The Wolf Den #844 - Contrarianism Reconsidered (Plus Chart Setups)

Why being a contrarian can lead to major losses.

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Contrarianism Reconsidered

Trading Alpha - $BTC $ETH $DOT $AVAX $MATIC

Bitcoin Thoughts And Analysis

Altcoin Charts - $HBAR $MATIC

Legacy Markets

Be Careful What You Download

The UN Doesn’t Understand Bitcoin

Elon Musk Won’t Create A Token

Bitcoin And Tether Will Fuel The Next Bull Market l Paolo Ardoino

Contrarianism Reconsidered

ANNOUNCEMENT!

I have A TON OF CHARTS shared just below this intro from Wick (@ZeroHedge_). Trading Alpha is the best group in crypto for traders, hands down. The market is giving setups and now is the time to capitalize. Wick was kind enough to offer all of my subscribers a great deal on signing up for a subscription that won’t last much longer. If you do plan to sign up, use my link HERE and get a couple of months for FREE.

Now, for the intro.

In the film "Margin Call," a pivotal scene unfolds when an entry-level analyst, Peter Sullivan, discovers an alarming pattern in the firm's risk models late one night. As he delves deeper into the analysis, he uncovers the impending financial catastrophe that could lead to the collapse of the entire market… in 2008.

I can confidently assert that this film is a must-see, but I have a bold observation to make — 'Margin Call' has, in fact, cost investors a significant amount of money. Sounds unbelievable, right? Let me elaborate.

Margin Call stands as the quintessential Hollywood portrayal of a financial hero making a daring, contrarian prediction that defies all expectations and ultimately proves correct. In essence, it’s indistinguishable from 'The Big Short' and similar to the recent film 'Dumb Money' covering the GameStop short squeeze.

Merely a handful of investors foresaw the Great Financial Crisis, and an even smaller number predicted GameStop's victory over hedge funds. Movies were made about these events because they represented once-in-a-lifetime trades, emphasizing that, as observers, we must acknowledge that such occurrences are truly rare and limited to once-in-a-lifetime.

If we were to check in on Roaring Kitty, Peter Sullivan, or the Big Short Crew, I'd bet they've likely achieved strong year-over-year returns. However, it's improbable that they've stumbled upon another incredible winning opportunity. This isn't a critique of their investing prowess; it's simply a recognition that lightning rarely strikes twice in the investment world.

While it's true that the best opportunities often emerge when everyone zigs and the right move is to zag, it's crucial for investors not to always prioritize being contrarian in every investment. For most investors, consistently going against the tide may lead to more wrong moves than right ones. As some may have heard me say before, it’s true that the trend is your friend.

Carl Icahn, recognized as one of the finest contrarian investors, maintains a significant position in Apple. Warren Buffet's ownership of Coca-Cola and Peter Lynch's stake in McDonald's are not contrarian decisions either; rather, they align with the prevailing market trends and represent bets in line with the established narrative.

Let me clarify. I don't believe movie stars and Hollywood producers should shoulder the blame for giving rise to a generation of contrarian financial heroes. However, it's hard to ignore that inspired investors might have made less-than-ideal decisions after being influenced by these movies. For the average investor, making it to the starting line in the financial race is challenging, let alone reaching the finish line or achieving success.

On a positive note, I firmly believe that Bitcoin and cryptocurrency represent one of the closest approximations to a fair race. However, taking a contrarian stance in the world of crypto can often result in significant losses for many investors. Merely being open to considering Bitcoin is still deemed contrarian, but this perception is shifting rapidly. This is precisely why I write this newsletter — to inspire and encourage all of you before the clock strikes midnight.

Trading Alpha

After building up much coiled-up volatility, signaled by the shaded areas, we were able to break past through resistance on our breakout arrows.

Since then the trend has stayed in tact forming bullish consolidation right below resistance.

If we break above resistance the Dots should help us stay confident in higher pricing as long as the Dots stay green, above our Track line. In the meantime, we are seeing Alts climb higher which is a great dynamic to see happening in the crypto market, which has not happened in a while.

If you like this analysis and want more like it, use the link HERE, to sign up for Trading Alpha.

