Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trade on Bitget!

Bitget is the best crypto exchange for both spot and leverage, world’s largest crypto copy trading platform, the official partner of Juventus Football Club and a top 5 exchange by volume as listed on CoinMarketCap!

Sign up using my link to Bitget and you will get:

Up to an $8000 sign-up bonus 🔥

15% discount on ALL futures trading fees 🔥

In This Issue:

You Missed The Bottom, Move On

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Explain Bitcoin To Me Like I Am 8

SBF Pulled Some Strings

Bill S.686 (Restrict Act)

RIP Beaxy

Gensler Wants More Money To Fight Crypto

You Missed The Bottom, Move On

I think it's time we all take a moment of silence.

129 days ago, Bitcoin's price fell below $16,000. FTX had just collapsed a few days prior. Picture the gains we could have made if we had all timed the bottom. Imagine what our portfolio would look like today if we scooped up some BTC, which is now up almost 100% from the lows, some ETH for the coming alt-run, and some altcoins just because, why not?

Think about the we would have buried in our bank accounts, that car we want that we could have bought, that castle we would be living in. Consider that elusive number that was just a few clicks away from becoming reality, the greatest missed opportunity potentially this decade had to offer.

Now STOP!

If you can’t tell, this is complete and utter nonsense. I don’t believe a single word of this.

Here's the truth: if you buy some Bitcoin today, you are going to be laughed at when Bitcoin finds a way to correct back to $20,000. If you wait for Bitcoin to break through $30,000, you are going to be laughed at for being too late, and if you wait for the pullback below $25,000, you will be laughed at when it never comes. It doesn't matter when you buy; there is a troll ready to laugh at you. And if we are keeping score (which we aren't), I don't think it's possible you could be any worse at timing Bitcoin purchases than Michael Saylor, one of the largest and smartest Bitcoin holders.

The time has come to forget this fictitious "should have, would have, could have" opportunity. It's not as if Bitcoin is an auction, and when the final bid is placed, whoever didn't win is out of luck. Bitcoin isn't going anywhere, so it's time we stop acting like there is a perfect time to buy it.

Going back to the Saylor example, Michael didn't know he would be buying more Bitcoin because he could pay back an early loan to Silvergate for a discount, but when it happened, he bought more. It's not like he collected the extra cash and sat around waiting for the "right time." He took the opportunity he was given and ran with it.

Now, I am not advocating going in as deep as Michael Saylor, but what I am advocating for is ending the financial nightmare that haunts you. For those of you who have been HODLing, there's nearly a 100% chance that a "shoulda, coulda, woulda" demon lives rent-free in your mind. It feeds off of your longing for that magical, perfect number. It thrives by reminding us that we are down 85%, 87%, 89%, and then some. And that 129 days ago, we could have made it all back. The more we think about it, the more the demon grows.

I challenge you to laugh at this demon every time you are reminded of it. The demon hates when you focus solely on the present and future. It writhes when you dollar-cost average, rebalance, study, paper trade, and take opportunities as they come. The demon has nowhere to hide when your long-term plan is so clear, there's not a shred of doubt that can shake your conviction. And the best secret of all? When your emotions are in check, the demon surrenders itself completely, relinquishing its reign of terror.

It is nearly impossible to time the top or bottom. Nobody knows what is going to happen, not even a second into the future. If you believe Bitcoin or Ethereum is the answer, then that is all there is to it; the rest is history. I do think there is a good chance we will see unpredictable chop this year as the dust settles, so don't be shaken out.

Your demon doesn't stand a chance.

Sign up for my other newsletter, THE DAILY CLOSE!

I built The Daily Close to give you the same institutional-grade indicators and signals that I use to trade the market on a daily basis. It's automatically generated and delivered to your inbox at the daily close everyday.

1 Week FREE for all subscribers

17% discount if you subscribe for a year

$25 a month, or $250 a year

Bitcoin Thoughts And Analysis

$28,600.

