Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Sign up for my other newsletter, THE DAILY CLOSE!

I built The Daily Close to give you the same institutional-grade indicators and signals that I use to trade the market on a daily basis. It's automatically generated and delivered to your inbox at the daily close everyday.

1 Week FREE for all subscribers

17% discount if you subscribe for a year

$25 a month, or $250 a year

In This Issue:

The Steve Jobs Of Crypto

Bitcoin Thoughts And Analysis

Legacy Markets

The DCG Skeleton Is Back

Only In Dubai

STEPN Adds ApplePay For In-Game Purchases

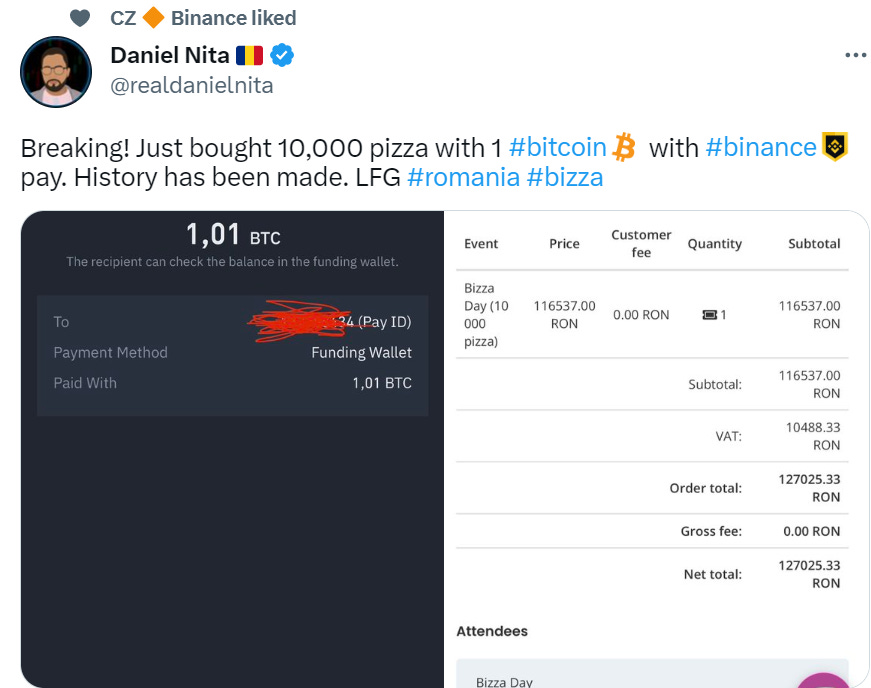

1 BTC And 100,000 Pizzas

Debt Ceiling | Time Is Running Out | Macro Monday With Dave Weisberger & Mike McGlone

The Steve Jobs Of Crypto

In 2007, Steve Jobs, during his keynote at the Macworld Conference & Expo, delivered one of the most unforgettable presentations in history. He began…

“This is a day I’ve been looking forward to for two-and-a-half years. Every once in a while, a revolutionary product comes along that changes everything.”

Inside his pocket, unbeknownst to the world, was the inaugural iPhone. Jobs continued…

“Apple’s been very fortunate. It’s been able to introduce a few of these into the world. 1984, introduced the Macintosh. It didn’t just change Apple. It changed the whole computer industry. In 2001, we introduced the first iPod, and it didn’t just change the way we all listen to music, it changed the entire music industry. Well, today, we’re introducing three revolutionary products of this class.”

The audience buzzed with anticipation.

“The first one is a widescreen iPod with touch controls. The second is a revolutionary mobile phone. And the third is a breakthrough Internet communications device. So, three things: a widescreen iPod with touch controls; a revolutionary mobile phone; and a breakthrough Internet communications device.”

Excitement mounted.

“An iPod, a phone, and an Internet communicator. An iPod, a phone … are you getting it? These are not three separate devices, this is one device, and we are calling it iPhone.”

Excitement erupted.

Jobs proceeded to introduce this revolutionary product, evoking gasps and applause with each feature - a camera, map, email, web browser, app store, and music, all available without a stylus or mouse. The notion of such immense power within their grasp was captivating. To demonstrate, Jobs searched for the nearest Starbucks and pranked them with an order of 4,000 lattes to go - the potential was limitless.

Steve Jobs’ legacy is one I deeply admire, and I could spend hours discussing it. However, this intro isn't about the iPhone or Apple's mission, but about crypto today, and the standard set by Steve Jobs. We remember him fondly.

