Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trade on Bitget!

Bitget is the best crypto exchange for both spot and leverage, world’s largest crypto copy trading platform, the official partner of Juventus Football Club and a top 5 exchange by volume as listed on CoinMarketCap!

Sign up using my link to Bitget and you will get:

Up to an $8000 sign-up bonus 🔥

15% discount on ALL futures trading fees 🔥

In This Issue:

The SEC Will Lose

Bitcoin Thoughts And Analysis

Legacy Markets

Arbitrum Airdrop

Bad News For Block

Do Kwan Arrested

The SEC Will Lose

On April 14, 2021, Coinbase achieved the unthinkable for the crypto world by making its public debut via a direct listing on the Nasdaq exchange. The excitement was palpable. This was a major win for the ecosystem. Coinbase earned itself a spot among the ranks of financial elites, but it has never been treated as such. The SEC probably wishes it could take it all back.

Just a few months after going public, the SEC threatened Coinbase with a lawsuit over their Lend product. Coinbase received a Wells notice from the SEC and was told in plain language that the SEC would sue if Coinbase went ahead with launching the product. Coinbase conceded. This is one of many examples in which Coinbase tried to play by the rules, but the SEC didn't allow it.

Aside from a couple of small run-ins with the SEC in 2022, Coinbase looked like the golden child compared to its counterparts, such as FTX, Voyager, and BlockFi. Basically, the SEC was busy frying other fish.

Now that the 2022 smoke has cleared, the SEC is back to picking a fight with Coinbase (for selfish reasons, of course), but this time the story will be different. My prediction is that the SEC is going to get knocked out. They poked the wrong bear.

Below is a screenshot of Coinbase's announcement.

Yesterday evening, Coinbase posted a blog announcing another Wells notice from the SEC, regarding "an unspecified portion of our listed digital assets, our staking service Coinbase Earn, Coinbase Prime, and Coinbase Wallet." In other words, the SEC has opted for the spray-and-pray method and is hoping to land a victory. The SEC is going to fail, and here's why.

First off, Coinbase's confidence this time around is through the roof. If it does come down to litigation, Coinbase not only has an army of users ready to go to war alongside them but also a deep war chest and an en endless number of allies to call on for backup. The SEC isn't just going face-to-face with Coinbase; they are also taking on BlackRock, Google, Visa, and the entire crypto ecosystem. Coinbase vs. the SEC is the final boss battle, and this is the one that we are actually prepared for.

Not much has been said regarding the angle the SEC will be taking, but in Coinbase's response to the SEC, this is what they said:

"Today's news does not require any changes to our current products or services."

"Coinbase does not list securities or offer products to our customers that are securities."

"Our staking services are not securities under any legal standard, including the Howey test."

"Coinbase Wallet is a technology, not an exchange or broker, or centralized platform."

"At our core, we are the very same company that we were on April 14, 2021, when we became a public company. Tell us the rules, and we will follow them."

Coinbase is fed up with the SEC, and for good reason. In the blog, Coinbase detailed all the efforts they have made to follow the law, only to be misled or shut down by the SEC. Coinbase also points out that not even the SEC knows what it has jurisdiction over, and enforcement is the only way in which the SEC is regulating.

The SEC is playing judge, jury, and executioner. The actual judge and jury may take issue with that.

If Coinbase is serious about welcoming the legal process, which they explicitly said in their blog, then the SEC is going to get a run for its money, and its crypto regime is facing the beginning of the end. This will be a pivotal point for the industry, but one that requires the industry to come together and work as one. Our advantage is that Coinbase has the law on its side, the SEC doesn't.

I am confident that the entire industry will come out stronger after this. It will definitely be a bumpy road, but one worth traveling. The SEC's days of dabbling in crypto enforcement are numbered. As the industry unites and supports Coinbase, the legal battle ahead has the potential to bring about much-needed clarity and create a more favorable environment for the crypto world. This pivotal moment in the industry's history will likely be remembered as the turning point when the crypto ecosystem came together to challenge outdated regulations and pave the way for a more innovative and inclusive financial future.

Bitcoin Thoughts And Analysis

Quite a bit of indecision. We had the bear div, then hidden bullish divergence confirm yesterday, followed by potentially more bearish divergence. We need to see how the day closes, but this is a sign of indecision.

I still think it would be quite healthy to see a drop to test the $25,212 level as support before heading up further, which could be the case with bear div, overbought RSI and price trading at a key resistance.

You can see how much trouble Bitcoin is having breaking through $28,600, the lows of the 2021 retracement. It looks almost exactly like resistance at $25,212. Usually we see price drop a bit to gather strength for the next push.

Volume is HIGH though, so anything can happen.

