Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Buy The Rumor Sell The ETF

Bitcoin Goes Parabolic

Altcoins Are Heating Up

Bonds Bounce, Long TLT

Research Suggests Hal Finney Is Not Satoshi

Updates On The ETF

MicroStrategy Is Back In Black

ETH Hits 100M Addresses

Bitcoin Pump | ETF Is About To Get Approved & Bring Billions Into Crypto | Macro Monday

Buy The Rumor Sell The ETF

Buy the rumor, sell the news.

“Buy the rumor, sell the news is a market adage based on the belief that stock prices move in anticipation of rumors and rebound when profit-taking occurs after the actual news is released. It’s a risky tactic of stock trading based on just rumors or moving events. The investor, who stands to make a nice profit on their stocks, then dumps positions as the news is announced.” - Kenny Polcari from CNBC.

Over the course of cryptocurrency's history, this saying has consistently held true. However, does it still hold relevance for the BlackRock ETF? If you had posed this question to me a few weeks ago, my response might have differed slightly from what I'm considering today. Moreover, if the market continues on its current trajectory, I might end up with a third, entirely distinct response. The key, as always, lies in the context.

Barely a few weeks ago, the SEC was proactively rejecting ETF applications in light of the impending government shutdown. The prevailing opinion was that the SEC might have more arbitrary and capricious rejections planned to postpone the ETF approval until the new year. Bitcoin was trading in the $26,000 to $27,000 range, and market sentiment oscillated between 'neutral' and 'fear.' During that period, it didn't seem like anyone was buying the ETF rumor.

Fast forward to today, and the sentiment regarding the ETF has undergone a complete 180-degree turnaround. A false news story triggered real FOMO (Fear of Missing Out), there's now a ticker for BlackRock's spot ETF, the SEC did not appeal the Grayscale decision, there are closed-door talks between the SEC and filers, and prominent figures in the industry are now confidently predicting that an ETF is on the verge of becoming a reality. It appears that everyone is starting to buy the rumor… and I wrote the first draft of this BEFORE Bitcoin moved from 31K to 35K.

I have no idea what the next few weeks will bring, but if the trend of positive ETF sentiment and developments continues down its current path, we may witness a sustained rally leading up to the announcement, with the excitement potentially going from warm to hot to steaming. Does this mean we should then proceed to buy while there is a rumor and then sell when the news drops? I have some thoughts.

First and foremost, I sincerely hope that none of you are currently grappling with the decision of taking a significant trading position after refusing to do so lower, now that the sentiment has shifted positively. These are some huge green candles. For those who've been following my insights, it's no secret that I've been suggesting the inevitability of an ETF ever since BlackRock filed and the high likelihood before then. Truthfully, the ideal time to establish a position has long passed, if you are TRADING on a shorter timeline. If you are investing, it’s never a bad time to dollar cost average.

The second point I'd like to address is the substantial inflow of funds into Bitcoin from various asset managers, eventually reaching into the trillions — yes, you read that correctly. As the Bitcoin ETF gains the same level of acceptance as the GLD ETF, billions of dollars will quickly find their way into Bitcoin. It's crucial to understand that the ETF isn't an overnight news sensation but a multi-year journey into a new chapter. Over the long term, prices will adjust accordingly.

The third point worth discussing is that the more Bitcoin continues to surge on the back of rumors, the less convinced I am that it will experience a significant jump when the rumor becomes reality. Such is the nature of markets. This isn't necessarily a negative development because the current market is finally aligning with reality, and prices are catching up. The god candles are already here. In my view, if prices persistently climb right up to the news release, we should probably anticipate a correction shortly after the announcement - and after the first sizable move UP. There should be a big pump on the first announcement, but anything is possible. The more the retail market gets excited about the ETF, and price drives that enthusiasm, the more cautious I become about a potential correction looming around the corner.

The last point to consider is that ALL OF THIS IS SPECULATION. While it's reasonable to assume that an ETF will attract a significant influx of capital into the market as institutions mobilize their resources to promote their new financial product, and as buyers seeking professionally managed ETF exposure see their wishes fulfilled, predicting how prices will respond to all of this is a pure guessing game. Relying solely on the 'buy the rumor and sell the news' is an old-school strategy, that everyone else is already thinking about.

I would like to think that that best move will be to buy the rumor, then buy the dip after the news… whenever it comes.

I have no personal interest in trying to pinpoint the exact bottoms and tops related to the ETF for my investment position. My core belief aligns with the still-contrarian view that Bitcoin will reach well over $100,000. It won't seem obvious to most people until we are close, which is basically what we are seeing now with the ETF. Throughout this journey, the market will attempt to shake out investors at various points; the market seldom offers easy victories to the 'buy the rumor, sell the news' crowd.

