The Wolf Den #735 - Will Crypto Loans Ever Make A Comeback?

It didn’t go too well the first time…

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Sign up for my other newsletter, THE DAILY CLOSE!

I built The Daily Close to give you the same institutional-grade indicators and signals that I use to trade the market on a daily basis. It's automatically generated and delivered to your inbox at the daily close everyday.

1 Week FREE for all subscribers

17% discount if you subscribe for a year

$25 a month, or $250 a year

In This Issue:

Will Crypto Loans Ever Make A Comeback?

Bitcoin Thoughts And Analysis

Legacy Markets

Only Half Of Top 60 Crypto Firms Have Auditors

The Wait To Stake

The SEC Changed Its Mind?

World coin May Be Here Soon

Will Crypto Loans Ever Make A Comeback?

One year ago, the crypto loan industry was thriving. Investors hesitant to liquidate their assets flocked to decentralized finance ('DeFi') platforms offering lucrative loan options. They also flocked to CeFi - BlockFi, Celsius, Voyager, and Nexo saw a surge in user engagement as investors scrambled to secure loans against their burgeoning portfolios.

We are all familiar with the aftermath.

Today's discussion, however, is not a lament over past failures, but a contemplation on whether our industry can recover from this setback. Regardless of your stance on crypto loans – a contentious topic, admittedly – it's difficult to dismiss the notion that we were heading in the right direction.

I candidly acknowledge that we, as an industry, faltered. Yet, I can't help but wonder if we were merely ahead of our time, suffering from a lack of regulation and preparation? Astute investors realize that they should anticipate a 20% to 40% tax rate in the United States upon the sale of any asset, including cryptocurrency. This tax burden underscores the persistent demand for legal tax mitigation strategies, hence, the continual relevance of loan services.

"But what about Coinbase?" you may ask, "didn't they terminate their loan program just six days ago? And aren't banks that used to service our industry closing their doors? Aren't these signs that the industry is pivoting?" My resolute answer is, 'No.'

Allow me to elaborate.

If the crypto industry is set to achieve the milestones we project – BTC surpassing $100,000, ETH hitting over $10,000, a bull run in NFTs, mass adoption of stablecoins, and so forth – there will undoubtedly be a significant and pressing demand for a resurgence of safe loan services. Prominent investors like Warren Buffet, Elon Musk, Larry Ellison, not to mention millions of everyday millionaires worldwide, utilize loans extensively. They're a cornerstone of finance, and cryptocurrency is not exempt from this rule.

Crypto loans persist even now, albeit sidelined in favor of more captivating trends. Nevertheless, I foresee a natural resurgence in loan services as asset prices soar and investors seek increased liquidity. While there will always be a segment of investors who swear off crypto loans, it's essential to remember that fresh investors will enter the market, and the phenomenon of short-term memory loss in investing is very real. I'm confident that crypto loans will reclaim their prominence, this time hopefully fortified by robust safety measures.

To clarify, I am not endorsing any specific platform, nor am I advising you to secure a loan immediately, or at all. I never even considered taking one myself. Loans carry inherent risks, and it's crucial to consult a financial advisor before making such decisions. We still have a long road ahead to ensure we get it right the next time. But if we're going to surpass previous record highs, the popularity of loans will inevitably make a comeback – that's my thesis.

Bitcoin Thoughts And Analysis

Rather than offer you my own charts today, here is a monster thread from Crypto Birb about the current state of Bitcoin