Legacy Markets

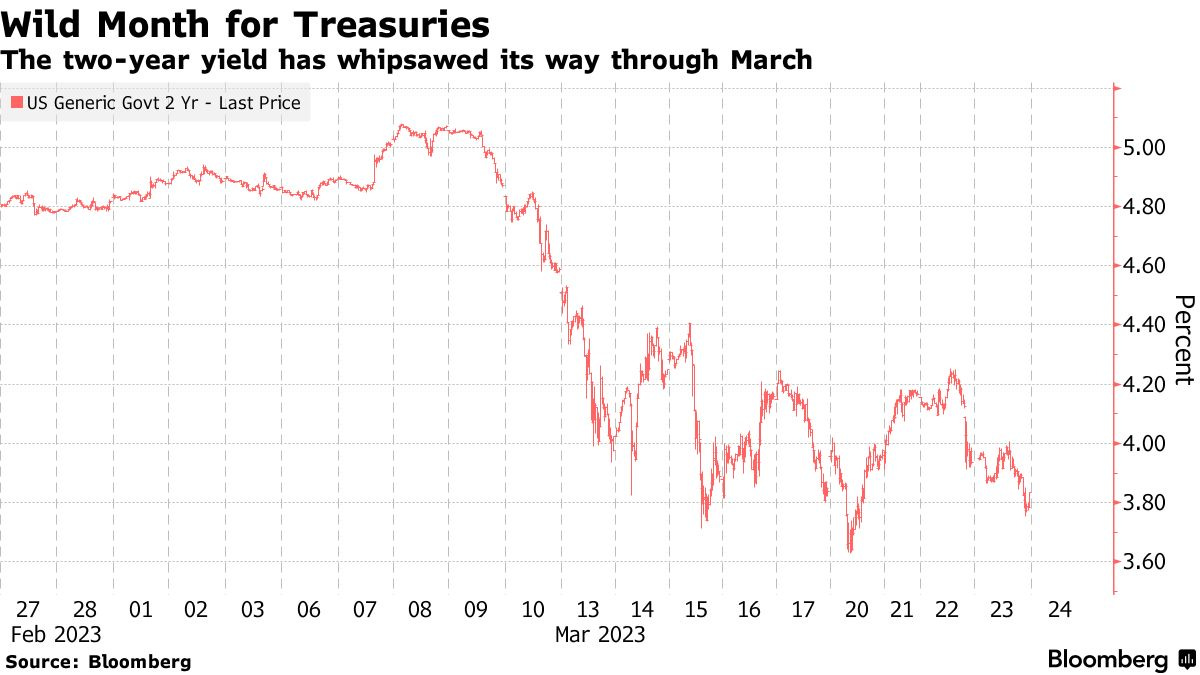

European stocks fell on Friday, with banks leading the decline due to investors' concerns over the stability of the financial sector. US equity futures also erased gains, while bonds and the dollar strengthened. The Stoxx Europe 600 Index slid for a second day, and UBS Group AG shares slumped amid a US Justice Department probe into potential sanction evasion assistance for Russian oligarchs. Traders remained wary of banking sector problems that accumulated during the Federal Reserve's rapid hiking cycle. Treasury yields fell, while the dollar headed higher after six sessions of weakening. Investors remain cautious about the risk of an economic downturn.

Key events this week:

Eurozone S&P Global Eurozone Manufacturing PMI, S&P Global Eurozone Services PMI, Friday

US durable goods, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 1.3% as of 8:52 a.m. London time

S&P 500 futures fell 0.4%

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average fell 0.5%

The MSCI Asia Pacific Index fell 0.2%

The MSCI Emerging Markets Index fell 0.6%

Currencies

The Bloomberg Dollar Spot Index rose 0.4%

The euro fell 0.5% to $1.0772

The Japanese yen rose 0.6% to 130.04 per dollar

The offshore yuan fell 0.7% to 6.8743 per dollar

The British pound fell 0.4% to $1.2239

Cryptocurrencies

Bitcoin fell 1% to $28,045.04

Ether fell 1.3% to $1,795.95

Bonds

The yield on 10-year Treasuries declined nine basis points to 3.34%

Germany’s 10-year yield declined 12 basis points to 2.08%

Britain’s 10-year yield declined 12 basis points to 3.25%

Commodities

Brent crude fell 1.4% to $74.83 a barrel

Spot gold fell 0.4% to $1,986.14 an ounce

Arbitrum Airdrop

My followers know that I have never been particularly interested in pursuing airdrops, as I prefer to seek profitable opportunities in trading and investing. However, there is still money to be made if this is your area of expertise. The long-awaited Arbitrum airdrop has finally arrived, and it has been successful. Over the past few days, Arbitrum recorded more daily transactions than the Ethereum mainnet, as 625,000 eligible addresses sought to claim tokens. Arbitrum is a robust layer 2 solution with genuine potential to reignite interest in DeFi, and Ethereum stands to benefit significantly from this development.

Bad News For Block

The notorious Hindenburg Research, known for its publicly announced short positions, has published some rather unsettling findings about Jack Dorsey's financial conglomerate, Block. According to Hindenburg Research, "Block allowed criminal activity to operate with lax controls and 'highly' inflated Cash App's transacting user base, a key metric of performance. Our 2-year investigation has concluded that Block has systematically taken advantage of the demographics it claims to be helping."

The story gets worse, though. To support their theories, Hindenburg applied for obviously fake accounts on Cash App cards to see if they would be approved. Hindenburg applied for accounts under the names "Donald Trump" and "Elon Musk," and sure enough, the cards arrived in the mail. According to the report, "former employees estimated that 40%-75% of accounts they reviewed were fake, involved in fraud, or were additional accounts tied to a single individual."

In response, Block has stated it is working with the SEC to "explore legal action" against the clearly false claims made by Hindenburg. It will be interesting to see where this story goes.

Do Kwan Arrested

Do Kwan was finally arrested, traveling on a fake passport, carrying another, packing 3 laptops and 5 phones. Now it’s a question of who gets to charge Do Kwan because Singaporean, South Korean, and United States authorities are all eager to bring him to justice. Hopefully, if Do Kwan is proven guilty, he will be punished justly wherever he ends up.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

I agree. The SEC has always expected companies to cave and settle. Then the SEC uses that settlement - as law - to go after other companies. Settlements are not laws. Those days are over. The industry is fighting back. And the SEC is on the verge of being obsoleted. https://decentmillionaire.substack.com/p/4-reasons-why-the-sec-will-cease