Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trade on Bitget!

Bitget is the best crypto exchange for both spot and leverage, world’s largest crypto copy trading platform, the official partner of Juventus Football Club and a top 5 exchange by volume as listed on CoinMarketCap!

Sign up using my link to Bitget and you will get:

Up to an $8000 sign-up bonus 🔥

15% discount on ALL futures trading fees 🔥

In This Issue:

What Is This, A Dip For Ants?

Bitcoin Thoughts And Analysis

Legacy Markets

Twitter Threads On The Current Banking Issue

Silvergate Is Finished

False Rumors Were Spread About JPMorgan

The Gensler Bargain and The CFTC

Adios, Wash Sale

Silvergate Drowns Crypto | Will We Get A Bitcoin ETF? Dave Nadig, James Putra, Lucas Outumuro

What Is This, A Dip For Ants?

There was a time when the price of Bitcoin seemingly sank each and every day, causing even the most ardent believers to question their convictions. During this period, pundits and experts made bold predictions of triple-digit price targets, while it appeared that no institution would ever touch the sector and governments were likely to ban it.

If you have been following the market for more than a few months, you are aware that what I am describing above is not a myth or fairy tale but a reality in the recent past. The same trend is starting again. Presently, investors are panicking over the US regulatory crackdown on the sector and a 7%+ drop in Bitcoin's value in a day.

Admittedly, it is scary.

Yes, these prices are on the low side, weak altcoins are fading away, and our conviction is being tested, but today is still a dream compared to the past.

Reminder: we are going to be fine. Consciously, we all know that the market moves in cycles, but subconsciously, it becomes easier to forget that another bull market is inevitable.

Bitcoin has had a predictable 4-year cycle since it’s inception, a result of the halving and the subsequent reduction in supply.

Ignoring all of the noise, the macro and the attacks on the industry, price continues to follow the cycle for now - bottoming when weekly RSI goes oversold, chopping for a long period and then (hopefully) rising a few months after the halving, which will be in May of 2024.

Little has changed this time, so it may not be different.

You could have fallen on your head and missed all of the news over the past year, woken up today, looked at the chart above and casually gone on with your life, assuming the cycle was intact.

My intention is not to pump you up, but to remind you of how the market operates. Today, this month, and this year are merely additional buying opportunities in the grand scheme of things, regardless of how low prices go in this cycle.

Zoom out and focus on the long term.

Even with this in mind, it is normal to feel vulnerable. Markets are designed to bring out the worst in us, but crypto is more than just prices and US politics. Dips can be painful, but the best investors view them as buying opportunities. They hurt, but they separate the best from the rest, which is why I am looking the other way and buying what I can. Again.

I cannot recommend that you do the same, as everyone is different. But nothing about my personal conviction has changed.

Regardless of your tenure in the market, you should be proud of yourself. You are still here, in the right place, and hopefully positioned for the right time. However, do not lose the chip on your shoulder or shut out the voice that warns you of bad days. The greatest investors understand and welcome balance, allowing them to thrive in both bull and bear markets.

This intro is not a recommendation to blindly buy into the market. Although I believe that we still have more pain to endure, I can only take guesses, as can everyone else. Consider this message a sticky note worth posting in the back of your mind that reads: "You will survive." One day, you will be grateful for your faith. There is much to anticipate, as regulators are merely posturing and making way for the winners they have in their back pockets. Do not be deceived by the price; tie your hands, lock your portfolio, and walk away.

I will be taking a break from the newsletter next week due to travel obligations but plan to hold a Twitter Space on Tuesday and fully return the following week.

See you all soon.

