Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Sponsored By DevvE

DevvE is a new exciting blockchain project and sponsor of The Wolf Den! DevvE has leading market technology which seamlessly connects Web2 to Web3 and a team of seasoned professionals with a proven track record.

The global ESG Market is $30 Trillion and growing, demand for reputable assets is far outstripping supply and there is currently no meaningful solution to account for the shortfall.

DevvE can easily provide developers with access to the fastest, cheapest and most flexible blockchain on the planet via their restful API which effectively allows the web2 world to utilize blockchain technology with zero knowledge or prerequisite smart contract experience. See more below.

🔥 DevvE is Capable of 8+ Million TPS

🔥 DevvE is 1/3 Billionth the Energy and CO2 of Bitcoin

🔥 DevvE is 1/10 Millionth the Cost of Ethereum

🔥 DevvE is a Compliant Sharding Solution

In This Issue:

We Won (ETFs Approved)

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

We Live In An Echo Chamber

X Confirms SEC Was Hacked

Are NFTs Dead?

The BIGGEST DAY For Crypto | Bitcoin Dumps And ETH PUMPS On Fake SEC ETF News (I’m Buying Altcoins)

We Won (ETFs Approved)

Hand us the belt, call us the champs, and give us our money - WE WON.

All of the emotions are hitting right now. All the feels.

The highs, the lows, the fake approvals, the real denials, the early release, the withdrawal, the error messages, the hack, the bad analysis and now the real thing. Did I miss anything?

Yesterday was a microcosm of all of the emotions that we've experienced in the past ten years, jam-packed into 24 hours. And today offers a glimpse into the future.

I hate to be petty, but one of the best parts of the yesterday was the heavy coping from Gary Gensler.

He isn't happy about the approval. See below.

Though we’re merit neutral, I’d note that the underlying assets in the metals ETPs have consumer and industrial uses, while in contrast bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware,[4] money laundering,[5] sanction evasion,[6] and terrorist financing.[7]

While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.[8]

He is so salty.

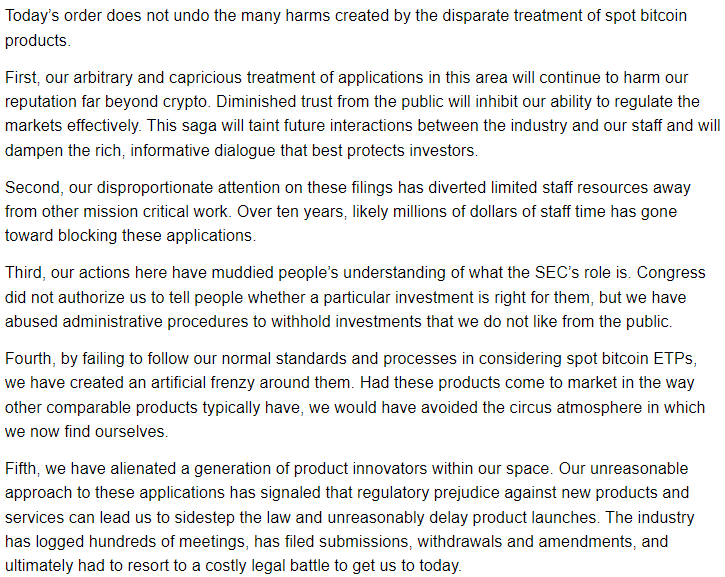

But he is not the only person of note at the SEC. Commissioner Hester Pierce once again showed we she is a hero to our industry.

Excuse my language, but her statement is F***ING AMAZING. Please take a moment to read this; it articulates everything I wanted to say, in the most eloquent manner.

What a legend.

In other “surprising” news, Ethereum completely stole the show in the most villainous way possible.

BTC/USD - Down (at first, no flat)

ETH/USD - Up

ETH/BTC - Up

Is Bitcoin's ETF approval the start of the Tour de Ethereum? If there is one thing that we know about crypto natives, it is that they love to search for the next narrative. ETH is the obvious choice, as I have been saying and writing about for months. The second the BTC ETF was approved, the community started looking to the ETH ETF on the horizon.

Ethereum could melt faces for the next few months, playing catch-up and then some. I'm uncertain, but what I do know is that the image below is poised to attract significant attention soon. My crystal ball is whispering Ethereum, as it has been for the past few months as it has slowly bottomed.

