Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

C.O.I.N.

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

The SEC Can’t Recruit Crypto Specialists

The Simpsons Saved NFTs

BSV Receives The Boot

Yields Collapsing! Will Bitcoin Pump? l Macro Monday

C.O.I.N.

Crypto’s (Most) Overlooked Investment Opportunity - C.O.I.N.

Today’s newsletter is entirely about COIN (the stock). Just so we are clear, I own COIN and I am personally bullish on COIN, but I am NOT endorsing COIN or recommending you buy it. This newsletter is only intended for educational and entertainment purposes. If you are considering a position in COIN, seek out a licensed professional. Now that the disclaimer is out of the way, let’s begin.

Yesterday afternoon, the Bankless Podcast unveiled a highly anticipated episode solely dedicated to dissecting COIN. It marked a significant milestone for their platform and they delivered an exceptional show. Spanning two hours, the episode is chalk full of high-level content, prompting me to share the highlights here. Full acknowledgment goes to Bankless for their outstanding work

Long story short: Wall Street has no clue what is coming.

Below, you'll find a blend of my reflections and insights gleaned from Bankless content. Once more, I strongly recommend watching the show if you can spare the time.

“The real opportunity here with COIN is that WallStreet is looking at it as this traditional bank and those of us who have spent some time digging in the weeds look at Coinbase as this diversified crypto juggernaut with its tentacles in just about every vertical across crypto, poised to capitalize on just about every area of growth across the crypto space.”

“Coinbase is not just an exchange anymore. The big question after Coinbase went public in 2021 was: Can it diversify its business away from just exchange fees and was it able to achieve that goal? Our analysts say that the answer is yes. So what is Coinbase’s new business?”

Before delving into Coinbase’s new business model, it's crucial to define its core strategy, primarily based on trading fees. For years, Coinbase has relied solely on exchange fees, making it somewhat of a one-trick pony. In 2021, the company printed billions in profit during the bull market but suffered significant losses when trading volume dwindled shortly after.

Wall Street appears to be struggling to comprehend all the innovative additions to Coinbase’s repertoire, which I'll discuss shortly, but there is an even bigger oversight. The inevitability of another bull market, where Coinbase could once again excel predominantly through its traditional avenue of trading fees.

“I don't know how much conviction Wall Street has when the next bull market is coming. They probably aren't foreseeing one the same way as us crypto bulls are.”

Now that the basics are out of the way, we can transition to Coinbase’s shiny new toys.

Yields and Interest Revenue

First on the list is Coinbase's approach to generating substantial returns from short-term treasuries. Their strategy involves an aggressive promotion of USDC; every time a user exchanges a dollar for USDC, Coinbase channels that dollar to purchase short-duration and highly liquid U.S. treasuries. It's a brilliant and straightforward strategy. Additionally, Coinbase holds an equity stake in Circle. While this strategy might not remain indefinitely effective, it currently thrives under the present market conditions.

“Coinbase has probably made about 450 million off interest income in 2023.”

“Coinbase also knows that USDC on the platform likely ends up bidding on the platform.”

Staking

Coinbase provides a solution for the hardware and technical necessities of staking while capturing a fee in the process. Presently, Coinbase charges roughly 25% for their services, a higher rate compared to the 10% charged by Lido. The premium charged by Coinbase is due to its user-friendly approach. Approximately a quarter of all staked ETH is held on the Coinbase platform, and it's projected that this figure could potentially reach a third of all ETH staked. Some argue that Coinbase should increase its charges to reduce the proportion of staked ETH on its platform.

“Coinbase sees itself as the primary way for retail and institutions to onboard into crypto. Coinbase wants to own the on-ramp, so they make it seamless and charge a premium. Coinbase earned about 325 million in Q2 earnings.”

International Expansion

Coinbase is expanding during a favorable window, with numerous exchanges out of the picture. Roughly 90% of Coinbase’s revenue comes from the American market. Expansion appears to be an effort to mitigate risks. Perpetual futures (perps) account for three times the volume of spot trading, and this is the market segment Coinbase is looking to take a big swing at beyond the U.S. The straightforward perspective here is that Coinbase holds regulatory alignment in a wide open market, where competition is largely inactive or dead.

“There have been 23 or 24 trillion dollars of volume on perps exchanges, the size of the U.S. GDP. If Coinbase can take over FTX’s and Bitmex’s volume, we are looking at jumps that can seriously move the stock. If Coinbase can capture Binanace’s perp volume, it would be good for a 97% revenue bump for the entire company.”

