Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Introducing DevvE

I’m excited to announce that DevvE is the sponsor of today’s newsletter! DevvE is a legally compliant alternative to Bitcoin and Ethereum and addresses other coins’ most significant weaknesses - regulatory compliance, energy consumption, costs and speed. Once a week, I plan to feature DevvE and spotlight important information about them. There's no better way to kick off this series than by showcasing this brief YouTube video. Check it out!

In This Issue:

Opinions Are Like…

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Be Careful Of This New Tax Law!

Jim Cramer Capitulated

The Cointucky Derby Is Here

Bitcoin Is Pumping, Smashes $45,000 | Bitcoin Spot ETF Approval Today?

Opinions Are Like…

Two years ago, I compiled a list of predictions for 2022. Surprise! They proved to be largely inaccurate. Please find the predictions below for your amusement.

After this swing and miss, I sacked up and took another shot a year later. I tempered my optimism, and crafted a list of predictions in late 2022 for 2023. I hit a single. Maybe a double.

Because I have an asshole… I mean opinions, how about we take another swing and see if we can hit a home run? If I was too optimistic at first and too cautious the second time, let’s try to nail the sweet spot this time. Third time’s a charm.

Governments Take Interest In Bitcoin | Another Country Adopts Bitcoin | Institutions Feel FOMO | U.S Recession Is Possible, But Weak and Quick | Strong Mining Companies Rapidly Expand | A New Class Of Altcoins Removes Old Guard | Spot Bitcoin + Ethereum ETF Approved | Mid-curve Investors Underperform Short and Long End Investors | Flippening Doesn’t Come Close, But No Altcoin Surpasses ETH | New Crypto Use Case Resparks DeFi - Maybe Gaming or Prediction Markets | OG NFTs Begin To Return | Crypto Equities Exceed Expectations | The SEC Shows Signs Of Pivoting On Crypto | Bitcoin Begins Journey To $100K | ETH Begins Journey to $12K

I'm anxiously crossing my fingers, hoping I haven't just penned can list for everyone's amusement a year from now, but I am feeling confident. Some of these predictions seem like safe bets, such as the Bitcoin ETF approval and institutions succumbing to FOMO. We are already on the brink of these developments. The prospect of a country adopting Bitcoin, ETH securing a spot ETF, and the SEC showing signs of pivoting, seem contrarian, even within our own space.

These predictions are generally optimistic. I am more confident now that the sentiment is justified by the timing. I anticipate there may be some turbulent moments this year, as all bull markets undergo multiple steep sell-offs. Nevertheless, by avoiding panic selling and seizing opportunities for substantial gains, this year has the potential to crown those who have been patient with well-deserved success.

Yes, this is all good news, but what I want to highlight is the importance of making profit-taking a regular practice as things begin to align in our favor, instead of succumbing to the temptation of constantly adjusting our goals further. If circumstances unfold favorably, the contrarian approach this year entails striking a balance between cashing in profits during periods of heightened greed and holding steady during market corrections. This strategy, while the majority resist profit-taking and yield to downturns, (in my non-professional opinion) has the potential to bring substantial success.

As a team, it's crucial we do everything in our power to resist the temptation of succumbing and contributing to extravagant predictions as Bitcoin continues its upward trajectory. The most distracting noise to filter out is that which misguides investors at the upper levels in each cycle. To eliminate this distraction, my primary advice is to categorize your Bitcoin holdings into distinct portions: one portion for selling at a small profit, another for a moderate profit, and a segment reserved for ambitious profit targets. Additionally, set aside a portion of Bitcoin that you have no intention of selling if this fits into your preferences.

By organizing your holdings into these distinct portions, a probable outcome is that you've sold some Bitcoin at levels you were content with while retaining a portion for diversification. In the best-case scenario, you might have sold the majority of your Bitcoin, and if the market continues to surpass even your ambitious targets, you'll find yourself with a good problem on your hands. In 2024, disciplined and conviction-driven investors are likely to reap substantial rewards.

