Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Sign up for my other newsletter, THE DAILY CLOSE!

I built The Daily Close to give you the same institutional-grade indicators and signals that I use to trade the market on a daily basis. It's automatically generated and delivered to your inbox at the daily close everyday.

1 Week FREE for all subscribers

17% discount if you subscribe for a year

$25 a month, or $250 a year

In This Issue:

These Numbers Will Shock You

Sign Up For OKX!

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Crypto Fear & Greed Index - Update

North Carolina May Be The First U.S. State To Buy Bitcoin

Bitcoin Is A Bulwark Against Totalitarianism

Coinbase International Is Off To A Strong Start

Hack The Bitcoin ETF | Mastercard Pushes Crypto Adoption | Scott Dykstra

These Numbers Will Shock You

In the traditional finance sector, public entities adhere to a standard practice of releasing quarterly financial statements. These documents, including balance sheets, income statements, and cash flow statements, provide a detailed picture of a company's financial health and are made available to the public.

Contrastingly, the cryptocurrency sector is fundamentally different. The lack of central control and standard governance structures, coupled with pseudonymous transactions, makes financial tracking in this industry uniquely challenging. Metrics such as tokenomics, decentralization, hash power, and staking are the key considerations in our domain.

I wonder how many Wall Street investors fully grasped that last point? Possibly one in 100?

Given this context and the current news drought, I decided to delve into some historical numbers from CoinMarketCap, courtesy of the Wayback Machine. Below, you will find data from 2017, along with the percentage changes starting from 2018, calculated on a year-over-year basis. I chose July 1st as the reference point due to the availability of more data on that date. We have come a long way.

July 1, 2017 Numbers

Bitcoin’s Price: $2,480

Ethereum’s Price: $295

Total Marketcap: $151b

Bitcoin’s Marketcap: $40.7b

Ethereum’s Marketcap: $27.4b

Bitcoin’s Market Share: 27%

Ethereum’s Market Share: 18%

July 1, 2018

Bitcoin’s Price: $6,403 (158.18% increase)

Ethereum’s Price: $455 (54.23% increase)

Total Marketcap: $300b (98.67% increase)

Bitcoin’s Marketcap: $109 Billion (167.81% increase)

Ethereum’s Marketcap: $45.7 Billion (66.78% increase)

Bitcoin’s Market Share: 36% (33.33% increase)

Ethereum’s Market Share: 15% (16.66% decrease)

July 1, 2019

Bitcoin’s Price: $10,820 (68.98% increase)

Ethereum’s Price: $290 (36.26% decrease)

Total Marketcap: $289b (3.66% decrease)

Bitcoin’s Marketcap: $192b (76.14% increase)

Ethereum’s Marketcap: $31b (32.16% decrease)

Bitcoin’s Market Share: 66% (83.33% increase)

Ethereum’s Market Share: 11% (33.33% decrease)

July 1, 2020

Bitcoin’s Price: $9,134 (15.58% decrease)

Ethereum’s Price: $226 (22.06% decrease)

Total Marketcap: $260b (10.03% decrease)

Bitcoin’s Marketcap: $168b (12.5% decrease)

Ethereum’s Marketcap: $25b (19.35% decrease)

Bitcoin’s Market Share: 65% (1.51% decrease)

Ethereum’s Market Share: 10% (9.09% decrease)

July 1, 2021

Bitcoin’s Price: $34,551 (278.6% increase)

Ethereum’s Price: $2,226 (884.95% increase)

Total Marketcap: $1.43t (450% increase)

Bitcoin’s Marketcap: $647.7b (285.53% increase)

Ethereum’s Marketcap: $259.4b (937.6% increase)

Bitcoin’s Market Share: 45% (30.76% decrease)

Ethereum’s Market Share: 18% (80% increase)

July 1, 2022

Bitcoin’s Price: $19,737 (42.87% decrease)

Ethereum’s Price: $1,061 (52.33% decrease)

Total Marketcap: $871.3b (39.06% decrease)

Bitcoin’s Marketcap: $376.6b (41.85% decrease)

Ethereum’s Marketcap: $128.8b (50.34% decrease)

Bitcoin’s Market Share: 43% (4.44% decrease)

Ethereum’s Market Share: 15% (16.66% decrease)

Today (June 30th, 2023)

