Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Sign up for my other newsletter, THE DAILY CLOSE!

I built The Daily Close to give you the same institutional-grade indicators and signals that I use to trade the market on a daily basis. It's automatically generated and delivered to your inbox at the daily close everyday.

1 Week FREE for all subscribers

17% discount if you subscribe for a year

$25 a month, or $250 a year

In This Issue:

GLD’s Epic Run

Bitcoin Has A One-Day Bull Market

Europe Crashing, Yuan Dying

Arkham Outs Grayscale Wallets and Holdings

Riot Triples Profit By Doing Nothing

The IMF Cautions Against Bitcoin Bans

JPMorgan Coin Is Back

Big Win For Crypto! | Ethereum Pump Ahead!

GLD’s Epic Run

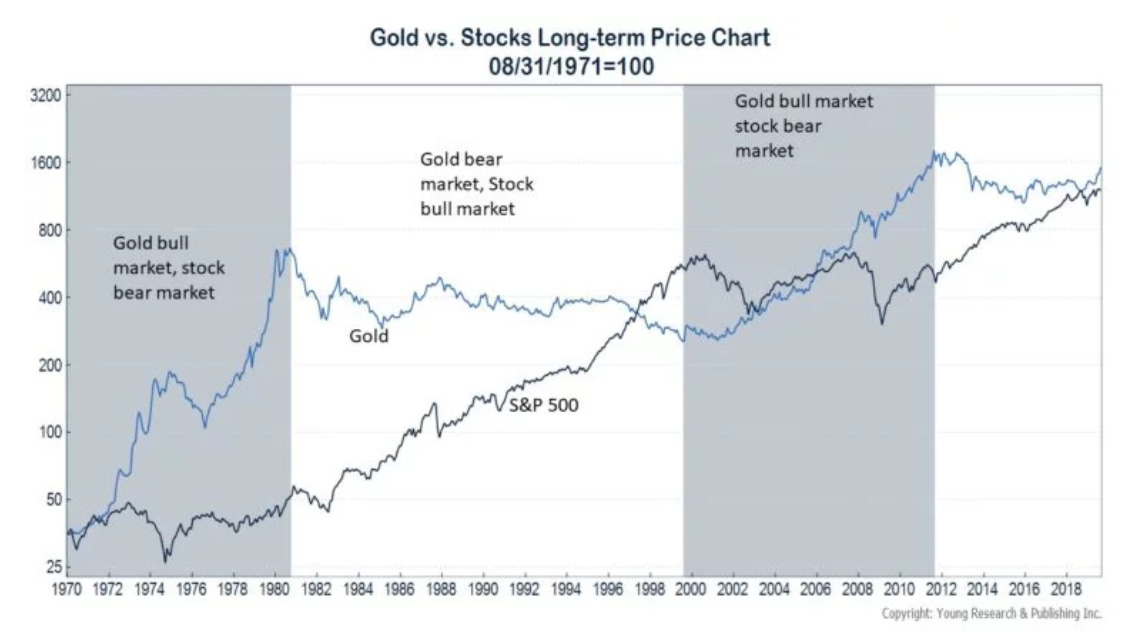

With the approval of Bitcoin and Ethereum ETFs on the horizon, GLD has rekindled the interest of crypto investors, as it bears the closest historical resemblance to what's to come.

For those that don’t know, GLD, short for "SPDR Gold Trust," is an exchange-traded fund that provides investors with exposure to the price of gold. Pretty simple. It was launched on November 18, 2004, by the World Gold Trust Services, LLC, and is designed to track the price of gold by holding physical gold bars in secure vaults, allowing investors to trade it on stock exchanges like a stock. GLD is the ideal alternative investment vehicle for those seeking to gain exposure to the price movements of gold without the hassle of owning physical gold bullion.

Investors excited about digital exposure rushed into the ETF, not only pushing the price of gold up, but also the AUM of the ETF. By the late summer of 2011, GLD was finishing off an epic 7-year bull run with over $77 billion in AUM. However, the following years told a different story, as GLD plummeted to just $21 billion in AUM by the end of 2014, and the value of gold saw a 43% decrease. This represents a substantial decrease in price, but an even more substantial outflow of assets - something worth monitoring as the Bitcoin ETF is rolled out.

On the flip side, the lead-up to GLD becoming the world's largest ETF tells a different story. From 2007 through August 2011, GLD's performance surged by more than 180%. However, the assets in the fund grew by nearly 700% during that same period. While a portion of this growth can be attributed to the financial crisis fallout, a weakening dollar, central bank buying, and speculation, the existence of the vehicle itself played a large role in giving investors access to the asset.

The Bitcoin ETF is captivating not just because it's expected to drive Bitcoin's price higher, but also because it represents a historic milestone — providing global investors with dependable access to this asset for the very first time. The implications for Bitcoin's ETF future are uncertain, however, GLD offers a glimpse into the potential dynamics of the next market bubble. While gold's bull and bear markets have mellowed over time, it's worth noting that GLD played a pivotal role in a remarkable market cycle for the hard asset, one that our industry has yet to witness.

The track record of GLD demonstrates a clear pattern: when the fund delivered a strong performance, it attracted a flood of assets, and conversely, when its performance lagged, investors withdrew their assets. When the Bitcoin ETF is given the green light, the price of Bitcoin and the resulting inflows will drum to their own beats. However, I anticipate that GLD will serve as our guiding light for what lies ahead in the industry. One thing is likely: an epic bull run awaits after approval.

