Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

TAP is a super-powered money app—an all-in-one investment, money, and trading platform coming to the U.S. very soon. Not far from now, a waitlist will be opening that offers enticing bonuses for new sign-ups. New customers will receive a random figure between $0 to $100, and you will also be automatically entered into a sweepstakes for a chance to win $5,000. More details are coming, when TAP goes live, you won't want to miss it!

In This Issue:

Mama Didn't Raise No Fool

Bitcoin Indecision

Stocks Down, Gold Up

87% Of Bitcoin Is In Profit

CZ Could Face 10 Years In Prison

President Milei Vows To Close The Central Bank

You Can Earn 6% Yield On USDC

Binance And CZ's Shocking Guilty Plea - What It Means For Crypto's Future!

Mama Didn't Raise No Fool

He who asks is a fool for five minutes, but he who does not ask remains a fool forever.

Some corners of the internet attribute this quote to Confucius, while others insist it originated on Pinterest. Regardless of where it came from, I love this quote because it perfectly encapsulates the essence of embracing the initial discomfort of seeking knowledge.

I've lost count of how often I've felt foolish since entering the crypto space, and it's especially challenging because anyone who puts their thoughts out there is constantly under a spotlight.

Lost access to funds? Yeah. Confused public keys for private keys? Yes. Left funds on a bankrupt exchange? Yup. Traded emotionally? You bet. Stumbled through basic facts on live TV? Unfortunately. Believed SBF? Duh. Expected immediate transaction confirmation on the blockchain? Been there. Bought the wrong token? Done that too. Made a million mistakes in this newsletter? You have seen them.

For goodness' sake, back in 2017, we all believed the floodgates for institutional involvement in crypto were about to swing wide open. Yet, here we are, and the arrival of a Bitcoin spot ETF is neither here nor guaranteed.

I can't tell you how many times I have felt like a fool in this space… but there was always a silver lining.

I learned.

I suppose the direction I'm heading with this intro involves sharing a few pieces of advice for the upcoming bull market. How have I come by this knowledge? Through ample moments of being the fool and falsely basking in the glow of feeling like a genius.

I learned.

My first piece of advice for traders and investors in this upcoming bull market is to swallow your ego as soon as possible and for as long as possible. Ideally, if you can maintain this humility indefinitely, that's great. At the very least, aim to keep it until you sell and are no longer at risk of experiencing FOMO by re-entering near the market's peak.

Ego is the subtle voice in your mind attempting to shield you from being the brief fool. Resist its influence as much as possible.

My second piece of advice, similar to the first, is to continue seeking discomfort. On a practical level, this means trying out new wallets, exploring web3, considering staking, and delving into unfamiliar aspects of the crypto space. Embracing discomfort in these areas not only expands your knowledge but also hones your adaptability in an ever-evolving market.

While predicting what comes next may be impossible, embracing discomfort keeps us ready for the future when it comes.

My third and final piece of advice is to stay disciplined. I know that it can be really tempting to rev up the risk engine when the bull market takes off, but resist the temptation and stay in the gear you are most comfortable in. If aggressive trading aligns with your strengths (consider this carefully), then stay in overdrive. For everyone else, guard against letting wins inflate your confidence.

The true test of discipline lies in adhering to it when everything is going right.

In essence, shed your ego, embrace discomfort, and maintain discipline. This approach not only enables you to keep asking crucial questions but also ensures that being a fool is only a temporary state. Many of us have already paid our 'fool' dues, and while it's true that we may never completely cease the payments, now is the time for us to seize control. The dues may linger, but our time to thrive is here.