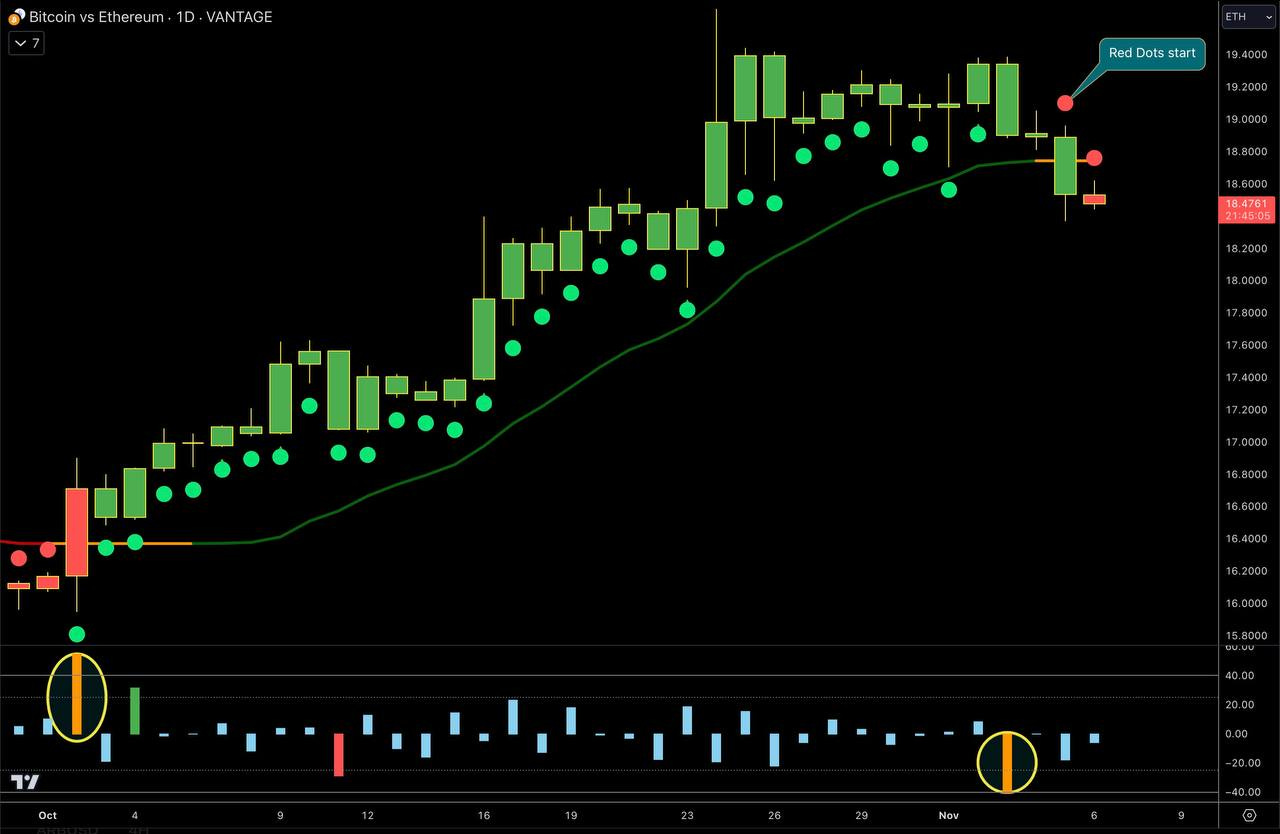

This chart shows how relative strength is flipping towards Ethereum as capital flows head from BTC to ETH

▪️ Consecutive bearish Red Micro Trend Dots

▪️ First bearish macro trend bar

▪️ Thrust indicator flashing our strongest downside orange bar

We could see Ethereum continue to this starting trend. Something to be aware of and pay attention to. Ethereum is a good proxy for the general altcoin market. This is why we are seeing many alts enjoying higher price action.

If you like this analysis and want more like it, use the link HERE, to sign up for Trading Alpha.

Ethereum is printing consecutive green micro trend Dots and its first macro trend bar!

We have some strong technical confirmation with bullish RSI divergence, and volume just tagging our high red threshold.

The bullish setup is there, and capital flows are coming into ETH, let’s see if it can break through the resistance zone. As long as the Dots keep printing green our probability stays high!

If you like this analysis and want more like it, use the link HERE, to sign up for Trading Alpha.