Custody

Custody might not spark the most exciting discussions, yet it becomes intriguing when considering its role in the Bitcoin spot ETF. This facet of Coinbase's business has been somewhat marginal, yet it remains a vital service. It streamlines what is otherwise a complex and messy process for both individual users and institutions. Being the exclusive custodian for ETF issuers and having a surveillance-sharing agreement creates new prospects. This not only enhances the company's credibility but also presents indirect advantages by bolstering custody of more assets due to these agreements.

“Existing Bitcoin funds have 29 billion AUM, 28 billion of that number is in spot vehicles. BlackRock’s blessing allows for other businesses to be comfortable choosing Coinbase for other avenues.”

Base

Base is Coinbase's answer to decentralization. It operates as an Ethereum layer 2 solution constructed on the OP stack, aiming to aid Ethereum in scaling and diversifying Coinbase's business. The introduction of BALD marked the inaugural significant event on Base, resulting in an instantaneous demand for the platform, subsequently paving the way for Friend.tech. All these developments generate transactions and fees on the network, which proves advantageous for COIN. What's remarkable is the impressive growth despite the absence of a token or airdrop incentive.

“Base won't affect Coinbase’s revenue in the short-term, it’s more of a long-term play. Base does give the company an opportunity to issue a token, which historically commands very large market caps.”

Honorable Mention, Coinbase’s Assets

Coinbase also owns its own assets, not customer deposits. According to their 10Q last year, Coinbase had 9,000 BTC and 130,000 ETH. Coinbase Ventures has also done about $75m in investments.

“This past bear market was a major wake-up call. It feels like Coinbase is much more focused today than a year or two ago. This is probably due to industry carnage, throw a rock and it will hit a bankrupt entity. The amount of fraud and ineptitude is stunning. I think that kind of prompted a rethink within Coinbase and they said this has gotten away from us, we're no longer a leader in our own space you know, we're going to reassert ourselves, we're going to like get fit, we're going to get focused and we're going to lead from the front.”

Personally, I don’t have the insight into where COIN will land in the next 6 months or a year. However, I strongly believe that Wall Street criminally misjudges Coinbase. The company hasn't experienced its own bull cycle and is currently well-positioned in the early innings of a crypto bull market. It's quite likely that Coinbase will embark on a streak of surpassing Wall Street's predictions and exceed expectations significantly.

My thesis is simple: COIN is C.O.I.N. — Crypto’s (Most) Overlooked Investment Narrative.