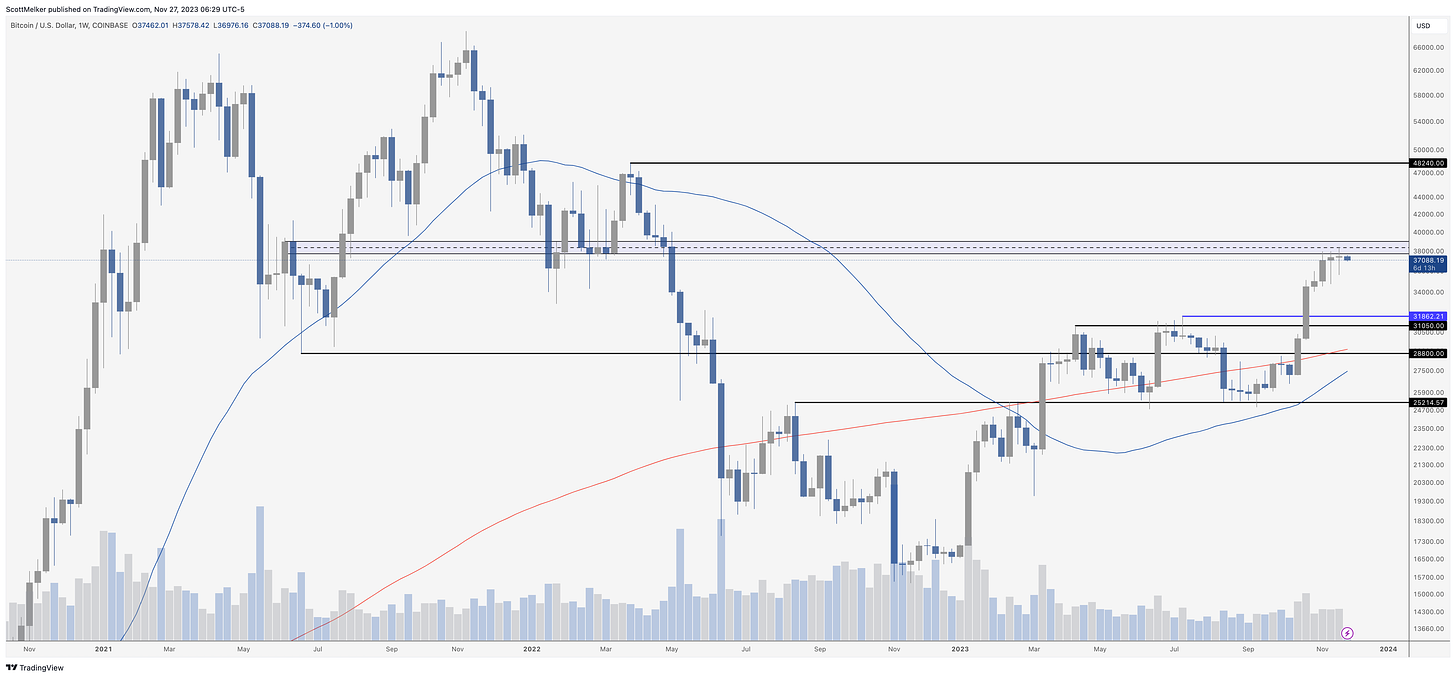

Bitcoin Indecision

The word of the day for Bitcoin is indecision. The past few weekly candles have closed within a few hundred dollars of $37,000 - the last two have also opened there. Both of the past two candles have made higher lows with long wicks down, showing that there is still buying demand in this area. That said, the doji candles show that neither side is winning - a clear signal there is no real reason to be trading in this area.

$38,000 remains the key area of resistance.

Stocks Down, Gold Up

The stock markets edged lower and gold rose above $2,000 as recent data highlighted a significant slowdown in China's industrial profits, underscoring concerns about the fragility of its economic recovery. The Stoxx 600 index dropped by 0.3% and Nasdaq futures by 0.2%, while the yield on 10-year Treasuries increased to its highest level in over a week. This downturn reflects heightened investor caution, further emphasized by a sharp rise in gold prices to a six-month high. Upcoming economic data releases, including euro-zone inflation, China PMIs, and US personal consumption figures, are expected to offer insights into the potential trajectory of markets. Despite the recent dip in the VIX index, a common measure of market volatility, the outlook remains cautious with limited fundamental reasons for optimism. In the earnings sphere, upcoming reports from companies like Crowdstrike Holdings and Salesforce are anticipated to highlight trends in cybersecurity and corporate spending. This market wrap also notes that gold's gains have been bolstered by weakening US economic data, fueling expectations of potential rate cuts by the Fed in the upcoming year. Meanwhile, oil prices continue to decline as the market anticipates the outcomes of the forthcoming OPEC+ meeting.