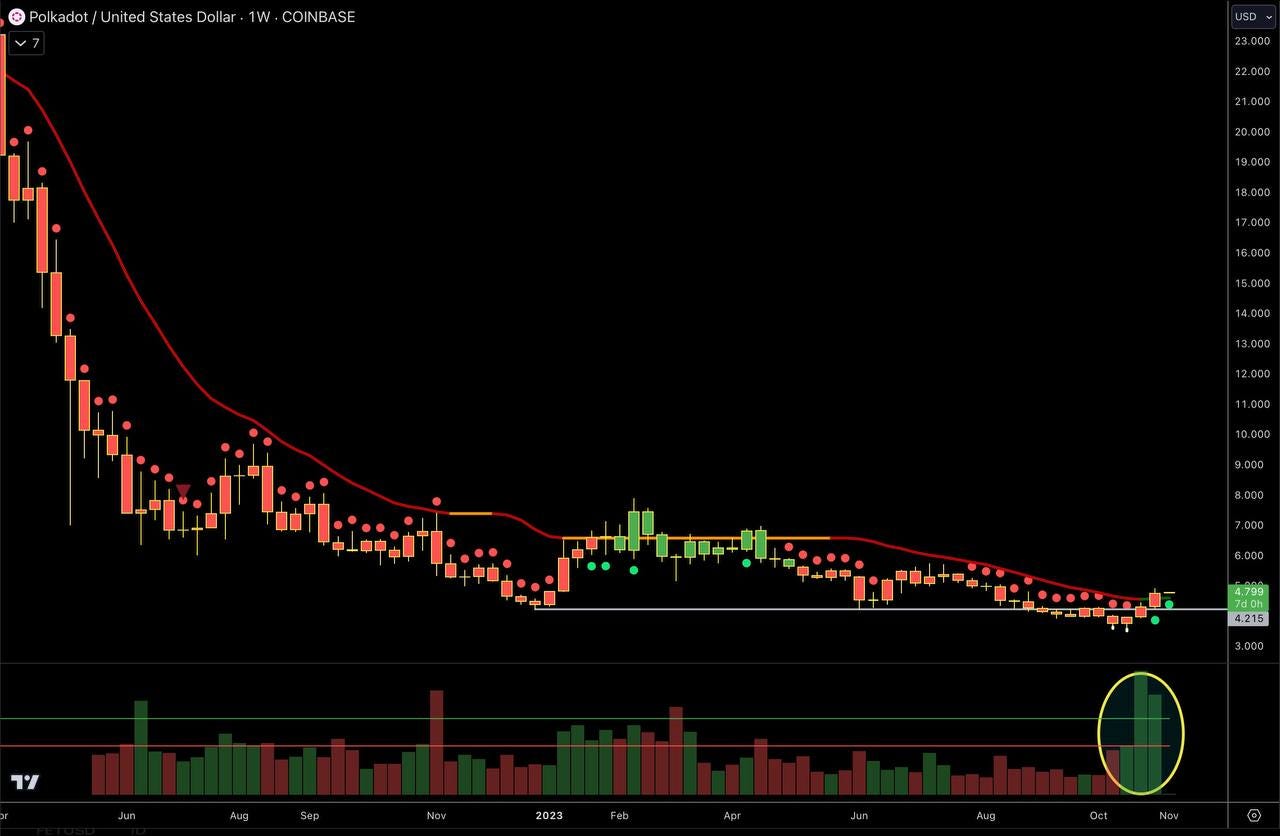

We like Dot here. Breaking above local resistance as it comes off the lows. The volume is quite impressive if you look at it relative to the rest of the chart. When volume pushes above our green line it is categorized as extreme levels.

What we need to see is some confirmation next in what we call a sign of strength (SOS). We’ll be watching closely

If you like this analysis and want more like it, use the link HERE, to sign up for Trading Alpha.

Binance coin is taking off as it gaps higher. I chose the chart more so as a technical lesson to show many setups can be as simple as seeing red Dots & bars turn green, signaling a change in trend dynamic, while also having clear increased volume come in above our extreme green line levels.

Having the price action above our Track line is yet another confirmation in the setup.

You can look for these in any chart using our Alpha Bundle in the link at the bottom of the newsletter

Avalanche breaking out, retesting the breakout, and having a good reaction with 3 consecutive green Dots.

If liquidity keeps flowing into alts, AVAX is primed for higher pricing!

If you like this analysis and want more like it, use the link HERE, to sign up for Trading Alpha.

Polygon printing consecutive green Dots which is one of the higher probability setups. Two green Dots above the track line let us know there is a continuation in the bullish micro trend, and momentum is in its favor.