Bitcoin Has A One-Day Bull Market

Bitcoin is utterly avoidable. Price attempted a push up over night, only to retrace the entire move in a single low time frame candle. This looks like a mini version of the Grayscale pump and dump on the left of the chart.

You cannot count on any move, based on news or otherwise, to last in this market. That goes for altcoins and other narratives as well. This is just THAT PART of the cycle.

Europe Crashing, Yuan Dying

Europe's Stoxx 600 Index experienced its longest slide since 2016, declining for eight consecutive days. The dollar also weakened due to dovish remarks from Federal Reserve officials. The broader market atmosphere has been affected by concerning economic data from Europe and China, and skepticism over the Federal Reserve's potential rate cuts in the upcoming year. Particularly, European markets are in a gloomy state, witnessing a continuous 26-week investment outflow. While the Bloomberg Dollar Spot Index did decline by 0.1%, it's still gearing up for its eighth week of consecutive growth, a record since 2005. Elsewhere, energy markets are in the spotlight; worker strikes at Chevron Corp.'s major Australian locations led to an 11% spike in European benchmark gas prices due to potential supply disruptions. In China, the yuan's value approaches an all-time low, hinting at a possible comfortable stance on its gradual devaluation. Lastly, Brent oil remains close to $90 a barrel, maintaining its trajectory for a modest weekly rise after the OPEC+ decision to persist with supply restrictions.

Key events this week:

US wholesale inventories, consumer credit, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.5% as of 10:15 a.m. London time

S&P 500 futures fell 0.2%

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average fell 0.2%

The MSCI Asia Pacific Index fell 0.4%

The MSCI Emerging Markets Index was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro was little changed at $1.0705

The Japanese yen was little changed at 147.33 per dollar

The offshore yuan was little changed at 7.3485 per dollar

The British pound was little changed at $1.2484

Cryptocurrencies

Bitcoin rose 0.6% to $26,161.18

Ether rose 0.3% to $1,643.71

Bonds

The yield on 10-year Treasuries declined one basis point to 4.23%

Germany’s 10-year yield declined one basis point to 2.60%

Britain’s 10-year yield declined two basis points to 4.44%

Commodities

Brent crude fell 0.2% to $89.76 a barrel

Spot gold rose 0.3% to $1,925.33 an ounce

Arkham Outs Grayscale Wallets and Holdings

The blockchain analytics firm, Arkham Intelligence, has identified Grayscale as the second-largest holder of Bitcoin globally, boasting an impressive $16 billion in its Bitcoin trust. The significance of this discovery lies in the assurance that Grayscale indeed possesses the assets it claims, eliminating any doubts. However, this revelation also brings forth potential security concerns as the associated addresses are now visible to the public eye.

Despite Grayscale's efforts to maintain the confidentiality of their holdings, Arkham has disclosed that these funds are spread across over 1,750 addresses, each containing 1,000 BTC or less. Furthermore, Arkham has unearthed that Grayscale's Ethereum Trust ranks as the second-largest holder of ETH, with addresses linked to the trust holding approximately $5 billion worth of Ethereum.

The question arises: ss Arkham performing a valuable service to the community by exposing addresses connected to prominent entities, or is it inadvertently contributing to security risks?

Riot Triples Profit By Doing Nothing

The dynamics among miners, power grids, and the energy demands of the cities they serve have always been intriguing. However, an unprecedented occurrence has recently unfolded: ERCOT, the Texas power grid operator, paid Riot, a prominent Bitcoin miner in Texas, a staggering $31.7 million in energy credits to halt their operations. In contrast, Riot would have typically earned approximately $9 million if they had continued their mining activities. This remarkable turn of events was triggered by an intense heatwave necessitating the full utilization of air conditioners. What an extraordinary narrative this is.

According to the CEO, “Riot achieved a new monthly record for Power and Demand Response Credits, totaling $31.7 million in August, which surpassed the total amount of all Credits received in 2022. Based on the average Bitcoin price in August, Power and Demand Response credits received equated to approximately 1,136 Bitcoin. Riot’s power strategy is a key competitive advantage, and when placed alongside our strong financial position and efficient miner fleet, put Riot in a leading position heading into the upcoming Bitcoin ‘halving’ event next year.”

The IMF Cautions Against Bitcoin Bans

In a surprising twist, the IMF and FSB have released a paper cautioning about the challenges and potential hazards associated with comprehensive crypto bans. Instead, they advocate for "targeted restrictions to address specific risks." The rationale behind this change in stance centers on cost considerations, technical complexities, and the potential for circumvention.

My perspective on this matter is as follows: It appears that the IMF and FSB are gradually grasping the intricacies of decentralization, which is a positive development. However, their focus on refining the implementation of bans represents a relatively less negative approach rather than a truly positive one - it’s a take-what-we-can-get situation.

JPMorgan Coin Is Back

The idea of JPMorgan creating a cryptocurrency is not new news. I don’t know how long the rumor has circulated, but yesterday was not the first time the speculation was tossed around. If JPMorgan can utilize blockchain technology for its own back end, great, but I wouldn’t expect anything JPMorgan creates to go mainstream anytime soon or see widespread success. The potential difference here is that this could be the tokenization of bank deposits - a novel new approaching to using blockchain.

Big Win For Crypto! | Ethereum Pump Ahead!

Accounting rules are changing for digital assets: soon US companies will be required to report their crypto holdings at fair value. What will it change and why is it important? KC Chohan, the Founder of Together CFO, a tax advisory, will explain why. In the second part of the show, Dan The Chart Guy will provide his market analysis.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.