What if I told you that someone in our sector reminds me of Steve Jobs, and their product evokes memories of Apple's early days? The inspiration for today’s intro comes from a recently released eight-part video series. As I watched the opening moments, I was reminded of the indelible legacy Jobs left, and I wondered who among us could fill those monumental shoes.

The individual who comes to mind is Brian Armstrong, CEO of Coinbase.

This is indeed a bold statement, and agreement is not expected, but I cannot suppress my intuition that Coinbase may emulate Apple’s success from the early 2000s. If Coinbase maintains its dominance during the next crypto bull run and fulfills its promises—defending against the SEC, bringing a billion people to crypto, successfully launching Base, and expanding Coinbase International—we'll soon consider it 'normal', not 'early'.

Should Coinbase realize this vision and continue innovating, there will be no doubt about its potential trajectory. In the video series that inspired this intro, Armstrong's poignant message is singularly focused: “It’s Time To Update The System.” His explanation of crypto's potential mirrors Steve Jobs' narrative about the iPhone—the similarity is uncanny.

Armstrong explains: “The naive view of crypto is that this is some speculative asset that people are trading and they are going to lose their shirts. That’s missing the forest through the trees. It’s early days, yes, some people are trading it as an asset class, but they are also starting to use it in many novel ways.

What happens is they often get a little bit of crypto and they start to use it, send some payments, use some decentralized applications, and the next step and the next step and they go down the rabbit hole. And eventually, they start to think, this feels like the early days when I first started using the internet.

Fundamentally, crypto is not a financial product, it’s a technology that can update all kinds of financial products. It can improve settlement times, make it cheaper to send money to your family overseas in another country and be a new way for artists to get paid and have a direct relationship with their fans.

Cryptocurrency regardless of what you think about it is not going anywhere, it can’t be uninvented.”

Piqued your interest? That's just the tip of the iceberg. Imagine if you could rewind time to watch Steve Jobs’ 2007 speech again. What if you paid closer attention, took a calculated risk—could your life have been different? While time travel is impossible, you can watch this series and contemplate what this means for technology's trajectory in the coming decade. That’s what I'm doing.

Steve Jobs is irreplaceable, but every so often, powerful disruptors appear—individuals capable of more than merely pushing boundaries, they alter the course entirely. Brian Armstrong is one such individual.

Apple's market cap today is $2.75 trillion. Jobs’ 2007 speech drove it to roughly $165 billion, a dramatic surge from $80 billion earlier that year. Coinbase's current market cap stands at $14.32 billion—a mere scratch on the surface. Just 10% of Apple's market cap is $275 billion, nearly 19 times greater than Coinbase's current standing. Digest these figures, ponder what Coinbase is set to achieve. Re-read this paragraph, because history may be in the making.

Every now and then, the system needs an update—now is such a time.