Legacy Markets

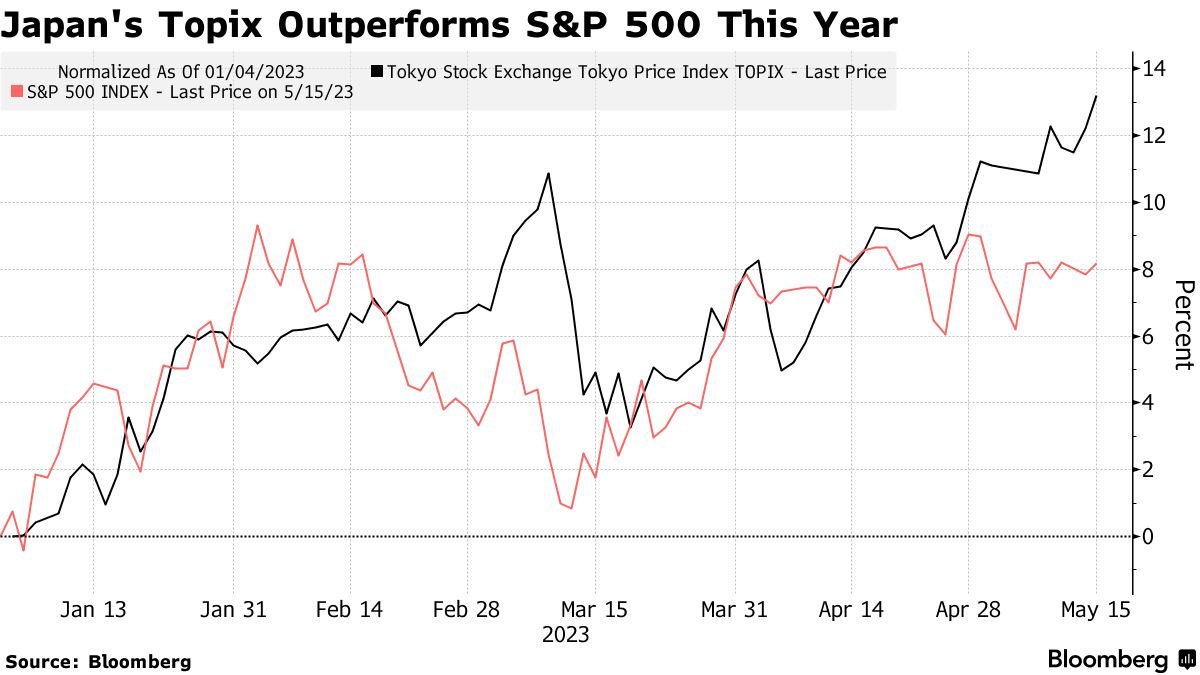

Global markets exhibited mixed trends on Tuesday as investors await US debt-ceiling discussions, with US stock futures holding steady and Japan’s Topix reaching its highest point since 1990. The standoff over the federal debt limit has put many investors on the sidelines, waiting for a resolution in Washington. In Europe, shares of Vodafone Group Plc and Telecom Italia SpA took a hit due to weak earnings and reports of Italy’s state lender dropping its offer for Telecom Italia’s landline network, respectively. The Stoxx Europe 600 index, however, remained largely unchanged. According to Joachim Klement from Liberum Capital, investors are looking for political clarity ahead of the upcoming earnings season, now that there's sufficient clarity on central bank policy.

Despite the ongoing debate over the debt ceiling, most investors anticipate a last-minute deal to avoid a default. Meanwhile, other market trends show declining appetite for risk-taking due to factors such as the slowing US economy, persistent inflation, and fears of a credit crunch following a series of regional bank failures. In contrast, Japan’s Topix equities benchmark has seen a surge due to corporate efforts to increase buybacks and focus on returns. However, Chinese stocks took a dip following disappointing industrial output, retail sales, and fixed investment data in April. Crude prices made modest gains after the International Energy Agency projected stronger than expected oil demand this year.

Key events this week:

Eurozone GDP, Tuesday

US retail sales, industrial production, business inventories, Tuesday

Fed speakers include Cleveland’s Loretta Mester, New York’s John Williams, Atlanta’s Raphael Bostic and Chicago’s Austan Goolsbee, Tuesday

Eurozone CPI, Wednesday

BOE Governor Andrew Bailey delivers keynote speech, Wednesday

US housing starts, Wednesday

US initial jobless claims, Conference Board leading index, existing home sales, Thursday

Japan CPI, Friday

ECB President Christine Lagarde participates in panel at Brazil central bank conference, Friday

New York Fed’s John Williams speaks at monetary policy research conference in Washington; Fed Chair Jerome Powell and former chair Ben Bernanke to take part in panel discussion, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 was little changed as of 9:33 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.4%

The MSCI Emerging Markets Index rose 0.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.2% to $1.0894

The Japanese yen rose 0.2% to 135.79 per dollar

The offshore yuan fell 0.2% to 6.9745 per dollar

The British pound was little changed at $1.2524

Cryptocurrencies

Bitcoin fell 0.5% to $27,225.77

Ether fell 0.2% to $1,822.13

Bonds

The yield on 10-year Treasuries declined three basis points to 3.47%

Germany’s 10-year yield declined three basis points to 2.28%

Britain’s 10-year yield declined six basis points to 3.76%

Commodities

Brent crude rose 0.6% to $75.69 a barrel

Spot gold fell 0.3% to $2,009.95 an ounce

Only Half Of Top 60 Crypto Firms Have Auditors

A recent Bloomberg survey reveals a startling statistic: “only 31 out of the top 60 companies in crypto have undergone a full financial audit.” If this alarms you as much as it does me, I urge you to read on. To qualify as a top company in the survey, the entity had to satisfy one or more of the following criteria: be publicly listed, raise over $1 billion in private funding, or be deemed as having significant influence as of January 2023. Bloomberg wasn't scrutinizing fringe crypto projects; they focused on the cream of the crop. It seems we haven't gleaned enough lessons from the FTX saga.