The ETF remains the biggest thing to ever happen to Bitcoin and I don't plan to miss out. I’ll see you all in Valhalla.

Bitcoin Goes Parabolic

Bitcoin has entered the vacuum. There’s an area above $31,000 where there is almost no resistance because of how quickly Bitcoin fell on the way down. Now that price has broken the yearly high around $31,800, it has quickly moved through that “gap” in resistance. You can find an area around $37,000 0 $38,000 on the weekly and daily charts that is technically the next area of resistance.

As you can see, that break of the 200 MA on multiple time frames that we were watching for was truly the tell as to what was to come.

This is a clear bull market for Bitcoin, with a clear serious of higher highs and higher lows from the bottom. Price is over 100% off those lows.

The god candles are back, at least for now. Enjoy.

Beautiful. As you can see, RSI is now well into overbought, which does not concern me until we see bearish divergence. That has consistently been our top and bottom signal.

There is a huge area of supply (resistance) around $38,000 that extends to around $40,000. Not much between here and there.

Altcoins Are Heating Up

Altcoins are performing rather well on their USD pairs, but largely suffering against Bitcoin. That’s the way this game is played. However, there have been some outliers, which is nice to see. If Bitcoin chills out and consolidates, we should see some real moves on altcoins. For altcoins and Bitcoin to be rising like this indicates that there is fresh capital coming into the market. This is not just the old washing machine of crypto traders going from alts to Bitcoin and back.

For those of you who have been reading the newsletter for years, you will know that EGLD holds a special place in all of our hearts. My early trades and investments on this coin are largely the reason that the newsletter grew - because we did 100s of Xs on trades on this coin, starting when it was ERD on the Bitcoin pair.

Either way, this is now AT RESISTANCE. If you bought the last time I shared a setup on this, then you are well in profit already (after some downside). Now is not the time to buy at resistance, but a break above should send price to $38 with minimal problem. We want to see a break above $29.24 then ideally a retest as support.

Remember, these are setups, not signals. You don’t buy things I list here just because they are listed. This is not even a trade yet.

* I own EGLD.

That worked out well. This is a review of the setup from yesterday, which gave the perfect entry for those who were watching. After the breakout that I shared, price perfectly retested both the horizontal and descending resistance on a single wick down. Assets don’t always give you this ideal entry, but MATIC has.

As always, I have no idea what will happen, but the ultimate target of a breakout like this is the high of the pattern - around $1.58 There are a lot of areas of resistance between here and there.

* I own MATIC.

Bonds Bounce, Long TLT

The global financial landscape is experiencing mixed signals across various markets. In the bond market, the U.S. 10-year yield has seen a decline to 4.8%, sparking speculation that its recent selloff might have been excessive. This comes after some market experts warned that economic slowdowns may force the Federal Reserve to consider lowering interest rates, even though the resilient economy makes it hard to pinpoint when the Fed will halt its rate hikes.

On the stock front, Nasdaq 100 index futures are rising, indicating positive sentiment ahead of major tech earnings reports from companies like Microsoft and Alphabet. European markets remained largely stable, with the Stoxx 600 index showing little change, while U.S. futures edged up by 0.4%.

Currency and commodity markets also showed interesting movements. Bitcoin reached $35,000, hitting its highest level since the previous year, possibly due to the expected approval of the first U.S. spot Bitcoin ETFs. The euro experienced a downturn against the dollar, impacted by struggling economies in France and Germany. Brent crude oil prices recovered, climbing above $90 per barrel amid increasing geopolitical tensions, specifically related to the Israel-Hamas conflict.

Separately, in Asia, most Chinese stock indices rose following intervention by China's sovereign wealth fund, buying exchange-traded funds to stabilize prices. This has led some market watchers to suggest that while it might be too early to claim a market bottom, Chinese authorities appear willing to intervene when market momentum takes a strong downward turn.

In summary, investors worldwide are dealing with a complex set of factors, including economic indicators, tech earnings, geopolitical tensions, and possible changes in monetary policy, all contributing to an uncertain market outlook.

