The Wolf Den #824 - War

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

War

Bitcoin Rejected at 200 MAs. Again.

Time To Go Risk Off? Legacy Market Summary.

BlackRock Is Bullish

Week One Of SBF’s Trial is In The Books

Stars Arena Hacked

OKX Updates To Comply With UK Regulation

The Biggest Companies In The World Are Already Using Blockchain | Sunny Lu

War

For the first time that I can recall, I’m actually dreading work this week. I don’t want to show up for my shows. I don’t want to write newsletters. I don’t want to discuss the SBF trial on X Spaces. Or the price of bitcoin. I don’t want to minimize what is happening by discussing less pressing issues.

Some days it’s hard not to be fed up with humanity. And discussing the impact of the war on markets seems to whitewash the atrocity when it is directly impacting the lives of so many, including many of you.

This newsletter is not designed to delve into geopolitics, global conflicts, or religious ideologies. I won't offer commentary on the logistics of the ongoing conflict because I am not a professional in that field, but I do want to express my profound sadness in witnessing the suffering, pain, destruction, and loss of life happening at this time. It's truly disheartening to exist in a world where violence consistently prevails over peace.

I have an emotional attachment to the Middle East, and to Israel in particular. I went there as a child. I was an archaeology major in college, focused on the religious history of the area and spent some of the best times of my life in the country.

I also was present for one of the largest suicide bombings in history, at a market that I had left moments before, where murderers slaughtered both civilians and, soon after, the rescue workers that came to save them.

The situation in Israel is emotionally triggering, and I find it challenging to think about anything else.

Commenting on the war carries the risk of becoming a target for direct attacks, as has already happened to me on Twitter. Does this mean I lack education or opinions? Absolutely not. However, I am also mindful that I have not devoted my life to the comprehensive study of Middle-Eastern conflicts. I acknowledge the limits of my knowledge.

What I do want to talk about is the thought that many of us have in the back of our heads that can be very intrusive if not handled with care: how am I directly affected?

First and foremost, it's essential to recognize that engaging in this conversation is a privilege while the lives of entire populations are at immediate risk. Discussing markets and cryptocurrencies from the comfort of our homes while others endure suffering is a reminder not to take this privilege for granted. My close friends from the crypto world who live in Israel no longer share that luxury - their children are on the front lines and they have already shared gut wrenching stories with me.

The second crucial point to emphasize is that financial markets, encompassing assets like Bitcoin, altcoins, and various investments, continue to exist in these trying times. In fact, taking a break from constantly monitoring your portfolio may prove beneficial, allowing you to step outside your comfort zone and gain a more profound understanding of events unfolding beyond your immediate sphere. While there may be financial consequences resulting from the ongoing circumstances, it's important to recognize that your investment portfolio won’t go anywhere. This stability can provide a source of solace in a world where others are enduring the painful loss of their possessions and loved ones.

Frankly, there are few things I care less about than how this war will affect my portfolio. It just doesn’t matter to me.

The third crucial point to emphasize is the clear distinction between caring for others and managing your portfolio. While investments undoubtedly play a significant role in meeting basic needs such as putting food on the table, paying bills, funding our children's education, and securing a comfortable retirement, it is essential not to intertwine these financial goals with ongoing conflicts. In the 21st century, our world has witnessed far too many instances of genocide, atrocity, and war. It should be a matter of common sense that we must never wish for specific outcomes solely for our personal financial benefit.

This brings me to my fourth and final point: Bitcoin's success is not contingent on global chaos. Bitcoin doesn’t depend on WWIII, Bitcoin doesn’t depend on nuclear warfare, it doesn’t depend on the collapse of fiat currencies, the bankruptcy of banks, global recessions, invasions, or the outcome of political elections, regardless of the party. Bitcoin's resilience and potential transcends these scenarios. Bitcoin is a tool for hope, peace and freedom that will thrive in any environment, so there's no need to hope for global adversity to benefit ourselves. We are better than this.

Markets hate uncertainty, so perhaps we should brace for volatility in the short term. Personally, it’s hard to focus on markets at the moment with all that’s going on.

