Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Sign up for my other newsletter, THE DAILY CLOSE!

I built The Daily Close to give you the same institutional-grade indicators and signals that I use to trade the market on a daily basis. It's automatically generated and delivered to your inbox at the daily close everyday.

1 Week FREE for all subscribers

17% discount if you subscribe for a year

$25 a month, or $250 a year

In This Issue:

Sifting Through The FTX Ashes

PayPal’s Former President Is Building Bitcoin

Vitalik’s Twitter Account Was Hacked!

Brian Armstrong Wants Gary Gensler Out

Big Crash Or Soft Landing? What Will Happen To The US Economy?

Sifting Through The FTX Ashes

I know it’s tempting to celebrate the good news that has piled in over the past couple of months, but the reality of our situation is that the market remains in a state of ongoing fragility.

I don’t make the rules.

Yesterday morning, a presentation on FTX, which had been prepared for a creditor meeting related to FTX's Chapter 11 bankruptcy, was unexpectedly made public. As one might expect, Crypto Twitter reacted with panic.

Since the presentation's release, the market has witnessed a staggering loss of approximately $30 billion, including notable declines in major cryptocurrencies, which, in theory, should have been the least affected by the liquidation process.

We'll delve deeper into that shortly.

Of the $30 billion downturn, Bitcoin took a substantial hit, accounting for roughly half of that amount, with a loss of $15 billion, while Ethereum suffered a decrease of a few billion, hovering around a $5 billion loss. Is this dramatic shift warranted? Probably not.

In retrospect, the implosion at FTX caused extensive damage, a fact we were already aware of. The only distinction now is that the smoke has cleared, revealing a heap of debris to be sifted through, leading to market panic. We were always cognizant of the hundreds of billions of dollars in non-customer claims looming over our industry. The multi-billion dollar gap in FTX's balance sheet was indeed substantial and authentic, and we were well aware of FTX's significant holdings in altcoins, particularly Solana. It was only a matter of time before these assets would be liquidated as part of the bankruptcy process. Yet here we are, reacting as if the FTX collapse is breaking news for the first time - quite the paradox.

The most popular image making its rounds through Crypto Twitter and outside media outlets is the following, so let’s start there.

In yesterday's newsletter, I shared a similar image, but this one offers greater clarity by excluding the 'Mixed' section, providing a more accurate representation of the largest positions. As mentioned yesterday, it's highly unlikely that FTX will fat-finger these orders, even if they're operating under a stringent sell schedule. The FTX liquidators will exert every effort to maximize returns from the assets on their books, all the while avoiding further market jitters, which we've already witnessed. Furthermore, it's worth noting that the Solana position is vested and will gradually unlock over the next few years.

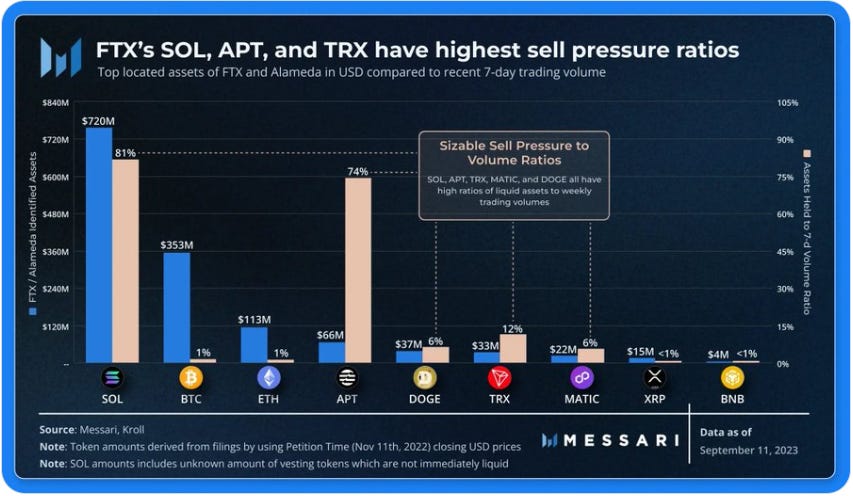

Solana holders can find solace in the vesting news. However, it is cause for concern that FTX still maintains sizable positions relative to the daily trading volumes of these coins, with Solana being a prominent example. Instead of crunching the numbers myself, I've included an image below for a visual representation. You can observe that the major losers in the FTX selloff encompass SOL, APT, TRX, MATIC, and DOGE, rather than Bitcoin or Ethereum.