You might assume this demonstrates imprudence on our part. However, according to the surveyed companies, the main hurdle is the reluctance of major audit firms to get involved. Here are some more figures: out of the 60 firms, 17 chose not to participate in the survey and eight did not respond at all. My hunch is these companies lacked an auditor to disclose. On a brighter note, half of the companies that did share their audit information are currently being audited by one of the 'Big Four' accounting firms.

The Wait To Stake

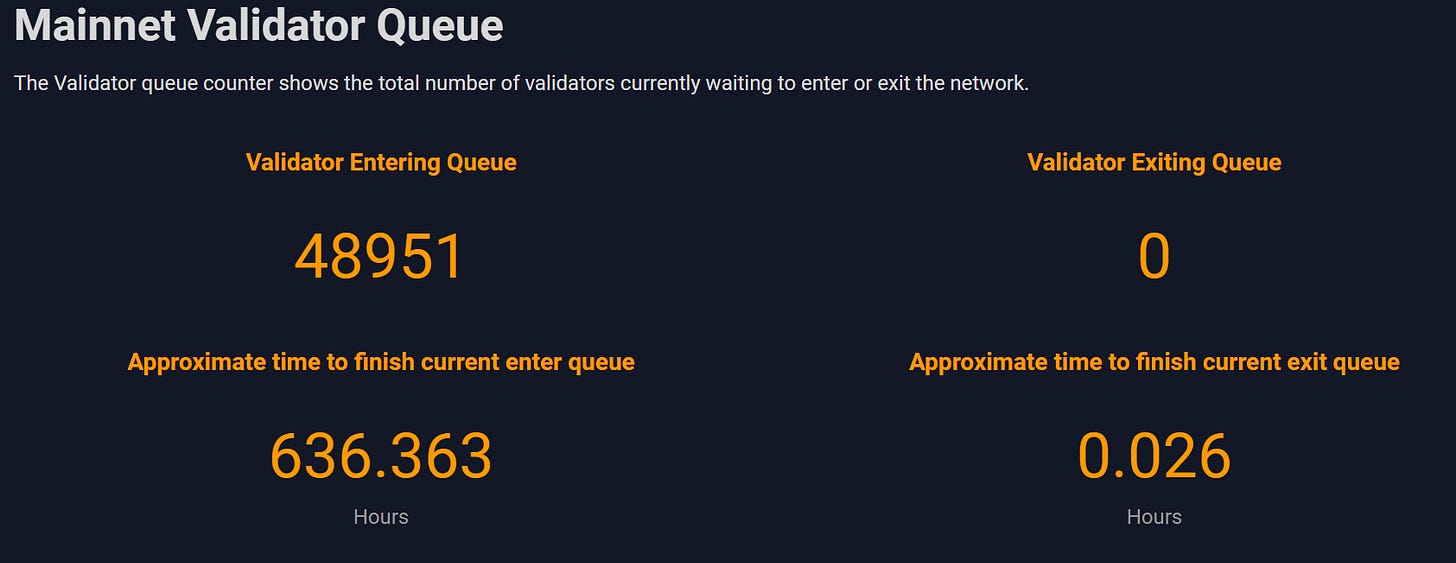

Just a few days short of a month since ETH withdrawals were enabled, the eagerness to stake has noticeably increased. With soaring demand, ETH owners intending to stake their tokens currently face an approximate wait time of 26 days to become network validators. On the contrary, the estimated time for exiting is a mere 0.026 hours. As reported by the Wen Merge? website, there are presently 49,135 validators lined up to join the network, while none are exiting. Investors should not be deterred by the prevailing prices. The persistent demand for staking underscores a robust long-term bullish trend.

The SEC Changed Its Mind?

In early 2021, the SEC filed a lawsuit against LBRY, culminating in a hefty $22 million penalty after the SEC won the case. However, in an unexpected twist, the SEC significantly reduced the fine for the crypto project by an astonishing 99.5%, whittling it down to $111,000. You might question why the SEC would exhibit such leniency. The reason is simple: LBRY would not have been able to pay the original sum, even in the most favorable circumstances. The SEC's victory and subsequent demand for payment was sufficient to severely undermine LBRY's viability. Now, the SEC is attempting to salvage whatever it can. Gary, you've claimed your victory.

Worldcoin May Be Here Soon

Do you recall the bold crypto project that proposed scanning individuals' eyes in exchange for cryptocurrency? It could soon become a reality. Reports indicate that Worldcoin is engaged in "advanced talks" with a group of investors poised to inject $100 million into the venture. This story offers much to explore, so I will keep this summary concise and reserve the topic for a more in-depth discussion. With developments in AI and now potentially biometrics, 2023 is shaping up to be a fascinating year

Will The USA Default On Its Debt? Macro Monday With Mike McGlone & Dave Weisberger

Will the USA increase the debt ceiling? What will happen if it won't? I along with my co-hosts will try to find an answer!

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.