Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

🔥 The Wolf Den is proudly sponsored by OKX, the world’s second largest crypto exchange.

🔥 Sign up for an OKX Trading Account then deposit & trade to unlock mystery box rewards of up to $60,000! Details in the image above.

🔥 SIGN UP HERE to show support for the FREE Wolf Den Newsletter!

In This Issue:

The Wall Of Worry

The Skip Heard Round The World

The Impact Of US Regulations On Cryptocurrency - IntoTheBlock

Bitcoin Thoughts And Analysis

Legacy Markets

Trouble In Korea

Bittrex Breaks The Curse

Janet Yellen Finally Catches On

Tether Depeg Or More FUD?

Hinman Bombshell - Ripple, Binance, Coinbase Strike Back

The Wall Of Worry

In terms of financial markets, 2023 has proven to be a complex year. The escalation of widespread concerns, including Quantitative Tightening (QT), inflation, crises in fiat currencies, the specter of an impending recession, and bank failures, have not hampered the performance of key indices. Contrarily, they are on the rise, and tech investors are gleefully raising their glasses. Interpretations of this scenario are divided, largely dependent on individual perspectives - some industry experts dismiss it as sheer luck, while others argue it's a typical case of 'scaling the wall of worry.' Let's delve into this.

Given the widespread conversation surrounding mega-cap companies at present, it's fitting that we begin our discussion there:

Alphabet - YTD +38%

Microsoft - YTD +40%

Apple - YTD +46%

Amazon - YTD +46%

Netflix - YTD +48%

Meta - YTD +117%

Tesla - YTD + 138%

Nvidia - YTD +191%

To put it simply, the observed percentages are extraordinary and are usually associated with small-cap stocks. Focusing particularly on mega-caps, this is not merely 'climbing the wall of worry,' it signifies a profound shift in investing preferences both in the U.S. and globally. Only three weeks ago, Nvidia set a record for the largest single-day stock market surge in U.S. history – we are indeed living in unprecedented times.

The 'climb' that experts refer to is the performance of the major indices, which are being propelled upward by the significant growth of these mega-cap companies.

Dow Jones Industrial Average - YTD +2.6%

Russell 2000 Index -YTD +7.5%

S&P500 - YTD +14.3%

Nasdaq-100 - YTD +37%

Major indices are indisputably performing well, but it's no secret that this growth owes a great deal to the ongoing tech boom. I believe there are several factors contributing to the current scenario, with the dominant one being the widespread fear that mainstream investors have seemingly embraced.

Here's my retrospective analysis: the pervasive skepticism, fear, and uncertainty that characterized 2023 resulted in widespread apprehension, consequently slowing down capital inflow into the market. The banking crisis in March further exacerbated investor anxiety, providing them with even more reasons to be hesitant. On the other hand, tech stocks, rebounding from a tough 2022, were ready for a mean reversion. Bold investors seeking to safeguard their excess capital amid uncertainties surrounding fiat currencies found their refuge in tech stocks. This scenario, coupled with an unexpected rise in the AI narrative, created the perfect storm for the tech stock boom we are witnessing today. While you should take my interpretation with a grain of salt, we may well be approaching a stage where late entrants are merely keeping the system afloat and scrambling for leftovers.

Here is a snapshot of the Fear & Greed Index for the S&P 500. You can let your imagination run wild when considering what the meter might look like for tech giants like Tesla or Nvidia - most likely in the high 90s range.

As someone who typically leans towards a moderate level of optimism in financial biases, I believe the true narrative of the 2023 markets likely falls somewhere between 'climbing the wall of worry' and insane FOMO. Importantly, this perspective depends significantly on where one chooses to look. To reiterate a point I've made often, the anticipated recession – potentially the most widely expected one ever – will likely occur when mainstream expectations of a recession have subsided, which is why my bias continues to be bullish in the short to midterm.

