The Wolf Den #733 - Tether Absolutely Crushing Haters

Money talks - and they're making a ton of it.

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Sign up for my other newsletter, THE DAILY CLOSE!

I built The Daily Close to give you the same institutional-grade indicators and signals that I use to trade the market on a daily basis. It's automatically generated and delivered to your inbox at the daily close everyday.

1 Week FREE for all subscribers

17% discount if you subscribe for a year

$25 a month, or $250 a year

In This Issue:

Tether Absolutely Crushing Haters

Bitcoin Thoughts And Analysis

Legacy Markets

Uniswap Continues To Outpace Coinbase

Justin Sun Got What He Wished For

#Deletecoinbase Is Trending

Coinbase Found A Powerful Ally

Did The Ethereum Chain Go Down?

US Regulators Are Trying To Kill Crypto | Will We Survive?

Tether Absolutely Crushing Haters

While the cryptocurrency community has been engrossed in bank failures, trending meme tokens, and Layer 1 network congestion, an ongoing battle has been simmering in the background. Among the plethora of stablecoins available, Tether and USDC are the undisputed frontrunners, each quietly competing for supremacy in the crypto marketplace.

We've previously delved into both of these organizations and their associated coins, but today, our spotlight falls on Tether, particularly its Q1 2023 assurance report. Tether, much like other veteran crypto firms, has weathered a fair share of scrutiny and controversy. Now, it appears to be charting a fresh course.

Tether's report declares an "excess of reserves reaching an all-time high of $2.44B, an increase of $1.48B for the first quarter of 2023." This news underscores Tether's commitment to exceeding a 1:1 reserve ratio.

They absolutely slayed, girl.

However, for most crypto enthusiasts, the excitement lies elsewhere – Tether is buying Bitcoin.

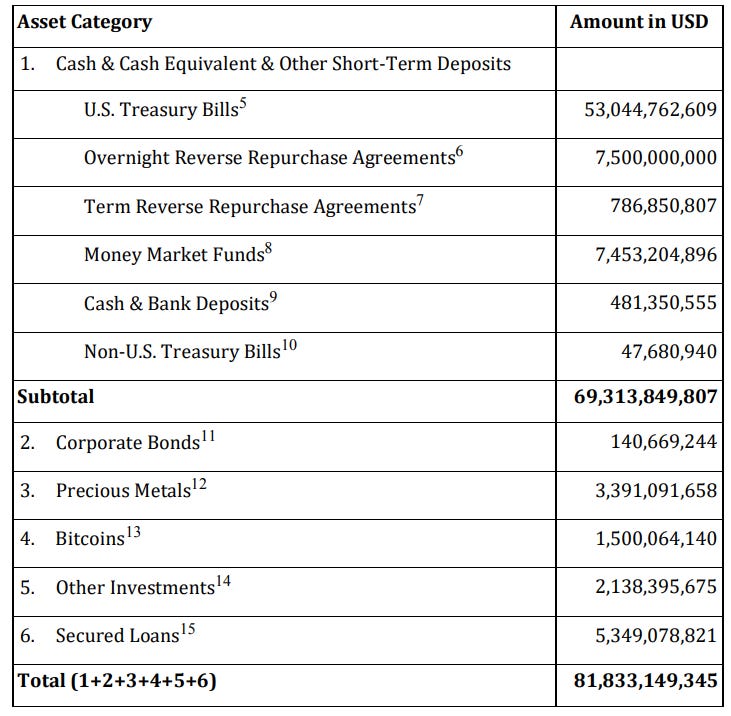

As of the March 31ˢᵗ report, Tether holds $1,500,064,140 worth of Bitcoin, accounting for 2% of its total reserves. From my perspective, this is a symbolic milestone, indicative of not just Tether's shift away from riskier reserves such as commercial paper, but also a testament to crypto's maturing role in the financial arena. Tether seems to be successfully carving a path that others have faltered on.

Tether has also decided to de-risk by investing in the repo market, precious metals, and corporate bonds. The image below offers a glimpse into Tether's current asset composition.

