Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Sign up for my other newsletter, THE DAILY CLOSE!

I built The Daily Close to give you the same institutional-grade indicators and signals that I use to trade the market on a daily basis. It's automatically generated and delivered to your inbox at the daily close everyday.

1 Week FREE for all subscribers

17% discount if you subscribe for a year

$25 a month, or $250 a year

In This Issue:

Denial Is A Hell of A Drug

Bitcoin Thoughts And Analysis

Altcoins Bleed

Dollar Dip - Will Stocks Rip?

Coinbase Aims To Compete With CD Rates

Will FTX Dump On The Market?

Crypto Attends The G20 Summit

Bitcoin Will Surpass $100,000 In 2025 | Yoni Assia, eToro

Denial Is A Hell Of A Drug

For today's introduction, I found myself torn between two compelling topics, prompting me to divide the intro into two segments to ensure that none of the ideas brewing in my mind go unexplored. I hope you'll find this approach engaging and enjoyable.

The Bottom Will Never Be In

While some crypto investors may believe the market will never find its bottom, I urge you not to embrace this defeatist viewpoint. I'll readily acknowledge that I, like everyone else, cannot definitively assert that the market's lowest point has been reached. In truth, nobody possesses a crystal ball to forecast such events accurately. But, consider this: if you're unwilling to take a stance at some juncture and let go of the fixation on finding the absolute bottom, you risk missing out on potential opportunities that could shape your financial future.

You might wonder who on earth could believe that the bottom has not yet occurred? Surprisingly, such investors do exist, and their viewpoint warrants consideration.

"Scott, what if your assessment is incorrect, and the market didn't reach its bottom back in November, leading to further declines?"

My response is simple: I'll admit my error and seize the opportunity to buy more. I'd rather be wrong and strategically positioned for the future than stubbornly cling to the notion of being right and miss out on potential profits. The collapse of FTX, for instance, presents a compelling case because there is no chance in hell that anyone who bought on the collapse was making a ‘bad’ buy. Even if the market were to revisit those previous price levels, I wouldn’t think twice. If the price is right, I buy.

On another note, the largest publicly acknowledged skeleton on our radar is Binance, and it's no secret that we've been aware of its vulnerabilities in the crypto ecosystem for quite some time. That being said, the present narrative exhibits far greater resilience in weathering potential setbacks compared to the time when FTX collapsed. In essence, this portion of the intro is my way of conveying that if you remain unconvinced that the market has reached its bottom, I encourage you to engage in some deep introspection and ask yourself: are you hesitating due to a fear of being incorrect, or do you genuinely believe that further market declines are imminent?

We Are More Similar Than Different

The notion that we (crypto investors) are more different than similar is patently false.

I'm acutely aware of the sometimes (or oftentimes) toxic environment on Crypto Twitter and the agenda of fervent maximalists who aim to sow division among investors. However, when we look at the crypto space in its entirety, we find a different reality. At its core, crypto investors are fundamentally more similar than different. I'm confident in this assertion because we all share a common ground: the belief that fiat currencies are fundamentally flawed, and cryptocurrencies offer a solution.

Admittedly, each crypto investor and builder charts a unique course toward this shared objective, but the overarching goal remains consistent. The true adversaries of the crypto space are not fellow enthusiasts with alternative viewpoints, but those who persist in promoting the fiat currency agenda and stymieing crypto's progress. By default, anyone who has taken the leap from fiat to cryptocurrency is more of an ally in our collective pursuit, as opposed to those who remain entrenched in fiat and adopt an anti-crypto stance.

That being said, it's equally vital to acknowledge that individuals who have yet to be exposed to crypto should not automatically be deemed adversaries. As a community, we must recognize that our marketing efforts to reach the mainstream haven’t exactly gone our way over the past few years. For instance, those who converted to crypto from an FTX commercial during the Super Bowl may never reengage with crypto again. Can we blame them? While these past experiences may be water under the bridge, the key message is that crypto investors should prioritize treating each other as allies rather than adversaries.

A prime illustration of this concept is Ripple. My long-term followers are aware of my critical stance on Ripple, which predates the SEC's lawsuit against them. However, since the lawsuit, my unwavering stance has been in support of Ripple, because after all, they are not the true adversary in the broader crypto landscape. The essential point here is that the crypto community must unite and collaborate if we genuinely intend to challenge the status quo; there's no alternative path forward.

Denial is a hell of a drug. Don’t deny the bottom and don’t deny our similarities.

Bitcoin Thoughts And Analysis

The last 3 weeks have had candles close within $400. This week’s low was around $25,831, with the high two weeks ago at $26,189. Not much happening. All three candles have had wicks up and down, showing extreme indecision for the market.