As you can see, we are on our third weekly candle that has touched this level and failed to break. We have 3 days left in this week’s candle, so let’s hope that we can make it through this time.

This is the key level to watch.

When you zoom in, you can see just how difficult $28,600 has been, much like $25,212 before it. We now have two monster wicks up, where price has attempted a major breakout and been slapped back down below resistance.

Bears will tell you that this is the top, because sellers are stepping in. Bulls will tell you that these wicks are “clearing the runway” for the next move up.

We have now had 3 4-hour closes above this line, each immediately followed by a candle back down below. Let’s hope the current candle finally closes above.

Altcoin Charts

Are there opportunities right now to make money in the altcoin market? Yes. But is this an ideal time to be focusing on alts when Bitcoin is still dominating? No, not in my opinion. Having been through many of these cycles before, it is important to note when it’s best to focus Bitcoin. When it finishes it’s move and is steady, alt coins should absolutely rip.

Legacy Markets

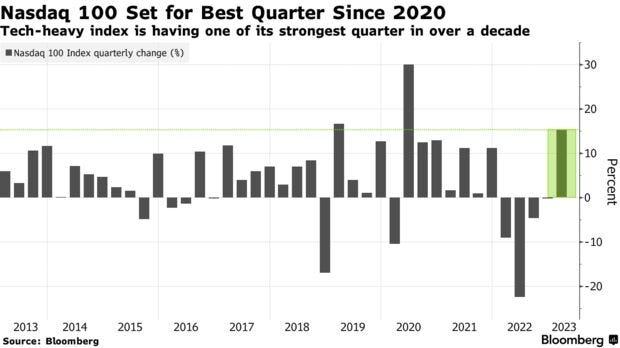

European stocks and US equity futures have risen following a Wall Street rally, driven by expectations that interest rates will peak soon and banking turmoil will ease. Real estate, banking, and retail shares led gains in the Stoxx Europe 600 Index, while S&P 500 and Nasdaq 100 futures also advanced. Investors are focusing on German inflation data and US core personal consumption expenditure and jobless data for insights into central bank policies. Treasury yields remained steady, and the dollar declined. The current rally relies on expectations rather than actions, leaving markets vulnerable if central banks disappoint investors.

Key events this week:

Eurozone economic confidence, consumer confidence, Thursday

US GDP, initial jobless claims, Thursday

Boston Fed President Susan Collins and Richmond Fed President Thomas Barkin speaks at event. Treasury Secretary Janet Yellen also speaks, Thursday

China PMI, Friday

Eurozone CPI, unemployment, Friday

US consumer income, PCE deflator, University of Michigan consumer sentiment, Friday

ECB President Christine Lagarde speaks, Friday

New York Fed President John Williams speaks, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.9% as of 10:09 a.m. London time

S&P 500 futures rose 0.4%

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.4%

The MSCI Asia Pacific Index rose 0.2%

The MSCI Emerging Markets Index rose 0.4%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.3% to $1.0873

The Japanese yen rose 0.2% to 132.57 per dollar

The offshore yuan rose 0.2% to 6.8814 per dollar

The British pound rose 0.4% to $1.2361

Cryptocurrencies

Bitcoin rose 0.6% to $28,565.13

Ether fell 0.2% to $1,799.88

Bonds

The yield on 10-year Treasuries was little changed at 3.57%

Germany’s 10-year yield declined one basis point to 2.32%

Britain’s 10-year yield was little changed at 3.48%

Commodities

Brent crude rose 0.8% to $78.92 a barrel

Spot gold rose 0.2% to $1,968.25 an ounce

Explain Bitcoin To Me Like I Am 8

From ChatGPT:

Alright kiddo, imagine you have a digital piggy bank where you can save special coins called "Bitcoins." These coins are not like the ones you see in real life, but they are very valuable and people use them to buy things on the internet.

Bitcoins are part of a big computer game where lots of people work together to solve puzzles. When they solve a puzzle, they get new coins as a reward. This whole game is called "Bitcoin," and the computer program that runs it makes sure no one can cheat or take other people's coins.

