Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Sign up for my other newsletter, THE DAILY CLOSE!

I built The Daily Close to give you the same institutional-grade indicators and signals that I use to trade the market on a daily basis. It's automatically generated and delivered to your inbox at the daily close everyday.

1 Week FREE for all subscribers

17% discount if you subscribe for a year

$25 a month, or $250 a year

In This Issue:

The SEC Is Not All Bad

Bitcoin Thoughts And Analysis

Oil Pumps (No Pun Intended), Props Markets

Citigroup Starts Tokenization Service

€1.34 Trillion Deutsche Bank Turns Pro Crypto

Bybit Say’s Bye To The UK

Binance.US Gets A Win Against The SEC

The Binance.US Executive Exodus Continues

The Fed, Bitcoin, NFTs & Kim Kardashian | Jon Najarian

The SEC Is Not All Bad

SCOTT, HOW COULD YOU POSSIBLY SAY, “THE SEC IS NOT ALL BAD?”

I understand my title may come across as hypocritical at first glance, but I promise it will make sense. Believe it or not, there is even nuance to the SEC.

Shocker, I know!

Allow me to explain the organization of the SEC in case you aren't familiar with it.

From SEC.gov:

“The SEC has five Commissioners who are appointed by the President with the advice and consent of the Senate. Terms last five years and are staggered so that one Commissioner's term ends on June 5 of each year. To ensure that the Commission remains non-partisan, no more than three Commissioners may belong to the same political party. The President also designates one of the Commissioners as Chairman, the SEC's top executive.”

Visually, this is what the structure looks like.

The Chairman, in this case Gary Gensler, holds more executive authority and influence within the agency than the other commissioners. However, when it comes to voting on issues, each commissioner, including the Chairman, typically has one vote on regulatory matters. Their votes are equal in terms of formal decision-making.

Before I move on to why this matters for crypto, I want to highlight one last point on the structure of the SEC. Both Commissioner Hester M. Pierce and Commissioner Mark T. Uyeda were appointed by Republicans. The remaining three commissioners, including Gary Gensler, were appointed by Democrats. Maybe you are thinking party affiliation isn't a major issue, and to some degree that may be right. On the flip side, is it possible that the other three commissioners are voting against crypto because of their expected party responsibilities?

Let's shift our focus to the world of crypto. In a recent enforcement action against Stoner Cats, it's noteworthy that two out of the five commissioners dissented from the majority decision: Commissioners Pierce and Uyeda. While two out of five votes may not be sufficient to alter the course of history, it does underscore how close we are to a significant shift in the perception of crypto in the world's most influential country.

What's remarkable about the dissenting opinion, is that both Commissioner Pierce and Commissioner Uyeda demonstrate a deep understanding of the case. While they may not have explicitly acknowledged Gensler's apparent focus on celebrities, which might be considered unprofessional (a sentiment we can freely express here), their analysis of all other relevant aspects was on point.

The application of the Howey investment contract analysis in this matter lacks any meaningful limiting principle. It carries implications for creators of all kinds. Were we to apply the securities laws to physical collectibles in the same way we apply them to NFTs, artists’ creativity would wither in the shadow of legal ambiguity. Rather than arbitrarily bringing enforcement actions against NFT projects, we ought to lay out some clear guidelines for artists and other creators who want to experiment with NFTs as a way to support their creative efforts and build their fan communities.

The above paragraph is the opener. Below are a few highlights that deserve notice.

Artists of all kinds have long struggled to support themselves, and NFTs offer a potentially viable way for them to monetize their talents.

While updated for the digital age, the Stoner Cats NFTs are not that different from Star Wars collectibles sold in the 1970s.

Using the analysis of today’s enforcement action, the SEC should have parachuted in to save those kids from Star Wars mania.

The Commission’s application of the securities laws here makes little sense and discourages content creators from exploring ways to harness social networks to create and distribute content. More generally, it contributes to the legal ambiguity facing artists, writers, musicians, filmmakers, and others seeking to build a loyal, engaged following.