This makes Polygon another asset primed for higher pricing as long as liquidity keeps flowing into alts.

If you like this analysis and want more like it, use the link HERE, to sign up for Trading Alpha.

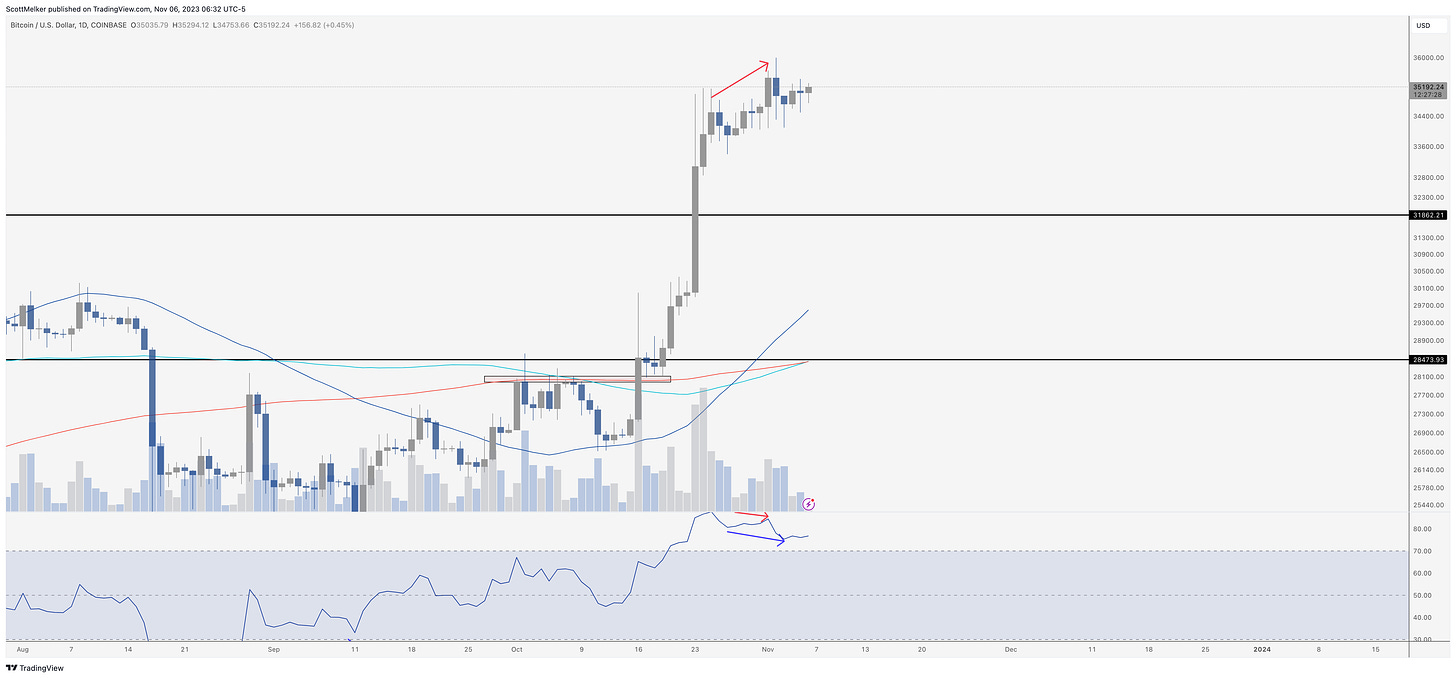

Bitcoin Thoughts And Analysis

Bitcoin has really just entered the power zone on the weekly chart, with RSI pushing into overbought. On higher time frames, this is usually when things really get going for Bitcoin. As I have mentioned, weekly RSI hit oversold at $12,000 in the last bull market, on the way to $65,000. We are not in the “right” part of the 4-year cycle for that to happen here again, so we there are obviously no guarantees.

The weekly candle looked very bullish until about an hour before the close - then price dropped, giving the slight wick up. No big deal, things are still green and proceeding nicely.

We had bearish divergence with overbought RSI on the daily, which I shared last week. I was not too worried, because odds were that we would see hidden bullish divergence to follow, which we now have. That means a lower low on RSI and a higher low on price. So the bear div is technically “canceled.”

This still look bound to go sideways and consolidate. This also looks like dips are for buying if we get them.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

A few thoughts….

