Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Sign up for my other newsletter, THE DAILY CLOSE!

I built The Daily Close to give you the same institutional-grade indicators and signals that I use to trade the market on a daily basis. It's automatically generated and delivered to your inbox at the daily close everyday.

1 Week FREE for all subscribers

17% discount if you subscribe for a year

$25 a month, or $250 a year

In This Issue:

Bitcoin Is A Call Option On A Better Future

Bitcoin RSI Breaking Out?

Inflation Comes In Hot, Markets Don’t Care

Binance.US Is Falling Apart

The SEC Charges Another NFT Collection

PayPal Made The Costly Mistake

Why A Bear Market Is The Best Time To Invest | Haseeb Qureshi, Dragonfly Capital

Bitcoin Is A Call Option On A Better Future

Let’s take a pause from the prevailing narratives and find our way back to our roots.

Today’s premise is simple: Bitcoin is a call option on a better future.

Forget about the SEC, BlackRock, ETFs, and lawsuits. The most fundamental reason why we are here is because of Bitcoin and what it means moving forward. Bitcoin is a call option on a better future is a metaphorical way of expressing the idea that investing in Bitcoin today represents a bet or speculation on the belief that the future will be significantly improved or different, thanks in part to the transformative potential of Bitcoin.

In other words, owning Bitcoin is not merely owning a financial asset, rather it is a belief in the positive impact it can have on the world.

Here’s how:

The most evident point to kick off a discussion about Bitcoin is its role in rectifying issues within the realm of money. I've consistently emphasized that 'fixing the money doesn't fix everything,' but it undoubtedly marks a robust beginning. I might sound like a broken record, but the truth remains: traditional fiat currencies grapple with inflationary pressures and the manipulation of central authorities, resulting in a gradual erosion of purchasing power. You might argue that this statement has become a bit cliché, but I would counter by challenging you to name a fiat currency that has stood the test of time – it's an impossible task.

Consider the British Sterling Pound, which has a remarkable history spanning 317 years. There's nothing else in widespread circulation today that boasts such longevity. This fact underscores a fundamental truth: currencies, as we know them, have a finite lifespan and eventually falter.

We can thank human nature for that.

Outside of Bitcoin’s advantages as an immutable form of money, Bitcoin is a powerful tool that empowers human rights. In regions plagued by financial instability, oppressive regimes, or censorship, Bitcoin provides an immediate and accessible escape hatch. It enables individuals to preserve their wealth, access financial services, and engage in economic activities without government interference. Bitcoin can serve as a lifeline for those facing economic crises or persecution, allowing them to safeguard their assets and maintain financial autonomy.

Furthering this thought, in areas with limited access to traditional banking services, Bitcoin offers a gateway to the global economy. Bitcoin has massive potential to improve our quality of life. Families, business owners, and merchants can participate in online commerce, receive remittances, and save for the future, even without a bank account. Bitcoin is a free ticket to a borderless and low-cost payment system that can reduce transaction fees and facilitate cross-border trade.

Last, but certainly not least, Bitcoin's most significant contribution to a better future is its preservation of individual freedoms. Bitcoin empowers individuals to make financial decisions independently, outside the control of any central authority. Bitcoin is a beacon for economic autonomy, privacy, and protection against asset seizures, reinforcing personal freedoms in the digital age. Bitcoin is the greatest money there has ever been in the free digital world, which is why it is so terrifying to bad actors in power. In essence, Bitcoin is a light that shines bright on the parts of the world that prefer darkness.

Investors own Bitcoin because they believe it will go up and they are probably right, but Bitcoiners own Bitcoin because it’s a call option on a better future.

I hope you see the distinction.

Let’s make sure the world knows this: Bitcoin stands for a better future.

Bitcoin RSI Breaking Out?

A little secret I used to share often… you can draw lines and patterns on indicators, and they often precede moves in price.

As you can see, RSI has a descending resistance and is trying for a breakout - pending today’s daily close above. This coincides with RSI attempting a move above 50, which is also considered bullish. The daily close will be telling, but this is looking good for now.

If RSI confirms the break out, price should follow up.

Inflation Comes In Hot, Markets Don’t Care

Stock futures climbed despite data suggesting the Federal Reserve might maintain higher interest rates. S&P 500 contracts rebounded after briefly dipping following inflation and retail sales data. Two-year US yields moved below 5%, and the dollar saw a slight gain. West Texas Intermediate oil reached $90 per barrel for the first time since November.