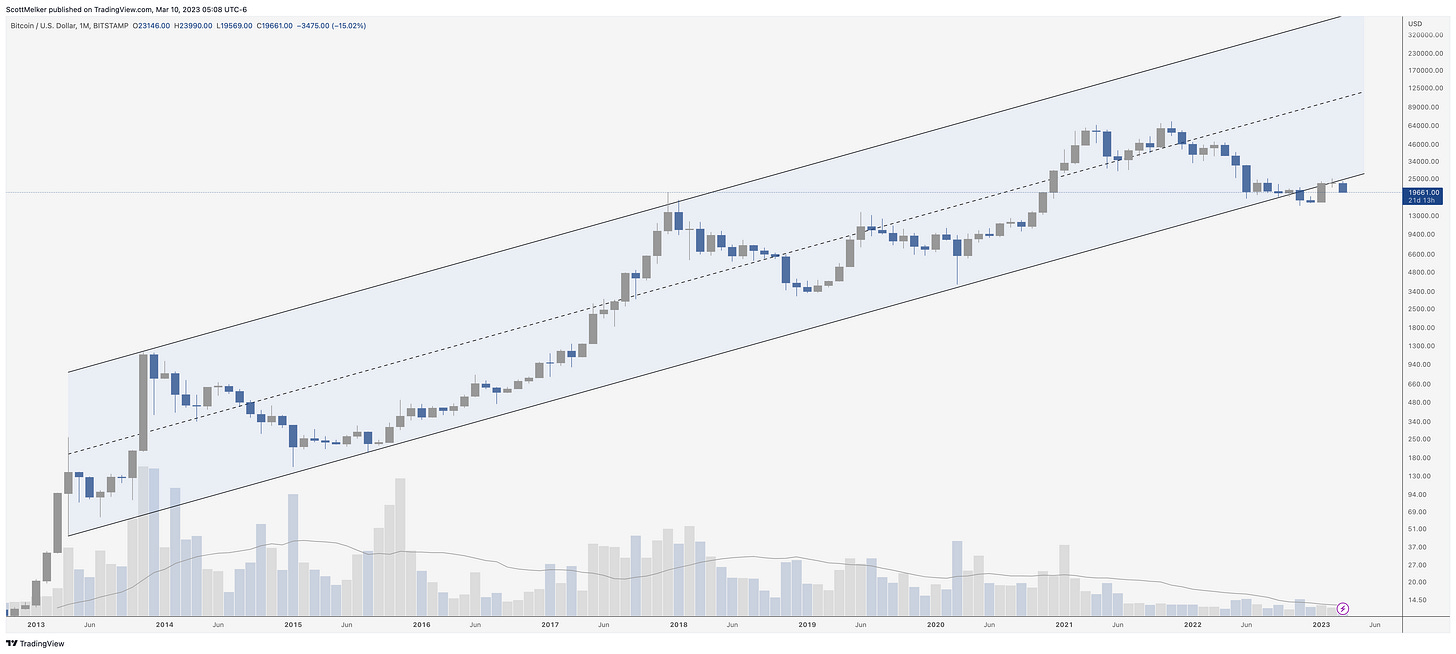

Bitcoin Thoughts And Analysis

Not great. As discussed at the end of the month, price was clearly rejected at the key level of $25,212, preventing a break in bearish market structure with a higher high. The monthly candle was a perfect doji, with equal wicks up and down and a tiny body created by price opening and closing at the same level. This was a signal of indecision, with the next candle being significant.

The next candle is far from closed, so there are not firm conclusions to draw. But it looks bad for now.

There is still no bullish case below $25,212.

I chose to revisit an old chart that many of you are likely familiar with. This channel was our case for 6 figure Bitcoin, because every trip to the bottom led to a trip to the top, and every flip of the dashed EQ (equilibrium, center line) sent price to the top or bottom.

It was not meant to be last time, and surprisingly the entire channel broke down.

Last month’s candle retested the bottom of the channel as resistance and was rejected.

Not much to like on the monthly for now, although price can stay below the channel while still rising.

I would like to see us back inside.

I do not want to harp on the same ideas over and over again, but once again we can see how much resistance there was at the $25,000 level. The 50 and 200 MA had a death cross while directly interacting with price at the most important horizontal level on the chart. This was a very natural place for a strong rejection, which has been exacerbated by bad news.

Support at $21,473 was nonexistent yesterday, so now we start looking to the $17,500 to $18,500 area as the next logical level. This would be a revisit to the June lows, before the FTX crash took us down on a black swan.

The 50 MA continues to curl down and act as very strong resistance.

The $21,473 support failed without even a whimper. Like a knife through hot butter. Our first signal of weakness here was the break of the 50 MA as support a week ago, also without almost no reaction.

Price is currently sitting directly on the 200 MA, which should theoretically be strong support. We will see. The 100 MA also broke with little effort.

The next logical daily level is $18,373. This was the key resistance the broke to launch Bitcoin to $25,000 and has never been tested as support.

Notably, RSI has made the inevitable round trip back to oversold. As you know, most tops and bottoms start at overbought and oversold, with bearish and bullish divergence. You can see the last two times on the chart above. So now we wait for bullish divergence, although we don’t need it.

There’s no reason to show the chart, but 4-hour RSI is currently around 9 - EXTREMELY oversold and effectively a historic low. We should see a bounce very soon. I will be watching for bullish divergences to build on lower time frames. As you know, I like to see everything oversold and for the divs to appear from the 1 hour and build up to the daily.