Should tech stocks maintain their upward trajectory, I would quickly be persuaded that some unexpected news is poised to level the playing field. I doubt that the Federal Reserve is pleased to observe such pronounced reactions following the historical tightening and declining inflation. So, before shifting focus from equities to the Federal Reserve and cryptocurrencies, I would emphasize one key point - the importance of diversification. Few investors will hit the jackpot by committing to a single narrative. I firmly believe that a robust portfolio should contain a balanced mix of different sectors that align with your strengths, with acute attention reserved for the top performers.

Turning now to the Federal Reserve's decision, as anticipated, they opted NOT to raise rates. As I often contend, the Federal Reserve is merely a facade, but I'll highlight the most crucial quotes below. Unless the Fed makes a drastic move, the markets will continue their independent trajectories. Jerome Powell might be missing the mark on key issues, as he acknowledges below, but he continues to broadcast the Fed's actions transparently. Markets appreciate clarity.

Nearly all policymakers view some further rate hikes this year as appropriate.

The Fed’s forecasts have been wrong on inflation the past 2 years.

We are talking about a couple of years out for rate cuts

The skip -- I shouldn’t call it a skip. The decision makes sense.

The Fed will not finance US debt.

I continue to think there is a path to a soft landing.

The situation becomes particularly intriguing when we look at cryptocurrencies. If the regulatory clampdown wasn't already painful enough, crypto investors are now witnessing their counterparts in legacy tech amass significant profits. Surprisingly, crypto remains detached from macroeconomic trends, not benefitting from the current tech boom. HOWEVER, it's crucial to remember that the entire crypto market had its shining moment earlier this year, along with a healthy surge in April.

BTC - YTD +56%

ETH - YTD +46%

If the prevailing hypothesis is correct - that investors are seeking safe havens to store value and tech is the driving narrative - it doesn't require extraordinary acumen to foresee that crypto will soon seize a portion of this capital. Capital tends to rotate from one market to another, and with the right conditions in place, cryptocurrency prices will once again embark on 'climbing the wall of worry.' 2022 created a significant barrier for crypto due to exchange collapses, and 2023 is erecting a new barrier on the foundation of governmental pressures.

Once the mainstream market 'officially' writes off crypto, it will likely do what it has always done - complete the ascent of the 2022 'wall of worry' and dismantle the 2023 'wall of worry' for a surge. While I can't predict exactly when this will happen, I maintain that it will likely occur when least expected. If you're not directly impacted by the AI narrative, don't lose sleep over it. There's no such thing as an everlasting new narrative that eternally drives prices upwards. Capital always shifts, and crypto will have its moment in the sun.

The Skip Heard Round The World

Federal Reserve Chair Jerome Powell corrected himself during a press conference for using the term "skip" when referring to the Fed's decision to pause interest-rate increases. He emphasized that the Fed's decision was not indicative of a new approach but was specific to the current meeting.

“If you think of the two things as separate variables, then I think the skip — I shouldn’t call it a skip — the decision makes sense,” he told reporters.

Quite the Freudian Slip, right? The damage was clearly done, because the term skip implies that the Fed is very likely to raise rates again before the year is out.

Oops.

Previously, the Fed had increased rates at each of its last 10 meetings. The target range for its benchmark rate is currently 5-5.25%. Projections indicate that most Federal Open Market Committee participants believe it would be suitable to raise rates by an additional half-percentage point this year.

Powell stressed that the decision to pause did not suggest a permanent shift in policy. He clarified that the committee did not discuss moving to an every-other-meeting approach.

The Impact Of US Regulations On Cryptocurrency - IntoTheBlock

In this report, we bring to you the latest in on-chain cryptocurrency analysis. We look at the blockchain directly and analyze balances, transactions, and the overall activity of market participants. This gives us a unique insight into the future of the market.

This section is written in conjunction with IntoTheBlock (ITB). ITB is an intelligence company that leverages machine learning and advanced statistics to extract intelligent signals tailored to crypto-assets. IntoTheBlock tackles one of the hardest problems in crypto: to provide investors with a view of a crypto asset that goes beyond price and volume data.

The Wolf Den research team uses IntoTheBlock to dig deeper and get the most important insights about the crypto market.