The dissent not only provides clear and compelling reasons to be optimistic about NFTs in the long term, but also articulates the view that the enforcement actions are excessively wide-reaching and inequitable - sentiments that we had already shared. In countless other instances, Commissioners Pierce and Uyeda have found themselves in the minority position as the SEC reigns terror on crypto. Eventually, this will change.

I maintain faith in the SEC's ability to fulfill its intended role. However, until there is a shift from prioritizing the protection of the archaic fiat system to genuinely safeguarding investors, the outlook remains bleak. While it may require time, strategic voting, and vocal advocacy, crypto has come too far to simply yield to the SEC. There's not a chance in hell of that happening. We just need one more reasonable commissioner.

I look forward to the day the SEC comes to their senses and guides safe innovation here in America. I know it’s possible.

#FireGaryGensler and #HireHesterPeirce

Bitcoin Thoughts And Analysis

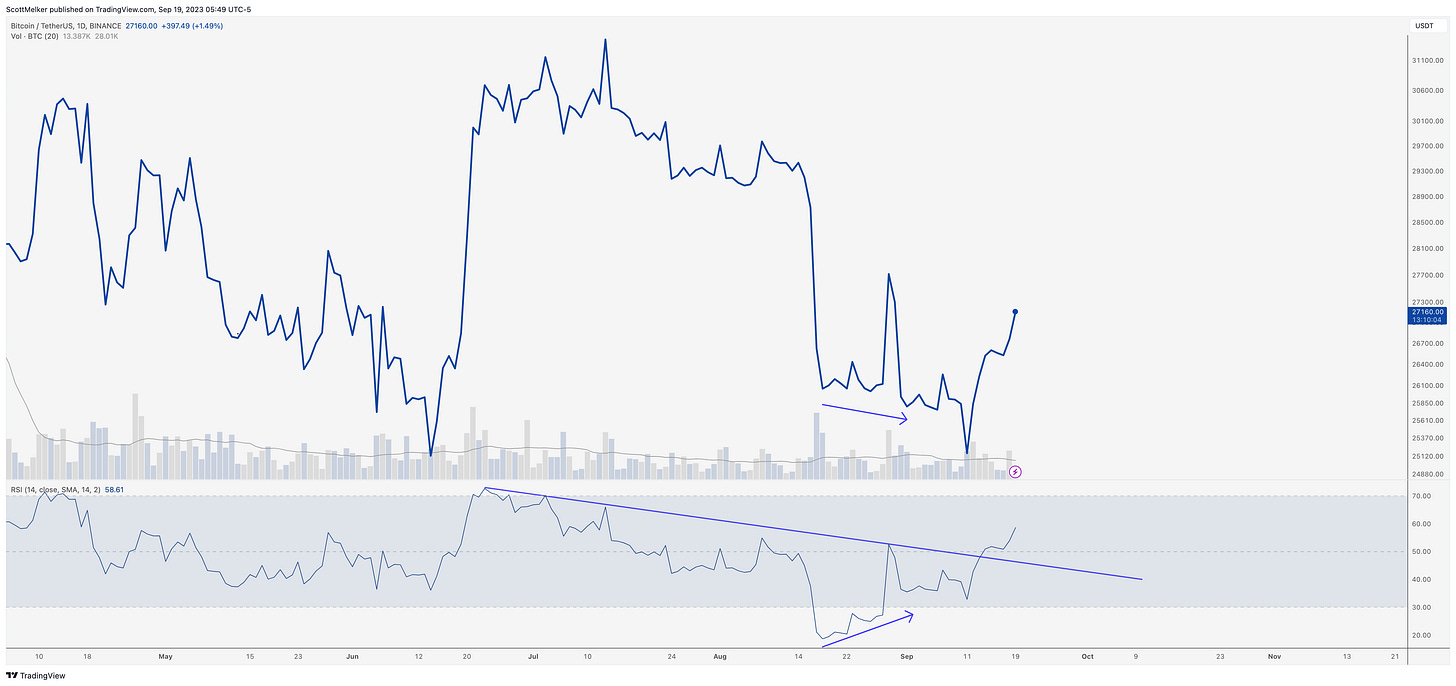

Bitcoin has made showed a bit of bullishness over the past few days, but nothing that has changed the longer term outlook. As you can see on the weekly chart, $25,214 support is intact and Bitcoin is continuing to range sideways, trapped between the 50 MA below and the 200 MA above.

