Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Sign up for my other newsletter, THE DAILY CLOSE!

I built The Daily Close to give you the same institutional-grade indicators and signals that I use to trade the market on a daily basis. It's automatically generated and delivered to your inbox at the daily close everyday.

1 Week FREE for all subscribers

17% discount if you subscribe for a year

$25 a month, or $250 a year

In This Issue:

I Smell Greed

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

The SEC Sucks

Gary Gensler Caught Red Handed

Only Bitcoin | Mike Germano, Bitcoin Miami Founder

I Smell Greed

Is it just me, or is there a subtle scent of greed starting to permeate the crypto market? Price charts aside, I'm detecting something sentiment-based. Have you noticed how people are suddenly convinced that "all news is good news" and "bears are entirely dead?" I don't want to be that person, but this behavior often precedes market tops, even if only temporary ones.

I'm not suggesting that the market has peaked or is on the verge of a massive correction, but the early signs of greed are present, and it's worth monitoring. In the crypto world, the saying, "markets can remain irrational longer than you can remain solvent," is especially relevant. A peak is inevitable, and we're certainly moving closer to it.

The fear and greed index agrees - we are well back in the green, but can push much further.

Let's talk about some indicators that have caught my attention. Do any of these statements sound familiar? Are you thinking similarly?

If the banks fail, it is good for Bitcoin.

If the banks find liquidity, it is good for Bitcoin.

If inflation goes down, it is good for Bitcoin.

If inflation rises, it is good for Bitcoin.

If the economy strengthens, it is good for Bitcoin.

If the economy weakens, it is good for Bitcoin

But it's not just Bitcoin enthusiasts at fault.

If more Ethereum is staked, it is good for Ethereum.

If less Ethereum is staked, it is good for Ethereum.

When did the entire crypto market become solely positively influenced by global events? A rising price trend doesn't mean we're now immune from downturns because we had a solid bounce from the bottom. The statements above have a logical appeal, but they primarily serve to bolster a bullish bias.

In a strong uptrend, it's easy to pick a narrative, add "is good for Bitcoin" at the end, and appear convincing. In any strong market, up or down, it's not hard to spin a narrative in one's favor - that's the game.

So here's my speculative theory: at some point, whales will decide it's time to take profits. This event may coincide with a negative news cycle, and the subsequent reaction could be excessive. The timing is uncertain, but the early signs of greed are visible.

There’s almost no way we shoot from 30K to a new all time high without serious pain in between.

When the correction comes, the "all news is good news" mentality will dissipate, and a new price floor will emerge as we regain level-headedness. At that point, any news deemed "not good enough" will be seen as bad, and bad news will seem worse. Fortunately, in a bull market, the positive sentiment will likely outweigh the negative, but there's no such thing as perpetual growth.

Remember the adage "sell in May and go away"? It refers to the notion that stocks underperform between May and October. With a major Bitcoin conference scheduled for May, it's worth considering that market events often align with such gatherings. I'm not a fortune teller, but it's food for thought.

So what has changed for me? I no longer think short-term max pain is upward. I do believe long-term max pain is upward, which is why I remain extremely bullish in the coming years. However, I wouldn't be surprised if we see a correction soon to temper the market. If crypto enthusiasts are the primary buyers and they expect uninterrupted growth, then new buyers are the last hope.

Unfortunately, I don't sense enough new interest; I think I smell greed instead.

