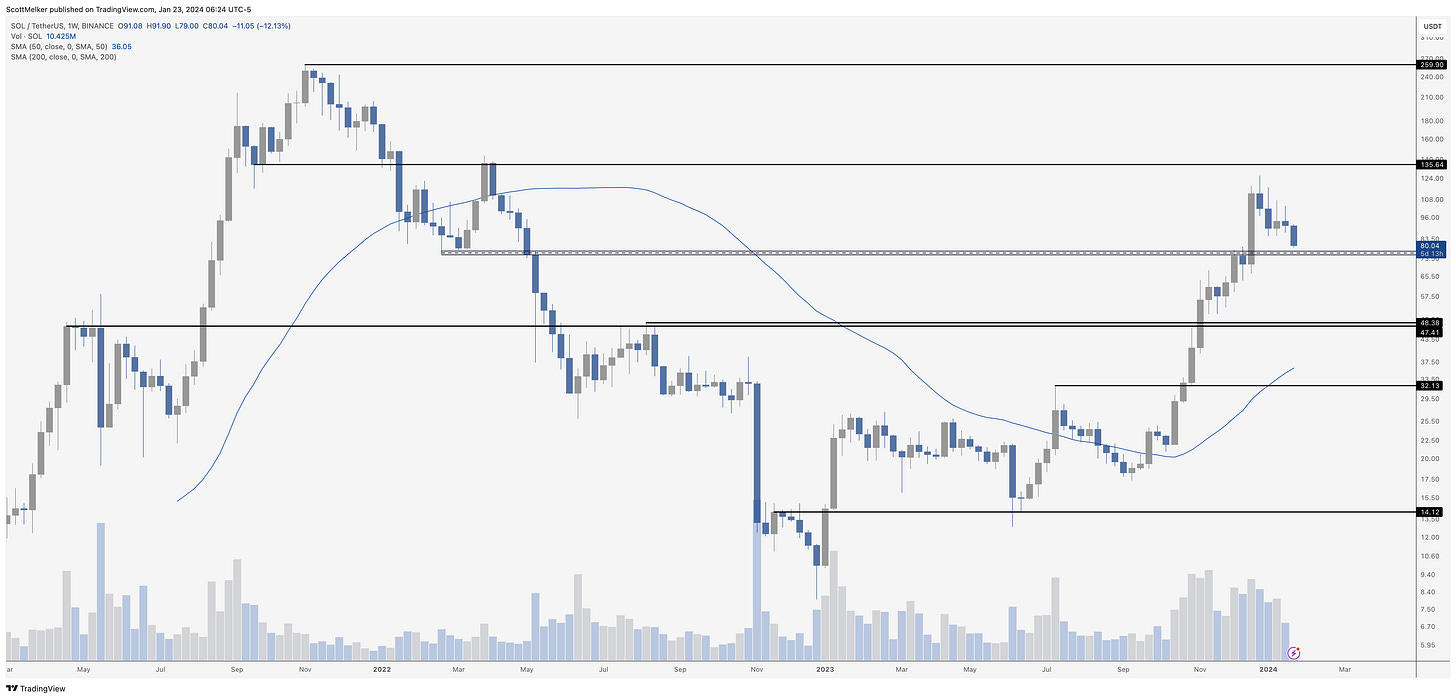

Since this chart was shared in the intro, I thought I would put it here as well.

As you can see, there is a major area of former resistance that I am watching to be tested as support around $76 (that zone, not that specific price). I have had bids here for weeks, even when Solana was still well over $100, which I have shared.

These may not fill, but it does show the important of setting low ball bids on assets you want positions in, just in case you get a major dip or a huge wick down into a key area.

I shared a number of charts with key weekly levels of support and resistance. You can revisit any of them and see where support now exists.

Legacy Markets

The stock rally experienced a pause as the market awaits a series of company earnings reports expected to shed light on the global economic outlook. Europe's Stoxx 600 index dipped slightly, influenced by the performance of commodity companies, while US equity futures remained stable following a record close. Key earnings reports are anticipated from major corporations such as Netflix Inc., Johnson & Johnson, Procter & Gamble Co., Tesla Inc., and Intel Corp.

In China, the stock market witnessed a rebound following reports of potential government intervention to stabilize the market. The yen saw an increase as the Bank of Japan (BOJ) indicated the possibility of a rate hike in April, signaling a shift in monetary policy.

The current earnings season is pivotal, with investors keenly observing company forecasts for consumer demand and profit margins in 2024. Notable movements in European stocks included declines in Ericsson AB and Swatch Group AG, with Ericsson anticipating a continued market downturn outside China and Swatch failing to meet projected sales records.

Central banks are under the spotlight, with the BOJ maintaining steady rates but hinting at a likely rate hike in the first half of the year, supported by increasing confidence in meeting its economic projections. Attention is also turning to the European Central Bank's upcoming meeting, with speculation on whether it will signal the beginning of policy easing.

