Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

TAP proudly sponsors this newsletter! While TAP is not yet available in the United States, anticipation is building. Once live, TAP will be offering a $5k prize to a randomly selected whitelist participant and a special welcome gift ranging from $0 to $100 for all new users.

In Europe, TAP stands as a fully functional crypto exchange with over 200,000 users, a selection of more than 40 assets to choose from, and availability in over 45 countries. TAP allows you to take back control of your finances - the all-in-one investment, money, and trading app.

In This Issue:

The Trip To Endgame

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Henry Ford Proposed A Currency Similar To Bitcoin

Did BlackRock Attack Stablecoins?

This Major Gaming Company Is Buying More Crypto

Disney Launching NFT Platform

SOL to $150? What Coin Will Pump Next?

The Trip To Endgame

With the increasing likelihood of a spot ETF approval, speculation has arisen suggesting that an ETF could pose a significant threat to Coinbase and other exchanges, essentially becoming a direct competitor in transaction volumes.

I don't believe or support this idea for a second.

To put this ridiculous notion to rest, I found research directly from Coinbase Institutional titled “Why an ETF Matters.” Would Coinbase go as far as arguing the benefits of an ETF if they secretly opposed its approval? No, and furthermore, Coinbase makes some really strong points I haven’t heard from anyone else regarding the spot ETF.

Let’s get into it.

For starters, let’s quickly recap the current ETF approval window that everyone is looking at right now.

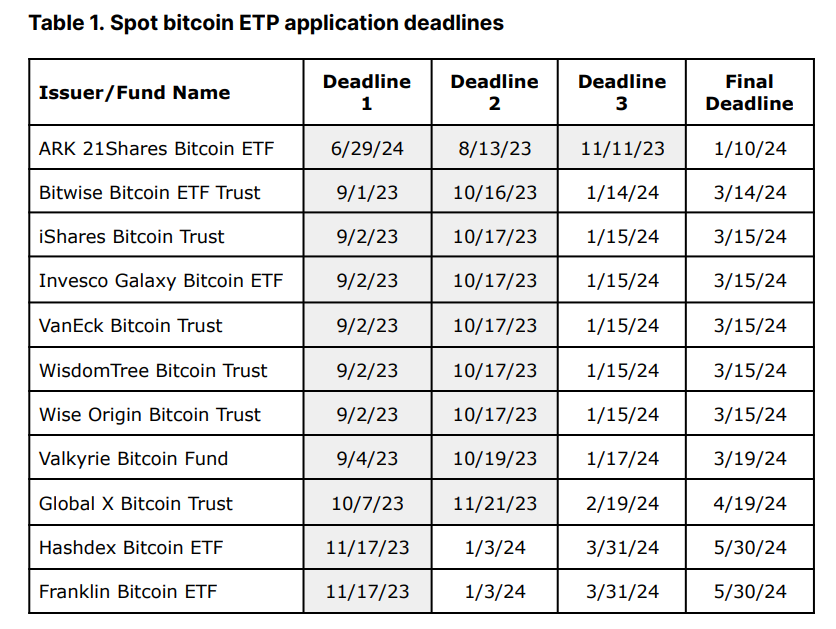

As you may already know, ARK 21Shares Bitcoin ETF has a final deadline on 1/10/24. This creates a very high chance the SEC will approve multiple or all ETFs on this deadline to avoid additional lawsuits and being labeled a ‘kingmaker.’

Now we can move to the research.

Coinbase’s research begins with a section titled, “All that glitters is not gold,” in which the case is made that the launch of gold ETFs was NOT the defining catalyst that fundamentally changed the gold market. This might come as a surprise to my readers because ,I along with many others, have drawn parallels between gold’s ETF launch in the past to Bitcoin’s upcoming ETF launch. But Coinbase has a different idea. “Whether it’s gold or bitcoin, granting users access is undeniably important. However, what drives flows are the narratives that reinforce the unique characteristics of these assets in the context of changing market conditions.”