Bitcoin’s Price: $30,700 (55.54% increase)

Ethereum’s Price: $1,879 (77.09% increase)

Total Marketcap: $1.19t (36.57% increase)

Bitcoin’s Marketcap: $596.6b (58.41% increase)

Ethereum’s Marketcap: $226.2b (75.62% increase)

Bitcoin’s Market Share: 50% (16.27% increase)

Ethereum’s Market Share: 19% (26.66% increase)

While there's much more to delve into beyond Bitcoin and Ethereum, the reality of our industry is that everything flows from these two foundational assets. Wall Street may not grasp the intricacies of our field yet, but once they comprehend the consistent gains we've been reaping, they will join the fold. Yes the last two years have been flat, but over any meaningful time frame, growth has been explosive.

BlackRock serves as a perfect case in point. A few years ago, Larry Fink asserted that there was no need for the firm to delve into digital asset-related products. Fast forward to today, and BlackRock is making serious strides to secure a stake in our market. Major Wall Street firms like BlackRock, under the leadership of individuals like Larry Fink, won't publicly advocate for Bitcoin until they are strategically positioned to profit. Their actions will communicate more than their words ever could.

Fink's commentary on crypto is sparse, but here’s a noteworthy quote: “Bitcoin has caught the attention and the imagination of many people. Still untested, pretty small market relative to other markets. You see these big giant moves every day (in bitcoin)...it’s a thin market. Can it evolve into a global market? Possibly.”

Bitcoin and Ethereum are the beating heart of our industry and form the bedrock of our sector's growth. As Wall Street comes to understand this, they will invariably follow BlackRock's lead, even if they don't fully comprehend the nuances as we do. The impending bull run (when it arrives) will be fueled by institutions, as we have predicted since 2017. Once Wall Street acknowledges our growth trajectory, the rest will fall into place.

Have a wonderful weekend, and I look forward to connecting with you all next week.

Sign Up For OKX!

🔥 The Wolf Den is proudly sponsored by OKX, the world’s second largest crypto exchange.

🔥 Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Details in the image above.

🔥 SIGN UP HERE to show support for the FREE Wolf Den Newsletter!

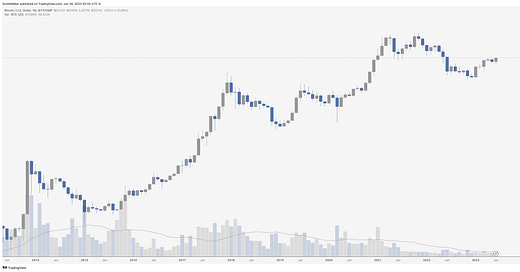

Bitcoin Thoughts And Analysis

K.I.S.S. - Keep is simple, stupid. Sometimes a quick look at the line chart eliminates the noise and shows you what is really happening.

Breakout, retest, expansion on increasing volume.

Bitcoin still look bullish to me on almost every time frame.

I still want to see it above $31,000 and closing candles there.

Altcoin Charts

All eyes should be on Litecoin right now. The halving is rapidly approaching in a month and the chart is heating up. That said, price is at both horizontal AND descending resistance, so I personally would be looking to buy HIGHER on a break of both. The descending blue line is the key resistance, since the all time high. The blue zone has been the main resistance for over a year. A close above $107 and that zone will be cleared. Keep an eye on this.

Zooming in a bit, we can see that price has made higher lows since last June, consolidating towards the blue zone that I shared above. You can also see the attempted breakout through descending resistance. Price is back above both the 50 and 200 MAs.

Legacy Markets

As Q2 ends, US equity futures saw gains while Treasuries experienced a selloff prompted by strong US economic growth and jobs data, stirring predictions of further interest rate hikes. The Treasury two-year yield rose to 4.93%, while the 10-year yield increased to its highest level since mid-March, suggesting a nearly 50% chance of a second US hike by year-end. Despite the expected softening of inflation, it is projected to remain persistent.

S&P 500 contracts were slightly higher, closing out a third consecutive quarterly gain. Conversely, Nike Inc. shares fell after its full-year forecast failed to impress Wall Street. European bond yields retreated, and the euro pared a decline after June's euro-area inflation slowed more than expected. Meanwhile, the Stoxx Europe 600 index climbed approximately 0.8% despite a disappointing quarter.

