Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Sign up for my other newsletter, THE DAILY CLOSE!

I built The Daily Close to give you the same institutional-grade indicators and signals that I use to trade the market on a daily basis. It's automatically generated and delivered to your inbox at the daily close everyday.

1 Week FREE for all subscribers

17% discount if you subscribe for a year

$25 a month, or $250 a year

In This Issue:

Six Blind Men And Bitcoin

Bitcoin Thoughts And Analysis

Legacy Markets

Yes, The US Has Defaulted In The Past

An Alternative View On Ledger

Tether Leans Into Bitcoin Strategy

LayerZero Is Bug Hunting

No ETH Futures In The Near Future

Ripple Expands East

These Coins Are Ready To Rally

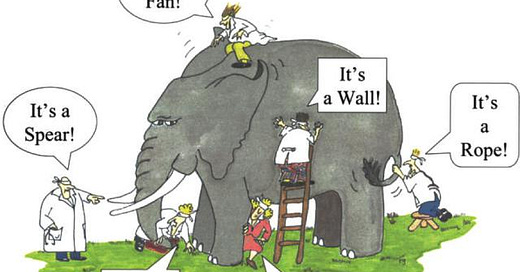

Six Blind Men And Bitcoin

Once upon a time, in the vibrant lands of India, a group of six blind men decided to finally understand what an elephant was. Having heard tales of this enormous creature, but never having encountered one, they set out to explore this mystery with their hands.

The Leg Man

The first blind man approached the elephant with caution. His hands met the firm, round column of the elephant's leg. Running his fingers over the rough texture, he confidently declared, "An elephant is like a pillar, sturdy and unyielding!"

The Tail Man

The second blind man found his way to the elephant's tail. Grasping the thin, rope-like appendage with a tuft at the end, he announced, "No, no! An elephant is like a rope, slender and flexible."

The Trunk Man

The third blind man, with outstretched hands, felt the elephant's trunk. He explored its length, the tapering shape, the way it moved and curled. He proclaimed, "You're both wrong. An elephant is like a snake, strong and undulating."

The Ear Man

The fourth blind man happened upon the elephant's ear. He felt the large, flat expanse flapping gently. With a knowing nod, he said, "I disagree with you all. An elephant is like a hand fan, broad and fluttering."

The Belly Man

The fifth blind man's hands landed on the elephant's broad side. Feeling the vast, solid wall of the elephant's belly, he contested, "You all are mistaken. An elephant is like a wall, expansive and smooth."

The Tusk Man

Finally, the sixth blind man got hold of the hard, sharp tusk. Exploring the smooth, pointed object, he rebutted, "You couldn't be more wrong. An elephant is like a spear, smooth and pointed at one end."

Each man, in his blindness, was sure of his truth. Yet each truth was merely a part of the whole, a fragment of the reality that was the elephant. The blind men argued amongst themselves, each believing they held the absolute truth, and yet, they were all correct, and also all wrong.

The parable of the blind men and the elephant is a powerful lesson on perspective. It teaches us that our individual experiences and perceptions are subjective and limited. To fully understand the truth—be it an elephant, Bitcoin, or any complex concept—we need to consider and respect multiple perspectives, understanding that each is a piece of the larger, more intricate puzzle.

Now, if we were to translate this famous parable to the context of Bitcoin, we could imagine six men encountering a different aspect of Bitcoin.

Six Blind Men and Bitcoin

Once upon a time, in the digital realm of the internet, six men set out to discover the nature of a strange new phenomenon known as Bitcoin. Each man, representing a different domain of human experience, touched upon a different aspect of Bitcoin. Like the ancient parable of six blind men encountering an elephant for the first time, each had a unique, yet incomplete understanding of what Bitcoin truly was.

The Infrastructure Man

The first man was an expert in information systems. He reached out and touched the backbone of Bitcoin, the blockchain. To him, the blockchain was a revolutionary way of storing and validating data across a distributed network. As he examined the intricate cryptographic links binding each block, he exclaimed, "Bitcoin is nothing more than a sophisticated database! It uses blockchain technology to create an immutable ledger of transactions. That's all there is to it."

The Finance Man

The second man was a financier, well-versed in the world of stocks, bonds, and currencies. When he encountered Bitcoin, he saw it as a volatile asset with the potential for significant returns. As he observed the wild fluctuations in Bitcoin's price, he declared, "Bitcoin is digital gold! It's a store of value, an investment to be traded."