Key events this week:

European Central Bank President Christine Lagarde appears in parliamentary committee, Monday

Australia retail sales, Tuesday

NATO foreign ministers meet, Tuesday

US Conf. Board consumer confidence, Tuesday

Fed Governor Chris Waller, Chicago Fed President Austan Goolsbee speak at different events, Tuesday

Australia CPI, Wednesday

Reserve Bank of New Zealand policy decision, Wednesday

Eurozone economic confidence, consumer confidence, Wednesday

Bank of England Governor Andrew Bailey speaks, Wednesday

US wholesale inventories, GDP, Wednesday

Fed releases its Beige Book of regional economic activity, Wednesday

Cleveland Fed President Loretta Mester speaks, Wednesday

China non-manufacturing and manufacturing PMIs, Thursday

Eurozone CPI, Thursday

US PCE deflator, Thursday

OPEC+ meeting, focused on finalizing output levels for 2024, Thursday

China Caixin manufacturing PMI, Friday

Eurozone manufacturing PMI, Friday

UK S&P Global/CIPS Manufacturing PMI, Friday

US construction spending, ISM Manufacturing, light vehicle sales, Friday

Fed Chair Jerome Powell, Chicago Fed President Austan Goolsbee speak at separate events, Friday

Some key moves in markets:

Stocks

The Stoxx Europe 600 fell 0.3% as of 10:09 a.m. London time

S&P 500 futures fell 0.2%

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average fell 0.3%

The MSCI Asia Pacific Index fell 0.3%

The MSCI Emerging Markets Index fell 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0949

The Japanese yen was little changed at 149.30 per dollar

The offshore yuan fell 0.2% to 7.1645 per dollar

The British pound was little changed at $1.2602

Cryptocurrencies

Bitcoin fell 0.7% to $37,352.38

Ether fell 1.4% to $2,045.3

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.49%

Germany’s 10-year yield was little changed at 2.65%

Britain’s 10-year yield was little changed at 4.28%

Commodities

Brent crude fell 1.2% to $79.65 a barrel

Spot gold rose 0.6% to $2,013.31 an ounce

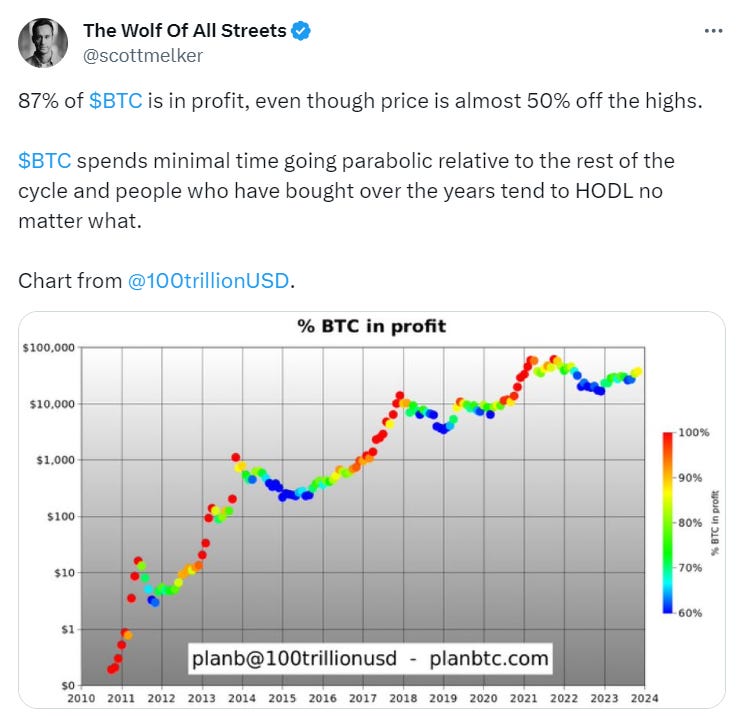

87% Of Bitcoin Is In Profit

I shared this image on Twitter initially but thought it was worth revisiting here with further elaboration. It's an intriguing phenomenon that nearly 87% of existing Bitcoins are currently in profit, yet Bitcoin itself is only 54% of the way to reaching its all-time high. What adds to the peculiarity of this phenomenon is that a relatively small number of us are overall profitable on our Bitcoin positions—odd, isn't it? The reasoning is that the majority of Bitcoin purchases occur during parabolic price runs, usually when the price is nearing its peak. These windows are typically brief, and it often takes years for the prices to return to those highs. Furthermore, this phenomenon is a result of Bitcoin ownership not being evenly distributed among all investors. A handful of ‘whales’ possess significantly more Bitcoin than the majortiy of smaller investors, often referred to as ‘shrimp,’ and many of these whales are very early adopters.

