Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

All-Time Highs

Bitcoin Thoughts And Analysis

Altcoin Charts - Weekly Levels

Legacy Markets

Coinbase Introduces Project Diamond

Inflation Persists And Joe Biden Doesn’t Understand

The Volcano Bonds Are Coming

Bitcoin’s Fair Value Is Over $50,000 - And Will Double! l Mark Yusko

All-Time Highs

All assets experience all-time highs - it's inevitable in a bull market. Whenever price surpasses a prior peak, it establishes a new "all-time high."

Rather than focusing solely on Bitcoin's all-time highs, a more intriguing analysis lies in exploring the notable recoveries Bitcoin has undergone since its inception. Let's delve into some of these significant recoveries from the past.

Bitcoin Hit $20, Dropped to $2

Bitcoin Hit $1,150, Dropped to $178

Bitcoin Hit $19,700, Dropped to $3,250

Bitcoin Hit $68,569, Dropped to $15,850

These comprise the four most substantial corrections, excluding the very early price action below $1. Alongside these four, there exist additional declines that have erased noteworthy portions of the crypto market cap. However, for the present analysis, we will focus on these four to derive certain conclusions.

These drops amounted to 90%, 84.5%, 83%, and 76.5%.

In each instance, Bitcoin rebounded from the correction and surged to new highs. How much did it rise after returning to the pre-crash price? 5,560%, 1,613%, 248% and ___%

Think about that. AFTER RECOVERING back to the price where the crash started, it continued to rise by these astounding numbers. And the unknown percentage at the end? We haven’t even begun discovering it. This will be a slow process – in the past, it has taken as long as 4 years.

I tried asking ChatGPT about the next number in a sequence using different question formulations but consistently received different answers for identical queries. To simplify things, let's resort to the old-school method of intuition—a skill the ‘ChatGPT generation’ might never acquire because of AI. Yes, I just coined that generation.

Intuitively, when contemplating the minimum potential for Bitcoin after surpassing its current all-time high, it's difficult for me to believe that Bitcoin sees anything less than an 80% increase before the end of the cycle.

Given the current cycle marks the first instance of active institutional participation, my optimism exceeds that of past cycles. While I don't expect an extravagant increase like 500%, considering Bitcoin's substantial growth as an asset, I've outlined a few potential outcomes below.

An 80% increase from $68,569 is $123,424.2.

A 100% increase from $68,569 is $137,138.

A 120% increase from $68,569 is $150,851.8.

A 150% increase from $68,569 is $171,422.5.

I understand what you might be thinking... Scott, are you suggesting that $100,000 is inevitable this cycle? Well, to that, I'd say the answer is essentially 'yes.' With just a 45.82% gain needed from the all-time high, and considering the dynamics of this market, it could be accomplished in just a few promising weeks.

So, what happens at the point Bitcoin is +80% (my magical number) from its current all-time high? Is this the end, or is this the first leg to 100%, 120%, and 150%? The decision on whether to sell doesn’t become much easier, whether you have been around for 6 months or 6 years. There are so many unknowns.

The good news? We are armed with the principles and knowledge that we have learned over the past few years. We know that the simplest strategy is scaling out slowly, having patience, and being content with profit-taking. Our big moment is coming and it will be a wild ride. Embrace the moment and put into practice everything you have worked on. You are not alone – I will be right here with you.

Bitcoin Thoughts And Analysis

Bitcoin has been correcting, as anticipated after printing multiple bearish divergences with overbought RSI.

That said, the key resistance on the chart was the blue zone, drawn from the LUNA collapse, which I have discussed ad nauseam. Is it a surprise to see that area retested as support? Not at all.

When will it end? Nobody knows, but technically it looks like it should continue to bounce here at the top of support or just dip slightly lower into that blue zone to give us the lower time frame bullish divergence discussed yesterday.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Remember the weekly levels that I have been sharing? Here are a few examples of why they are important… just pictures, not links, because they were linked last week. You can see that almost every big move was stifled as a large time frame resistance, for now.