The yen weakened significantly against the dollar for the first time since November, while the offshore yuan, after recently hitting a seven-month low, appreciated as China set a stronger daily reference rate. The global equities index is headed for a quarterly rise of 4.5%, despite the risk of recessions in major economies. US data showing the economy's robust health amplified the yield-curve inversion, indicating the possibility of a future recession due to Fed rate increases. Oil prices increased despite facing the worst run of quarterly losses in three decades.

Key events this week:

US personal income and spending, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.8% as of 10:11 a.m. London time

S&P 500 futures rose 0.3%

Nasdaq 100 futures rose 0.4%

Futures on the Dow Jones Industrial Average rose 0.1%

The MSCI Asia Pacific Index was little changed

The MSCI Emerging Markets Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.2% to $1.0842

The Japanese yen was little changed at 144.68 per dollar

The offshore yuan fell 0.1% to 7.2759 per dollar

The British pound was little changed at $1.2621

Cryptocurrencies

Bitcoin rose 1.3% to $30,792.78

Ether rose 2% to $1,886.63

Bonds

The yield on 10-year Treasuries advanced four basis points to 3.88%

Germany’s 10-year yield advanced two basis points to 2.44%

Britain’s 10-year yield advanced five basis points to 4.43%

Commodities

Brent crude rose 1.1% to $75.19 a barrel

Spot gold fell 0.3% to $1,903.09 an ounce

Crypto Fear & Greed Index - Update

I just wanted to call to your attention to the Fear & Greed Index returning to neutral, which is a good opportunity for Bitcoin to refuel and continue higher. As long as the market structure maintains the current bullish bias ie. no major bad news, my expectation is for Bitcoin to hold support and continue up.

North Carolina May Be The First U.S. State To Buy Bitcoin

North Carolina legislators are pushing a bill to permit the state to possess digital assets and precious metals. The bill has successfully passed the North Carolina House of Representatives and now requires approval from the state Senate, followed by Democratic Governor Roy Cooper. However, potential obstacles remain, as the bill was sponsored by Republicans and faced opposition from Democrats in the House. Despite the possibility of a veto by Governor Cooper, states persist in their efforts to enact crypto-friendly legislation. Given the rapid pace of change in this space, it wouldn't be surprising to see a state purchase Bitcoin within the next couple of years. We will be hosting all of the parties who have made this happen on Crypto Town Hall today.

Bitcoin Is A Bulwark Against Totalitarianism

Presidential candidate Robert F. Kennedy has committed to backing Bitcoin if he wins the election. While other candidates have expressed similar views, Kennedy's stance appears the most robust. If you're a U.S. resident, I urge you to support candidates who are open to cryptocurrency. Even though we may not be a large enough voting group to sway the election, we can certainly influence the issues discussed and shape the caucus voting. It's essential our voices are represented.

Please find below a quote from John F. Kennedy on Bitcoin. Remember, Kennedy is not a Bitcoin maximalist - he has indicated his support for the broader cryptocurrency industry in previous statements. “As president, I will make sure that your right to use and hold Bitcoin is inviolable. Bitcoin is not only a bulwark against totalitarianism and the manipulation of our money supply, it points the way toward a future in which government institutions are more transparent and more democratic.”

It's important to remember that the presidential election often coincides with numerous other elections, making it crucial for us to stay informed. As the election approaches, I will strive to succinctly summarize all the relevant information for you here.

Coinbase International Is Off To A Strong Start

Despite succumbing to global regulatory pressures, Binance faces stiff competition as Coinbase International aggressively targets market share. From June 21 to June 28, Coinbase International reported around $100 million of daily trading volume, totaling approximately $900 million over this period. While a promising start, it pales in comparison to Binance's $444 billion trading volume for the month.

To put it into perspective, Coinbase's $100 million per day translates to about $3 billion for the month - only one-fifth of what Binance achieves in a single day. This gap is substantial, but it's essential to note that Coinbase International currently offers only two products and serves exclusively institutional clients, which is likely to change. If Binance's regulatory issues persist, it would be unwise to underestimate how quickly Coinbase could close the gap.

Hack The Bitcoin ETF | Mastercard Pushes Crypto Adoption | Scott Dykstra

I am joined by Scott Dykstra, Co-Founder & CTO of Space And Time.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.