Coinbase acknowledged that GLD did attract meaningful inflows in its first year, but stated that there is more to the equation (characteristics and narratives) than just the vehicle itself.

For the most part, I am going to skip Coinbase’s discussion of why Bitcoin characteristically is different from gold. We already know that story. What I am going to share is Coinbase’s long-term view on what the ETF means for Bitcoin. This is where things get good, and where the question of ‘why’ begins.

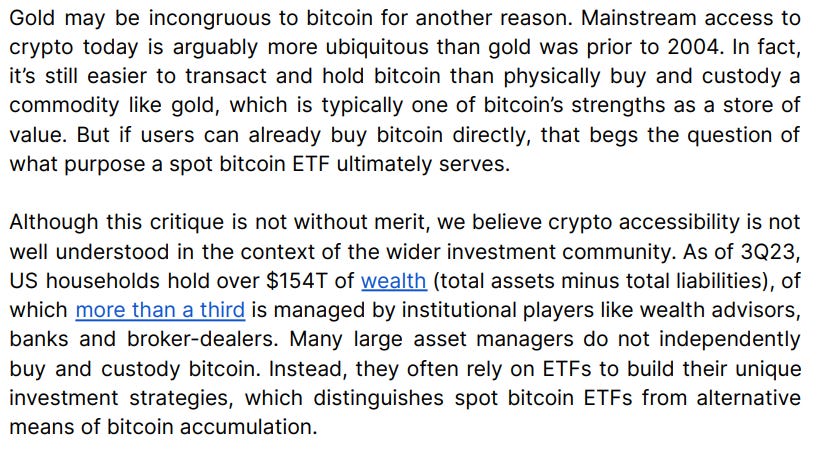

$154T of wealth, of which more than a third is managed by institutions that are preparing to push Bitcoin products… let that soak in as Coinbase continues…

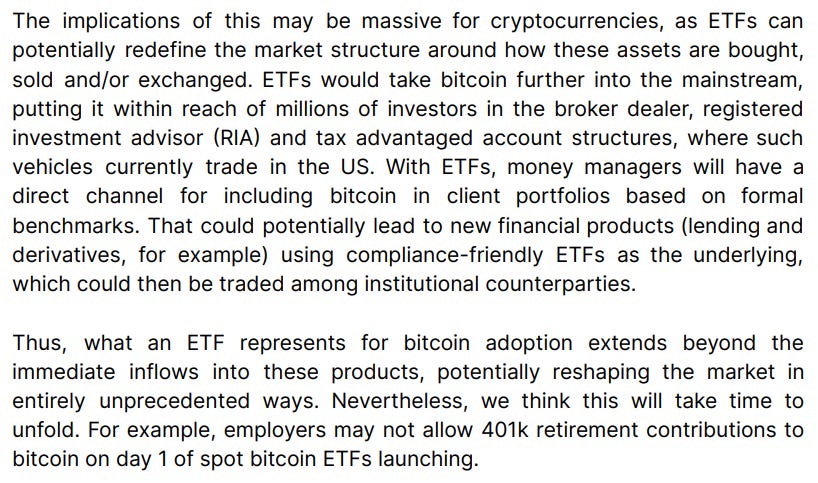

“New financial products” is the key. Bitcoin is slowly going to find its way into 401k’s IRAs and all sorts of vehicles because of the spot ETF. But here comes the best part...