Ethereum is not the only thing that went up. Altcoins performed well vs. Bitcoin across the board.

Is there anything better than Gary Gensler finally approving 11 spot Bitcoin ETFs in the most unprofessional way, and then seeing altcoins going on a F**** YOU giga-run? Did Gary Gensler just spark “unregistered security (alt)” season by accident? He HATES these assets with a passion, and his actions on the ETF are causing them to rise.

My ADHD brain is spasming, if you can't tell, but how perfect is this?

Part of me wants to pump my fist in the air, while the other part yearns to step outside and enjoy some peace. The victory lap begins today as we observe the inflows and witness our win echoing for years to come. I am already seeing rumors that BlackRock has a couple billion lined up ready to go - today.

Congratulations to all of the investors who took on financial and reputational risk to be here; today is your day! And, of course, a huge thank you to all of you who stood by this newsletter when it seemed like the ETF was impossible and we were just barely holding on. This year is ours.

Bitcoin Thoughts And Analysis

I truly believe that the massive leverage flush last week on the Matrixport report and the fake news of the ETF approval two days ago took the wind out of the sails of the big news event - which is not a bad thing.

Altcoins stole the show, but the show is just beginning. Today should see around $4B in inflows into ETF products, a portion of which will likely need to be purchased on the open market to fill demand. The bulk is already purchased or will be Bitcoiners making a horizontal move into ETFs at the behest of the issuers who they have worked with.

Either way, this party is just getting started, and I anticipate a slow grind up for Bitcoin, with all of the volatility and major dips we have already gotten in the past.

For now, Bitcoin is barely up on the day and has not even made a new yearly high.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

I have been screaming about Ethereum for ages to anyone crazy enough to listen. There are countless reason why I believed that it was bottoming over the past few weeks and months, due to sentiment, fundamentals and technicals. My favorite indicators were all aligned - people saying the asset was “dead” that it would not have another cycle, that there was no use, that it was too expensive and slow, that only Solana mattered etc. All of this while it was hitting oversold on the weekly and forming bullish divergence, signals with 100% hit rate on Ethereum.

Here we are. The second we saw the ETF approved, the money flowed from Bitcoin into ETH and the surrounding ecosystem. We currently have a massive bullish engulfing weekly candle (not closed yet) with a huge wick through the last key support, all with RSI coming out of oversold and bullish divergence. RSI itself is working on a breakout through resistance, which I discussed yesterday. That almost always leads price if the breakout is successful.

All of the signals were there if one was able to remove their emotions and the noise.

This could fail, I could be wrong. But for now things are looking very good.

Here is the hourly chart.

The fake approval of the ETF two days ago showed us the way, as I said. Ethereum immediately went up on the fake news, which indicated that it would do the same on a real approval.

That's exactly what happened, on serious volume. We are now seeing follow through.

Beautiful.

Here is the ETH/USD weekly chart, which I have shared a few times before. As you can see, it broke resistance and retested it as support multiple times and now is pushing through another resistance, likely headed to around $3000 - the next key level.

Ethereum is a bellwether for the entire altcoin market. I think we see huge moves across the board.

Legacy Markets

Stocks saw modest gains as the market eagerly awaits the U.S. inflation report, crucial for shaping Federal Reserve policy. In Europe, the Stoxx 600 index increased by 0.4%, and U.S. equity futures showed similar trends. Asian stocks surged, with Japanese equities reaching a three-decade high. The dollar weakened against its major counterparts.

The upcoming U.S. inflation data is a pivotal factor for traders. A decrease in core inflation, as expected by economists, could reinforce hopes for Federal Reserve interest-rate cuts. However, higher than expected inflation could trigger market volatility.

In a significant development, the U.S. Securities and Exchange Commission approved exchange-traded funds (ETFs) that invest directly in Bitcoin, driving up cryptocurrency stocks in premarket trading. Bitcoin itself saw a modest increase, briefly reaching $47,000. This follows a 160% rise over the past year, partly in anticipation of these ETFs and a more relaxed monetary policy.

Japanese stock indexes have soared to a three-decade high, boosted by the yen's weakness and a new tax-free retirement savings program attracting more domestic investment. This rally reflects a shift in investor sentiment towards Japanese stocks.