Bitcoin Thoughts And Analysis

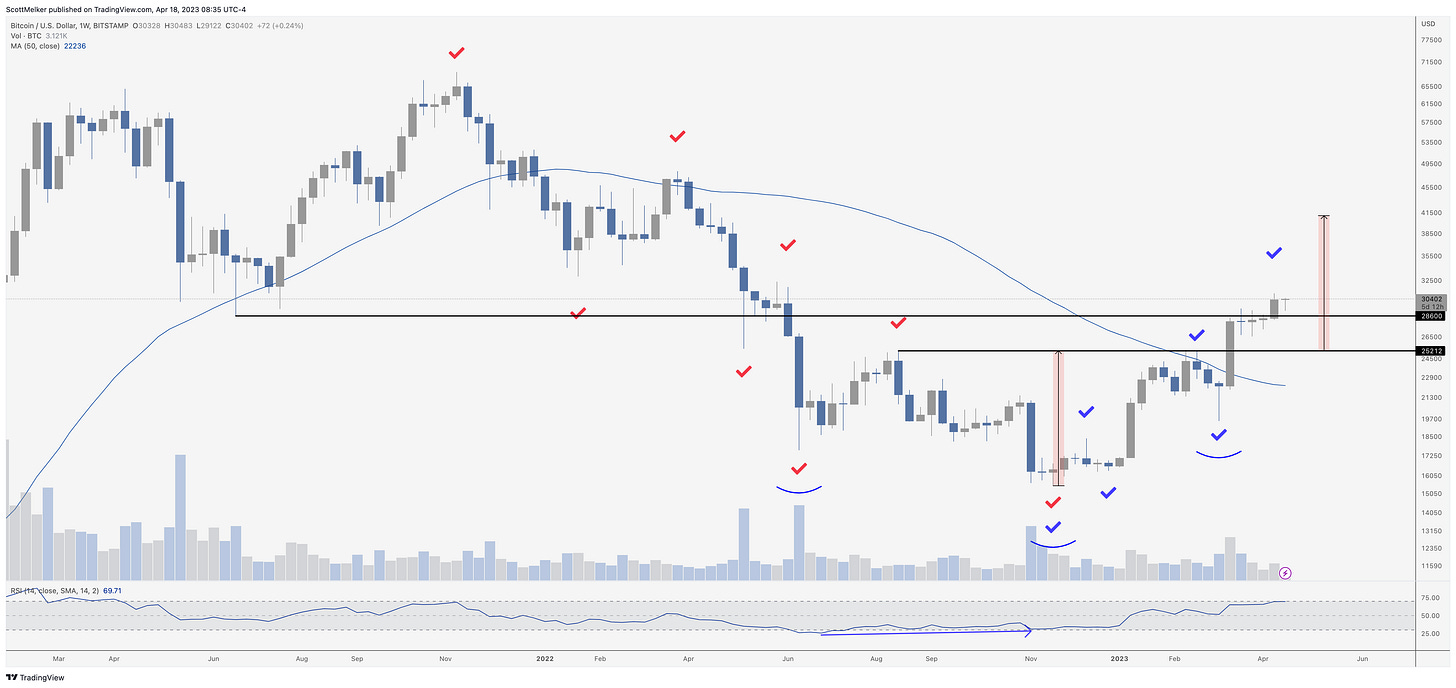

Another beautiful weekly candle. After a few weeks of consolidation around $28,000, price convincingly broke through $28,600 resistance and closed well above. Nice. We also almost had a test of that line as support yesterday, although it was front run just above $29,000.

No reason to be bearish for now, things look like they will continue grinding higher.

Look for bids at $28,600 and $25,212 if things drop further. As I said in the intro - we WILL get corrections.

Otherwise, let’s enjoy this moment.

Altcoin Charts

Throw a dart - altcoins have been performing well. I have showed the Dominance chart a number of times, so I will not bore you with that. I will continue to share more specific ideas as I see them, but you should be looking for lagging coins that are yet to break out. As I said, alt coins usually are not worth focusing on and those moments are few and far between. We nailed this one, so enjoy it.

XRP is risky, and not a chart I would usually share considering the case with the SEC. That said, the chart is the chart and this one is on the verge of a major potential move… if it can break key resistance. That means this is NOT A BUY yet, but something you should be watching. We have a major descending resistance that is two years old that price is pushing against as well as key resistance at .5597. I would like to see price above BOTH, although traders who take more risk will accept a close above descending resistance. Remember, this is a weekly chart, so I am watching this for a huge move if it can break out… even back up to almost $2. For now, I would be watching $1 as the real target here.

I do not own any XRP.

Legacy Markets

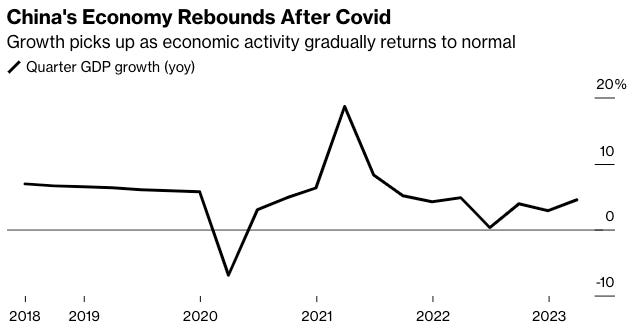

US equity futures indicated gains on Wall Street, driven by signs of economic recovery in China, despite concerns over patchy earnings and potential central bank policy tightening. S&P 500 contracts rose 0.4%, while Nasdaq 100 contracts climbed 0.6%. Positive Chinese consumer spending data boosted European markets, lifting the Stoxx 600 benchmark and benefiting luxury and travel shares.

Mixed reactions followed in Asia, with slower-than-expected industrial production in China, despite overall GDP growth. Investors' allocation of equities versus bonds hit its lowest since 2009 due to recession concerns. First-quarter earnings remain unconvincing, with this season predicted to be the worst since the pandemic began.

Two-year Treasury yields slid more than 3 basis points to around 4.15%. Central banks in Australia and the UK may also consider further tightening measures. The pound and Australian dollar both strengthened, while oil prices initially rose due to China's recovery but later reversed gains due to increased output in Russia and shale.