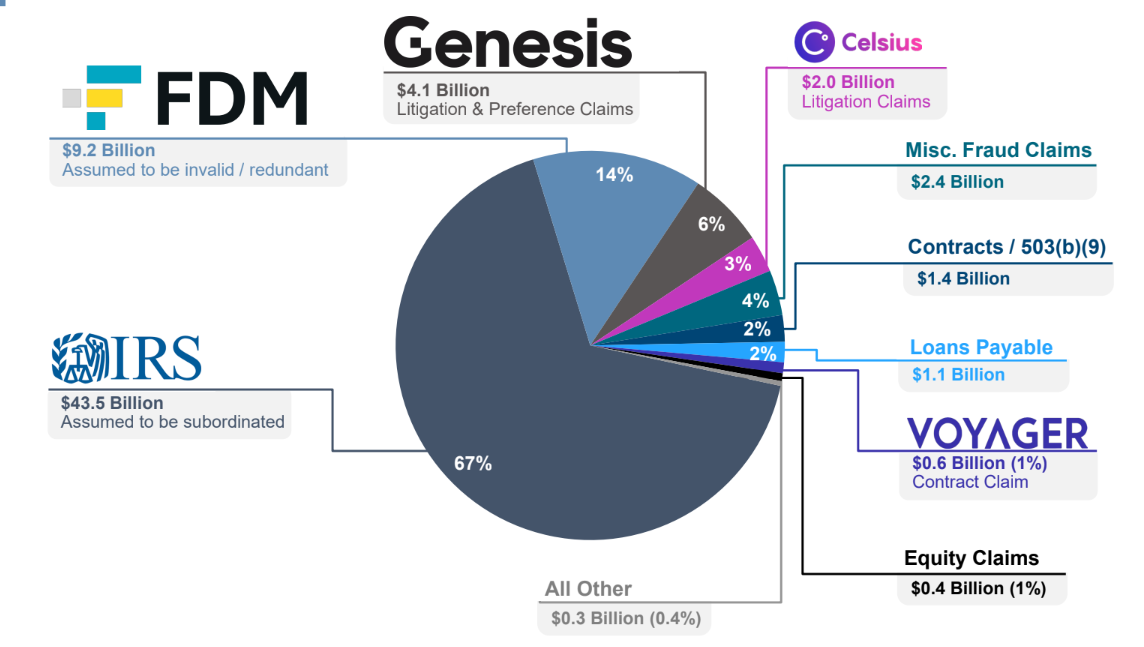

One particularly intriguing aspect is the IRS claim against FTX, now accounting for 67% of non-customer claims, totaling a whopping $43.5 billion - it's hard not to smirk at that one.

Shifting focus away from digital assets and non-customer claims, FTX held a substantial venture portfolio valued at $4.5 billion in assets, along with $529 million in securities held in debtor brokerage accounts and 38 Bahamian properties appraised at $199 million. Amid these sections, there were additional minor details not particularly noteworthy for discussion here. However, it's worth highlighting $86.6 million in political and charitable donations, as well as $2.2 billion disbursed to insiders. Please bear in mind that all of these figures are best estimates, and we may never have a definitive account of the full extent of the payouts to SBF, FTX insiders, and politicians.