IMO there is still nothing to see here, merely price trapped in large range between $25,000 and $31,000.

Just wanted to highlight something that I pointed out previously. We had bullish divergence with RSI and we had RSI breaking through descending resistance. As I mentioned, you can often draw patterns on an indicator and their breakouts will precede those of price. This was a good hint that at least a small move to the upside was coming.

While I was gone, the much anticipated death cross (the 50 MA dropping below the 200 MA) was confirmed… right at the bottom. As I often mentioned, these signals are lagging, a result of what has happened before. So we often see them come after the move. That said, we also often see price run up to them before dropping again, and the 50 MA is acting as strong resistance now. This is not the area to get too excited, as we are still sideways and at resistance.

Oil Pumps (No Pun Intended), Props Markets

European stock markets experienced a modest rise, driven largely by gains in oil companies, as the global financial community awaits upcoming decisions from major central banks. Brent crude, a key oil benchmark, surpassed $95 a barrel for the first time since November. This surge in oil prices is attributed to Saudi Arabia and Russia's decision to limit supply, propelling prices upwards and intensifying inflation worries. Leading oil companies like TotalEnergies SE, BP, and Shell saw significant gains, boosting Europe’s Stoxx 600 by 0.3%. Concurrently, US stock futures indicate possible slight gains.

The recent rally in oil prices places added pressure on central banks, as they grapple with managing inflation and potential economic risks. Key policy decisions are expected from the Federal Reserve, the Bank of England, and the Bank of Japan this week. David Kalfon of Sanso Investment Solutions comments on the challenges faced by central banks, emphasizing that controlling inflation takes precedence over promoting growth.

Meanwhile, the tech sector, particularly the Nasdaq 100, is experiencing bearish tendencies, with the index dropping roughly 3.9% since mid-July. As for the Federal Reserve's upcoming announcements, financial experts are keenly observing any indications of future interest rate adjustments, with a special focus on projections for potential rate hikes or cuts. Richard Flax of Moneyfarm anticipates the Fed to maintain a cautious stance on inflation, suggesting that interest rates might stay elevated for a longer duration.

Key events this week:

This week, Ukrainian President Volodymyr Zelenskiy is expected to meet with Joe Biden at the White House, attend United Nations General Assembly in New York

OECD releases interim economic outlook report on the global economy, Tuesday

Eurozone CPI (August final), Tuesday

Bloomberg Future of Finance Conference in Frankfurt, with speakers to include German Finance Minister Christian Lindner, Tuesday

US housing starts, Tuesday

Japan trade, Wednesday

China loan prime rates, Wednesday

UK CPI, Wednesday

Federal Reserve policy meeting followed by Fed Chair Jerome Powell’s news conference, Wednesday

Bank of Canada issues summary of September’s policy meeting, Wednesday

Eurozone consumer confidence, Thursday

Bank of England policy meeting, Thursday

US leading index, initial jobless claims, existing home sales, Thursday

China’s Bund Summit, Friday

Japan CPI, PMIs, Friday

Bank of Japan rate decision, Friday

Eurozone S&P Global Eurozone PMIs, Friday

US S&P Global Manufacturing PMI, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.1% as of 6:19 a.m. New York time

Nasdaq 100 futures rose 0.1%

Futures on the Dow Jones Industrial Average rose 0.1%

The Stoxx Europe 600 rose 0.3%

The MSCI World index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0694

The British pound was little changed at $1.2388

The Japanese yen was little changed at 147.72 per dollar

Cryptocurrencies

Bitcoin rose 1.7% to $27,230.02

Ether rose 0.7% to $1,649.82

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.31%

Germany’s 10-year yield was little changed at 2.71%

Britain’s 10-year yield declined four basis points to 4.35%

Commodities

West Texas Intermediate crude rose 1.4% to $92.74 a barrel

Gold futures rose 0.1% to $1,956.10 an ounce

Citigroup Starts Tokenization Service

U.S. bank Citigroup has introduced a tokenization service for institutional clients, leveraging blockchain and smart contracts for cash management and trade finance. These smart contracts are intended to replace traditional bank guarantees and letters of credit. In collaboration with shipping firm Maersk and a canal authority, Citigroup conducted a trial to streamline typically cumbersome processes associated with extensive paperwork. The bank highlighted that its token services cater to institutional clients' demand for continuous, programmable financial offerings, enabling real-time cross-border payments, liquidity, and automated trade finance. Earlier in March 2023, Citigroup projected the digital securities tokenization market to reach between $4 trillion to $5 trillion by 2030.