The Impact Of US Regulations On Cryptocurrency

This week, we delve into the latest actions taken by the Securities and Exchange Commission (SEC) and briefly discuss their potential implications for the cryptocurrency world. After months of increasing tensions surrounding cryptocurrency in the U.S., the SEC recently carried out its most significant actions to date. Last week, the SEC filed a lawsuit against Binance US and its CEO Changpeng Zhao (CZ), accusing them of operating an unlawful securities exchange. Mere a day later, the SEC leveled similar charges against Coinbase. Following these events, 11 U.S. states issued cease and desist orders, requiring these platforms to demonstrate within a 28-day period that they aren't trading unregistered securities, or they would be forced to withdraw from these states.

The recent developments have affected Coinbase's stock price and are likely to significantly shape the trajectory of the cryptocurrency industry within U.S. boundaries.

Via IntoTheBlock's free capital markets insights

Coinbase's stock experienced a decline of more than 15% this week, along with numerous tokens that the Securities and Exchange Commission (SEC) alleges to be securities.

Approximately $37 billion worth of crypto-assets were classified as securities

The list encompasses major capitalization assets like Cardano, Solana, and Polygon, all of which have seen their value plummet by double-digit percentages

Despite Gary Gensler implying that ETH is a security, the SEC didn't categorize Ethereum as such. Also, Ripple, which is currently dealing with a preceding lawsuit alleging XRP to be a security, was not included.

In the wake of the news, Bitcoin and Ether experienced a price surge on Binance US, compared to global prices. This was mainly because traders offloaded some of the implicated tokens in favor of the two largest cryptocurrencies.

Via ITB's Bitcoin ownership indicators

The number of Bitcoin held by long-term holders achieved a new record high, indicating a substantial increase in the total amount of Bitcoin held by addresses for over a year.

This seems to indicate the market's shift as a reaction to the SEC's interventions

While the news might have prompted some less committed traders to sell, the amount of Bitcoin owned by long-term investors is now greater than it has ever been

Broadly speaking, the SEC's actions may expedite the migration of cryptocurrency activities towards foreign jurisdictions and on-chain transactions, as opposed to centralized exchanges. While there's much to evaluate and legal proceedings could prolong for a considerable duration, it appears that long-term investors remain unperturbed by these developments.