Key events this week:

Eurozone consumer confidence, Tuesday

New Hampshire holds first-in-the-nation presidential primary, Tuesday

European Central Bank issues bank lending survey, Tuesday

Canada rate decision, Wednesday

Eurozone S&P Global Services & Manufacturing PMI, Wednesday

US S&P Global Services & Manufacturing PMI, Wednesday

Eurozone ECB rate decision, Thursday

Germany IFO business climate, Thursday

US GDP, initial jobless claims, durable goods, wholesale inventories, new home sales, Thursday

Japan Tokyo CPI, Friday

US personal income & spending, Friday

Bank of Japan issues minutes of policy meeting, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.3% as of 10:32 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.3%

The MSCI Emerging Markets Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0885

The Japanese yen rose 0.2% to 147.80 per dollar

The offshore yuan rose 0.3% to 7.1691 per dollar

The British pound rose 0.1% to $1.2726

Cryptocurrencies

Bitcoin fell 1.8% to $39,100.51

Ether fell 3.9% to $2,233.73

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.13%

Germany’s 10-year yield advanced two basis points to 2.31%

Britain’s 10-year yield advanced three basis points to 3.94%

Commodities

Brent crude fell 0.5% to $79.50 a barrel

Spot gold rose 0.3% to $2,026.78 an ounce

FTX Is To Blame

Grayscale’s fee structure is contributing to the outflow issue, but as per new data from Coindesk, the current market downturn can largely be attributed to FTX selling its 22 million shares of GBTC valued close to $1B. Fortunately, FTX has exhausted its GBTC holdings, but the damage has been done, leaving sentiment bruised. FTX, like other arbitrage traders, was evidently aiming to capitalize on the discount, and now we are feeling the repercussions of that trade. I believe this narrative won’t endure for long, mainly because it objectively can't. This suggests that we should soon shift to a new bearish narrative, or the market could bounce back. Given that we are in a bull market, I am leaning toward the latter, especially with the halving fast approaching.

Furthermore, think about this: Sentiment turns positive + spot buying increases + ETF inflows no longer muted by forced outflows = BIG UPSWING.

I can’t predict when this happens, but I can confidently say it will happen.

We Are Growing

Not only was 2023 a solid year for prices making a comeback, but engagement-wise, things were also looking up. Crypto.Com conducted a report on the growth in the sector, and the numbers are quite impressive.

“Global cryptocurrency owners increased by 34% in 2023, rising from 432 million in January to 580 million in December.

Bitcoin (BTC) owners grew by 33%, from 222 million in January to 296 million in December, accounting for 51% of global owners.

Ethereum (ETH) owners grew by 39%, from 89 million in January to 124 million in December, accounting for 21% of global owners.”

Ordinals Are Here To Stay

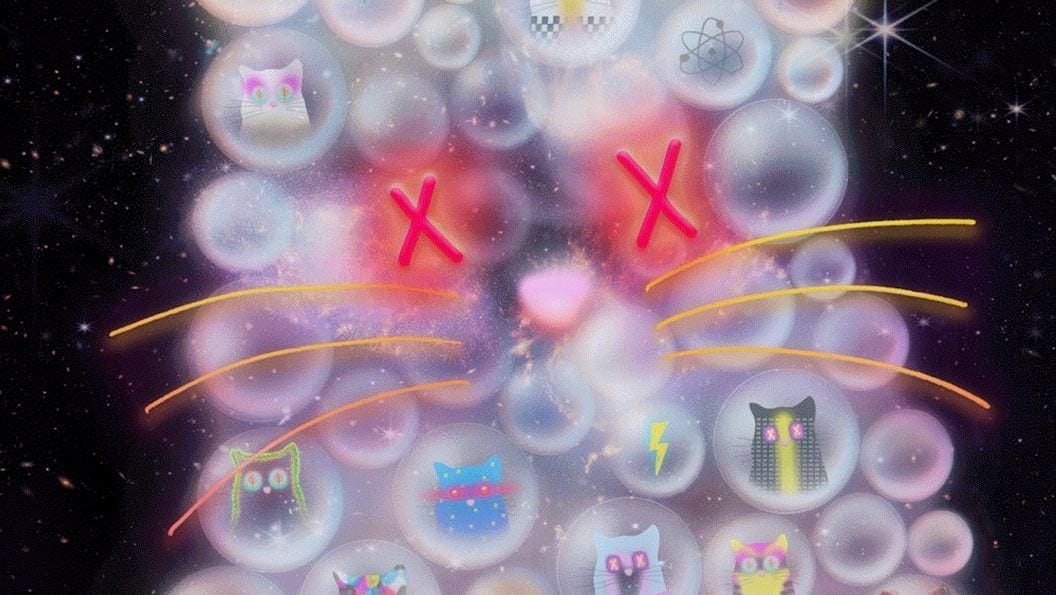

A Bitcoin ordinal auction at Sotheby’s sold 19 unique Bitcoin NFTs, totaling a staggering $1.1 million, with the standout being the single sale of ‘Genesis Cat’ fetching $254,000. What's even more impressive is that ‘Genesis Cat’ was initially expected to sell for somewhere between $15,000 to $20,000, surpassing expectations by over 12 times. The success of Ordinals in the NFT space doesn't mark the end of Ethereum NFTs by any means. If anything, it solidifies that the NFT space is just beginning to unfold, and collector interest remains.

Online Pastor Scams Congregants

If you had 'deranged pastor scams his virtual congregants' on your 2024 Bingo card, you can scratch that one off. Eli Regalado, an internet pastor from Denver, knowingly led his congregants into a scam, purportedly following the Lord’s advice, and managed to steal 3 million in the process. Eli somehow appealed to the Old Testament to convince his followers to buy into the scam. Instead of me explaining, read the quotes below directly from Pastor Eli.

“We launched an exchange, the exchange technology failed, things went downhill, and now we are waiting on the Lord for a miracle.

The charges are true. Half a million went to the IRS and a few hundred thousand went to a home remodel that the Lord told us to do.

He (the Lord) took us into a crypto, it turned out to be a scam, and the Lord said to give that to them and a 10x.

We were under the impression God was going to provide and the source was never-ending.

We sold a crypto with no clear exit. We are praying for a miracle in the financial sector.”

Stocks Make All Time Highs - Can Bitcoin Follow? | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Trading Alpha - My new go-to indicator site and trading community. Use my link and get 2 months for FREE. Make sure to use code “25OFFBUNDLE”

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Really good reminders on dip buying