CZ Could Face 10 Years In Prison

It would be a disheartening development for the crypto space if CZ were to face a 10-year sentence in a U.S. federal prison. Currently, CZ is free in the U.S. and is awaiting sentencing scheduled for February 23, 2024. However, the unusual circumstance of this case, CZ turning himself in, is creating a unique layer of judicial complexity.

Judge Richard A. Jones is set to determine today whether CZ can return to the UAE until the sentencing. The primary concern of the prosecutors stems from CZ's wealth, citizenship, and family all residing in a non-extradition country, amplifying the apprehension about him potentially being labeled a 'flight risk' by the U.S. government.

The following paragraph is a note from the prosecutors:

“The defense claims that Mr. Zhao faces merely a ‘brief’ sentence and has no incentive to flee. The reality is that the top-end of the Guidelines range may be as high as 18 months, and the United States is free to argue for any sentence up to the statutory maximum of ten years.”

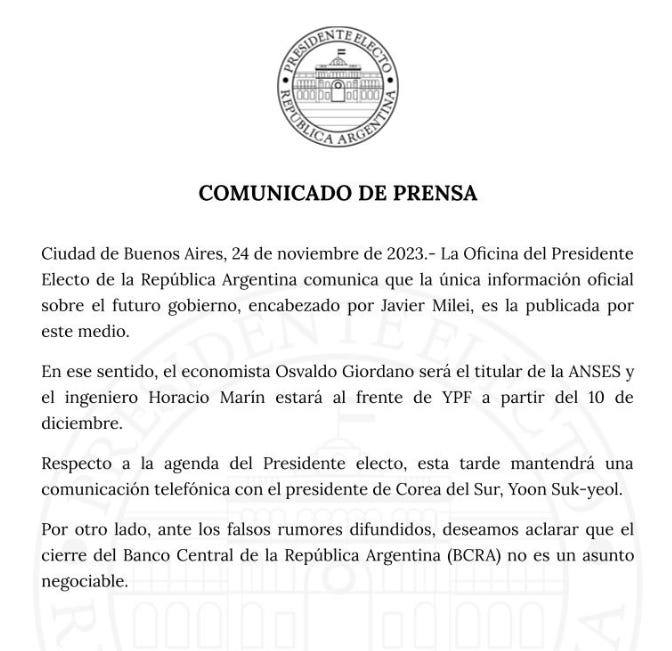

President Milei Vows To Close The Central Bank

Is Argentina's president initiating the first steps toward adopting a Bitcoin standard? I can't say for certain, but what I do know is that President Milei is a wildcard, and if anyone is on the verge of embracing Bitcoin, he is a plausible candidate. Interestingly, approximately 10% of the world's countries do not use their own currency, and Argentina holds a world record with 9 defaults. Given Argentina’s longstanding monetary struggles, the idea of the country taking another risk and adopting Bitcoin doesn't seem radical. President Milei's announcement was made in Spanish, so here's the English version: "On the other hand, given the false rumors spread, we wish to clarify that the closure of the Central Bank of Argentina is not a negotiable thing."

You Can Earn 6% Yield On USDC

Coinbase recently increased its USDC yield from 5% to 5.05%. However, did you know that subscribing to Coinbase One elevates the yield to 6%? Priced at $30 per month or $360 annually, for the subscription to be worthwhile, an individual would need to hold approximately $36,000 USDC on the platform, justifying the subscription cost based on USDC yield alone. While there are additional benefits, I wanted to highlight this aspect for those for whom it could be a deciding factor. It's important to note that other assets also experience boosted yields, but there are limits. For instance, with USDC, the elevated rate applies only to the first $250,000. Additionally, it's worth considering that these rates are not permanent, so it's advisable to capitalize on them while they last.

On another note, although ETH staking might not seem appealing at the moment, when the bond market cools off, we all know what is coming. Consider yourself warned.

Always understand that WITH ANY YIELD COMES RISK.

Binance And CZ's Shocking Guilty Plea - What It Means For Crypto's Future!

CZ and Binance have both pleaded guilty - what will it mean for the market? James Murphy (MetaLaw Man), Joshua Frank, and Christopher Inks join to discuss.

My Recommended Platforms And Tools

TAP - A super-powered money app—an all-in-one investment, money, and trading platform. Coming to the U.S. soon, with tons of bonuses. Click HERE.

Trading Alpha - My new go-to indicator site and trading community. Use my link and get 2 months for FREE. Make sure to use code “2MONTHSOFF.”

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Fine advice. . . Thanks Scott!