There's concern about a potential strike in the automotive industry as United Auto Workers and Detroit automakers remain at odds over a new labor contract. The union's current contract is set to expire soon.

Ray Dalio, founder of Bridgewater Associates LP, expressed his preference for cash over bonds due to concerns about managing inflation in the current investment landscape.

Richard Clarida, former vice chair of the Federal Reserve, believes that fiscal policy risk is a more likely driver of higher US bond yields than further tightening by the Fed.

In corporate news, Adobe Inc. is expected to report earnings with a focus on its artificial intelligence offerings. AMC Entertainment Holdings Inc. raised $325.5 million through a share sale, while HP Inc. fell after Berkshire Hathaway sold shares of the company. Visa Inc. is taking steps to allow major US banks to sell their shares in the payments network. SoftBank Group Corp. successfully conducted the year's largest IPO, raising $4.87 billion. Microsoft Corp. faces scrutiny from the European Union's antitrust enforcers over its Teams video-conferencing app. Lazard Ltd. aims to double revenue by the end of the decade under the leadership of Peter Orszag.

Overall, market dynamics are influenced by inflation concerns, labor disputes, and corporate developments in various sectors.

Key events this week:

US retail sales, PPI, business inventories, initial jobless claims, Thursday

China property prices, retail sales, industrial production, Friday

US industrial production, University of Michigan consumer sentiment, Empire Manufacturing index, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.5% as of 9:06 a.m. New York time

Nasdaq 100 futures rose 0.5%

Futures on the Dow Jones Industrial Average rose 0.5%

The Stoxx Europe 600 rose 1.1%

The MSCI World index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.4% to $1.0685

The British pound fell 0.3% to $1.2450

The Japanese yen rose 0.1% to 147.25 per dollar

Cryptocurrencies

Bitcoin rose 1.1% to $26,519.81

Ether rose 1.4% to $1,626.13

Bonds

The yield on 10-year Treasuries declined one basis point to 4.23%

Germany’s 10-year yield declined eight basis points to 2.57%

Britain’s 10-year yield declined eight basis points to 4.26%

Commodities

West Texas Intermediate crude rose 1.4% to $89.80 a barrel

Gold futures fell 0.3% to $1,927.50 an ounce

Binance.US Is Falling Apart

The SEC is killing Binance.US in broad daylight, and it seems there’s little that can be done to stop it. It raises questions about why anyone would choose to remain employed by a company facing such relentless scrutiny and interference from both the SEC and DOJ, which are actively hindering its normal operations. It's only natural that the CEO might seek an exit strategy amidst this blazing fire, and the recent dismissal of 100 employees adds to the melancholy.

As for Binance.US itself, the platform is presently grappling with severe functionality issues. Users have received emails advising them to withdraw their USD holdings, while USD deposits have been temporarily suspended, and the available trading pairs have been severely restricted. At this point, I wouldn’t be surprised to see Binance.US completely close its doors and wave the white flag.

It’s sad to say this, but the industry would probably benefit if Binance.US were to close shop along with competing exchanges that are in a healthier position.