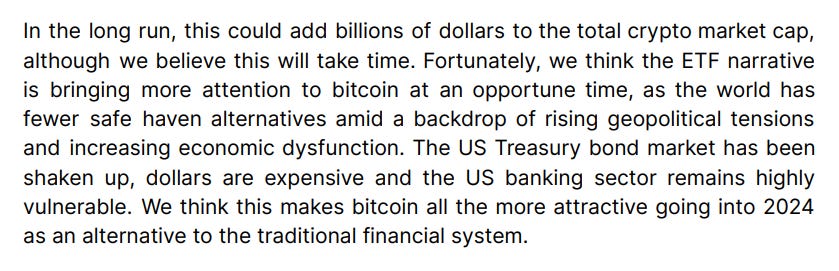

In essence, Coinbase argues that the Bitcoin ETF facilitates the development of narratives surrounding the asset, ultimately serving as the driving force behind Bitcoin. This, according to Coinbase, is the key reason why an ETF matters. Coinbase is not concerned with week one inflows or Bitcoin’s appreciation vs. gold, because, in the grand scheme of things, neither of those events matter.

GLD didn’t truly shine until a few years after its inception in 2008. In comparison, Bitcoin has yet to witness a narrative as compelling, while a spot ETF offers accessible and credible entry points. This could be years away. Coinbase clearly cares about more than just the vehicle; it’s always been about where the vehicle takes Bitcoin. In short, a spot ETF is far from endgame, it’s merely accessible transportation to the starting line.

- I am taking the rest of the week off, see you all on Monday!

