Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Margaritas On The Beach

Bitcoin Thoughts And Analysis

Legacy Markets

Bitcoin Goes 0 To 60 With Ferrari

MetaMask Removed From The Apple Store

Listen To This

SBF Is F*cked! JPMorgan Goes All In Crypto l Friday Five

Here Is Why These Fan Tokens Are So Popular | Alexandre Dreyfus, Socios

Margaritas On The Beach

A 2021 study from the American Psychological Association discovered some really interesting findings related to free time: having too little or too much time is linked to lower subjective well-being. Is this a load of crap or is the APA onto something? Let’s have a quick group therapy session.

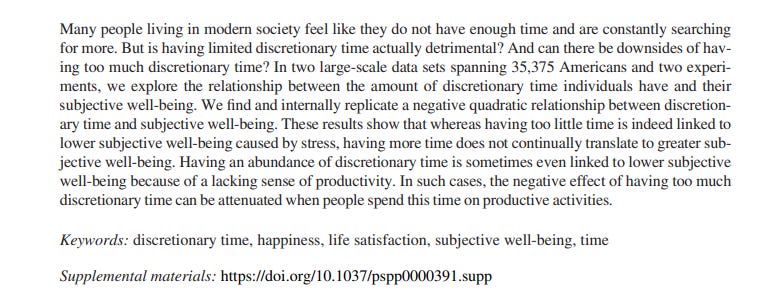

Below is a screenshot of the abstract of the study - don’t cut corners, read it.

Essentially, the study discovered that a healthy range of free time exists somewhere between 2 and 5 hours a day. Well-being tends to decrease with free time up to about 2 hours per day and alsobeyond 5 hours of free time a day. Is this an absolute truth for everyone? Certainly not. However, intuitively, these findings seem to make sense and appear to align with the experiences of the majority of people.

Excessive free time doesn't necessarily lead to happiness, just as an abundance of money doesn't guarantee it either; true happiness is never as straightforward as it may seem. So no, I would say the study isn't a load of crap. What is a load of crap is the idea that we invest solely for the purpose of accumulating free time - I am speaking from experience here.

I won't point any fingers, but I know a lot of investors do what they do solely to enjoy all-you-can-drink margaritas on a sunny beach in Cancun. I may or may not have viewed investing this way in the past…

The vacation I just dreamt up actually sounds wonderful right now, and I would love to be there with you, but investing for the sake of soaking up the sun and spending your hard-earned conviction capital on all you can drink morning margarita packages doesn’t feel as good as it does in your dream. Especially when that lifestyle becomes permanent.

Again, there exist outliers who are perfectly content doing nothing more than passively enjoying their free time until the day they die. However, this is the exception rather than the rule. For us, as investors, it means we must seek meaning and purpose between and beyond the lines, just as we search for alpha and opportunities in charts and reports. Is this starting to make sense?

What I am not asking you to do is tear up the Cancun postcard you are holding onto, nor should you throw away your ‘67 Camaro model car you are looking to replace with the real one when Bitcoin hits $100,000. But I am asking you to build on and add to these motivators. I know that the Cancun postcard symbolizes meaningful rest and/or time with your family and the Camaro represents a lifelong dream of hard work, but let’s expand beyond these motifs.

When you finish with this newsletter, take a look at your portfolio. Is there anything in there that represents something bigger than the name of assets or equities that fluctuates? Does there happen to be an asset that represents freedom from authoritarian constraints and infinite fiat printing? How about a company that is ushering in new financial technology to billions of people around the world? Is there an asset that is reshaping the forefront of a decentralized revolution? These are just a few ideas, but I hope you see what I am getting at.

The concept of investing in something for both the means and the ends is profoundly impactful. Never before in history has there been a moment where virtually everyone in the world has access to an opportunity that, by engaging with it, can directly lead to disrupting the established norms and status quo. I completely share your excitement when Bitcoin begins to rise, but I’m also passionate about Bitcoin for everything that it will accomplish outside of price.

I look forward to the day we all can appreciate some hard-earned free time on the beach, but more than that, I look forward to and enjoy the work we put in to get there and the difference Bitcoin makes along the way. Together, we can cheers to that.