We have a very clear sign that the market has turned bullish... Bitcoin pumped and is consolidating, and altcoins are actually moving while Bitcoin is sideways. This has not happened in a LONG time. This is the recipe for every previous bull market. When there is confidence in the market and new money entering, we get tastes of alt season.

Identifying a chart set up for an altcoin is a skill. I have shared quite a few here over the past weeks, all of which have done quite well. $EGLD just pulled a 2X in a matter of days.

But… I believe that knowing when to even look at altcoins and when to ignore them for months at a time is a greater skill. Finding a setup now is easy - just throw a dart. Understanding when the market is right and taking advantage is the major challenge. It is hard to sit on your hands... especially as a content creator who is "expected" to provide alpha. It was a barren dessert in the newsletter and on YouTube for a long time for me, refusing to share charts and ideas. I lost quite a few subscribers by refusing to share altcoin charts in a subpar market. Hopefully this price action remains and we keep going!

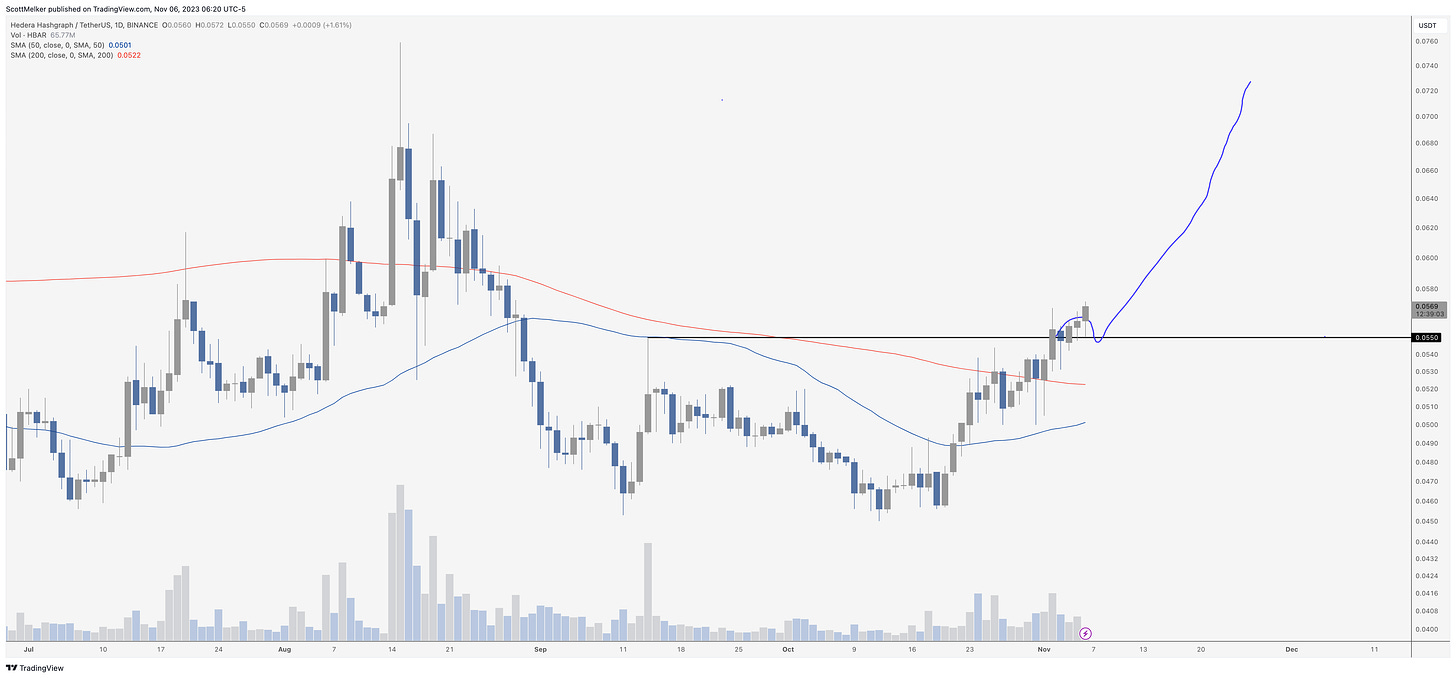

I shared this last week. As you can see, it has started to move but is yet to take off. The ideal entry was the retest of the line at .055, but price is still only slightly above that at .0569. Target around .075.

I have been screaming from the mountaintops about this MATIC reversal, and have confluence from Wick above in the Trading Alpha section.