Interestingly, the credit for Tether's recent strides can be largely attributed to the Federal Reserve. Tether's soaring profits are predominantly a consequence of high yields in the bond market, courtesy of the Fed's monetary policy. The yield curve rates may not have been a hot topic lately, but they remain as lucrative as ever, as demonstrated below.

The question arises: has Tether exposed itself to fresh risks? The response is complex. My speculative take is 'probably not.' While a bond market correction is inevitable, the likelihood of a U.S. default impacting Tether significantly is dubious. The U.S. has a strong incentive to avoid a default, and Treasury obligations would likely take precedence in a default scenario.

Experts in history and economics are better equipped to tackle these subjects, so I'll leave the analysis there. However, I'm intrigued by what Tether's next move might be. One plausible scenario is a continued Bitcoin buying spree, setting an industry benchmark. Another intriguing prospect is a major crypto entity like Tether or Circle acquiring a significant bank. Adding to this intrigue is the fact that Tether manages these operations with a lean team of just 60 employees.

The takeaway here is clear: while some crypto firms may be retreating from the U.S., the most resilient ones, like Tether, are innovating and thriving. The current regulatory landscape is challenging, but not eternal, and firms are evolving to enhance their reputation and risk management under these stringent conditions. The future appears promising for crypto, and hopefully for Tether as well. Wishing you all a splendid weekend. Peace.