Bitcoin Thoughts And Analysis

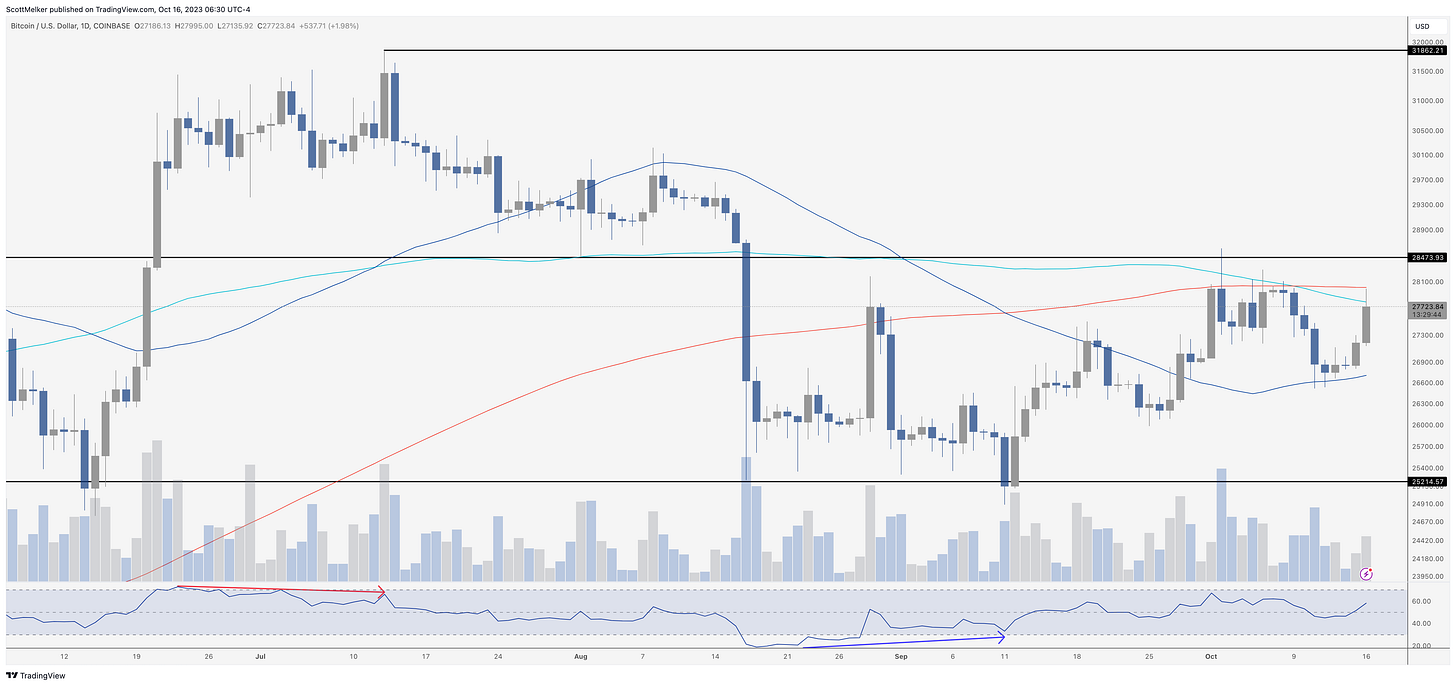

Bitcoin continues to trade sideways, liquidating bears and bulls on low time frames. It is nice to see a push up, which made last week’s candle a bit… confusing. While the evening star pattern discussed was somewhat intact, you can see that the candle had a large wick down to the rally at the end of the week. So for me, this is just a signal of more indecision. We are still below the key 200 MA on the weekly chart. For now we have a very positive start to this week - but still sideways.

Nice move up - right into the red 200 MA that has acted as an impenetrable wall now all month. The 100 MA is also acting as resistance, in light blue.

I refuse to get excited at all below the 200 MA on every meaningful time frame, and I am not even an MA maximalist! We just need to see real key levels broken. We are still just trading sideways between $28,600 and $25,000.

Legacy Markets

European and U.S. stock markets showed mixed performance amid concerns over the Israel-Hamas conflict and geopolitical tensions. Technology shares dipped following news of potential U.S. restrictions on China's semiconductor access, while energy stocks rose with Shell Plc reaching an all-time high. In Poland, a pro-European bloc's potential election win boosted equities and the local currency. Markets stabilized after a rush to safe assets last week but remain focused on developments in the Middle East, as any escalation could impact oil prices and market stability.

U.S. Treasury yields rebounded slightly after last week's drop. Gold prices fell, while Brent crude remained above $90 a barrel. On the corporate front, Pfizer cut its revenue forecast, and Manchester United shares dropped after a Qatari investor group withdrew its bid for the football club. The People’s Bank of China injected significant liquidity into the market, and the U.S. is tightening restrictions on China's access to advanced semiconductors. Traders are also eyeing central bank comments for clues on interest rate policies amid ongoing macroeconomic uncertainties.