MATIC is breaking above the daily 200 MA here (has to close above) for the first time since losing it in April. I still think this has a relatively easy path to .94 as long as Bitcoin behaves.

Legacy Markets

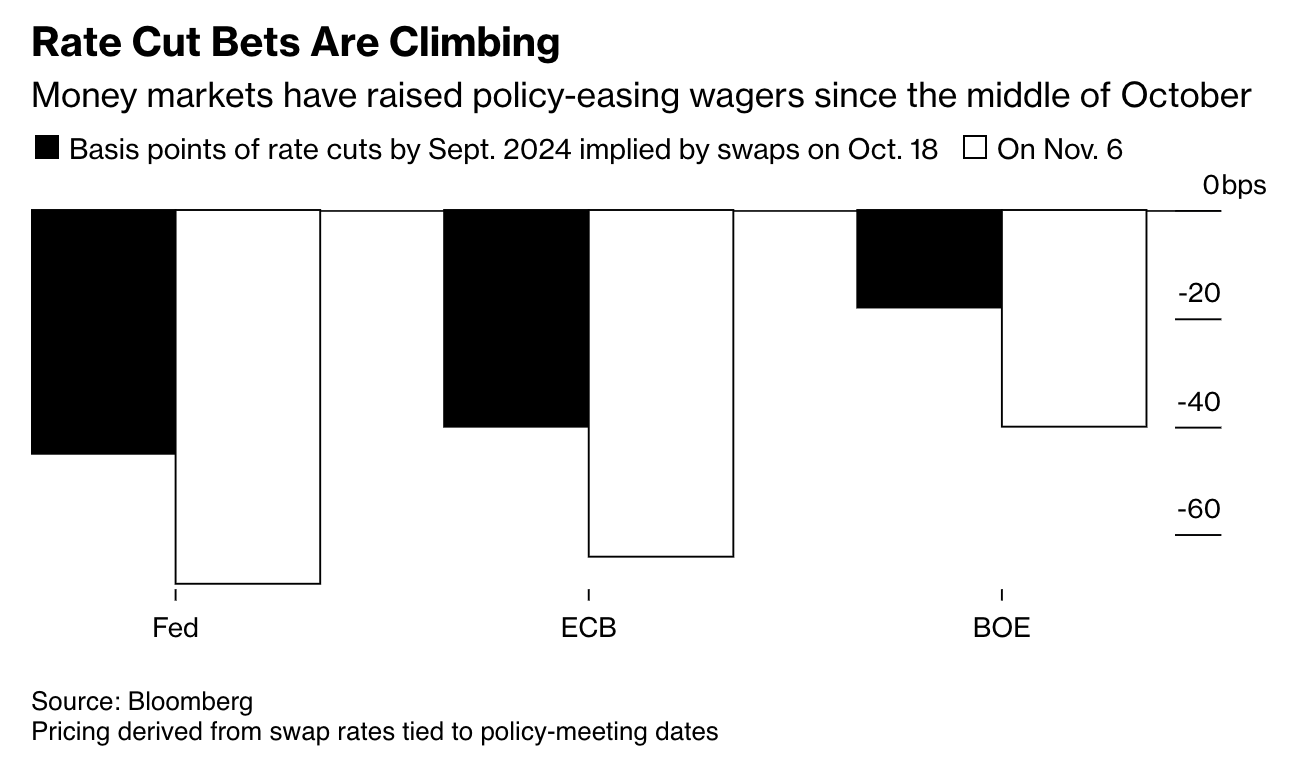

Global stock and bond markets showed signs of steadying after a strong rally the previous week, as optimism grew over the possibility of rate cuts by US and European central banks in the coming year. The Stoxx 600 in Europe paused its advance, while US futures saw modest gains. In Asia, South Korea's Kospi surged due to a ban on short selling. The dollar weakened further, continuing its downward trend, and crude oil prices increased after Saudi Arabia and Russia confirmed their commitment to supply cuts.

Market sentiment has been buoyed by recent US economic data suggesting a slowing economy, causing traders to anticipate lower interest rates by mid-year. Despite this, the 10-year Treasury yield rose slightly after dropping from 16-year highs. Investors are looking forward to more clarity on inflation from upcoming speeches by Fed Chair Jerome Powell and Bank of England Governor Andrew Bailey.

However, there's caution in the air; some experts warn that if the economy remains robust and inflation persistent, yields could rise again. Last week's market rise could represent a temporary rally rather than a long-term trend, especially given a less-than-rosy earnings outlook and weaker macroeconomic data.