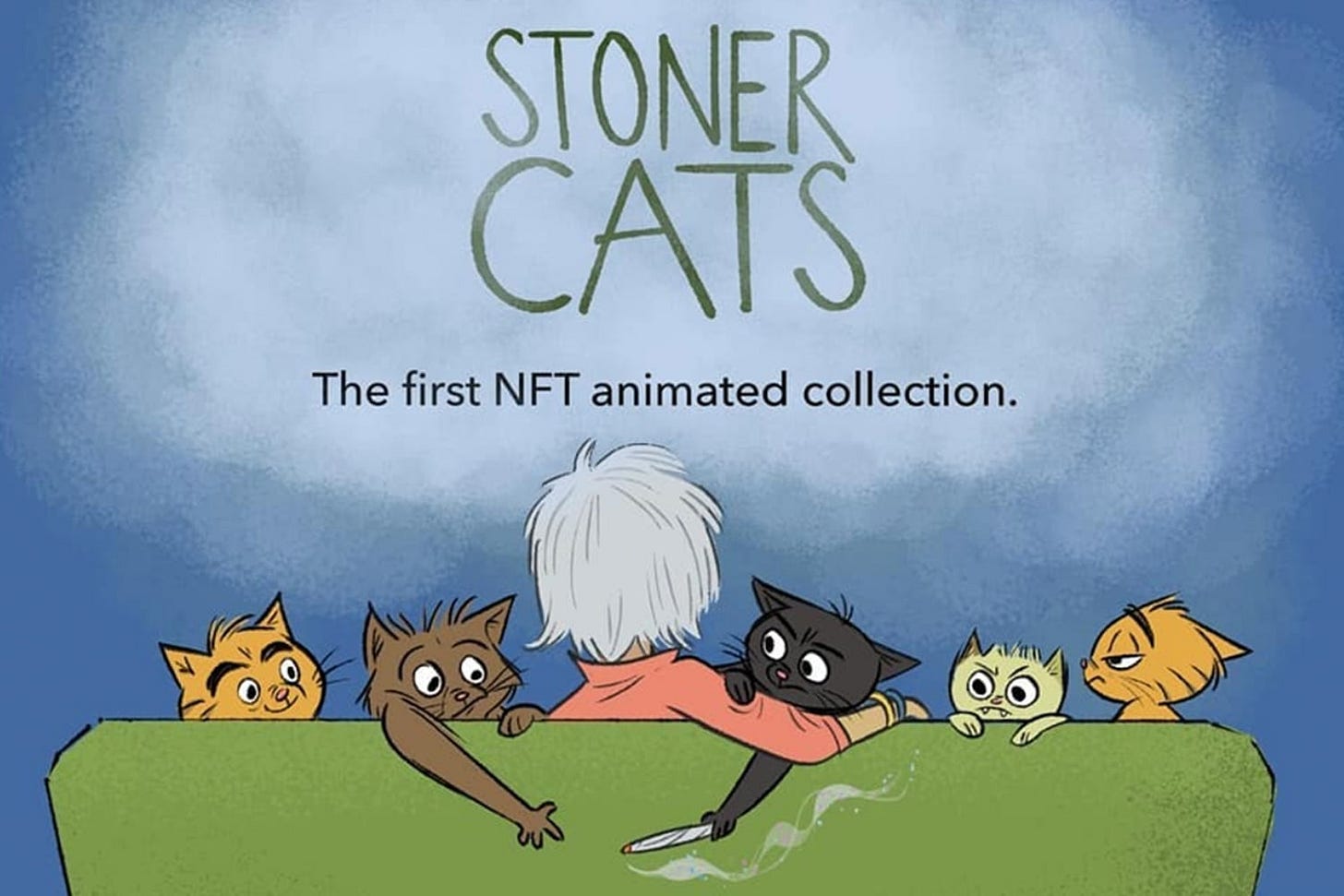

The SEC Charges Another NFT Collection

Two weeks ago, Impact Theory made headlines for serious accusations from the SEC, and now another NFT collection, Stoner Cats, is facing charges related to selling unregistered securities. While there was a prevailing sentiment, even within the crypto community, that Impact Theory was clearly in violation of security laws, the same sentiment may not hold true for Stoner Cats. Yes, celebrities were involved, but the projects are not the same.

In my opinion, the SEC's rationale for charging Stoner Cats appears rather weak. If Stoner Cats is deemed an unregistered security, it could potentially pave the way for numerous other collections to face SEC charges. The current state of the NFT space can be likened to a dark age, as the initial bear markets in any cycle tend to be the most severe. Below, you can review the SEC's reasoning, it’s a bunch of crap. Gary Gensler is clearly trying to target celebrity NFT involvement, this is hardly about actually establishing fair security laws and regulations.

PayPal Made The Costly Mistake

A few days ago, reports surfaced regarding a significant mishap involving an entity, most likely an exchange or payment processor, inadvertently paying half a million dollars for a single Bitcoin transaction. We now know that PayPal was behind this costly blunder. In this transaction, a mere $200 was intended to be transferred, but it incurred a staggering cost of about 20 BTC, far from a fair trade. The exact cause of this error remains unknown, but it can be attributed to buggy software and inadequate transaction management. I guess someone at PayPal had to learn a very expensive lesson on how blockchains work.

Why A Bear Market Is The Best Time To Invest | Haseeb Qureshi, Dragonfly Capital

I am still in Singapore, but here is another all-time great podcast episode. I think you will like it.

“A lot of things seem to be breaking in crypto, but is it as bad as it seems? Haseeb Qureshi, Managing Partner at Dragonfly, joined me on the show to discuss these growing pains. We had an honest conversation about how crypto can’t solve everything and why it’s so important to learn from our mistakes instead of criminalizing them. You don’t want to miss this conversation with one of the most brilliant minds in the space.”

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.