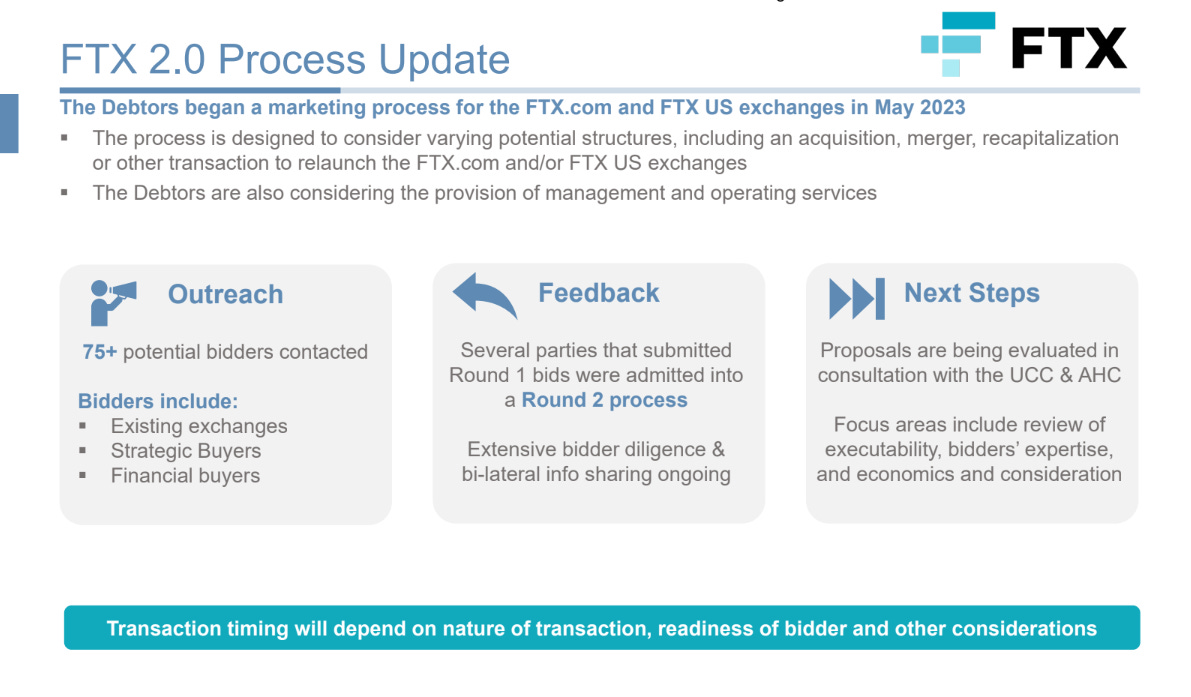

The final two noteworthy points from the presentation were a somewhat cryptic reference to 'FTX 2.0,' accompanied by an infographic and some brief information on possible clawbacks. As far as clawback goes, the concept is technical, legal, and varies by jurisdiction, so my only suggestion is to urge affected investors to seek professional legal advice if affected.

Regarding FTX 2.0, limited information is available and it remains surprising that the platform is slated for a return. Let's leave it at that. What piques my interest here is that the market's reaction is likely more pronounced now compared to what the forced liquidations will induce when they come into effect, which, I suppose, is somewhat expected.

As much as I'd prefer it to be otherwise, in recent months, the market has exhibited an inclination to overreact to adverse news and underreact to positive developments. My speculation is that this phenomenon is linked to our current position in the market cycle, potentially presenting a final opportunity for larger players to enter positions and weed out weaker participants.

Side note - I am on a flight without access to charts today! This will be a brief newsletter

PayPal’s Former President Is Building Bitcoin

While the former President of PayPal is actively developing the Bitcoin Lightning Network, the crypto community remains solely focused on the FTX's bankruptcy proceedings. It's these subtle shifts that reaffirm my belief in another imminent bull market. Instead of dwelling on the negative news, let's pay attention to what David Marcus has to share.

We are trying to turn Bitcoin into a real global payment network. We can email or text anyone within minutes, but if we were to send anyone money who isn't a U.S. citizen using the same fintech app, we wouldn't be able to do that. We are still in the fax era of global payments. Money does not have a universal protocol for money on the internet, that enables value to be transported through the internet.

The business for international payments is trillions of dollars. Our view is that Bitcoin won't be a currency to buy things. A fragment of a Bitcoin on top of Lightning is like a small data packet on the internet for value. You can exchange at the edges of the Network and send dollars with someone who will receive Japanese Yen on the other side or Euros. The net settlement layer that is used is Bitcoin and Lightning and is cash final.

Vitalik’s Twitter Account Was Hacked!

It's unfortunate that such incidents continue to occur, but it's crucial to recognize that these issues aren't the fault of the cryptocurrency itself. Vitalik's Twitter account was compromised, and the perpetrator(s), well aware of their target audience, promoted a cryptocurrency scam, resulting in victims collectively losing nearly $700,000 after clicking on a malicious link. The post enticed users to connect their wallets via a link promising a free NFT, a red flag in itself and then proceeded to siphon funds from those wallets.

It's disheartening that such scams persist, but until Twitter enhances its security measures, we must exercise caution and refrain from impulsively engaging with unfamiliar links offering freebies in the crypto space. It's imperative to stress that, under no circumstances, should you rush to purchase or claim anything in the crypto realm, particularly if it involves connecting your wallet to an unknown source.

Brian Armstrong Wants Gary Gensler Out

It’s not a secret that we all share Armstrong’s sentiment, I just wanted to finish off the letter reiterating the fact that Gary Gensler needs to go. In a recent interview, Armstrong made the following statement: 'Someone else doesn't need to occupy that seat for Coinbase to prosper, but it would certainly be beneficial.' Armstrong's assessment is accurate; it's evident that Coinbase has the capability to challenge the SEC without the need for a new commissioner, as we've witnessed previously. However, the removal of Gensler would significantly streamline and expedite growth within the industry.

Big Crash Or Soft Landing? What Will Happen To The US Economy?

Macro Monday with Dave Weisberger and Mike McGlone.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.