Last but certainly not least, avoid dwelling excessively on my predictions or your own. I engaged in this exercise mainly for enjoyment and as a lighthearted look back year-over-year. These predictions weren't the result of days of intensive analysis; instead, I approached them as a quick exercise. Ultimately, I firmly recognize that Bitcoin trends positively, and the future looks promising regardless of the specific twists and turns it may take.

2024 is our year, so let’s make the most of it.

P.S. Stay tuned for tomorrow's edition, where I'll share far more detailed predictions.

Bitcoin Thoughts And Analysis

Bitcoin appears to be dropping down to reset the pennant resistance as support.

Not worried about anything here, just normal price action. A successful reset would be quite bullish.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

One of my favorite setups is a "blue sky" breakout - when an asset makes a new all time high. When this happens, there is no resistance left on the chart! We saw this recently with Injective, and now we are seeing ARB make a new all time high.

For confirmation, we want to see a daily close above $1.82. Then the best entry is a reset of that level as support, if it comes.

Remember, no setup is certain, this can definitely fail. But it has easy invalidation if it stars closing candles back above that level.

Legacy Markets

Bonds continued their decline as traders anticipated a range of U.S. data that may validate expectations for interest rate cuts this year. Government debts across Europe fell and U.S. Treasury yields increased, with the rate on the 10-year bond rising by five basis points to 3.98%. The Stoxx 600 benchmark and U.S. stock futures saw a slight decrease. The dollar remained stable against its major counterparts after recording its largest daily gain since March.

This drop in bonds and stocks globally on the first full trading day was the most significant since at least 1999, leading to speculation about the Federal Reserve's easing plans. Upcoming Fed minutes, manufacturing data, and job openings data are expected to provide further insights. The market's reaction to this data, along with the upcoming U.S. nonfarm payrolls data, will help determine whether the current market trend is a significant shift or a temporary adjustment.

In Asia, attention is on Chinese tech stocks following reports that Beijing removed a top official from the gaming industry. This move might indicate an attempt to mitigate the impact of strict new regulations that caused a significant market downturn. Notably, Tencent Holdings Ltd. and NetEase Inc. managed to recover from earlier losses.

Bitcoin has shown strength for the fifth consecutive day, trading around $45,000. This uptrend is fueled by expectations that the U.S. will approve a direct investment exchange-traded fund for Bitcoin.

In the commodities market, oil prices remained subdued, reflecting the broader risk-off sentiment in the markets despite escalating tensions in the Red Sea.

Key events this week:

Germany unemployment, Wednesday

US FOMC minutes, ISM Manufacturing, job openings, light vehicle sales, Wednesday

Richmond Fed President Tom Barkin — an FOMC voter in 2024 — speaks, Wednesday

China Caixin services PMI, Thursday

Eurozone S&P Global Eurozone Services PMI, Thursday

US initial jobless claims, ADP employment, Thursday

Eurozone CPI, PPI, Friday

US nonfarm payrolls/unemployment, factory orders, ISM services index, Friday

Richmond Fed President Tom Barkin — an FOMC voter in 2024 — speaks, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.1% as of 9:05 a.m. London time

S&P 500 futures fell 0.1%

Nasdaq 100 futures fell 0.3%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index fell 1%

The MSCI Emerging Markets Index fell 1.1%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.1% to $1.0956

The Japanese yen fell 0.4% to 142.60 per dollar

The offshore yuan was little changed at 7.1516 per dollar

The British pound rose 0.2% to $1.2646

Cryptocurrencies

Bitcoin rose 0.3% to $45,260.83

Ether rose 0.3% to $2,374.01

Bonds

The yield on 10-year Treasuries advanced five basis points to 3.98%

Germany’s 10-year yield advanced three basis points to 2.10%

Britain’s 10-year yield advanced four basis points to 3.68%

Commodities

Brent crude fell 0.4% to $75.57 a barrel

Spot gold was little changed

Be Careful Of This New Tax Law!