Since there's no bank involved, people can send their coins to friends or family all around the world very quickly without having to ask anyone for permission.

And that's Bitcoin! It's like a cool digital piggy bank that's also a game where people work together to solve puzzles and earn rewards.

Not bad, right?

SBF Pulled Some Strings

When I read the article subline linked above, my brain translates the sentence to, "SBF's legal defense is being funded by stolen user funds." Astonishingly, none of the money this man touches seems to be earned, yet he is somehow affording a team of powerful attorneys for his trial this October. According to a source with "operational knowledge," in 2021, SBF "made a large monetary gift to his father, funded by a loan from the exchange's trading firm, Alameda Research." FTX lawyers have not yet responded to this accusation, but considering what SBF allegedly accomplished, this wouldn't surprise me in the slightest.

The second piece of news regarding SBF is new evidence that Alameda got caught in the middle of a Chinese freezing order. Chinese police discovered that the fund was bribing government officials with $40 million to unfreeze a Chinese account containing approximately $1 billion worth of cryptocurrency. After the bribes occurred, prosecutors claim that SBF went on to fund "loss-generating trades." This story has to be made into a movie; there's no way around it. Moreover, it seems nearly impossible for this man to avoid a prison sentence.

Bill S.686 (Restrict Act)

Controversy on Capitol Hill is brewing following TikTok's CEO's recent testimony in front of Congress. For a while now, there has been a significant push by regulators and politicians to ban the social app, and now it appears we have come one step closer with Bill S.686.

Bill S.686, also known as the Restrict Act, has quickly gained support from Biden and bipartisan representatives, but is it as bad as some are making it out to be? The fear is that passing this bill gives the government the right to impose a $250,000 fine and up to 20 years of prison time for using a VPN on a blocked site. I am not sure this is entirely true.

There's no doubt that this bill is an overstep of American freedoms, i.e., the 4th amendment, and can hurt crypto, but it's more geared towards companies and serious risks, not teenagers sneaking onto TikTok to post trending dances. I know that if we believed everything the government said, we would all be zombies, but here's the government's take for those curious. Quoted below is a spokesperson for Sen. Mark Warner (D-Va.), the representative who introduced the act.

“Under the terms of the bill, someone must be engaged in ‘sabotage or subversion’ of American communications technology products and services, creating ‘catastrophic effects’ on U.S. critical infrastructure, or ‘interfering in, or altering the result’ of a federal election, in order to be eligible for any kind of criminal penalty … To be extremely clear, this legislation is aimed squarely at companies like Kaspersky, Huawei, and TikTok that create systemic risks to the United States’ national security—not at individual users.”

RIP Beaxy

The SEC charged Beaxy with a list of violations, resulting in a complete shutdown of the operation. According to the SEC's official statement, both the exchange and executives were charged with "failing to register as a national securities exchange, broker, and clearing agency." In addition, the founder found himself charged with misappropriating funds to the tune of at least $900,000. If the SEC is right, with each success, the agency grows a little stronger.

Gensler Wants More Money To Fight Crypto

SEC Chair Gary Gensler has supported President Joe Biden's request for a record $2.4 billion in funding for the regulator, emphasizing the need to address misconduct in the cryptocurrency industry. In a budget hearing, Gensler said the additional funding would allow the SEC to hire 170 more staff, primarily for its enforcement and examination divisions. He described the crypto industry as the "wild west," rife with noncompliance, and highlighted that the SEC received over 35,000 separate tips, complaints, and referrals in FY 2022, resulting in over 750 enforcement actions and $6.4 billion in penalties and disgorgement.

Sponsored by NORD VPN!

Privacy and security are essential for everyone, but especially for crypto investors. I use NORD VPN to protect my privacy and help keep my crypto safe!

Sign up HERE & enjoy the benefits of NORD VPN, for just $4 a month.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.