In company news, Ryanair announced a regular dividend, leading to a significant stock increase, while Tesla's shares moved up following news of a potential new, more affordable electric car model to be produced in Germany.

Key events this week:

Eurozone services PMI, Monday

Australia interest rate decision, Tuesday

China trade data, Tuesday

US trade balance, Tuesday

Dallas Fed President Lorie Logan speaks, Tuesday

Germany CPI, Wednesday

Bank of England Governor Andrew Bailey speaks, Wednesday

China PPI, CPI, Thursday

US initial jobless claims, Thursday

Fed Chair Jerome Powell speaks, Thursday

US consumer confidence, Friday

UK industrial production, GDP, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.1% as of 10:58 a.m. London time

S&P 500 futures rose 0.2%

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 2%

The MSCI Emerging Markets Index rose 2.1%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.2% to $1.0749

The Japanese yen fell 0.2% to 149.65 per dollar

The offshore yuan rose 0.2% to 7.2769 per dollar

The British pound rose 0.3% to $1.2416

Cryptocurrencies

Bitcoin rose 1.5% to $35,185.08

Ether rose 1.4% to $1,896.38

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.59%

Germany’s 10-year yield advanced six basis points to 2.70%

Britain’s 10-year yield advanced five basis points to 4.34%

Commodities

Brent crude rose 1.6% to $86.26 a barrel

Spot gold fell 0.3% to $1,987.50 an ounce

Be Careful What You Download

A counterfeit Ledger Live application present on the official Microsoft App Store led to the loss of more than 16 Bitcoins within just a few weeks of its appearance. What makes this situation even more concerning is that it's not the first instance of a fake Ledger app infiltrating the Microsoft store to pilfer funds. Similar incidents occurred in December of last year and again in March of this year.

In response, Ledger Live emphasized that the most secure approach to thwart phishing scams is to download their app exclusively from their official website. However, the challenge remains: how can users be certain that the visited website is genuinely Ledger’s and not an imposter?

Investors must exercise extreme caution when downloading apps, diligently verifying and cross-referencing sources. No legitimate platform will ever request your 24-seed phrase unless it's for wallet recovery purposes. Any request for this phrase outside of that specific context is undoubtedly a scam and should be treated as such.

The UN Doesn’t Understand Bitcoin

What a surprise! We have another international organization that hasn't taken the time to understand Bitcoin. The United Nations University recently released a blog criticizing Bitcoin mining, yet it's worth questioning whether their concerns are solely about the environment or stem from deeper biases. The suggestive opening sentence, “Undeniably, digital currencies have won the faith of the world's top investors, ranging from large corporations and tech millionaires to criminals, money launderers, and sanction busters,” hints at a negative bias within their perspective.

I won't spend extensive time refuting the UN's portrayal of Bitcoin as the next environmental menace, but a few key points are worth noting. The UNU compares the surge in the crypto market to the historical gold rush but fails to acknowledge a crucial difference - Bitcoin mining hasn't caused physical devastation or loss of life as the gold rush did. In fact, Bitcoin has propelled a renewable energy boom, relies more on renewable sources than non-renewable ones, has contributed to grid improvements, and harnesses otherwise wasted energy.

You can make the argument that the surge in the crypto market may be compared to the gold rush in terms of excitement and that’s about it. Bitcoin critics don’t actually care about the environment, the argument has only ever been a smokescreen to protect a fiat standard.

Elon Musk Won’t Create A Token

Elon Musk's statement, "none of my companies will ever create a crypto token," holds two implications: the explicit meaning is a clarification regarding scams and low-value cryptocurrencies. However, the implicit meaning suggests the potential adoption of existing cryptocurrencies by his companies, which is an exciting prospect.

Tesla previously embraced crypto as a payment method but later withdrew the option. However, it seems inevitable that the option will reemerge, and it's likely that X will implement a method to integrate crypto payments into the app. Elon Musk's fervor for technology implies an eventual foray into financial technology--another exciting prospect during this bullish market.

Bitcoin And Tether Will Fuel The Next Bull Market l Paolo Ardoino

Tether has been arguably the most successful company in crypto, as stablecoin adoption increases and the company makes billions. Is this what will drive the next cycle? Paolo Ardoino, CEO of Tether, and Scott Melker discuss.

My Recommended Platforms And Tools

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.