Bitcoin Thoughts And Analysis

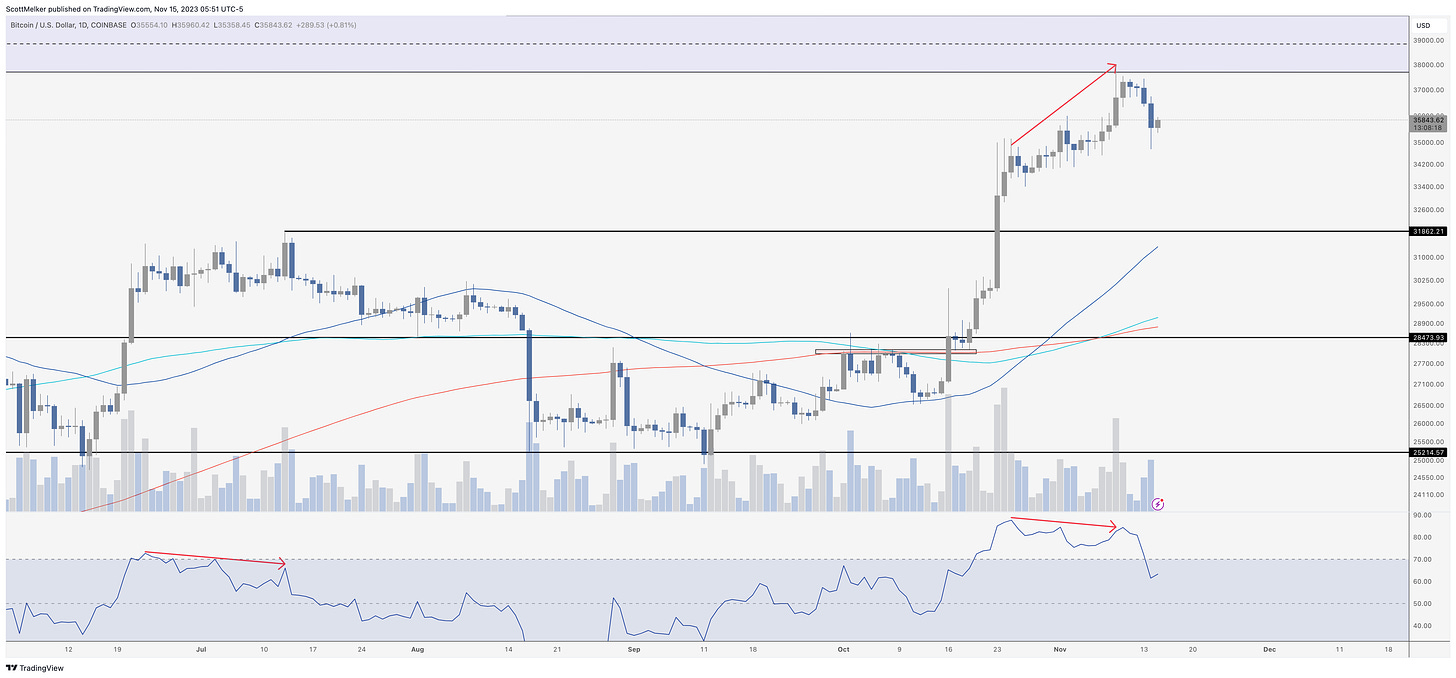

The bearish divergence on the daily chart with wildly overbought RSI has finally showed its teeth, prefacing a drop to roughly $34,700. It ALWAYS does eventually. Technically the divergence is still valid, although al elbow up on RSI today (or any day around this price) will likely print hidden bullish divergence. This was a nice reset of most indicators, which we want to see on any move up.

$38,000 is going to be a tough nut to crack, for all of the reasons I have discussed before.

RSI is already oversold on the 4-hour chart, so you know that I will be looking for bullish divergence there to signal the bottom of this correction.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Altcoins bounced hard, showing continued strength and validating the bullish trend. Nothing has really changed. Enjoy this bullishness while it lasts!