Key events this week:

US housing starts, Tuesday

Goldman Sachs and Bank of America release first-quarter earnings, Tuesday

Fed’s Michelle Bowman discusses digital currency, Tuesday

Eurozone CPI, Wednesday

Fed releases Beige Book, Wednesday

Fed’s John Williams gives a speech, Wednesday

Fed’s Austan Goolsbee is interviewed on NPR, Wednesday

China loan prime rates, Thursday

Eurozone consumer confidence, Thursday

US initial jobless claims, existing home sales, index of leading economic indicators, Thursday

ECB issues report on March policy meeting, Thursday

Fed’s Christopher Waller speaks at cryptocurrency-focused event, Thursday

Fed’s Patrick Harker speaks on “monetary policy and housing”, Thursday

Fed’s Loretta Mester discusses the economic and policy outlook, Thursday

Fed’s Raphael Bostic discusses regional and national economic conditions, Thursday

Fed’s Michelle Bowman and Lorie Logan speak at event, Thursday

PMIs for Eurozone, Friday

Japan CPI, Friday

Fed’s Lisa Cook discusses economic research at an event, Friday

Some of the main moves in the market:

Stocks

S&P 500 futures rose 0.4% as of 6:34 a.m. New York time

Nasdaq 100 futures rose 0.7%

Futures on the Dow Jones Industrial Average rose 0.3%

The Stoxx Europe 600 rose 0.5%

The MSCI World index rose 0.2%

S&P 500 futures rose 0.4%

Nasdaq 100 futures rose 0.7%

The MSCI Asia Pacific Index rose 0.2%

The MSCI Emerging Markets Index fell 0.2%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.4% to $1.0975

The British pound rose 0.5% to $1.2440

The Japanese yen rose 0.3% to 134.03 per dollar

The offshore yuan was little changed at 6.8807 per dollar

Cryptocurrencies

Bitcoin rose 1.6% to $29,924.63

Ether rose 1.3% to $2,104.71

Bonds

The yield on 10-year Treasuries declined two basis points to 3.58%

Germany’s 10-year yield declined one basis point to 2.46%

Britain’s 10-year yield advanced three basis points to 3.72%

Commodities

West Texas Intermediate crude fell 0.3% to $80.57 a barrel

Gold futures rose 0.4% to $2,014.40 an ounce

The SEC Sucks

Two weeks ago, the U.S. crypto community bid a reluctant farewell to an OG exchange, Bittrex, without much explanation. All we knew was that "regulatory requirements" made it economically unviable for the exchange to continue operations.

Now we learn that the SEC is suing the exchange.

According to the SEC press release, "Bittrex, Inc. and its co-founder and former CEO William Shihara are being charged with operating an unregistered national securities exchange, broker, and clearing agency. The SEC also charged Bittrex, Inc.'s foreign affiliate, Bittrex Global GmbH, for failing to register as a national securities exchange in connection with its operation of a single shared order book along with Bittrex."

Here's a brief summary with some additional details: "Bittrex's business model was based on three factors: evading federal securities laws' registration requirements; advising issuers of crypto asset securities to do the same by modifying their offering materials; and consolidating multiple market intermediary functions under one roof to maximize profits."

This development is significant because of the persistent rumor that Coinbase is next. I'm not a lawyer, but my assessment is that if the SEC wants to take on Coinbase, it needs to build its case on more accessible targets. Coinbase is the ultimate challenge, as it did register and has the financial and legal resources to defend itself. The SEC realizes that other exchanges will succumb to a little pressure – it's disheartening, but it's the truth.

Gary Gensler Caught Red Handed

In the Bittrex lawsuit, the SEC identified six tokens it claims are securities. While this revelation isn't surprising, a video has surfaced in which Gary Gensler, the SEC chairman, is seen promoting Algorand—one of the tokens involved in the lawsuit. The coins mentioned in the complaint are DASH, ALGO, OMG, TKN, NGC, and IHT. The full complaint is available for review, but let's focus on the more intriguing aspect.

The Old Gary Vs. The New Gary

The Old Gary - “You can create Uber or Lyft on top of blockchain technology today. Well maybe in 5 years you could. Silvio Micali's Alogrand, a Turing Award winner at MIT that I work with. Silvio has a great technology that has a performance you could create Uber on top of it.”

In an old lecture, (Algorand’s mainnet was 2019, so it’s not too old) Gary literally promoted Algorand. Let’s see how he feels today.

The New Gary -“In other words, in promoting the ALGO token sale, the Algorand Foundation tied the potential growth of the Algorand blockchain to potential demand for the ALGO token itself, and to its own commitment to preserving a price floor for ALGO.”

It would seem the SEC should be targeting Gary instead of Bittrex. In any case, the SEC's aggressive approach will eventually falter when there are no more easy targets to pursue. That's when the crypto community will come out on top.

Only Bitcoin | Mike Germano, Bitcoin Miami Founder

In this episode of The Wolf Of All Streets, Mike Germano, founder of Bitcoin Magazine and Bitcoin Miami, discusses the highly-anticipated Bitcoin Miami 2023 conference. As a key figure in the cryptocurrency industry, Mike shares his insights and thoughts on the current state of the market, and announces exciting speakers who will be joining the event. Viewers can also enjoy a special promo code to save on tickets. Learn more about the future of Bitcoin and what to expect at the world's largest Bitcoin-only conference in this engaging interview.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.