Bitcoin Thoughts And Analysis

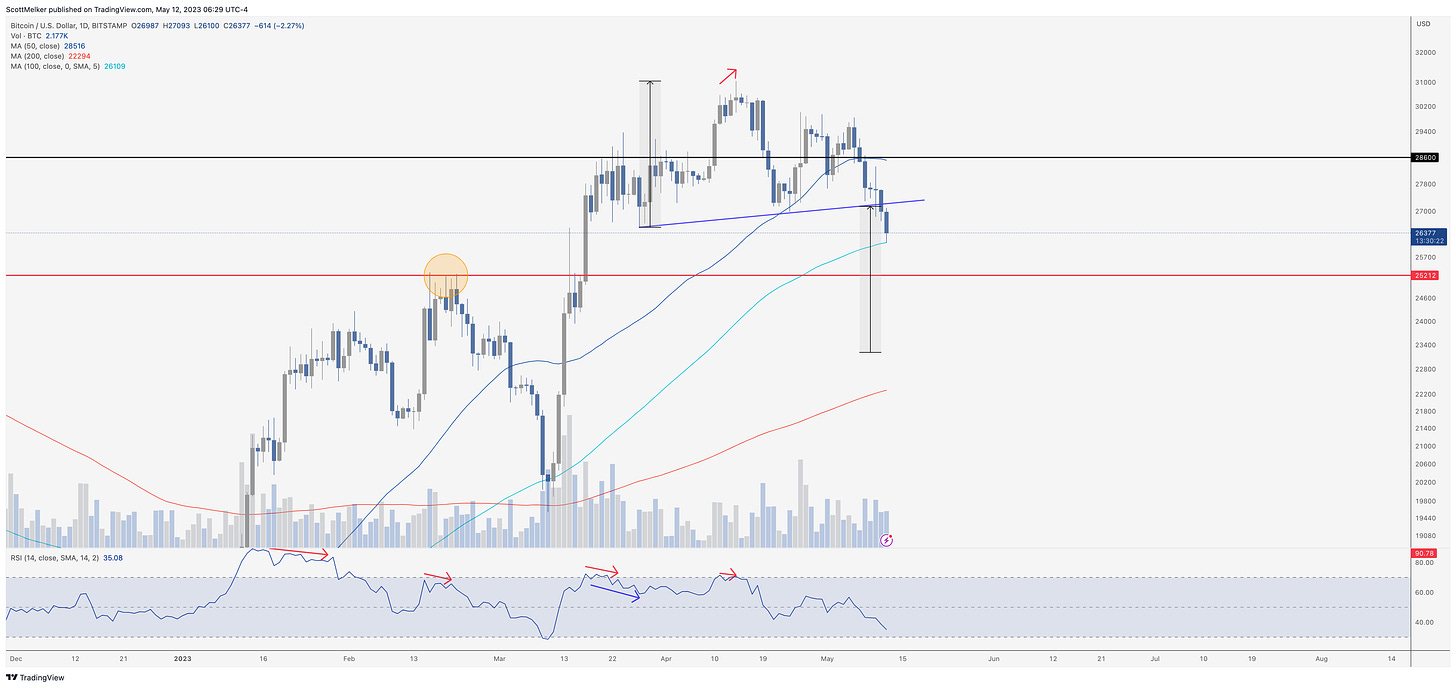

Bitcoin has been consistently declining after facing multiple rejections above the $30,000 threshold. As previously discussed, the price point of $25,212 is anticipated for a retest as a support level. This specific level has been crucial in indicating a shift from the persistent bearish market following the all-time high. Surpassing the $25,212 mark signaled the first higher high in this sequence, which makes it logical to anticipate a retest of this level for support.

Generally, when a level receives substantial interest, two outcomes are likely: either the price rebounds above it in what's known as front running, or the price plummets through it, typically with a long wick to unsettle traders, before eventually rising above it.

Although shorter time frames indicate oversold conditions, the daily chart has not yet reached this state. As you may recall, the recent market peak coincided with an overbought bearish divergence, a common occurrence. As a result, the relative strength index (RSI) is bound to return to the oversold region, and it is nearing that area now.

The head and shoulders pattern that I've mentioned before has been validated with the break of the blue ascending neckline. This pattern's estimated target is around $23,000, but it's noteworthy that these patterns seldom reach their targets exactly. Should the price hit $23,000, the nearing 200-day moving average (MA) could serve as a support level.

At present, the price decline found support precisely at the 100-day MA.

From a statistical perspective, the current expectation would be for the price to rise and test the head and shoulders pattern before ultimately descending towards the aforementioned support level. However, it's crucial to acknowledge that market dynamics rarely unfold as predicted.

Regardless of the short-term forecast, there's no cause for alarm when looking at longer time frames. From that viewpoint, this correction seems to be a healthy pullback following a substantial 2x upward movement from the bottom.