I hope that none of you have been directly affected by this madness and that we will see a quick and peaceful resolution. No matter what happens, I will be here with you.

Bitcoin Rejected at 200 MAs. Again.

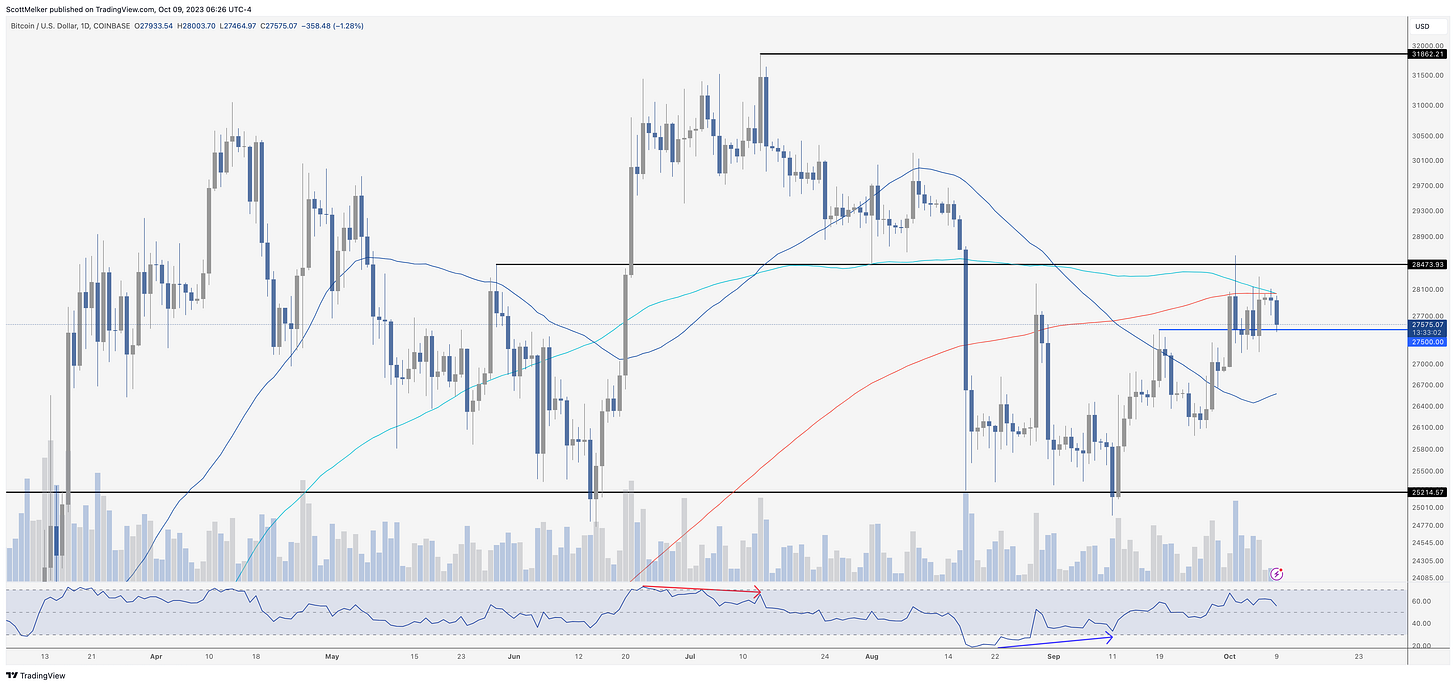

Bitcoin was rejected at the 200 MA on the weekly chart for the second week in a row, which is something I have been discussing and watching for. The world is likely heading into a risk off environment, so it will be very interesting to see how Bitcoin performs in this context. Is it ready to be viewed as a flight to safety, like gold? Or will it sell off alongside riskier assets?

Like on the weekly chart, Bitcoin has once again been clearly rejected at the 200 MA, as well as the 100 MA on the daily time frame. We have had 6 daily candles touch that line without a single close above. That’s a lot of selling pressure in that area!