The Politics Man

The third man was a political activist. He saw Bitcoin as a tool for decentralization and resistance against established financial institutions. As he examined Bitcoin's potential to operate outside of central banks' control, he passionately announced, "Bitcoin is a tool for political revolution! It's a way to resist control and preserve freedom."

The Culture Man

The fourth man was a sociologist, keenly interested in cultural trends and movements. He encountered the vibrant culture of Bitcoin enthusiasts, complete with its own language and belief system. Looking at the fervor and dedication of the Bitcoin community, he concluded, "Bitcoin is a cultural movement! It's a new way of thinking and living."

The Economics Man

The fifth man was an economist. He saw Bitcoin's potential to change global economic structures, with its finite supply and resistance to inflation. Observing the potential for Bitcoin to act as a hedge against economic instability, he declared, "Bitcoin is a new economic paradigm! It's a potential antidote to reckless fiscal policies."

The Technology Man

Finally, the sixth man was a technologist. He saw Bitcoin as a technological innovation with its unique proof-of-work consensus mechanism and its potential for creating trustless systems. As he marveled at the cryptographic principles underpinning Bitcoin, he proclaimed, "Bitcoin is a technological breakthrough! It's a pioneering system that could redefine trust and security in the digital age."

As in the original parable, each man's understanding was both correct and incomplete. They each touched upon a different facet of Bitcoin, yet none could see the entire picture. Bitcoin, like the elephant, is a complex entity that cannot be reduced to any one perspective. It is a technology, a currency, a cultural movement, a political tool, an economic paradigm, and a financial asset, all at once.

In our endeavor to understand Bitcoin, and indeed, all complex phenomena, we must remember the lesson of the six blind men. We must strive to look beyond our own narrow perspectives and appreciate the multitude of ways in which others may interact with and understand the world. Only then can we hope to grasp the full complexity of things as multifaceted as Bitcoin.

Bitcoin Thoughts And Analysis

Nothing to see here, Bitcoin remains sideways!