Legacy Markets

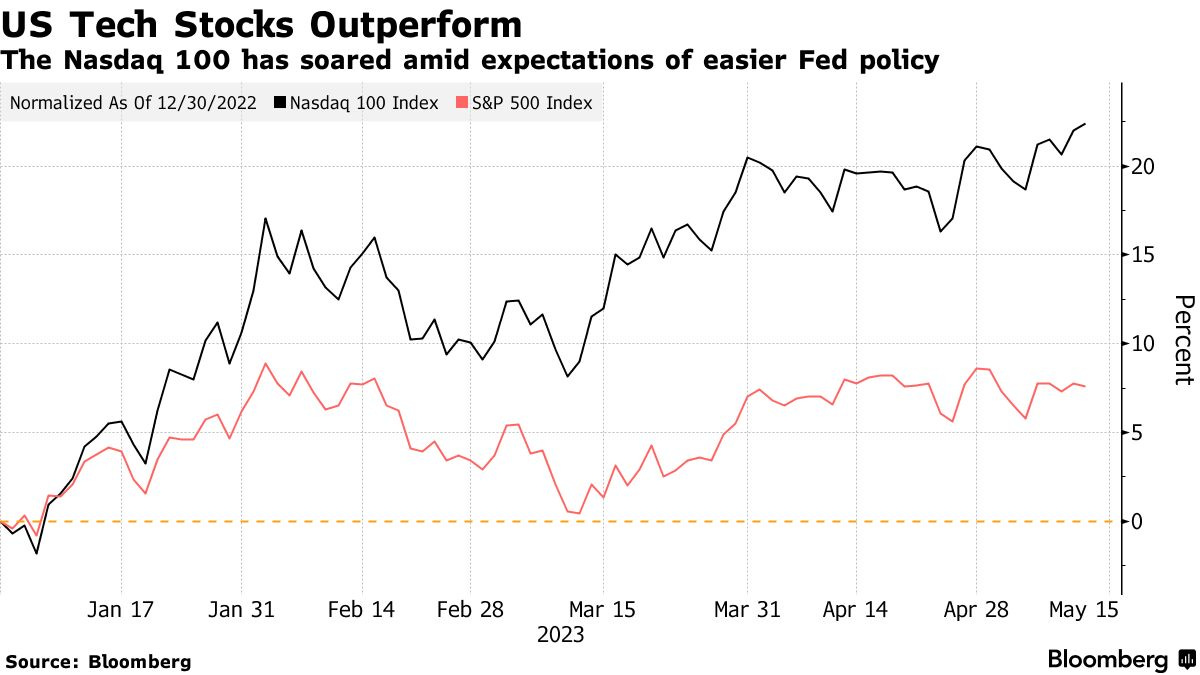

Stocks rose as investors gained confidence from strong earnings reported by Richemont, the maker of Cartier, and positive signs of progress in US lawmakers' discussions to raise the debt ceiling. Richemont's shares surged 7.8% to a record high, leading to a broader rally in European luxury stocks. S&P 500 futures also traded higher following the postponement of a meeting on the debt ceiling between President Joe Biden and House Speaker Kevin McCarthy. The delay indicates progress in staff-level talks. Despite mixed US economic data and concerns about the debt ceiling, tech stocks, represented by the Nasdaq 100 Index, have performed well this week, though skepticism about the industry remains.

Key events this week:

US University of Michigan consumer sentiment, Friday

Fed Governor Philip Jefferson and St. Louis Fed President James Bullard participate in panel discussion on monetary policy at Stanford University, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.7% as of 10:08 a.m. London time

S&P 500 futures rose 0.5%

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.5%

The MSCI Asia Pacific Index fell 0.2%

The MSCI Emerging Markets Index fell 0.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0914