Key events this week:

Reserve Bank of Australia Governor Michele Bullock speaks at the Commonwealth Bank Annual Conference in Sydney, Tuesday

Paris-based International Energy Agency releases its world energy outlook annual report, Tuesday

Eurozone S&P Global Services PMI, S&P Global Manufacturing PMI, Tuesday

Euro-area bank lending survey, Tuesday

US S&P Global Manufacturing PMI, Tuesday

Microsoft, Alphabet earnings, Tuesday

Australia CPI, Wednesday

Germany IFO business climate, Wednesday

Canada rate decision, Wednesday

US new home sales, Wednesday

IBM, Meta earnings, Wednesday

European Central Bank interest rate decision; President Christine Lagarde holds news conference, Thursday

US wholesale inventories, GDP, US durable goods, initial jobless claims, pending home sales, Thursday

Intel, Amazon earnings, Thursday

China industrial profits, Friday

Japan Tokyo CPI, Friday

US PCE deflator, personal spending and income, University of Michigan consumer sentiment, Friday

Exxon Mobil earnings, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 was little changed as of 10:33 a.m. London time

S&P 500 futures rose 0.4%

Nasdaq 100 futures rose 0.6%

Futures on the Dow Jones Industrial Average rose 0.3%

The MSCI Asia Pacific Index rose 0.2%

The MSCI Emerging Markets Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.2% to $1.0646

The Japanese yen was little changed at 149.62 per dollar

The offshore yuan was little changed at 7.3176 per dollar

The British pound was unchanged at $1.2249

Cryptocurrencies

Bitcoin rose 8.6% to $34,251.31

Ether rose 6.7% to $1,823.36

Bonds

The yield on 10-year Treasuries declined two basis points to 4.83%

Germany’s 10-year yield declined eight basis points to 2.80%

Britain’s 10-year yield declined six basis points to 4.54%

Commodities

Brent crude rose 0.6% to $90.33 a barrel

Spot gold fell 0.3% to $1,967.82 an ounce

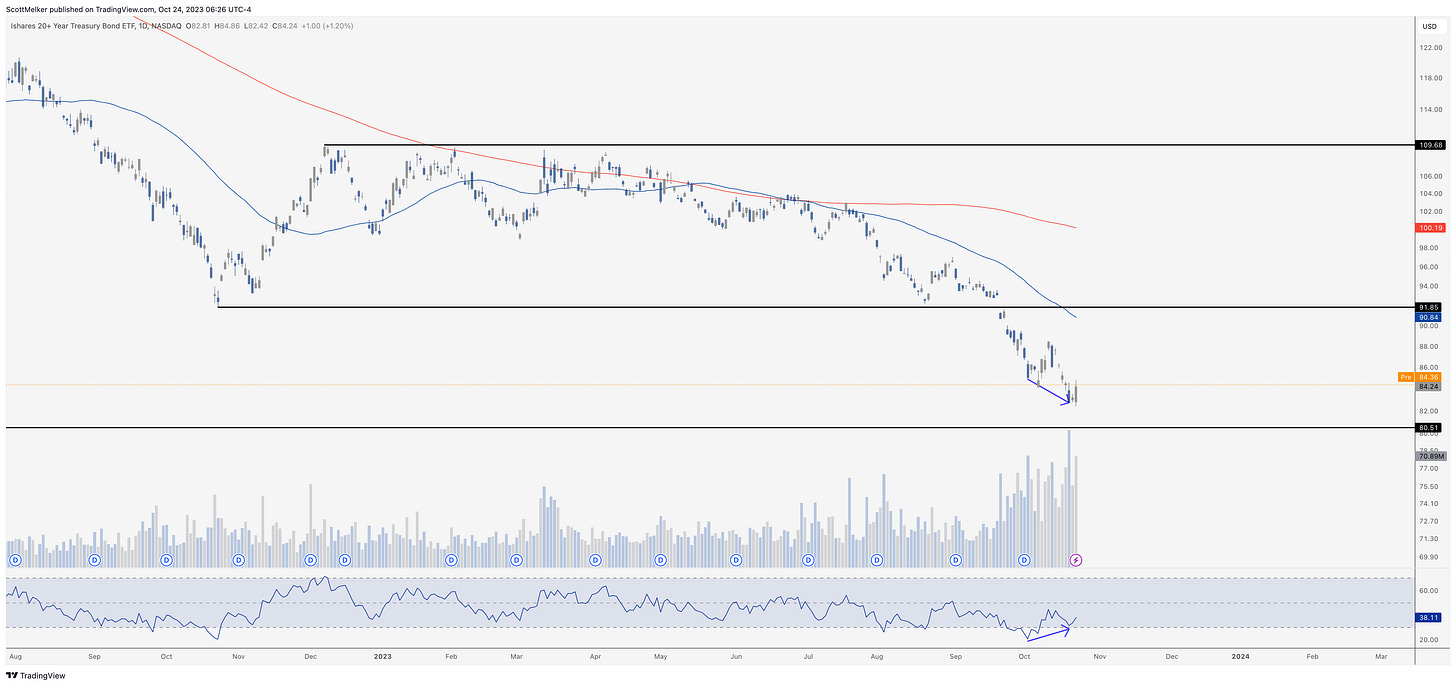

TLT (Ishares 20+ Treasury Bond ETF)

I took a significant long position in TLT yesterday, which is the proxy ETF instrument for betting on bonds. My belief is that yields are topping for now, which means that the value of bonds should rise. Remember, bonds go down when yields go up, because the bond is less valuable vs new bonds with higher yields.