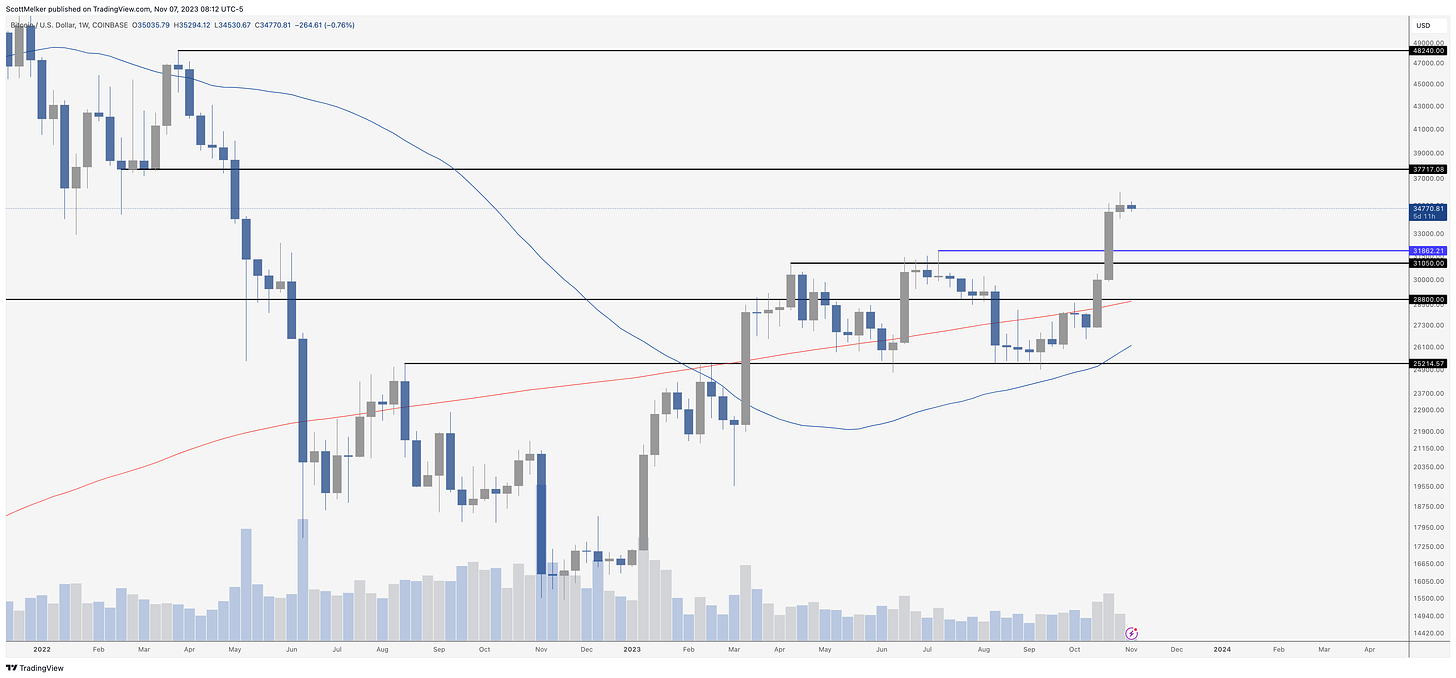

Bitcoin Thoughts And Analysis

I would love to see a retest of the $31,000 to $31,800 area as support. This would be very healthy. We don’t want to see a parabolic rise and fall, but rather a healthy climb with clean retests of key areas as support on the way up.

Not sure we will get it, but I have bids there.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

As tends to happen with many strong altcoins, EGLD left the station and broke resistance without any retracement. I do not know if it will come back down, but if it does, $38 look like the spot to add on a dip. That was a key level of resistance (July High, 2022 summer low) that was broken on a huge candle on historic volume.

With setups like this, you may miss them if the retest never comes. No big deal, find another chart to stalk for a trade.

If it does hit, you have easy invalidation if candles start closing below. High risk/reward setup, which is why I like retests.

These days, I look for confluence on my own setups with Trading Alpha, which is still showing green dots. If these start turning red or I get a clear sell signal, I will reconsider. For now, most of these coins look like they are dips worth buying, if we get them.

If you like this analysis and want more like it, use the link HERE, to sign up for Trading Alpha.

Legacy Markets

Stock markets have experienced a downturn, with the S&P 500 futures dropping over 0.3%, potentially ending a six-day rally, and the Stoxx 600 in Europe showing similar declines. This shift in sentiment comes after Minneapolis Fed President Neel Kashkari made remarks suggesting it's premature to consider the fight against inflation won, cooling expectations for an immediate easing of interest rates by the Federal Reserve.

WTI crude oil also fell below $80 a barrel, a level not seen in over two months. The dollar, on the other hand, saw an upswing.

In the UK, bond markets have rallied after the Bank of England's Chief Economist Huw Pill hinted at possible rate cuts by mid-2024, despite last week's more hawkish tone from the Bank. German industrial data also pointed towards a looming recession, adding to bond market positivity. In response, yields on two-year UK gilts and 10-year US Treasuries have both decreased.

Oil companies like Shell and BP suffered stock price declines in Europe, while UBS saw gains after reporting strong wealth-management client inflows. Watches of Switzerland Group's stock jumped 10% following a positive sales and profit outlook.