Altcoins are bleeding out, often a sign that Bitcoin is about to follow, but for now there’s no reason to expect anything but sideways.

Let’s see what this week has in store for us.

Altcoins Bleed

I think it is easy to see why I have generally viewed altcoins as avoidable. I have no idea why the market is dipping hard today. Maybe this is people selling in fear that FTX will dump altcoins. Maybe this is showing us where Bitcoin is headed next. Maybe the moon is in retrograde with Uranus. Either way, this is the part of the cycle where bullish price action is rare and even more rarely sustained.

In case you are wondering, the image above is from Banter Bubbles, which was started by my friend Ran Neuner and his team at Crypto Banter. It's a very cool way to get a quick visual snapshot of the market and to then dig into each coin and get more info.

Dollar Dip - Will Stocks Rip?

The dollar took a dip, its largest in two weeks, while stock values climbed. This positive turn for stocks came from positive signals in Chinese economic data and insights from US Treasury Secretary Janet Yellen.

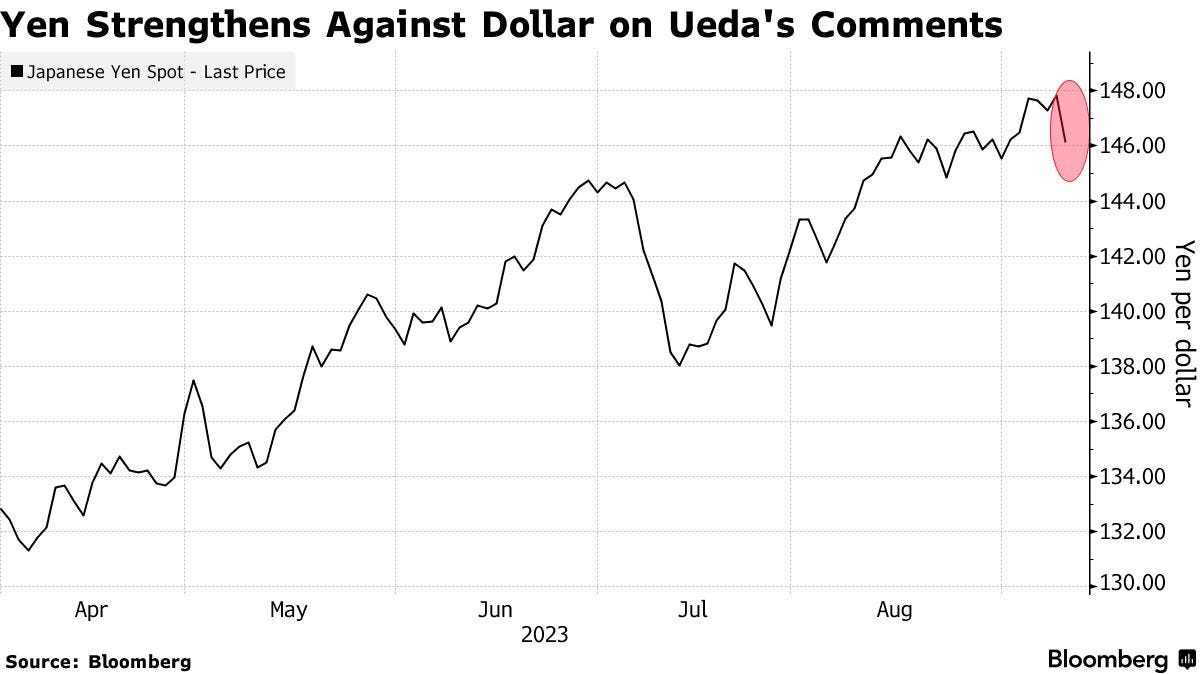

The yen made a notable jump against the dollar, going up over 1% after the Bank of Japan's Governor, Kazuo Ueda, hinted at the potential end of a significant negative interest rate in the developed world.

In other regions, Europe's Stoxx 600 nudged up by 0.5%, and there's anticipation for growth on Wall Street. Tesla Inc. experienced a 5% boost in US pre-market trades after a thumbs-up from Morgan Stanley. Meanwhile, Italian banks are on the rise, seemingly due to discussions about a potential adjustment to a contentious bank profit tax.

Over the weekend, Yellen expressed growing confidence that the US could handle inflation without causing significant harm to employment. She stated, "Every measure of inflation is on the road down."

China shows signs of economic stability following a notable downturn. Recent data reveals that initiatives to support the housing market might be influencing a rise in household mortgage demands, and business loans are on the upswing too.