The Treasury market is bracing for potential turbulence when the U.S. consumer price data are released. Bond traders have reduced their expectations for Treasury gains, and the swaps market indicates a lower likelihood of Fed rate cuts by March.

Federal Reserve Bank of New York President John Williams emphasized the need for more signs of economic cooling before rate reductions. His stance contrasts with earlier comments, suggesting a more cautious approach to rate cuts.

JPMorgan Asset Management suggests that the Fed might reduce interest rates more than currently anticipated as the U.S. economy slows, potentially fueling a rally in shorter-maturity Treasuries.

Oil prices increased due to ongoing tensions in the Middle East, and gold prices also saw an uptick.

Key events this week:

US CPI, initial jobless claims, Thursday

China CPI, PPI, trade, Friday

UK industrial production, Friday

US PPI, Friday

Some of the biggest US banks report fourth-quarter results, Friday

Minneapolis Fed President Neel Kashkari speaks, Friday

ECB chief economist Philip Lane speaks, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.4% as of 9:53 a.m. London time

S&P 500 futures rose 0.2%

Nasdaq 100 futures rose 0.4%

Futures on the Dow Jones Industrial Average rose 0.1%

The MSCI Asia Pacific Index rose 1.1%

The MSCI Emerging Markets Index rose 0.6%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0965

The Japanese yen rose 0.2% to 145.48 per dollar

The offshore yuan rose 0.2% to 7.1716 per dollar

The British pound was unchanged at $1.2742

Cryptocurrencies

Bitcoin rose 0.7% to $46,259.76

Ether rose 3.3% to $2,610.3

Bonds

The yield on 10-year Treasuries declined four basis points to 3.99%

Germany’s 10-year yield was little changed at 2.21%

Britain’s 10-year yield declined three basis points to 3.78%

Commodities

Brent crude rose 1.5% to $77.96 a barrel

Spot gold rose 0.4% to $2,032.45 an ounce

We Live In An Echo Chamber

Matt Hougan's insight serves as a compelling reminder of the importance of expanding our perspectives beyond the confines of Twitter. My guess is that 95% of everyday investors who don't engage with this platform lack a comprehensive understanding of the ETF or may not even be aware that it's approved. These investors are nowhere close to our level of enthusiasm.

This isn't to diminish the legitimacy of our excitement. On the contrary, it emphasizes three critical points: A) we are pioneers ahead of the trend, B) the broader world remains largely unaware, and C) Bitcoin transcends the significance of an ETF. If the public is still this clueless about a Bitcoin ETF, then it's safe to assume they know absolutely nothing about an ETH ETF.

X Confirms SEC Was Hacked

So, there appears to be no conspiracy theory behind this incident; instead, it was a straightforward hack. Astoundingly, the regulator in charge of consumer protection did not even use simple 2FA to protect their account - leading to a hack that moved market prices dramatically.

There is a pressing need for an investigation into the SEC and Gary Gensler. The public deserves an agency that is capable of basic security. There is no justification for the regulatory agency responsible for preventing market manipulation to inadvertently contribute to market manipulation.

Are NFTs Dead?

In yesterday's newsletter, I explored a segment on X's vision for 2024, emphasizing the central focus on a peer-to-peer payment system. Notably absent from that discussion were any mentions of NFTs; however, it seems that X has discreetly removed the option for paid members of the platform to use an NFT as their profile picture.

Currently, individuals who had an NFT set as their profile picture still retain hexagonal avatars, leaving uncertainty about whether their profile pictures will revert to the standard format. In brief, I believe that NFTs may be premature for companies seeking to experiment. While social interest may resurface in the future, for now, NFTs seem to be dormant.

The BIGGEST DAY For Crypto | Bitcoin Dumps And ETH PUMPS On Fake SEC ETF News (I’m Buying Altcoins)

What has happened with the SEC's Twitter account? Will Bitcoin ETF be approved today? What's going on with crypto? We will discuss all this and more with my guests: Eleanor Terrett (FoxBusiness), Haseeb Qureshi (Dragonfly) and of course, Chris Inks.

My Recommended Platforms And Tools

Trading Alpha - My new go-to indicator site and trading community. Use my link and get 2 months for FREE. Make sure to use code “25OFFBUNDLE”

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.