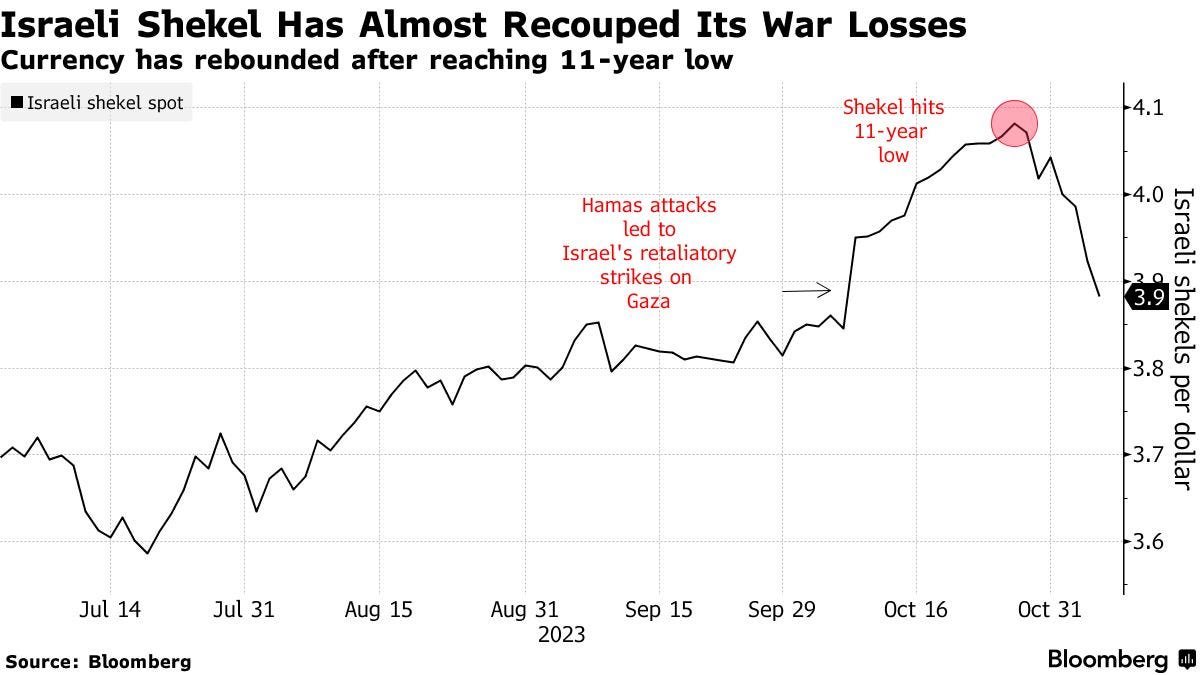

The Israeli Shekel recoups almost all of the war losses.

In Asia, South Korea’s Kospi Index dropped after a previous rally, and Australia signaled a continued monetary policy tightening, raising its inflation forecast, indicating that rate hikes from central banks may not be concluded yet.

Key events this week:

China forex reserves, Tuesday

Eurozone PPI, Tuesday

US trade, Tuesday

UBS earnings, Tuesday

Kansas City Fed President Jeff Schmid and his Dallas counterpart Lorie Logan speak, Tuesday

Eurozone retail sales, Wednesday

Germany CPI, Wednesday

BOE Governor Andrew Bailey speaks, Wednesday

US wholesale inventories, Wednesday

New York Fed President John Williams speaks, Wednesday

Bank of Japan issues October summary of opinions, Thursday

BOE chief economist Huw Pill speaks on the economy, Thursday

US initial jobless claims, Thursday

Fed Chair Jerome Powell participates in panel on monetary policy challenges at the IMF’s annual research conference in Washington, Thursday

Atlanta Fed President Raphael Bostic and his Richmond counterpart Tom Barkin speak, Thursday

UK industrial production, GDP, Friday

ECB President Christine Lagarde participates in fireside chat, Friday

US University of Michigan consumer sentiment, Friday

Dallas Fed President Lorie Logan and her Atlanta counterpart Raphael Bostic speak, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.3% as of 11:49 a.m. London time