The Japanese yen fell 0.2% to 134.74 per dollar

The offshore yuan was little changed at 6.9575 per dollar

The British pound rose 0.2% to $1.2530

Cryptocurrencies

Bitcoin fell 2.5% to $26,321.24

Ether fell 1.8% to $1,764.61

Bonds

The yield on 10-year Treasuries advanced three basis points to 3.41%

Germany’s 10-year yield advanced two basis points to 2.24%

Britain’s 10-year yield advanced two basis points to 3.73%

Commodities

Brent crude fell 0.5% to $74.59 a barrel

Spot gold fell 0.5% to $2,005.68 an ounce

Uniswap Continues To Outpace Coinbase

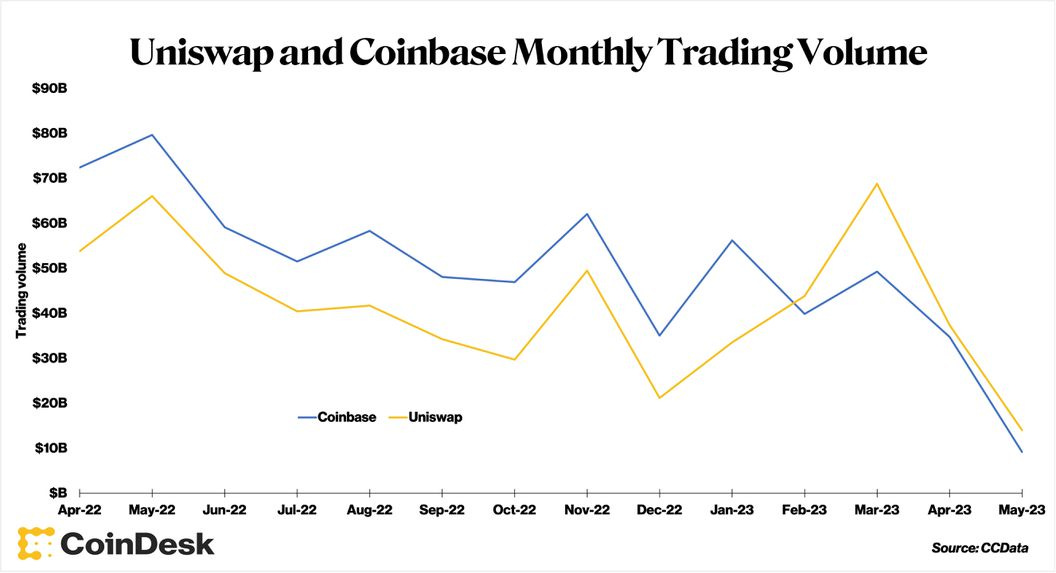

Uniswap has now significantly outperformed Coinbase in terms of trading volume for the fourth consecutive month. Several factors are contributing to this trend, notably USDC's depegging, the surge in meme coins, and the increased regulatory scrutiny of centralized exchanges (CEXs), all of which are propelling users towards decentralized exchange (DEX) trading. To provide some context, “Uniswap handled some $37 billion trading in April, compared to March when it handled over $70 billion. Coinbase saw $34 billion worth of trading volume on its exchange in April, versus $49 billion in March.” While it's uncertain whether this trend will persist, it appears that CEXs tend to fare better during periods of market instability.

Justin Sun Got What He Wished For

In an intriguing turn of events, Justin Sun is now trading meme coins to raise funds for charitable causes – a fascinating sign of our times. While Justin's intentions may be commendable, it's akin to adding fuel to an already fiery situation. Scammers, opportunists, and meme enthusiasts have wasted no time in sending low-quality coins to his wallet. Some are even impersonating him to deceive others. Please exercise extreme caution. Justin Sun can afford to take financial hits, many times over, but the same may not apply to the rest of us. Avoid becoming reckless in your investment decisions.

#Deletecoinbase Is Trending

Coinbase sent out an email that pissed off the Pepe community and now there is Twitter beef between the two. The community is upset that Coinbase said the following: “The token is based on the Pepe the Frog meme, which first surfaced on the internet nearly 20 years ago as a comic-strip character. Over time it has been co-opted as a hate symbol by alt-right groups, according to the Anti-Defamation League.” I don't care what you believe, just don't lose money on a meme coin. Coinbase went on to apologize for their mischaracterization.

Coinbase Found A Powerful Ally

The anticipation is escalating as the U.S. Court of Appeals has allowed cryptocurrency firms to enter the legal fray against the SEC. Intriguingly, among the briefs being filed, Coinbase has found an unexpected ally in the U.S. Chamber of Commerce. Indeed, you read that right – not the Chamber of Digital Commerce, which concentrates specifically on crypto-related matters, but the largest lobbying group in the United States.

This is what the U.S. Chamber of Commerce said in their brief: “nobody knows for certain which digital assets, if any, are ‘securities’ under federal law. That is no small question. It has immense implications for every person involved in the $1 trillion digital-asset economy, and it is the threshold regulatory question from which all others flow.” It’s not over until the fat lady sings, but this is promising for Coinbase and for broader regulatory clarity.

Did The Ethereum Chain Go Down?

On May 11, an unidentified problem on Ethereum's Beacon Chain caused a disruption in transaction finality for around 30 minutes. Although new blocks could be proposed, an unknown issue prevented them from being finalized. This issue was somewhat similar to a previous incident on March 15, where low validator participation rates led to a delay on the Ethereum Goerli testnet.

The Beacon Chain is Ethereum’s original proof-of-stake blockchain, which officially merged with the original proof-of-work Ethereum chain on Sept. 15, 2022, marking the network's full transition to a more efficient and eco-friendly proof-of-stake consensus mechanism.

After 25 minutes of disruption, the mainnet started finalizing blocks again, as announced by Ethereum core developer Preston Van Loon. The root cause of the issue is still unknown, but it is under investigation to prevent future recurrence.

The temporary loss of finality was kept brief partly due to "client diversity," as noted by pseudonymous Ethereum consultant Superphiz. This concept refers to the variety of software clients available to network validators, which contributes to a more secure and robust network. Superphiz suggested that such incidents could be avoided if no single client had more than 33% control.

US Regulators Are Trying To Kill Crypto | Will We Survive?

Live panel with Joshua Frank (The Tie), Sidney Powell (Maple Finance), and Scott Dykstra (Space & Time).

Follow the guests:

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.