Key events this week:

Russian Foreign Minister Sergei Lavrov visits China, Monday

US Treasury Secretary Janet Yellen meets with euro-area finance ministers in Luxembourg, Monday

European Central Bank governing council member François Villeroy de Galhau speaks, Monday

Bank of England chief economist Huw Pill speaks, Monday

US Empire Manufacturing index, Monday

Philadelphia Fed President Patrick Harker speaks, Monday

Chinese President Xi Jinping hosts world leaders at the Belt and Road Initiative forum in Beijing, with Russian President Vladimir Putin expected to attend, Tuesday

Germany ZEW survey expectations, Tuesday

UK jobless claims, unemployment, Tuesday

Joint European Central Bank/IMF policy and research conference, Tuesday

US retail sales, business inventories, industrial production, cross-border investment, Tuesday

Goldman Sachs, Bank of America earnings, Tuesday

New York Fed President John Williams moderates discussion, while Richmond Fed President Tom Barkin speaks at a separate event, Tuesday

Reserve Bank of Australia Governor Michele Bullock speaks, Wednesday

China GDP, retail sales, industrial production, Wednesday

UK CPI, Wednesday

Eurozone CPI, Wednesday

Morgan Stanley, Netflix, Tesla earnings, Wednesday

Federal Reserve issues Beige Book economic survey, Wednesday

Philadelphia Fed President Patrick Harker and New York Fed President John Williams speak at separate events, Wednesday

Australia unemployment, Thursday

Japan trade, Thursday

China property prices, Thursday

US initial jobless claims, Thursday

Federal Reserve Chair Jerome Powell, Chicago Fed President Austan Goolsbee, Atlanta Fed President Raphael Bostic, Philadelphia Fed President Patrick Harker, Dallas Fed President Lorie Logan speak at different events, Thursday

Japan CPI, Friday

China loan prime rates, Friday

President Joe Biden hosts the European Union’s Ursula von der Leyen in Washington, Friday

Philadelphia Fed President Patrick Harker speaks, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 was little changed as of 9:54 a.m. London time

S&P 500 futures rose 0.2%

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average rose 0.3%

The MSCI Asia Pacific Index fell 0.9%

The MSCI Emerging Markets Index fell 0.7%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.3% to $1.0540

The Japanese yen was little changed at 149.50 per dollar

The offshore yuan was little changed at 7.3164 per dollar

The British pound rose 0.1% to $1.2158

Cryptocurrencies

Bitcoin rose 2.3% to $27,841.38

Ether rose 1.1% to $1,582.35

Bonds

The yield on 10-year Treasuries advanced seven basis points to 4.68%

Germany’s 10-year yield advanced four basis points to 2.78%

Britain’s 10-year yield advanced five basis points to 4.44%

Commodities

Brent crude fell 0.4% to $90.50 a barrel

Spot gold fell 1.1% to $1,912.28 an ounce

Bitcoin Goes 0 To 60 With Ferrari

Should I buy a Ferrari when one Bitcoin is worth one Ferrari? If only Bitcoin went to 60k in a few seconds rather than 60mph, but I’ll take what I can get. What’s cool about this news is that Ferrari is one of the world’s most recognizable brands, and according to the CMO, “prices will not change, no fees, no surcharges if you pay through cryptocurrencies.” The logistics of the announcement are as follows: BTC, ETH, and USDC are all accepted as currencies, with Bitpay, a major payment processor, responsible for handling the transactions. Europe is set to be the next destination following the United States. Of course, this news will have no effect on prices, but crypto has matured to a point where brands can consider accepting it as a payment, and if enough brands adopt it, it will undoubtedly have a significant impact on price and legitimacy.

MetaMask Removed From Apple App Store

MetaMask experienced a temporary removal from Apple's App Store over the weekend, lasting only a few hours due to compliance with guidelines and legal concerns. The reassuring aspect is that this removal was unrelated to functionality, security issues, or malicious activity, and it is not expected to result in any permanent consequences. Presently, this incident does not appear to be a significant concern; however, given Apple's reputation as a big-tech tyrant, uncertainties can arise at any moment. It's advisable to secure your funds offline.

Listen To This!

This recovered audio recording of a secret meeting between FTX and Alameda employees is an absolute shit show. In the dialogue, Ellison basically admits to Alameda and FTX being one big house of cards, “Most of Alameda’s loans got called in in order to meet those loan recalls. We ended up borrowing a bunch of funds on FTX, which led to FTX having a shortfall in user funds. And so, once there started being like FUD about this and users started withdrawing funds.”

The recording literally sounds like a nervous child trying to explain how billions of dollars were lost, mismanaged, and stolen, kind of because that’s exactly what happened. Caroline has been cooperating with law enforcement, but I know for a fact Sam isn’t the only person in the scheme who deserves jail time. I look forward to the bull run resuming while justice is served.

SBF Is F*cked! JPMorgan Goes All In Crypto l Friday Five

Friday Five is THE show about the main news in crypto. Join me and Nathaniel Whittemore as we delve into the main topics that moved the markets.

Here Is Why These Fan Tokens Are So Popular | Alexandre Dreyfus, Socios

Curious about the hottest tokens in the crypto world? Look no further than fan tokens, which are gaining widespread popularity. These tokens are embraced by fervent supporters of major sports teams worldwide, quietly propelling the widespread adoption of cryptocurrency. Dive deeper into this topic by exploring my interview with Alexandre Dreyfus, the visionary founder behind Socios and Chiliz. Discover the intriguing world of fan tokens and their role in the crypto revolution.

My Recommended Platforms And Tools

OKX - Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Use my code HERE.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO. This is the wallet that I personally use!

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.