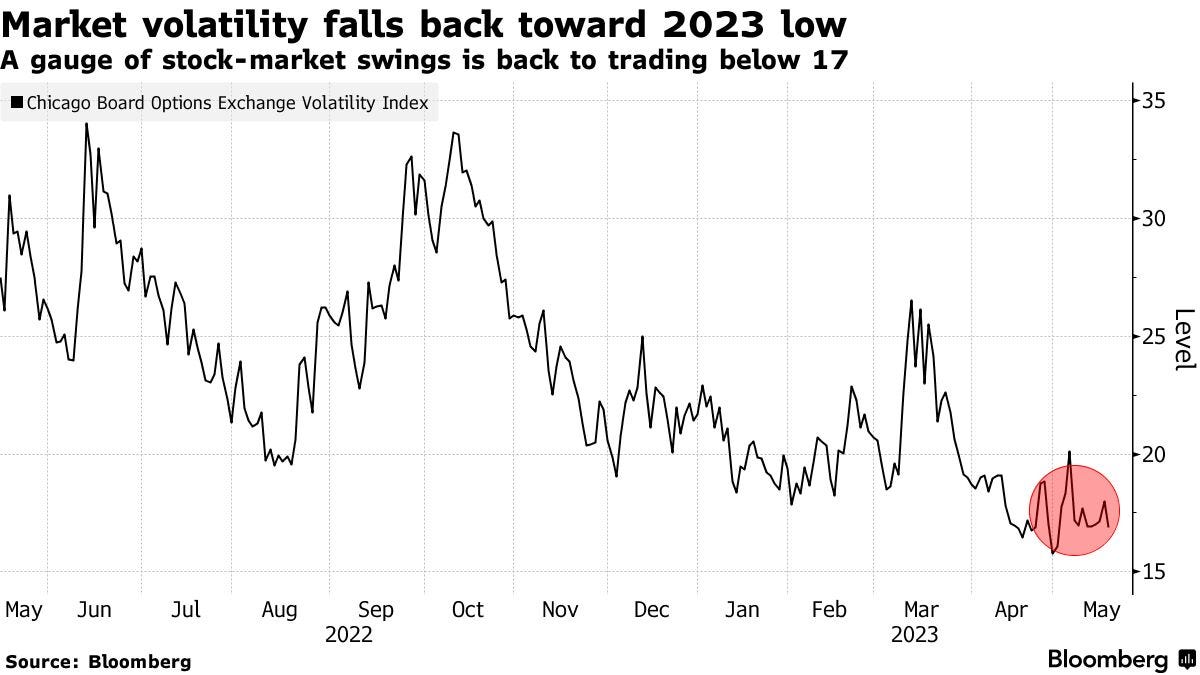

Legacy Markets

Markets rebounded after concerns of a potential U.S. default, fueling optimism that the economy might avoid a downturn. European stocks rose, led by autos, technology, and banking sectors, while the UK's BT Group Plc saw a significant drop after announcing workforce reduction plans. Encouraging news from U.S. regional banks also boosted sentiment. The risk of recession may decrease if banking crisis and debt ceiling issues diminish, according to Roger Lee of Investec Bank Plc. The dollar index rose for a third day, and President Biden expressed confidence in avoiding a U.S. default. Investors are now focusing on upcoming U.S. jobless claims data and Walmart's earnings report for insights into the Federal Reserve's policy and the state of the economy.

Key events this week:

US initial jobless claims, Conference Board leading index, existing home sales, Thursday

Japan CPI, Friday

ECB President Christine Lagarde participates in panel at Brazil central bank conference, Friday

New York Fed’s John Williams speaks at monetary policy research conference in Washington; Fed Chair Jerome Powell and former chair Ben Bernanke to take part in panel discussion, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.5% as of 10:07 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures rose 0.1%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.7%

The MSCI Emerging Markets Index rose 0.4%

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.2% to $1.0816

The Japanese yen was little changed at 137.78 per dollar

The offshore yuan fell 0.6% to 7.0487 per dollar

The British pound fell 0.4% to $1.2439

Cryptocurrencies

Bitcoin rose 0.2% to $27,391.86

Ether was little changed at $1,827.75

Bonds

The yield on 10-year Treasuries advanced two basis points to 3.58%

Germany’s 10-year yield advanced six basis points to 2.39%

Britain’s 10-year yield advanced four basis points to 3.87%

Commodities

Brent crude fell 0.5% to $76.55 a barrel

Spot gold fell 0.3% to $1,976.64 an ounce

Yes, The US Has Defaulted In The Past

People keep saying that the United States has never defaulted. Those people are wrong. I wrote about it. Click the link above.

An Alternative View On Ledger

In an effort to shed more light on the Ledger decision, I am presenting Haseeb’s unconventional perspective. This compels me to question if the so-called 'majority' viewpoint is simply the voice of the most vocal individuals within our sphere, yet regardless, Haseeb's stance is compelling. At the heart of Haseeb's contention is the belief that Ledger is fundamentally carrying out its standard practices.

“Every Ledger app (for any blockchain you run) can in principle extract the private key on your device. Of course it can! Because Ledger Apps often have to derive a key for another blockchain, which originates from the master secret on the device. There is no way around this.” My initial hypothesis is that investors who are receptive to cryptocurrencies beyond Bitcoin exhibit a greater comprehension of the Ledger decision.

Tether Leans Into Bitcoin Strategy

Following an abundance of accolades in Tether’s Q1 2023 attestation report, the company has elected to intensify its recent Bitcoin strategy and bolster its resources. “Starting this month, Tether will regularly allocate up to 15% of its net realized operating profits towards purchasing Bitcoin (BTC).”