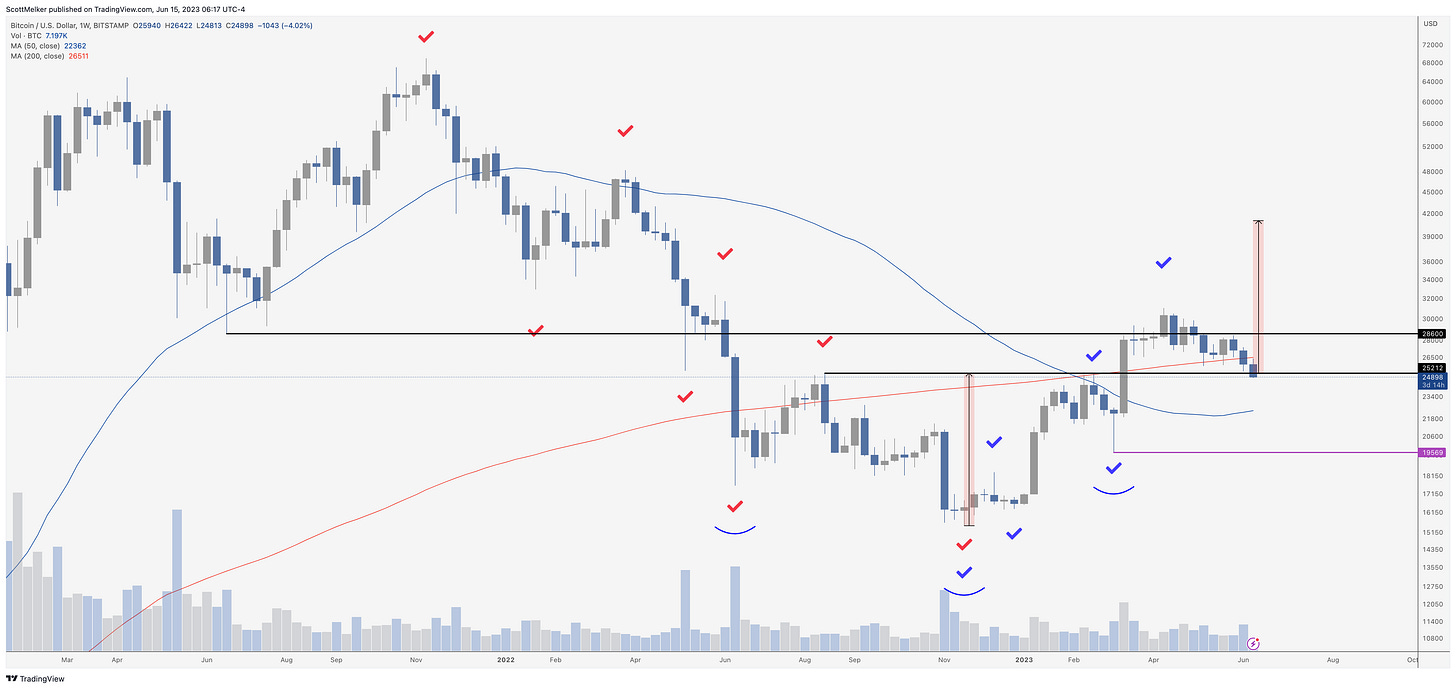

Bitcoin Thoughts And Analysis

$25,212.

I have been anticipating a retest of this level since it was broken to the upside 3 months ago. The bids that I had sitting there for the last 90 days have filled, an addition to my longer term investment in Bitcoin and not a “trade,” per se.

I am not thrilled that the level was passed through so easily, but am watching it on the weekly chart. I want to see a weekly close above $25,212 on Sunday, rather than a close below and this level becoming potential resistance once again.

$25,212 broke yesterday on the daily chart and quickly was perfectly tested as resistance today. Not ideal, but we have a long way to go in the daily candle.

The next logical area of support is shown in blue below, with the 200 MA just below that screaming up.

Today will be interesting.

If you are looking for a place to buy Bitcoin, check out OKX!

Legacy Markets

Stocks took a downward turn on Thursday due to the Federal Reserve's hawkish stance and weak economic data from China. U.S. market futures dropped after Chairman Jerome Powell indicated that most Fed officials expect further interest rate hikes this year, despite a recent pause. This affected tech stocks, with the Nasdaq 100 set to lose some of its 37% gain in 2023.

Chinese economic activity softened in May, leading to declines in global mining stocks like Anglo American Plc and Rio Tinto Plc. While most sectors dipped in anticipation of the European Central Bank's (ECB) inflation policy update, retail stocks, including Hennes & Mauritz AB and Asos Plc, showed a positive trend.

The ECB is expected to increase its deposit rate to 3.5%, with attention primarily on further measures to tackle inflation that's currently three times the 2% target.

In other news, SoftwareOne Holding AG's stock surged following Bain Capital's $3.2 billion private acquisition offer. Meanwhile, the dollar eased its gains as traders evaluated the potential for further U.S. rate hikes.

Asian markets showed some resilience as Chinese equities rose in response to the People’s Bank of China lowering a key lending rate. However, data indicating slower retail sales in May raised concerns about a further economic slowdown in China. Lastly, gold prices continued to drop due to expectations of more Fed tightening, while European natural gas prices spiked due to supply concerns amidst prolonged outages and hot weather.

Key events this week:

European Central Bank President Christine Lagarde holds press conference following the rate decision, Thursday

US initial jobless claims, retail sales, empire manufacturing, business inventories, industrial production, Thursday

Bank of Japan rate decision, Friday

US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.3% as of 5:59 a.m. New York time

Nasdaq 100 futures fell 0.6%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 fell 0.3%

The MSCI World index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.2% to $1.0847