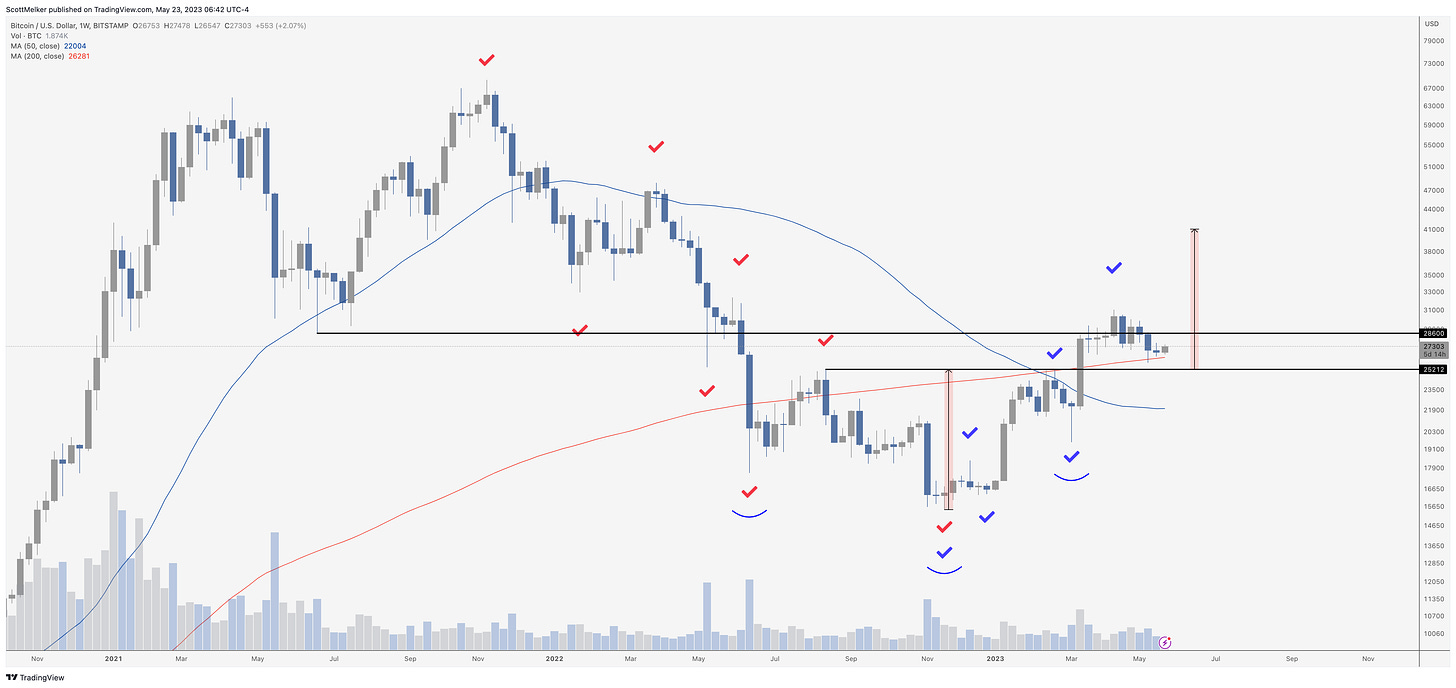

Bitcoin Thoughts And Analysis

Bitcoin made a nice little move up over night, after bouncing off of the 200 MA 2 weeks ago. Right now on the larger time frames, that red line is the key, because so many traders view it as the line that determines the prevailing trend.

Nothing has really changed here, but it’s worth watching through the weekly close on Sunday.

In the short term, little to do here.

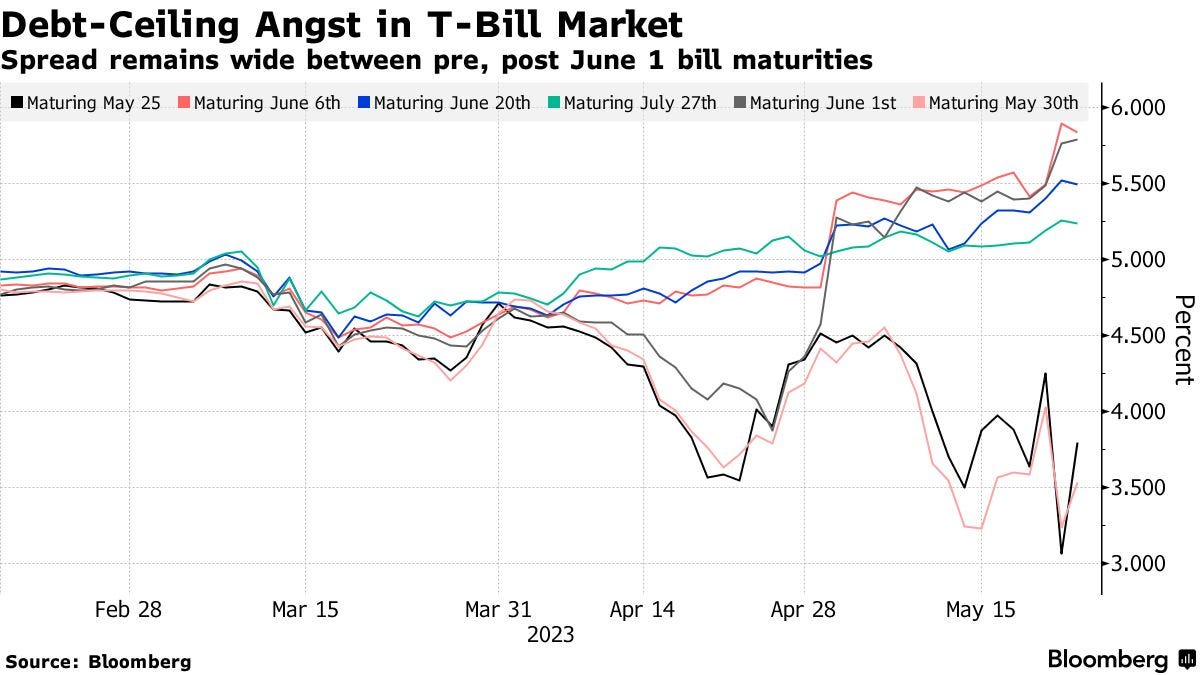

Legacy Markets

Investors are demanding higher premiums for US debt that is at risk of default as talks on the borrowing limit continue without a deal. Yields on four-week Treasury bills have risen more than 60 basis points since May, while the two-year Treasury yield increased by 7 basis points. European shares slipped due to a decline in manufacturing activity, particularly in luxury-goods makers. The debt-ceiling issue is causing concern in global markets, as time runs out for US politicians to reach an agreement. While a default is seen as unlikely, nervousness is increasing as the deadline approaches. Commodities were lower, and the dollar and yen strengthened. Concerns over China's recovery impacted iron ore and copper prices. The Tokyo stock index fell, and European market sentiment was affected by weaker manufacturing data. Individual stock movers included Vivendi SE and Julius Baer Group Ltd., which experienced declines.