ADA/USDT

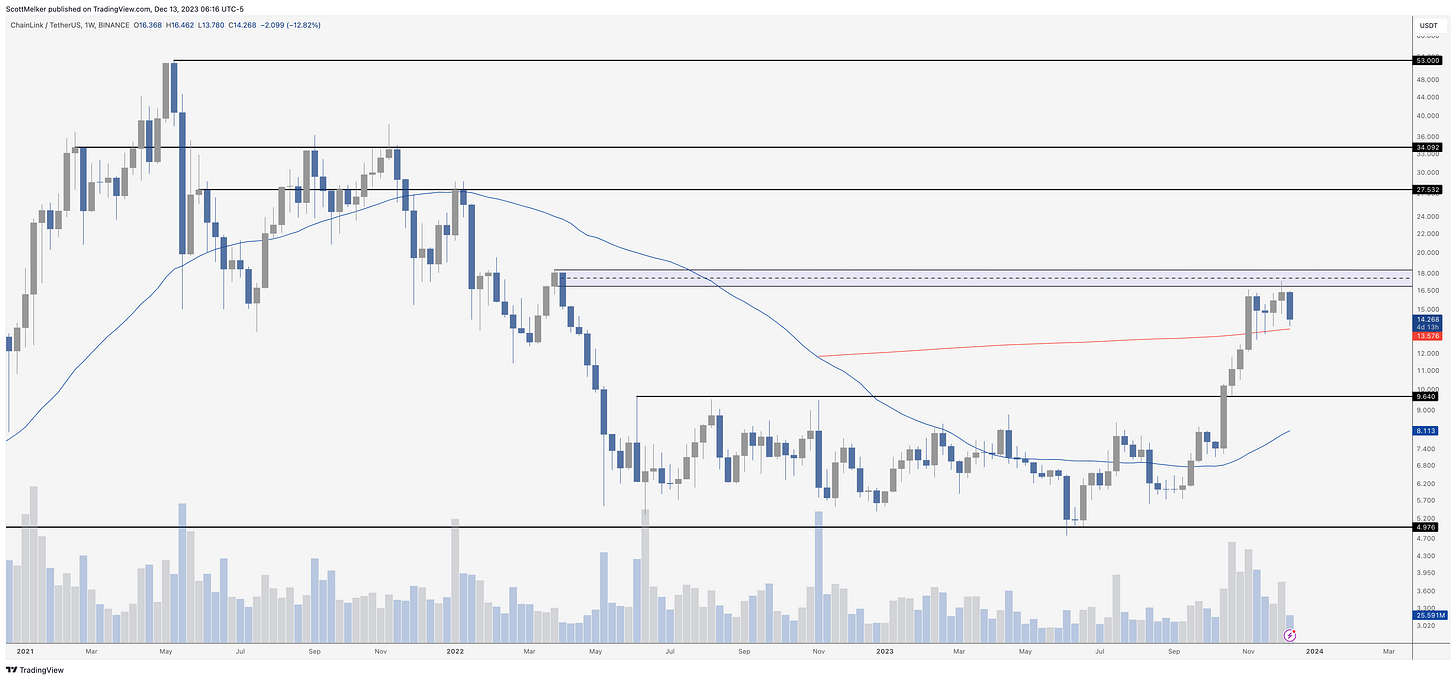

LINK/USD

MATIC/USDT

SOL/USDT

Legacy Markets

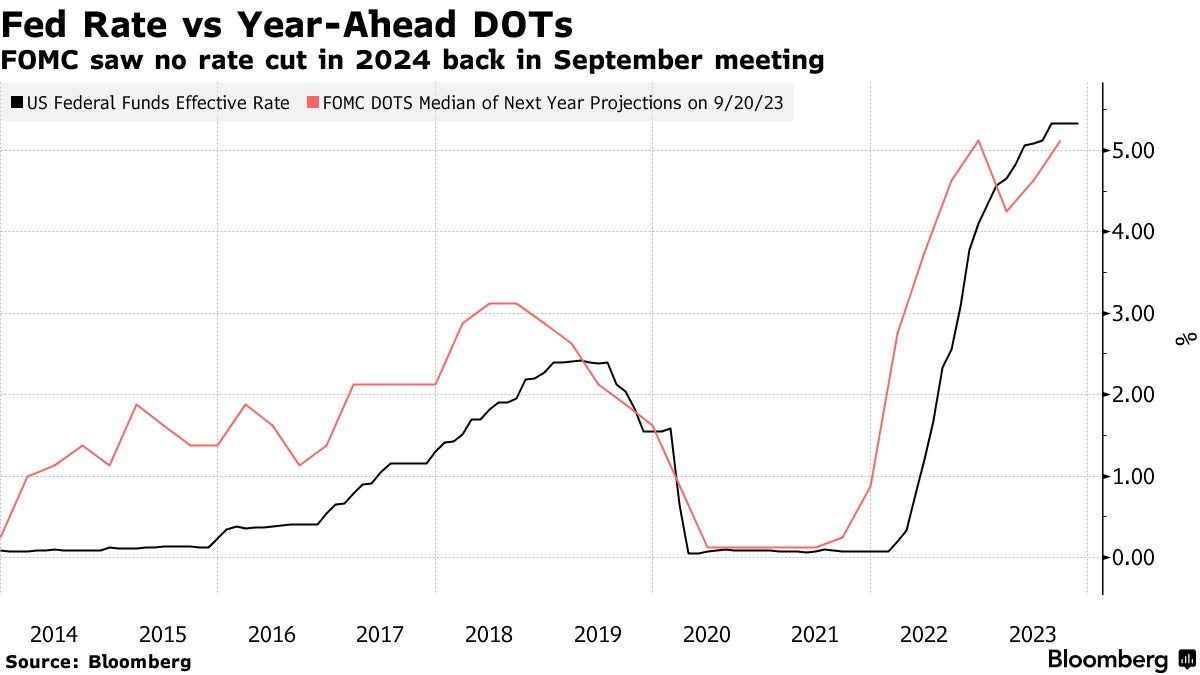

Stock markets have exhibited small movements in cautious trading, with investors' attention focused on the Federal Reserve’s upcoming interest-rate decision. There's a general anticipation for any indications from Chair Jerome Powell that expectations for policy easing might be excessive.

The Stoxx 600 index in Europe saw a slight increase, with notable gains in companies like Inditex SA. In the U.S., S&P 500 and Nasdaq 100 futures pointed to modest gains, though Tesla Inc. saw a premarket drop after recalling vehicles due to safety concerns.

In the UK, the pound weakened and bond prices rose as economic data showed a more significant contraction than expected in October, leading to increased speculation about potential rate cuts by the Bank of England next year. Meanwhile, the dollar and U.S. Treasuries edged higher.

The focus is on the Fed's final policy meeting of 2023. While it's widely anticipated that the Fed will hold rates steady, recent U.S. inflation data has raised doubts about an aggressive shift towards policy easing. The market's disagreement with the Fed's inflation outlook is expected to result in some resistance from Powell, but no significant change in direction is anticipated.

The S&P 500 closed at its highest since January 2022, as Treasury yields have fallen on speculation of a significant rate cut by the Fed next year, although market bets on this easing have been slightly reduced.