The Chinese yuan bounced back after a stern warning to market speculators from the People’s Bank of China. In addition, the CSI 300 Index increased by 0.7%, breaking its four-day drop.

Lastly, commodities like copper and iron ore benefited from the dollar's dip, with positive Chinese data giving the markets a little extra pep.

Key events this week

UK jobless claims, unemployment, Tuesday

Eurozone industrial production, Wednesday

UK industrial production, Wednesday

US CPI, Wednesday

Eurozone ECB rate decision, Thursday

Japan industrial production, Thursday

US retail sales, PPI, business inventories, initial jobless claims, Thursday

China property prices, retail sales, industrial production, Friday

US industrial production, University of Michigan consumer sentiment, Empire Manufacturing index, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.5% as of 10:27 a.m. London time

S&P 500 futures rose 0.3%

Nasdaq 100 futures rose 0.5%

Futures on the Dow Jones Industrial Average rose 0.2%

The MSCI Asia Pacific Index rose 0.5%

The MSCI Emerging Markets Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index fell 0.5%

The euro rose 0.3% to $1.0727

The Japanese yen rose 0.9% to 146.47 per dollar

The offshore yuan rose 0.8% to 7.3071 per dollar

The British pound rose 0.5% to $1.2525

Cryptocurrencies

Bitcoin fell 0.5% to $25,701.63

Ether fell 1.6% to $1,593.26

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.28%

Germany’s 10-year yield advanced one basis point to 2.62%

Britain’s 10-year yield advanced four basis points to 4.46%

Commodities

Brent crude was little changed

Spot gold rose 0.4% to $1,926.52 an ounce

Coinbase Aims To Compete With CD Rates

It can be challenging to generate enthusiasm for crypto yields when tradfi is consistently outperforming us. However, it's essential to recognize that market conditions are cyclical, and a shift will inevitably occur. When that shift happens, I anticipate a significant influx of capital flowing into the crypto space. While we're passionate about promoting cryptocurrency, it's undeniable that our current yields may appear less attractive compared to what industry giants like Fidelity might be offering. For example, USDC, which was previously yielding 2% on Coinbase, now boasts an impressive 5%, which still doesn’t beat the CDs above.

Will FTX Dump On The Market?

FTX faces impending approval for the liquidation of its assets on September 13th, following its April crypto holdings valued at $3.4 billion. The proposed strategy is to sell up to $200 million in crypto each week, which of course has caused panic on Crypto Twitter. To begin with, it's important to note that a critical court hearing regarding this request is still on the horizon, scheduled for September 13th. Additionally, we should consider whether the crypto market has historically experienced significant downturns due to anticipated unlocks and sell offs. This doesn't seem to align with historical trends. As mentioned in a recent introduction, whales seeking to execute large buy and sell orders do so in small increments to minimize any adverse impact on their overall holdings.

It's safe to assume that FTX, aims to prevent any substantial downward movement in the market before offloading its assets. When assessing the potential impact of this liquidation, it's worth emphasizing that the most substantial effects are likely to be felt by SOL and FTT holders. Who is even holding FTT anymore anyway? In contrast, Bitcoin and Ethereum should remain relatively unaffected by this selling activity, and any impact on them is unlikely to be substantial in terms of FTX’s impact. Here are the figures: SOL ($650m), (FTT $500m), BTC ($268m), ETH ($90m), APT ($67m), DOGE ($42m), MATIC ($39 million).

Crypto Attends The G20 Summit

While the United States continues to struggle with the formulation of coherent cryptocurrency legislation and regulatory frameworks, the G20 is actively advancing in the realm of fostering international information exchange, set to commence in 2027 - go figure. Here’s what was stated on a signed consensus declaration, “We call for the swift implementation of the Crypto-Asset Reporting Framework (CARF) and amendments to the CRS [Common Reporting Standard]. We ask the Global Forum on Transparency and Exchange of Information for Tax Purposes to identify an appropriate and coordinated timeline to commence exchanges by relevant jurisdictions.”

It’s impossible to say if the G20’s call for action will be a positive development for crypto or even happen, but I’m not opposed to countries working together on advancing digital assets if it's done right. The G20 is no joke, the countries affected include, Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, the United Kingdom, and the United States, as well as the European Union, which is 2/3rds of the global population.

Bitcoin Will Surpass $100,000 In 2025 | Yoni Assia, eToro

"Bitcoin is USA, Ethereum is Europe, and Israel is Doge"! Join this long-awaited conversation with Yoni Assia, founder of eToro and the crypto OG. We covered Yoni's story in crypto, founding eToro, colored coins, regulation, tokenization, the upcoming bull market, and even why Yoni thinks Bitcoin is like USA and Ethereum is like Europe.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.