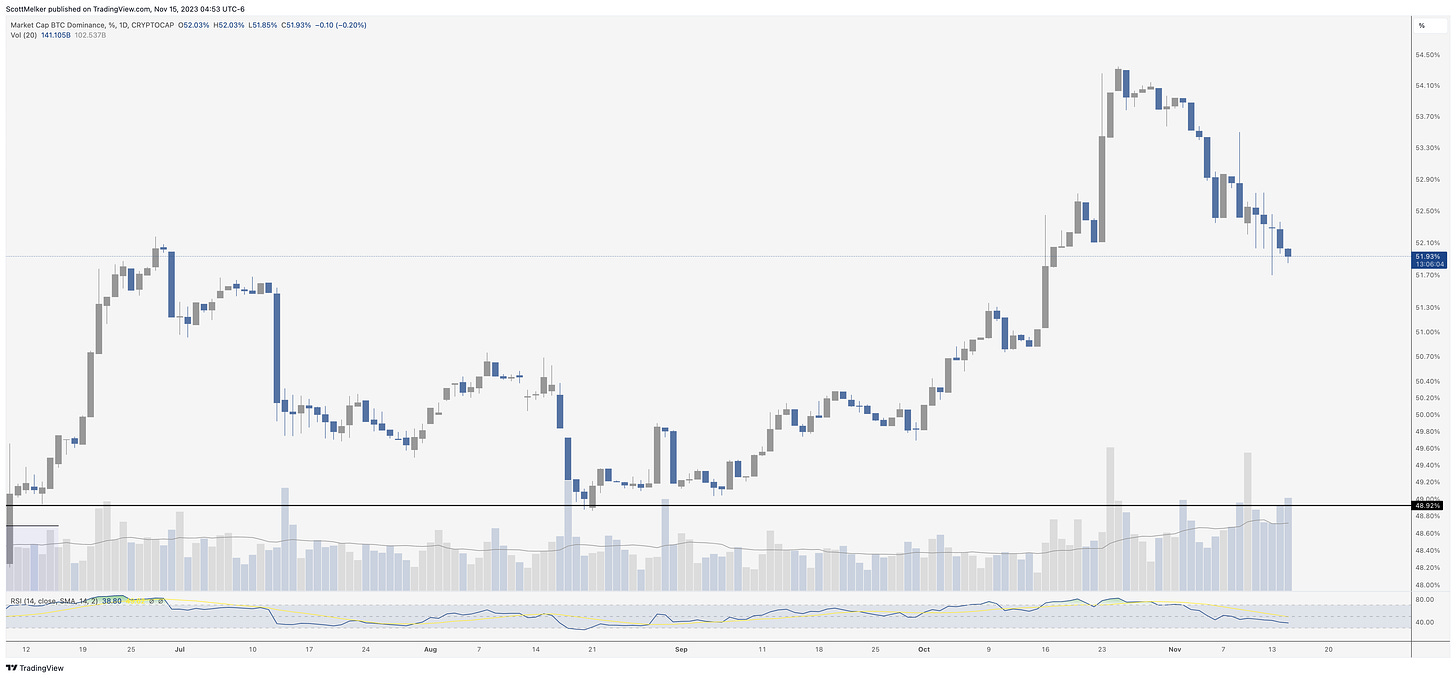

You can see that bitcoin dominance continues to drop. This is not a signal about altcoins, but rather an illustration of the strength that they have been showing. If this continues down, it is because altcoins continue to take market share from bitcoin as it consolidates.

Legacy Markets

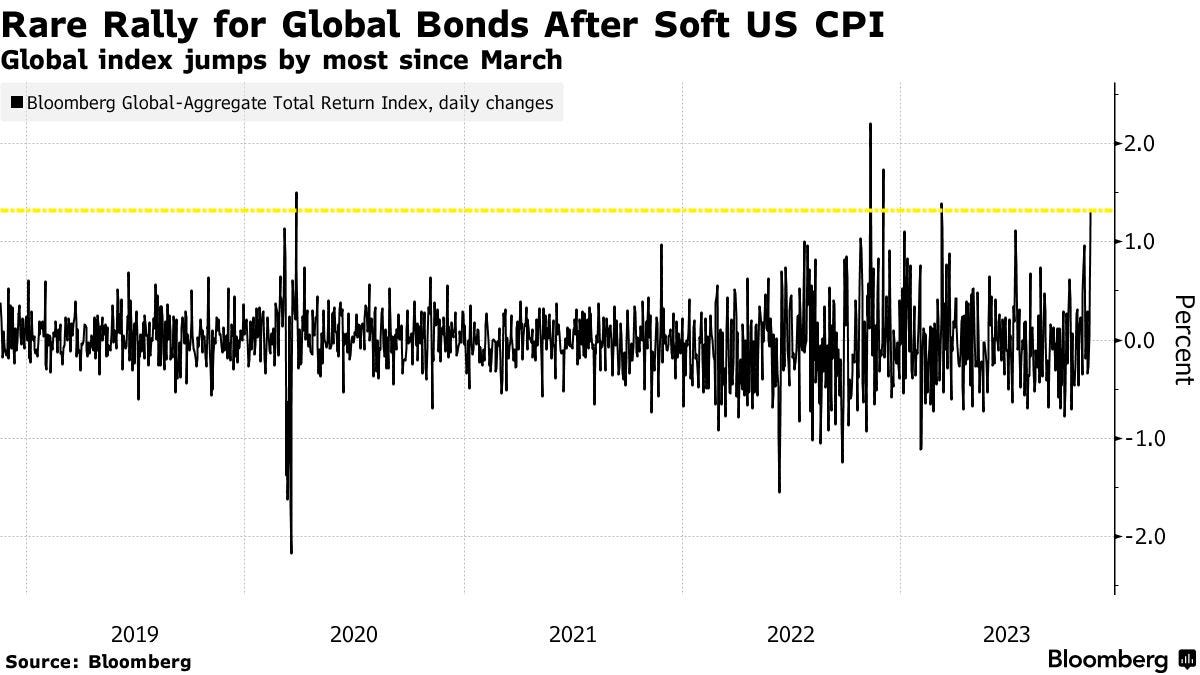

Stock markets experienced a surge as cooler-than-expected inflation data in the US and UK led investors to believe that central banks might halt aggressive interest rate increases. The European Stoxx 600 Index and the FTSE 100 in London both showed significant gains, while the British pound declined following the UK's unexpectedly low inflation rate. US equity futures also experienced an upswing, riding on the wave of optimism generated by the possibility of a pause in interest rate hikes.