€1.34 Trillion Deutsche Bank Turns Pro Crypto

Germany's largest bank is laying the foundation for digital asset custody, thanks to a strategic partnership with Taurus, a Swiss fintech specializing in enterprise-grade crypto services. This collaboration positions Deutsche Bank to effectively manage cryptocurrencies, digital assets, and tokenized assets on behalf of its clients. What particularly caught my attention in this announcement was the statement made by the Global Head of Securities at Deutsche Bank. In a press release. Paul Maley remarked, "As the digital asset space is poised to encompass trillions of dollars in assets, it is inevitable that it will become a top priority for both investors and corporations. Consequently, custodians must proactively adapt to support their clients." Just two newsletters ago, before this news happened, I wrote the headline, ‘Trillions Will Pour Into Bitcoin,’ and now we see a trillion-dollar asset manager coming more heavily in the space.

Bybit Says Bye To The UK

At the same time s aTradFi is finding its footing in crypto, crypto-native companies are finding themselves stifled by regulations and being shown the door. This juxtaposition is one of the strongest themes we have seen this year, one part good for the space and part evil. In Bybit's case, beginning on October 8, all major exchanges in the UK will be subject to stringent marketing regulations from the Financial Conduct Authority, that effectively prohibit nearly all forms of advertising for their crypto platforms. Additionally, crypto services will be classified as high-risk investments, which will significantly impact their normal operations. I don't know the future, but let’s see what happens in a couple of years in the U.K. My guess is that after most crypto companies are squeezed out, the traditional players will be offered an open door. This is exactly what crypto is fighting against.

Binance.US Gets A Win Against The SEC

The U.S. Securities and Exchange Commission (SEC) is suing Binance.US, accusing it of selling unregistered securities to American customers. In a recent court hearing, the SEC's request for immediate access to Binance.US's software was denied by federal magistrate Judge Faruqui, who asked the SEC to be more specific in its discovery requests. The SEC claims that Binance.US, affiliated with Binance Holdings Ltd and led by CEO Changpeng "CZ" Zhao, has been uncooperative in providing essential information. The SEC highlighted that Binance.US's parent company, BAM Trading, delivered insufficient and unclear documents during discovery.

While Binance.US defends itself by stating that the SEC's discovery demands were excessive, the ongoing legal dispute has severely impacted Binance.US's operations. The exchange has seen its trading volume drop to $5.09 million, faced banking issues, paused US dollar deposits, and experienced significant staff cuts, including the exit of former CEO Brian Shroder. Since the lawsuit's initiation, Binance.US has also suspended trading for over 100 token pairs.

Most importantly, the crypto industry keeps dealing blows to Gary Gensler and the SEC.

The Binance.US Executive Exodus Continues

The revolving exit door at Binance.US is gaining momentum, prompting the question: what happens to the crypto market if Binance.US were to close shop? My guess is that we would see a quick panic driven selloff initially, followed by the realization that Binance.US was never more than a drop in the bucket in terms of Binance’s exchange volume and global exchange volume.

The real concern behind Binance.US shutting down would be the hint of a larger Binance collapse, potentially having a more significant impact on the market. Frankly, it might be in the industry's best interest if Binance.US is disconnected, given that its productivity for Binance is questionable at this point. If Binance.US is just an infected limb, then it needs to go.

The Fed, Bitcoin, NFTs & Kim Kardashian | Jon Najarian

Another old episode, but I’ll be back soon! Since NFTs and celebrities are the current narrative, I figured this episode is relevant.

Don't miss this conversation with the legendary Jon Najarian: we cover everything from the Fed to the housing market, Bitcoin volatility, crypto leverage, inflation, ETFs, and more.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.