Legacy Markets

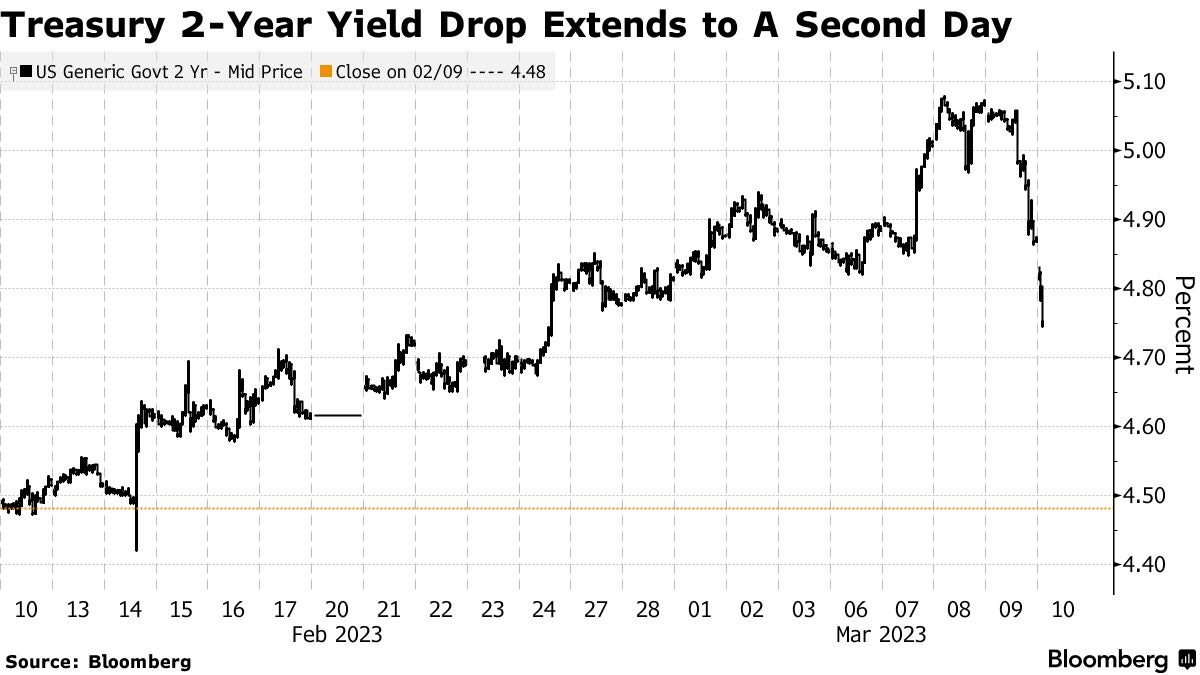

Stocks in the US tumbled and Treasuries rallied after worries about the US banking sector’s health increased. European markets also saw a decline in stocks. The Stoxx 600 equity gauge fell by 1.7%, while Deutsche Bank AG’s shares dropped by 7%. Credit Suisse Group AG also suffered a slide in its share price to a record low, while HSBC Holdings Plc fell over 5%. The yield on Treasury bonds also fell with the two-year segment falling to 4.75%, its biggest two-day slide since last June. The fall in Treasury yields came as investors sought safety amid the banking concerns. The rout was prompted by the collapse of Silvergate Capital Corp, which had financial strength eroded by the crypto industry’s meltdown, and SVB Financial, which extended a slump in the US premarket trading, tumbling as much as 22%.

Key events this week:

US nonfarm payrolls, unemployment rate, monthly budget statement, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.4% as of 4:25 a.m. New York time

Nasdaq 100 futures fell 0.1%

Futures on the Dow Jones Industrial Average fell 0.6%

The Stoxx Europe 600 fell 1.6%

The MSCI World index fell 0.6%

S&P 500 futures fell 0.4%

Nasdaq 100 futures fell 0.1%

The MSCI Asia Pacific Index fell 2%

The MSCI Emerging Markets Index fell 1.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0586

The British pound rose 0.2% to $1.1948

The Japanese yen fell 0.4% to 136.75 per dollar

The offshore yuan was little changed at 6.9701 per dollar

Cryptocurrencies

Bitcoin fell 1.6% to $19,911.73

Ether fell 1.9% to $1,405.35

Bonds

The yield on 10-year Treasuries declined seven basis points to 3.83%

Germany’s 10-year yield declined 12 basis points to 2.53%

Britain’s 10-year yield declined 11 basis points to 3.69%

Commodities

West Texas Intermediate crude fell 0.7% to $75.20 a barrel

Gold futures rose 0.3% to $1,839.70 an ounce

Twitter Threads On The Current Banking Issue

There is a hell of a lot of misinformation and speculation surrounding the current banking crisis. Here are a couple of noteworthy threads.

Silvergate Is Finished

The saga of Silvergate Bank has come to a close with the official announcement of its shutdown after months of struggling and losses. Despite a calm winding down, the impact of its closing will be significant. With very few legitimate banking options for exchanges, funds, and market makers, more activity is being forced offshore. Signature Bank is picking up new customers, but this further centralizes banking risk in the space.