This market positivity is set against a backdrop of anticipation for upcoming US retail sales and producer price data. These figures are critical as they might affect market sentiment regarding future Federal Reserve actions. Currently, market swaps have nearly ruled out further Fed rate hikes, with expectations of a rate cut by July. However, stronger-than-anticipated data could dampen this enthusiasm.

Market players are closely observing consumer demand, gauging it through upcoming earnings reports from retail giants like Target and Walmart. Notably, Target is projected to report a second consecutive sales decline. Earlier, Home Depot indicated a slowdown in big-ticket purchases.

The latest inflation data also impacted bond markets, with the Bloomberg Global Aggregate Bond Index climbing significantly, nearing the point of offsetting this year's losses. Meanwhile, ten-year Treasury yields increased slightly after a substantial drop in the previous session. The dollar remained steady after experiencing its largest decline in a year.

In Asia, stock markets were buoyed by the Chinese central bank's significant cash injection into the banking system, aimed at stimulating growth. Additionally, a meeting between Chinese President Xi Jinping and US President Joe Biden was anticipated to potentially ease tensions, further lifting market sentiment.

Oil markets, however, showed a more measured response, stabilizing after a brief rally as analysts weighed varying outlooks on supply and demand.

Key events this week:

US retail sales, business inventories, PPI, Empire manufacturing, Wednesday

Target earnings, Wednesday

China new home prices, Thursday

US initial jobless claims, industrial production, Thursday

Walmart earnings, Thursday

US President Joe Biden and Chinese President Xi Jinping expected to speak at APEC leaders summit, Thursday

Cleveland Fed President Loretta Mester, New York Fed President John Williams and Fed vice chair for supervision Michael Barr speak, Thursday

Bank of England deputy governor Dave Ramsden and ECB President Christine Lagarde speak at event, Thursday

US housing starts, Friday

US Congress faces a midnight deadline to pass a federal spending measure, Friday

ECB President Christine Lagarde speaks, Friday

Chicago Fed President Austan Goolsbee, Boston Fed President Susan Collins and San Francisco Fed President Mary Daly speak, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.5% as of 9:46 a.m. London time

S&P 500 futures rose 0.2%

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.1%

The MSCI Asia Pacific Index rose 2.3%

The MSCI Emerging Markets Index rose 2.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.3% to $1.0847

The Japanese yen was little changed at 150.45 per dollar

The offshore yuan was little changed at 7.2562 per dollar

The British pound fell 0.3% to $1.2463

Cryptocurrencies

Bitcoin rose 0.8% to $35,855.28

Ether rose 0.5% to $1,991.27

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.46%

Germany’s 10-year yield was little changed at 2.59%

Britain’s 10-year yield advanced one basis point to 4.16%

Commodities

Brent crude fell 0.5% to $82.04 a barrel

Spot gold rose 0.3% to $1,971.01 an ounce

Henry Ford Proposed A Currency Similar To Bitcoin

On Dec. 4, 1921, the New York Tribune published an article on the front page of the newspaper titled, “Ford Would Replace Gold With Energy Currency and Stop Wars” with a subheading that read, “Declares if Government Will Give Him Muscle Shoals Plant He Can Demonstrate Success of Plan to Substitute Natural Wealth as a Basis of World’s Money.”

In his vision, Henry Ford aimed to replace gold with an energy currency, firmly believing that such a move would diminish the influence of banking elites and, subsequently, bring an end to global conflicts. Ford argued that gold was the root cause of wars, a perspective I find resonant with today's understanding that economic factors often drive conflicts. He posited that opposition to this shift would primarily come from bankers and media outlets.

Here is Ford’s explanation of how the currency would function: “Under the energy currency system the standard would be a certain amount of energy exerted for one hour that would be equal to one dollar. It’s simply a case of thinking and calculating in terms different from those laid down to us by the international banking group to which we have grown so accustomed that we think there is no other desirable standard.”