The British pound was little changed at $1.2661

The Japanese yen fell 0.7% to 141.03 per dollar

Cryptocurrencies

Bitcoin fell 0.2% to $24,882.31

Ether fell 0.3% to $1,632.48

Bonds

The yield on 10-year Treasuries advanced two basis points to 3.81%

Germany’s 10-year yield advanced four basis points to 2.49%

Britain’s 10-year yield advanced one basis point to 4.41%

Commodities

West Texas Intermediate crude rose 1.1% to $69.05 a barrel

Gold futures fell 1.2% to $1,945.50 an ounce

Title

Trouble In Korea

Over the past 48 hours, two crypto companies with close ties, Haru and Delio (entities with a structure similar to BlockFi), have suspended deposits and withdrawals due to issues with a regional service provider. The predicament for these Korea-based companies began when Haru noticed that investors weren't receiving their deposits, which subsequently led to an investigation and the halting of all deposits and withdrawals. Following suit, Delio, likely leveraged through Haru, was compelled to do the same due to its inability to meet customer withdrawal demands.

Regrettably, Haru announced that the issue originates from their service provider being an "unreported business operator," and thus, "there is no way to get help from the financial authorities." This situation is disheartening, but it's essential to remember that there's a great deal of misinformation concerning the actual amount of trapped funds. An often overlooked factor in the coming years will be retail customers' efforts to recover their investments, which leads me to my next discussion point.

Bittrex Breaks The Curse

Starting tomorrow, Bittrex U.S. and its associated entities will be permitted to withdraw locked funds, following a significant judgment by a Delaware bankruptcy court. The Bittrex case is intriguing since the platform never lost funds but had to declare bankruptcy when it was hit with steep government fines. This ruling implies that the funds will be returned to creditors, though potential future clawbacks could occur if the courts determine that Bittrex has outstanding obligations to the government. At present, it's uncertain whether customer claims will be permanently prioritized over the government's claims.

Janet Yellen Finally Catches On

During a Housing Financial Services Committee meeting, Janet Yellen finally recognized that the dollar's proportion of global reserves is gradually diminishing. The news itself isn't shocking; what is surprising, however, is Yellen's relatively pragmatic response, which might imply that the situation is more severe than she's letting on. Along with her acknowledgement, Yellen argued that the U.S. should not decouple from China, another reasonable assertion. I anticipate de-dollarization to be a prevailing narrative over the next decade. While this is indeed worrisome, there's a potential alternative at hand... enter Bitcoin.

Tether Depeg Or More FUD?

Tether's stablecoin, USDT, has slightly de-pegged on exchanges due to a significant imbalance in the Curve's 3Pool, one of the leading pools for stablecoin trading in decentralized finance. Ideally, the Curve 3Pool should have a 33.33% balance for each of its three stablecoins - USDT, USDC, and DAI. However, USDT's balance has surged to over 70% as traders are selling substantial amounts of USDT for DAI or USDC, causing USDT to de-peg to $0.997.

Remember, a stablecoin can depeg because of traders on exchanges, but is not truly depegged unless redemptions are unavailable 1/1.

Tether CTO Paolo Ardoino attributed this trend to a tense market situation, with the latest news prompting large groups to exit the crypto markets. He mentioned that Tether is the gateway for liquidity and experiences inflows when interest in crypto grows and outflows when the sentiment is negative. He also highlighted the possibility of a direct attack on Tether.

Previous instances of imbalance in the Curve 3Pool were observed in March when USDC and DAI’s balance increased to over 45% each, after the collapse of crypto exchange FTX in November, and after the Terra ecosystem crash in May 2022.

Despite the occasional price discrepancies, USDT has never maintained a prolonged de-peg from its intended value. Ardoino stated that Tether is "ready to redeem any amount" and will closely monitor the situation.

Hinman Bombshell - Ripple, Binance, Coinbase Strike Back

John E. Deaton and Eleanor Terrett discuss Hinman's papers and what it means to the future of crypto. Chris Inks to share his market ideas in the second half of the stream.

Sign up for my other newsletter, THE DAILY CLOSE!

I built The Daily Close to give you the same institutional-grade indicators and signals that I use to trade the market on a daily basis. It's automatically generated and delivered to your inbox at the daily close everyday.

1 Week FREE for all subscribers

17% discount if you subscribe for a year

$25 a month, or $250 a year

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.