Furthermore, it is worth noting that Signature and Metropolitan were already distancing themselves from crypto prior to this fiasco. As the news breaks, Silvergate's stock is plummeting, which will be a hard hit for institutions fighting to sell off their positions. While Silvergate has promised to make everyone whole, the bank's closure leaves a significant void in the space. The official statement regarding the "unwind statement" is copied below.

“Silvergate Capital Corporation announced its intent to wind down operations and voluntarily liquidate the Bank in an orderly manner and in accordance with applicable regulatory processes.

In light of recent industry and regulatory developments, Silvergate believes that an orderly wind down of Bank operations and a voluntary liquidation of the Bank is the best path forward. The Bank’s wind down and liquidation plan includes full repayment of all deposits. The Company is also considering how best to resolve claims and preserve the residual value of its assets, including its proprietary technology and tax assets.

In addition, Silvergate Bank made a decision to discontinue the Silvergate Exchange Network (SEN), which it announced on March 3, 2023 on its public website. All other deposit-related services remain operational as the Company works through the wind down process.”

Finally, it is noteworthy that Senator Warren says that she predicted this would happen.

But nobody can seem to find where she predicted it…

However, her predictions were met with skepticism. "As the bank of choice for crypto, Silvergate Bank's failure is disappointing but predictable. I warned of Silvergate's risky, if not illegal, activity—and identified severe due diligence failures. Now, customers must be made whole, and regulators should step up against crypto risk," she said.

Idiotic. The bank did not fail because of crypto, but rather because they invested in treasuries when they had low yields, making those treasuries effectively worthless when they were forced to liquidate to meet financial obligations. Nobody wants to buy 1.5% yield bonds when the government will give you the same ones now for 5%.

Tale as old as time - poor risk management.

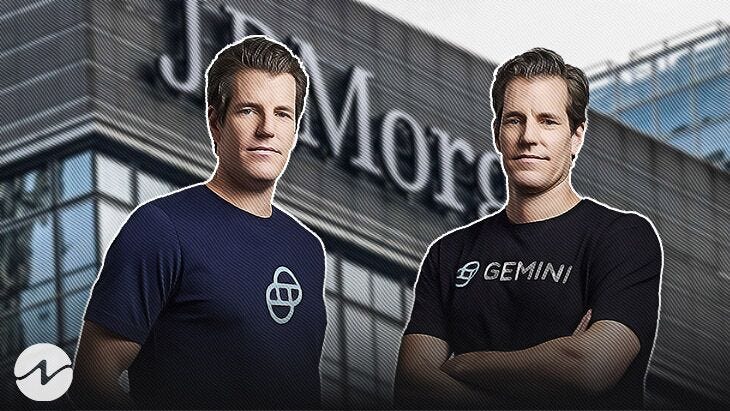

JPMorgan Did NOT Unbank Gemini

It is important to note that the article linked above is not true, and it is intended to prove a point about how quickly rumors spread in the cryptocurrency industry. It seems that we are akin to a small-town high school, where gossip spreads like wildfire. The rumor that was circulated claimed that JPMorgan was severing ties with Gemini, without providing any reasons for the decision. Gemini responded to the claims via Twitter, denying any truth to the reports. While there is a possibility that Gemini may not be truthful, it is difficult to ascertain the validity of either side's claims. This incident highlights how fake news can spread rapidly, even in the absence of any credible sources to support it.

The Gensler Bargain

There is a disagreement between the SEC and CFTC regarding the classification of cryptocurrencies. Gary Gensler, the SEC chairman, recently stated that "everything else other than bitcoin is a security," while the CFTC disagrees. In the FTX case, the CFTC declared that Ether, Bitcoin, and Tether were commodities and that they would not have allowed Ether futures products to be listed on CFTC exchanges if they did not believe it was a commodity asset.

While the CFTC is defending the industry, Gary is pushing back. In a recent interview, he stated, "we lose more if investors get harmed here. It’s a basic bargain in finance: If you want to raise money from the public, disclose certain facts and figures. The path to compliance is clear. It’s [that] the firms, in some regard, have generally been operating outside of those parameters."

Accurate crypto regulation is of great interest to the CFTC, and it would be harmful if the SEC overstepped its bounds. Overall, the CFTC's advocacy for the industry is positive.

Adios, Wash Sale

One of our favorite tax loopholes is likely to get legislated away in the Biden Budget Plan. I can’t really blame them for this one. In most markets, “wash sales” are illegal, meaning that you cannot sell an asset at a loss an immediately buy it back with a lower tax basis. This has not applied to crypto. It seems like it will.

Silvergate Drowns Crypto | Will We Get A Bitcoin ETF? Dave Nadig, James Putra, Lucas Outumuro

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.