The Fed's stance remains data-dependent, with expectations for the central bank to maintain its target rate range unchanged at 5.25% to 5.5% for the third consecutive meeting. Traders will be keenly watching Powell's signals on future policy paths and the Fed's updated quarterly forecasts.

In Asia, Chinese stocks led regional declines following a top leadership meeting that fell short of investor expectations for strong economic support measures. This came after China's annual economic work conference, which focused on industrial policy with little indication of large-scale stimulus.

In Argentina, the peso was devalued by 54%, and spending cuts were announced as part of President Javier Milei’s economic revival plan. The central bank now targets a 2% monthly devaluation of the currency.

Oil prices continued to fall, reaching a five-month low, amid signs of abundant supplies. Gold remained relatively stable as investors awaited the Fed’s rate decision.

Key events this week:

US PPI, Wednesday

Federal Reserve policy meeting and news conference with Chair Jerome Powell, Wednesday

European Central Bank policy meeting followed by news conference with ECB President Christine Lagarde, Thursday

Bank of England policy meeting, Thursday

Swiss National Bank policy meeting, Thursday

US initial jobless claims, retail sales, business inventories, Thursday

China 1-yr MLF rate and volume, property prices, retail sales, industrial production, jobless rate, Friday

Eurozone S&P Global Manufacturing PMI, S&P Global Services PMI, Friday

US industrial production, Empire manufacturing, cross-border investment, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.2% as of 10:27 a.m. London time