For now, we need to see Bitcoin trading comfortable above that level on the daily and ideally the weekly to have confidence that this move can sustain to the upside.

Time To Go Risk Off? Legacy Market Summary.

In the wake of a surprise attack by Hamas on Israel, global markets have experienced significant shifts as investors recalibrate their risk assessments. The immediate reaction was a surge in oil prices, with West Texas Intermediate (WTI) experiencing a jump of more than 5%, although it later pared some of these gains. Brent and WTI were already headed toward $90 per barrel, but the geopolitical tensions added fuel to the upward price movement.

Investors have been moving away from traditionally risky assets like stocks, opting instead for safe havens such as gold, bonds, and the U.S. dollar. Gold saw a 1% increase, and an index tracking the strength of the dollar also rose modestly by 0.3%. This trend of risk aversion was echoed by Alexandre Baradez, chief market analyst at IG Markets in Paris, who stated, "This is a classic risk-off positioning towards safe havens."

European markets were not immune to these shifts. Notably, shares in European energy and defense companies like Shell Plc, BP Plc, BAE Systems Plc, and Saab AB saw a rally. This was despite the broader Stoxx 600 index trading flat after erasing earlier declines.

In Israel, the situation has put significant pressure on the shekel, causing it to weaken by 2% and touch its lowest point in seven years. In response, the Bank of Israel has unveiled a massive $30 billion foreign exchange program and plans to extend up to $15 billion through swap mechanisms in a bid to support the markets.

While the conflict's direct impact on oil flows appears minimal for now, there's underlying concern that this could develop into a proxy war, notably involving Iran—a major oil producer and supporter of Hamas. Any retaliatory actions against Iran could potentially jeopardize oil flows through the Strait of Hormuz, a critical choke point that Iran has previously threatened to close.

Given the multifaceted uncertainties—ranging from the conflict itself to macro-economic issues in Europe and China, as well as hawkish central banks and already rising oil prices—the market environment is becoming increasingly complex and challenging for investors. Some analysts recommend adopting a more defensive positioning as it doesn't seem like markets will be taking an upward trend anytime soon.

Key events this week (there are A LOT):

China money supply, new yuan loans, Monday

Bank of England policymaker Catherine Mann speaks, Monday

World Bank-IMF annual meetings open in Marrakech, Morocco, Monday

Fed Vice Chair Michael Barr speaks, Monday

Dallas Fed President Lorie Logan speaks, Monday

Fed Governor Philip Jefferson speaks, Monday

Japan balance of payments, Tuesday

BOE releases minutes of financial policy meeting, Tuesday

The IMF issues its latest world economic outlook, Tuesday

US wholesale inventories, Tuesday

Fed Governor Christopher Waller delivers keynote address, Tuesday

Minneapolis Fed President Neel Kashkari speaks, Tuesday

Germany CPI, Wednesday

NATO defense ministers meeting in Brussels, Wednesday

Russia Energy Week in Moscow, with officials from OPEC members and others, Wednesday

US FOMC minutes, PPI, Wednesday

Fed Governor Michelle Bowman speaks during World Bank-IMF meetings, Wednesday

Japan machinery orders, PPI, Thursday

Bank of Japan’s Asahi Noguchi speaks, Thursday

UK industrial production, Thursday

ECB publishes account of September policy meeting, Thursday

BOE’s Huw Pill speaks, Thursday

US initial jobless claims, CPI, Thursday

China CPI, PPI, trade, Friday

G20 finance ministers and central bankers meet as part of IMF gathering, Friday

ECB President Christine Lagarde, IMF Managing Director Kristalina Georgieva speak on IMF panel, Friday

Eurozone industrial production, Friday

France CPI, Friday

BOE’s Andrew Bailey speaks, Friday

US University of Michigan consumer sentiment, Friday

Citigroup, JPMorgan, Wells Fargo, BlackRock results as the quarterly earnings season kicks off, Friday

Philadelphia Fed President Patrick Harker speaks, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 was little changed as of 11:05 a.m. London time