As of January 1st, a new tax law, outlined in the Infrastructure Investment and Jobs Act that passed Congress in November 2021, impacts all crypto users in America. According to this legislation, individuals engaged in trade or business who receive $10,000 or more in cryptocurrency must report such transactions to the IRS within 15 days, with the risk of facing felony charges for non-compliance.

Though currently under appeal, this federal law mandates compliance from both businesses and individuals. If you're wondering about gray areas, such as who to report the money coming from in a block reward or DEX transaction, I am equally confused. My best advice is to seek legal counsel if you are uncertain. I don't anticipate this law remaining in its current form for long.

Jim Cramer Capitulated

It was a long time coming, and I expect some small flip-flopping in the future, but it appears that Jim Cramer has officially capitulated and bent the knee to Bitcoin. I wouldn't say he is now a laser-eyed maxi like some of us, but recognizing that Bitcoin “can't be killed” is a pretty steep feat for any bear to accomplish, especially hard-headed Jim Cramer. I think there is a chance a couple more names are crossed off the list this cycle i.e. Jamie Dimon, Warren Buffet, Nouriel Roubini, Elizabeth Warren, Brad Sherman, and Maxine Waters to name a few potential converts

We got that clearing event of SBF going down and that seemed to make people feel safe and then the ETF. Endless ETF. There will be an ETF. The people who are in it for that will use it as a chance to sell. This thing, you can't kill it. The late Charlie Munger who was brilliant was blind to this. It’s a reality and a technological marvel and people have to start recognizing it's here to stay. The SEC has been against it the whole time. That does not mean that every one of these is here to stay. This is a remarkable comeback that was unexpected. Except for all the bulls who turned out to be right.

The Cointucky Derby Is Here

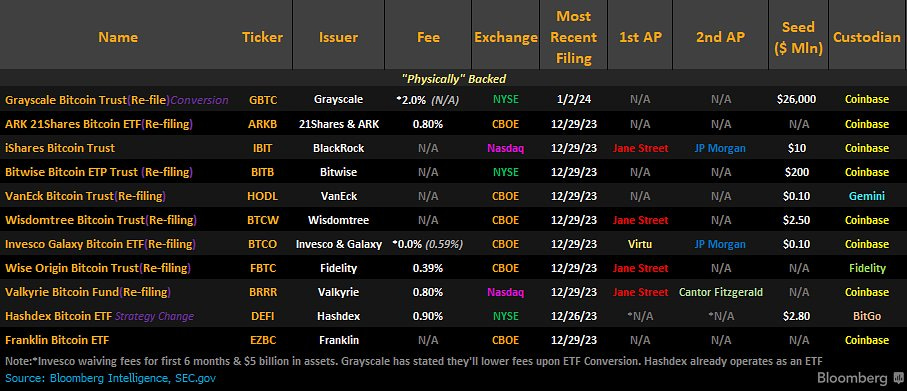

With additional details emerging, we are approaching a comprehensive understanding of the total seed capital required to fund the ETFs. While there are still some gaps that need filling, the current running total stands at $215.5 million, excluding the known $26 billion from Grayscale, equivalent to the market capitalization of GBTC that needs to be converted.

The clear standout in the image below is Bitwise, opting for a substantial $200 million in seed funding, a figure many magnitudes higher (20 times BlackRock’s size) than that of their competitors. Bitwise and Grayscale have not yet disclosed their authorized participants, so an upcoming announcement is eagerly anticipated. It will be interesting to see whether new names will be added or if JP Morgan and Jane Street will be retained.

Bitcoin Is Pumping, Smashes $45,000 | Bitcoin Spot ETF Approval Today?

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Trading Alpha - My new go-to indicator site and trading community. Use my link and get 2 months for FREE. Make sure to use code “2MONTHSOFF.”

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Great stuff Scott. Daily listener for a couple years now but really love the newsletter to watch along with. Great guests, great energy and just an all around great guy who I enjoy getting my alpha from. Thanks and Happiest of New Years to you, your family and all your awesome guests!