S&P 500 futures fell 0.4%

Nasdaq 100 futures fell 0.3%

Futures on the Dow Jones Industrial Average fell 0.4%

The MSCI Asia Pacific Index fell 1.4%

The MSCI Emerging Markets Index fell 0.9%

Currencies

The Bloomberg Dollar Spot Index rose 0.4%

The euro fell 0.5% to $1.0669

The Japanese yen fell 0.2% to 150.40 per dollar

The offshore yuan fell 0.1% to 7.2902 per dollar

The British pound fell 0.5% to $1.2280

Cryptocurrencies

Bitcoin fell 1% to $34,685.51

Ether fell 0.9% to $1,876.35

Bonds

The yield on 10-year Treasuries declined three basis points to 4.61%

Germany’s 10-year yield declined five basis points to 2.69%

Britain’s 10-year yield declined seven basis points to 4.30%

Commodities

Brent crude fell 1.6% to $83.80 a barrel

Spot gold fell 0.7% to $1,964.37 an ounce

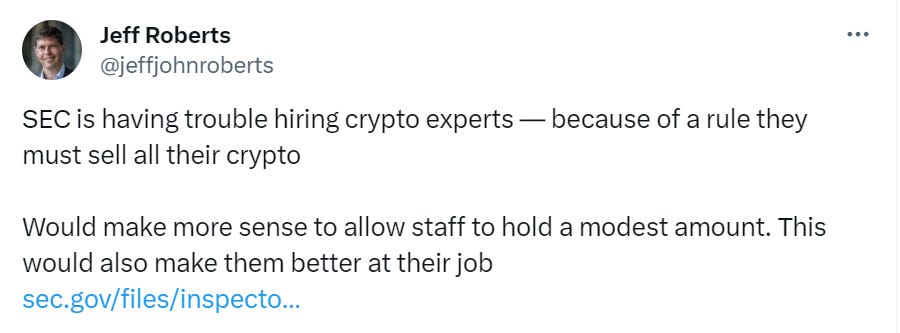

The SEC Can’t Recruit Crypto Specialists

The SEC recently released a 2023 statement addressing its current management and performance challenges, and an intriguing discovery was made by a Twitter user regarding the agency's struggle with recruiting crypto specialists. Evidently, the SEC has highlighted difficulties in finding qualified candidates due to the limited pool of qualified experts in the field. The reason behind this shortage explains the SEC’s idiocy in a nutshell.

Officials also reported that many qualified candidates hold crypto assets, which the Office of the Ethics Counsel has determined would prohibit them from working on particular matters affecting or involving crypto assets. This prohibition, according to SEC officials, has been detrimental to recruiting, as candidates are often unwilling to divest their crypto assets to work for the SEC

Shouldn't those responsible for regulating the digital asset industry be permitted to own at least a modest amount of the assets they oversee? The SEC is likely to encounter considerable difficulty in finding truly knowledgeable crypto candidates who either do not possess crypto assets or are ready to relinquish their holdings for a position at the SEC. I'm not a proponent of elected officials engaging in market trading as much as the next guy, but it's evident that the SEC is in dire need of employees who actually know what they are talking about.

The Simpsons Saved NFTs

The Simpsons creating an episode centered on NFTs could potentially be the most significant event for the NFT space this year. Given the show's track record of surprisingly accurate predictions, watching this episode might just be the boost needed for your NFT holdings. The episode is filled with quality inside jokes and references that are remarkably on point - personally, I found myself laughing out loud a few times.

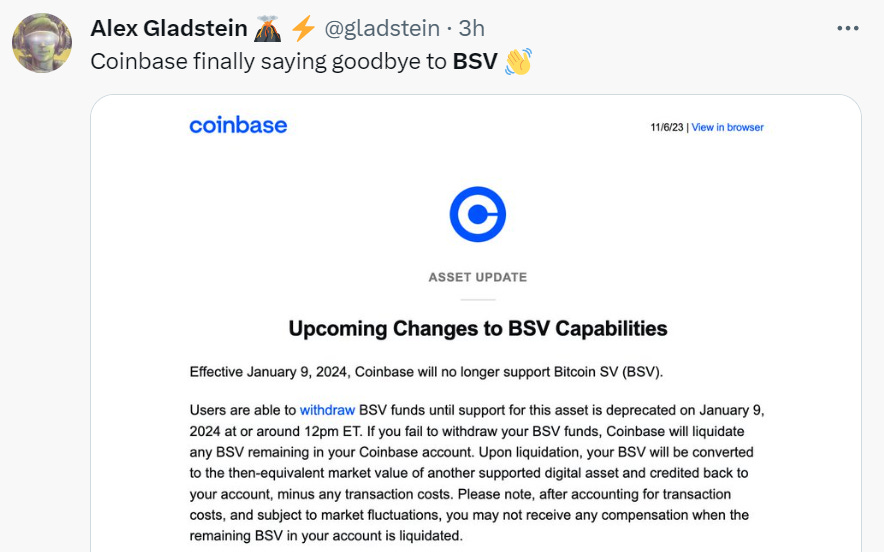

BSV Receives The Boot

Farewell, BSV, you weren't in demand anyway. Moving on, Coinbase ought to take further actions beyond just removing BSV. Numerous Bitcoin-related scams persist on the platform, such as Bitcoin Cash, Bitcoin Classic, Bitcoin 2, Bitcoin Gold, and the list continues. Coinbase understandably does not want to be a gatekeeper in the industry, however, some lines need to be drawn in the sand.

Yields Collapsing! Will Bitcoin Pump? l Macro Monday

Scott Melker, James Lavish, Mike McGlone, and Dave Weisberger cover everything relevant to financial markets - it is Macro Monday!

My Recommended Platforms And Tools

Trading Alpha - My new go to indicator quite and trading community. Use my link and get 2 months for FREE.

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.