S&P 500 futures rose 0.1%

Nasdaq 100 futures rose 0.1%

Futures on the Dow Jones Industrial Average rose 0.1%

The MSCI Asia Pacific Index fell 0.3%

The MSCI Emerging Markets Index fell 0.5%

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.2% to $1.0777

The Japanese yen fell 0.2% to 145.80 per dollar

The offshore yuan was little changed at 7.1958 per dollar

The British pound fell 0.4% to $1.2515

Cryptocurrencies

Bitcoin rose 0.1% to $41,136.5

Ether was little changed at $2,170.02

Bonds

The yield on 10-year Treasuries declined one basis point to 4.19%

Germany’s 10-year yield declined three basis points to 2.20%

Britain’s 10-year yield declined seven basis points to 3.90%

Commodities

Brent crude was little changed

Spot gold was little changed

Coinbase Introduces Project Diamond

Coinbase is committed to attracting institutional involvement in the cryptocurrency space, and Project Diamond serves as a prominent example of this dedication. Within the framework of Project Diamond, Coinbase will leverage smart contracts specifically crafted by institutions for use with institutions. These smart contracts will allow institutions to create, buy, and sell digital assets within the institutional landscape.

As stated in the blog announcement, “the initial use cases will be for registered institutional users outside the U.S. only.” To me, this suggests a keen interest in eventually introducing Project Diamond to the U.S. market at a later, opportune moment. Below, I've included a couple of paragraphs that provide a more detailed explanation of the initiative. Kudos to Coinbase once again for their ongoing efforts.

Today, less than 0.25% of total global assets are represented on blockchain infrastructure, leaving massive efficiency gains uncaptured. Our goal is to close this gap by enabling institutional use of next-generation financial technology. Project Diamond is a platform to create, buy, and sell digitally native assets leveraging the power of the Coinbase technology stack and Base, an Ethereum layer-2 blockchain.

Coinbase Asset Management is building Project Diamond to enable a future where institutions can create, distribute, and manage a wide range of digitally-native assets directly on-chain. On our journey, we seek world-class partners to join us in imagining and creating the future of the global financial system. Together, we will make finance scale-like software.

Inflation Persists And Joe Biden Doesn’t Understand

According to the latest report from the Labor Department on Tuesday, the consumer price index increased by only 0.1% from October to November. In comparison to the same period the previous year, prices showed a 3.1% rise in November, slightly lower than the 3.2% year-over-year increase recorded in October. If that seemed unclear... ahem... Joe Biden, the monthly rate suggests an increase from the October figure, while the annual rate indicates a further decline after reaching 3.2% just a month prior.

The screenshot provided above has to be one of the most noteworthy community notes on Twitter, ever. And for those curious, I took a screenshot of the prediction from the CME FedWatch Tool below.

The Volcano Bonds Are Coming

After over 2 years, El Salvador's Volcano Bond has at last secured regulatory approval and is expected to be issued in the first quarter of 2024. These bonds are slated to be available on Bitfinex Securities, a regulated arm of the crypto exchange Bitfinex, with a targeted fundraising goal of $1 billion, assuming the original target is maintained. I believe the performance of the bond will serve as a significant indicator of the market's trajectory in 2024. Wishing the best for El Salvador.

Bitcoin’s Fair Value Is Over $50,000 - And Will Double! l Mark Yusko

Investing legend Mark Yusko joins to discuss his thesis that fair value of Bitcoin is over $50,000 - and will double at the halving!

My Recommended Platforms And Tools

TAP - A super-powered money app—an all-in-one investment, money, and trading platform. Coming to the U.S. soon, with tons of bonuses. Click HERE.

Trading Alpha - My new go-to indicator site and trading community. Use my link and get 2 months for FREE. Make sure to use code “2MONTHSOFF.”

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

#1 I have followed you on YouTube for approx 3 years but have now started following your "free newsletter" & I would review this newsletter as a 10/10. Thank you for creating this. It is very organized, gives me the info that I want & I can obv see you put a caboodle of time into this thing. Thank you for making it.

#2 The only thing I can throw in there that would be helpful to me is possibly throwing in the info of what coins you actually hold*. I know you hold BTC, Etc & Matic from watching your YouTube videos. But possibly giving out a number in terms of % of your portfolio would be super helpful to me (ex. 80 % BTC, 20 % Eth) possibly other people (if it's even legal to do so lol).