S&P 500 futures fell 0.5%

Nasdaq 100 futures fell 0.7%

Futures on the Dow Jones Industrial Average fell 0.4%

The MSCI Asia Pacific Index was little changed

The MSCI Emerging Markets Index fell 0.1%

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.5% to $1.0531

The Japanese yen rose 0.1% to 149.13 per dollar

The offshore yuan rose 0.2% to 7.2935 per dollar

The British pound fell 0.4% to $1.2187

Cryptocurrencies

Bitcoin fell 1.2% to $27,576.5

Ether fell 2.5% to $1,595.95

Bonds

The yield on 10-year Treasuries was little changed at 4.80%

Germany’s 10-year yield declined three basis points to 2.85%

Britain’s 10-year yield declined three basis points to 4.54%

Commodities

Brent crude rose 3.3% to $87.41 a barrel

Spot gold rose 1% to $1,851.22 an ounce

BlackRock Is Bullish

Did you know that the United States dominates crypto futures ETF trading volume, accounting for a staggering 98%? Here's another intriguing tidbit, courtesy of Eric Balhchunas: “Every single one of the Top 15 best-performing equity ETFs this year is crypto-related.” Shifting gears, I've shared this segment to highlight some commentary from former BlackRock managing director Steven Schoenfield, take a look below for more details.

“If approved, a spot Bitcoin ETF could unlock a massive inflow of capital from institutional investors, up to $17.7 trillion from financial institutions. The SEC will probably approve all spot bitcoin ETF applications at the same time. Don’t think they want to give anybody first mover advantage. Instead of completely rejecting the whole list, they’ve asked for comments, which is a marginal but significant improvement in the dialogue.”

Week One Of SBF’s Trial Is In The Books

The SBF case isn't going to be a quick one, but it hasn't taken long for SBF to face some hard-hitting punches after just a short amount of time. One of the most significant blows for the defense was FTX co-founder Gary Wang admitting to committing fraud by providing "special privileges" to Alameda, Bankman-Fried's hedge fund, enabling them to withdraw unlimited resources. Wang's testimony also implicated other high-ranking FTX and Alameda executives, including Caroline Ellison and Nishad Singh, in a range of fraud-related activities, such as wire fraud, securities fraud, and commodities fraud. To make matters worse, it wasn't just testimonies that put SBF back on his heels; there have also been continued legal maneuvers by the DOJ to seize assets, along with a mountain of incriminating evidence from SBF’s ‘apology tour’ across Twitter Spaces. It’s all fair game, and as of right now, the trial is expected to last about 6 weeks. Hopefully, justice is served.

Stars Arena Hacked

A smart contract exploit took place last Friday, leading to a $3 million loss in AVAX tokens for the Stars Arena social media platform. Fortunately, public concerns have been alleviated with a prompt effort to secure funding for recovery. In the aftermath of the hack, the Stars Arena team has made a commitment to fortify their security measures and has enlisted the services of a white-hat development team to ensure their systems are thoroughly scrutinized. As of now, there hasn't been an announced date for the platform's return, but one is expected to be announced soon.

OKX Updates To Comply With UK Regulation

OKX has updated its UK marketing strategies to comply with new regulations set by the UK Financial Conduct Authority (FCA). The FCA had recently warned crypto firms about the need for transparent and fair marketing, along with accurate risk warnings. Non-compliant firms could face serious consequences, including up to a two-year prison sentence. To align with these regulations, OKX has reduced its token offerings in the UK from over a hundred to just 40 and added a prominent risk advisory banner on its website. A dedicated OKX_UK social media channel has also been established to disseminate compliant content. The move comes as other crypto firms like Nexo and Binance make similar adjustments, while some, like ByBit and PayPal, have temporarily suspended their UK services.

The Biggest Companies In The World Are Already Using Blockchain | Sunny Lu

I met with VeChain's founder, Sunny Lu, at Token2049 to delve into the evolution of crypto over the past decade. We explored the role of music and sports in accelerating crypto adoption and discussed why top-tier companies are gravitating towards blockchain. This is a conversation you won't want to miss.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.