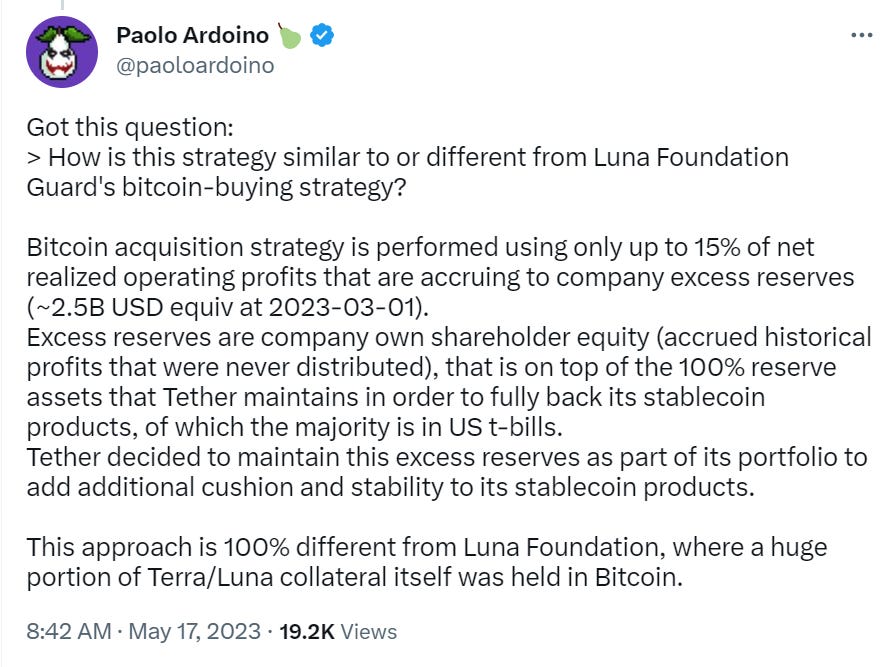

There seems to be some misunderstanding about this decision and its implications for Tether's reserves, so consider this statement for clarification: “Tether’s purchase of BTC is part of its conservative and prudent approach to investment decisions aimed at strengthening, increasing, and diversifying its reserves.”

Tether is not acquiring Bitcoin using your dollars, nor does Tether anticipate Bitcoin substituting its 1:1 reserves. The Bitcoin that Tether buys will be part of surplus reserves, procured solely from, “newly monthly net operating profits (i.e., accounting for the realized dollarized profits coming from t-bill and similar investments).”

It piques my curiosity whether Tether's choice to persist and augment their Bitcoin acquisitions was a direct consequence of the favorable publicity or had been premeditated. Regardless, it is indeed remarkable. An additional point of interest, given the relevance of the storage topic, is Tether's stance articulated as follows, “Tether believes in the philosophy ‘Not your keys, not your bitcoin’ and takes possession of the private keys associated with all of its Bitcoin holdings.”

For more insights, the image below provides additional context to the comparison between Tether and Luna.

LayerZero Is Bug Hunting

In light of the recent significant Ethereum finalization bug, the launch of LayerZero's new bug bounty program couldn't be more timely. LayerZero has joined forces with Immunefi to provide substantial rewards for ethical hackers who identify protocol bugs. Depending on the seriousness of the bug uncovered, rewards can range from $250,000 to 10% of the at-risk asset value for ETH, BNB, AVA, OP, MATIC, and FTM.

Minor chains are also included in the program with corresponding smaller rewards. To promote secure practices, all bounty hunters interested in the program are required to comply with stringent Know Your Customer (KYC) standards, which is likely a prudent measure. Since its establishment, Immunefi has received 1,248 reports, with a total of $65,918,994 awarded in crypto bounties as of December 2022 - evidence that bug bounties are a serious business.

No ETH Futures In The Near Future

A recent Grayscale filing discloses that the asset manager has modified its intentions to launch an ETH futures ETF, prompting analogous decisions from Bitwise, Direxion, Roundhill Investments, and Valkyrie. It's challenging to determine if the decision was due to regulatory apprehensions, a mutual stand-down given Grayscale's decision not to proceed with the product, or a combination of both. Regardless, I don't anticipate this having a significant impact on Ethereum. The Bitcoin Futures ETF didn't move the needle, so it's unlikely that an Ethereum futures ETF would have much effect either. With the SEC currently embarked on a crusade against securities, I'm skeptical there's any pressing need to approve a futures ETF with ETH as the sole asset.

Ripple Expands East

Given the less than favorable treatment Ripple has received from the United States, the company has declared its acquisition of Metaco, a Swiss-based crypto custody provider, to broaden its geographic reach. As stated in the press release, “With this acquisition, Ripple will expand its enterprise offerings providing customers the technology to custody, issue, and settle any type of tokenized asset.” My preliminary interpretation was that this might suggest Ripple's confidence in winning their case, though it's uncertain since this will influence their overseas operations - further updates will follow.

These Coins Are Ready To Rally

Scott Melker & Chris Inks are joined by Big Cheds and Crypto Birb.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.