Key events this week:

US new home sales, Tuesday

Dallas Fed President Lorie Logan speaks, Tuesday

Fed issues minutes of May 2-3 policy meeting, Wednesday

Bank of England Governor Andrew Bailey speaks, Wednesday

US initial jobless claims, GDP, Thursday

Interest rate decisions in Turkey, South Africa, Indonesia, South Korea, Thursday

Tokyo CPI, Friday

US consumer income, wholesale inventories, durable goods, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.2% as of 6:11 a.m. New York time

Nasdaq 100 futures fell 0.1%

Futures on the Dow Jones Industrial Average fell 0.2%

The Stoxx Europe 600 fell 0.2%

The MSCI World index fell 0.2%

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.4% to $1.0775

The British pound fell 0.5% to $1.2378

The Japanese yen was little changed at 138.54 per dollar

Cryptocurrencies

Bitcoin rose 1.4% to $27,270.13

Ether rose 2% to $1,855.06

Bonds

The yield on 10-year Treasuries advanced three basis points to 3.74%

Germany’s 10-year yield advanced three basis points to 2.49%

Britain’s 10-year yield advanced eight basis points to 4.14%

Commodities

West Texas Intermediate crude fell 0.2% to $72 a barrel

Gold futures fell 0.8% to $1,976 an ounce

The DCG Skeleton Is Back

Regrettably, this narrative has not reached its conclusion. Genesis, DCG, Gemini, Winklevoss brothers— it's a convoluted story, but the crux is this: Gemini Earn owes money to their customers, however, the collapse of Genesis and DCG is hampering repayment. The ramifications are uncertain if these debts aren't fulfilled, and the situation has taken a grim turn with the recent missed payment of $630 million to Gemini. I was serious when I stated that a contagion could persist long after it has receded from the public consciousness. Gemini is now faced with a difficult decision: to extend forbearance (essentially, granting some flexibility) or reclaim the funds, a move that could potentially trigger a system-wide collapse. As this story unfolds, it's vital to keep a close eye on it since it could influence market prices.

Only In Dubai

Feeling let down that Bitcoin City never materialized in El Salvador? Fear not, for you can now journey to Dubai to experience a hotel that is a 40-story Bitcoin-themed tower. Scheduled for unveiling tomorrow, this hotel is fashioned in the likeness of a Bitcoin and offers guests NFTs as well as staking opportunities. The project's developer claims, “it will be the first hotel that essentially refunds your payment, with interest.” How exactly guests are to receive this reimbursement plus interest remains unclear to me, but it appears we'll have to patiently await further details. The last thing the crypto landscape needs is another coin, isolated in its own ecosystem, convincing people to 'stake' as an alternative to selling.

STEPN Adds ApplePay For In-Game Purchases

The Web3 game STEPN is integrating Apple Pay as a fiat onramp for in-app purchases, aiming to increase its accessibility. Users will be able to use Apple Pay to buy NFT sneakers required for gameplay without the need for a crypto wallet. STEPN aims to onboard the next 100 million users to Web3 by incorporating a popular fiat onramp like Apple Pay. While the game initially gained over 700,000 monthly active users, it has seen a decline in recent months. The integration of Apple Pay is expected to remove barriers to entry and promote the mainstream adoption of Web3.

1 BTC And 100,000 Pizzas

We're all familiar with the famous pizza story, aren't we? Laszlo Hanyecz made the first recorded Bitcoin purchase, buying two Papa John's pizzas for 10,000 BTC. Fast-forward 13 years, and now we're celebrating the purchase of 10,000 pizzas with just 1 BTC—it's truly an extraordinary era. Perhaps in another decade, 1 BTC could buy us 100,000 pizzas, if Bitcoin's value reaches around $200,000. Just imagine that narrative!

Debt Ceiling | Time Is Running Out | Macro Monday With Dave Weisberger & Mike McGlone

The US debt ceiling is the most important news in macro.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.