As for the details, Ford playfully remarked that they would be addressed 'when Congress cares to hear about it.' It's remarkable how closely Ford's vision aligns with Bitcoin. Not only does Bitcoin essentially function as an energy-backed currency, but enthusiasts also assert that Bitcoin has the potential to mitigate or halt global conflicts. Ford even got today's roadblocks right; Congress, the media, and bankers. If you wish to read the article in its original form, click HERE.

Did BlackRock Attack Stablecoins?

The answer is, no. BlackRock did not mindlessly attack stablecoins. Rather, they addressed reasonable risks they pose to the market. Yesterday on Twitter, major accounts began posting single-line engagement farming Tweets stating, “BlackRock, says USDT & USDC stablecoins pose risks to Bitcoin,” without providing context.

Immediately, I knew this was false because BlackRock’s largest investment in the crypto space happens to be Circle, the company behind USDC. The context of the statement is that BlackRock was pointing out that, “a stablecoins fundamental liquidity can have a dramatic impact on the digital asset market.”

BlackRock wouldn’t be involved in crypto if stablecoins actually posed serious threats to the space. Tether and Circle combined account for a large portion of total market cap and a MASSIVE amount of volume. They are essential!

This Major Gaming Company Is Buying More Crypto

Three months ago, reports emerged that Boyaa Interactive, a Hong Kong-based gaming company, intended to invest $5 million in Bitcoin and Ethereum as part of its web3 strategy. Now, the company is seeking shareholder approval to significantly increase this investment to $100 million. Boyaa's revised plan involves allocating $45 million each to Bitcoin and Ethereum, with an additional $10 million earmarked for stablecoins USDT and USDC. While this purchase may not create a substantial impact on the market, it is likely to draw the attention of other companies in the region. Slowly, then all at once.

Disney Launching NFT Platform

Disney has partnered with Dapper Labs, a blockchain and metaverse company, to launch an NFT platform named Disney Pinnacle. This platform will tokenize Disney's iconic cartoon characters, Pixar icons, and Star Wars heroes and villains as collectible, tradable digital pins. Set to launch on iOS, Android, and the web later this year, Disney Pinnacle is built on the Flow blockchain, also developed by Dapper Labs. This move follows Disney's earlier decision to shut down its metaverse division as part of a major restructuring plan. Dapper Labs, known for NFT brands like CryptoKitties and NBA Top Shot, has faced challenges recently, including layoffs in 2023.

We’re so back.

SOL to $150? What Coin Will Pump Next?

Solana has led this massive bull run for crypto - is it done, or can it still 3X from here? Invest Answers has a thesis. You don't want to miss this.

My Recommended Platforms And Tools

TAP - A super-powered money app—an all-in-one investment, money, and trading platform. Coming to the U.S. soon, with tons of bonuses. Click HERE.

Trading Alpha - My new go-to indicator site and trading community. Use my link and get 2 months for FREE. Make sure to use code “2MONTHSOFF.”

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

A few days ago on Twitter, I expressed concerns about the need for improved communication from an exchange regarding the ongoing issue of Canadian banks attributing missing funds to exchanges and labeling their payment systems as dubious, even associating them with fraud. The exchange is placing responsibility on the bank, asserting that the funds never arrived, while the client, a believer in the potential of BTC, is now unable to purchase it through certain exchanges in Canada. The client has unfortunately lost the initial funds sent, seemingly caught in a financial limbo, while the bank initiates an investigation. It's a complex situation, and I'm not well-versed in navigating the current environment for BTC purchases. I suspect that this major bank might be at fault, potentially disadvantaging its clients to discourage BTC transactions. Nevertheless, exchanges could play a more supportive role for their clients in such scenarios, as a mere email stating that funds didn't arrive seems insufficient. Can we delve into the broader issue of individuals encountering difficulties in the cryptocurrency realm, losing their hard-earned money, and feeling as if it's vanished into thin air?

Take easy T