Right after I took my position, I saw the following tweet from Bill Ackman - his thinking is the same.

TLT is oversold with bullish divergence on both the daily and weekly chart. Yields are largely overbought with bearish divergence with RSI on their own charts. This seems like peak fear on bonds, so I am in.

Research Suggests Hal Finney Is Not Satoshi

For more than a decade, a widely circulated theory has suggested that Hal Finney, the first individual to download and execute Bitcoin's software after Satoshi, might indeed be Satoshi Nakamoto. Personally, I have never been particularly preoccupied with the identity of Satoshi, and as such, I don't hold a strong opinion on the matter. However, if you're interested, you might want to explore early cyberpunk Jameson Lopp's comprehensive debunking of the theory that associates Hal Finney with Satoshi Nakamoto.

In his thorough examination, Jameson Lopp marshaled compelling evidence to conclusively demonstrate that Hal Finney was engaged in a marathon during a specific period when Satoshi was known to be sending emails. Furthermore, Lopp dissected other corroborating evidence, including Satoshi's communication patterns, instances of Bitcoin transactions when Hal Finney was occupied, and various objections to these supporting facts.

I am going to end this section with a quote from Jameson Lopp, “It is better for Bitcoin that Satoshi not be a man, for men are fallible, fickle, and fragile. Satoshi is an idea; it is better that all who contribute to Bitcoin be an embodiment of that idea. As such, I pose to you that it is to the benefit of Bitcoin that we crush any myths of Satoshi’s true identity.”

Updates On The ETF

Crypto prices are pumping, driven by the increasing public perception of the likelihood of an ETF going live. Just yesterday, BlackRock acquired its CUSIP (Committee on Uniform Securities Identification Procedures), a unique identifier that plays a crucial role in the early stages of listing a security. Furthermore, BlackRock has secured a ticker name for its spot ETF, 'IBTC,' and has indicated in its filing that it's prepared to fund the ETF this month. As a part of this, most investment managers begin to seed their fund with the underlying asset… so they will be buying at least a bit of Bitcoin.

In other ETF-related developments, the courts have directed the SEC to review Grayscale's filing and continue their ongoing dialogue. While the SEC could have imposed more stringent requirements, which would have favored Grayscale, it remains a 'take-what-we-can-get' situation, as has been the case throughout.

MicroStrategy Is Back In Black

As Bitcoin's value continues to surge, MicroStrategy is poised to become a prominent topic of discussion as everyone assesses the extent of the company's profitability. Remember when everyone was talking about the chance of Bitcoin prices forcing MicroStrategy to liquidate? That script is going to quickly be flipped.

As of October 23, MicroStrategy holds 158,245 BTC with a total worth of $4.847 billion, purchased at an average cost of $29,870. These holdings have appreciated by approximately $132 million. To put it in perspective, a gain of just over $100 per coin translates to over $100 million in profit—truly remarkable. The window for doubting Saylor's strategy is rapidly closing.

ETH Hits 100M Addresses

It's important to emphasize that achieving milestones in terms of total addresses doesn't necessarily prove a growing number of long-term believers in the network. Currently, the number of addresses actively interacting with the network has decreased to 14,600, which is notably low for this asset. Nevertheless, Ethereum has been in a transitional phase over the past year, moving from a bear market to a bull market, and is only now starting to regain its momentum. Once the initial hype surrounding the ETF subsides, and new DeFi trends emerge, I have full confidence that Ethereum will regain its full vigor and even impress its critics. While Bitcoin may lead the way, Ethereum has consistently been its strongest counterpart.

Bitcoin Pump | ETF Is About To Get Approved & Bring Billions Into Crypto | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's going on in macro and crypto!

My Recommended Platforms And Tools

Trading Alpha - Ready to trade like the pros? The best traders in crypto are relying on these indicators to make trades. Use code ‘2MonthsOff’ when visiting my link HERE.

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.